Conflict and firms: Industrial organisation in the face of insecurity

Conflict has a long shadow, and its role in inhibiting development is clear. Today, a billion and a half people live in countries affected by fragility, conflict, or violence (World Bank 2011). The important decisions individuals make in their daily lives – where to travel, where to live, where to work – are all haunted by the spectre of violence. Not only does personal safety suffer, but so too do institutions and the economy.

The physical destruction associated with violence, such as the tearing down of bridges, the uprooting of roads, or the demolition of buildings, forms the popular image of war. Yet its effects run deeper still: public spending shifts away from social goods towards the military, valuable human capital turns from production to protection, labour markets and transportation networks collapse, and essential institutions erode.

Knowledge gaps and implications

That conflict affects business is not surprising; however, it is not well understood how persistent the effects of conflict are, how different types of firms react, and how firms make strategic decisions about where to operate based on their perceptions of violence. The ways in which businesses adapt to these conditions carries significant implications for the development of markets and for the provision of goods and services in-country. Ultimately, a focus on the firm implies a focus on the individual: firms are the lifeblood of the economy, providing stable streams of income for workers. Weak firms mean weak opportunities for work, creating disillusionment and discontent as job creation lags behind demographics – a breeding ground for future fragility.

The study

Researchers have wrestled with the “paucity of firm-level data” around conflict events, making these questions historically difficult to answer (Besley et al. 2011). A recent paper (Blumenstock et al. 2018), presented by Tarek Ghani at the IGC-PEDL conference on firms, markets, and development in December, looks at how violent events impact the industrial organisation of firms in Afghanistan. Ghani and his co-authors get around this hurdle by using a novel application of commercial mobile phone data to deduce information about firms. The two key variables used are the number of corporate subscribers and incoming/outgoing calls by firms. This data is validated by correlating it with actual values for location and size among a sample of firms. Combining 45 months of mobile phone records for 2,300 firms in Afghanistan with administrative and survey data, they create measures of firm location, size, and overall economic activity. This firm data is then matched with geocoded data on confirmed fatalities.

Results

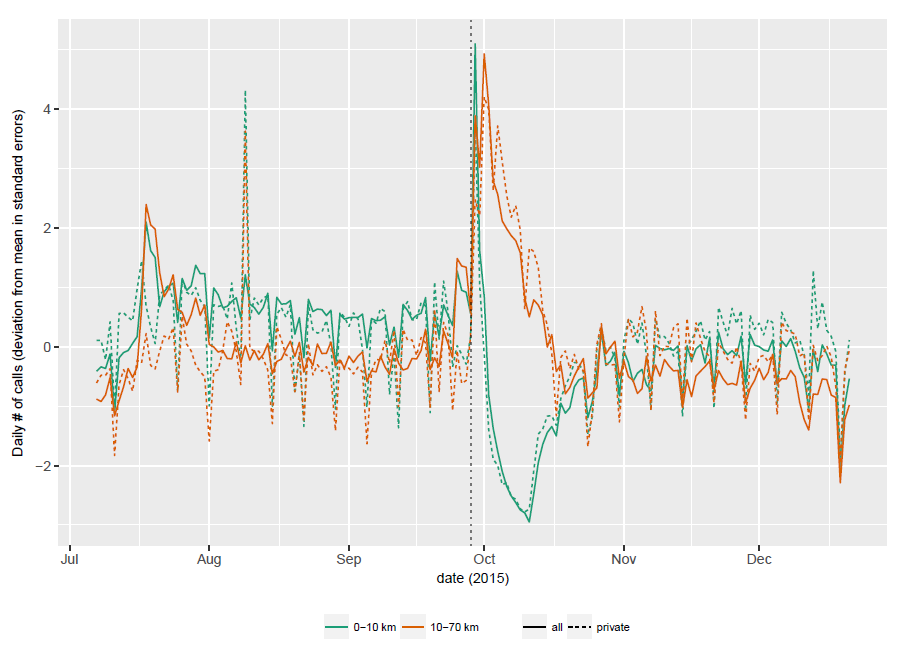

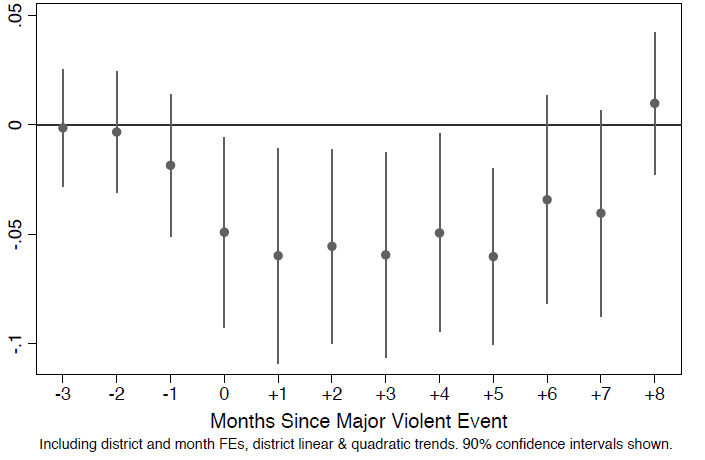

When insecurity strikes, the response is clear: firms decrease their presence in affected areas, an effect which persists for up to six months. The number of active firms decreases by 5-6% in the months after a violent event. The takeover of Kunduz – a mid-sized city of 300,000 in the north of Afghanistan – by the Taliban in late 2015, demonstrates this clearly. Immediately following the seizure of the city, the volume of calls originating from within the city plummeted (dotted green line in graph below) as business ground to a halt.

Among the sample of firms, larger firms appear to be more affected. As a consequence, they are more likely to invest in private security and to make protection payments. In addition to the real costs from harmed employees or damaged assets, the cost of doing business is also escalated.

Insecurity may therefore be another channel explaining the underrepresentation of large firms in developing countries (Hsieh and Olken 2014). If larger firms need to pay a disproportionately larger share on protection to fend off predation in insecure environments, then the optimal firm size becomes smaller. To keep the engine of growth running, it is necessary that firms survive and grow over time. Insecurity, along with poor institutions and credit constraints, may be yet another hurdle that firms must overcome.

Calling activity inside and outside Kunduz (2015 & 2016)

Response of log active firms to major violent events

Future research

Several questions still remain. It is uncertain whether dips in business activity reflect temporary displacements or permanent fixtures. At what level of conflict will a firm cease to operate altogether? Investor perceptions also matter: genuine improvements in the security environment may not be met with corresponding increases in firm activity if beliefs about stability lag behind reality (or vice versa). Lastly, from the perspective of a firm operating in an insecure environment with property rights constantly at risk, what constitutes an optimal survival strategy? One approach might be to limit the size of their operations to ‘fly under the radar’, while another might be to invest heavily in private security to protect their assets.

Despite its unique role in lifting countries out of fragility, we are only beginning to understand how conflict affects the private sector. Studying the mechanisms behind how businesses cope in insecure settings can offer insights for policy. For example, if the only way for a business to survive is by heavily fortifying itself, then such costs of entry will influence the competitive structure of the market, which carries long-run implications for growth. To address regional inequalities, governments will also have to consider how to allocate scarce resources for providing security in urban versus rural areas. Overall, this remains a fruitful area for future research.

References

Besley, T., et al. (2011), “Conflict and Investment”, Working Paper.

Blumenstock, J., et al. (2018), “Insecurity and Industrial Organisation: Evidence from Afghanistan”, Policy Research Working Paper; No. 8301, World Bank, Washington, DC. Available at: https://openknowledge.worldbank.org/handle/10986/29211 License: CC BY 3.0 IGO.

Hsieh, C.T. and Olken, B. (2014), “The Missing ‘Missing Middle’”, Journal of Economic Perspectives, 28(3), 89-108.

World Bank (2011), “World Development Report 2011: Conflict, Security, and Development”, Washington, DC. Accessible: https://siteresources.worldbank.org/INTWDRS/Resources/WDR2011_Full_Text.pdf (Accessed: 2 February 2018)