Employer-sponsored health insurance: low premiums, low savings

We study the impacts of an employer-sponsored health insurance policy giving modest coverage for in-patient hospitalisation in Bangladesh. There are no evident out-of-pocket cost savings, but there are changes in health care seeking behaviour consistent with the incentives of the programme. Higher premiums for broader coverage may realise higher savings.

Bangladesh, like many developing countries, has experienced robust growth over the last couple decades, and higher incomes have led to higher demand for health care. No universal health coverage has been established there, but both universal and premium-based health insurance schemes are being tested in various developing countries.

Effective insurance requires a certain scale to diversify risk and overcome the problem of adverse selection. These requirements can be problematic because voluntary health insurance policies in developing countries often have difficulty enrolling sufficiently large portions of the poor population. However, the required enrolment can be achieved through mandatory participation through employers.

Designing health insurance that works in context

We have partnered with a large employer that employs female artisans primarily in rural Bangladesh and has designed and implemented a mandatory health insurance policy. The partner organisation (PO) is a supplier for one of the most well-known local brands and employs about 20,000 female artisans who are eligible for the health insurance scheme.

The insurance scheme offers modest coverage and focuses primarily on in-patient hospitalisation in pre-specified eligible hospitals. This relatively low coverage is an attempt to make the programme viable, as it is primarily financed through the artisans’ premiums. Each artisan paid 25 taka (US$0.31) per month, which was accompanied by an equal contribution by the employer. The total 50 taka monthly contribution is less than 5% of the artisans’ average monthly income and less than 0.05% of total household income. While the PO largely subsidised the cost of running the operation, the total reimbursement was 97% of the total premium revenue, suggesting an actuarially fair scheme. Still, the scheme covered only about 15% of the total hospitalisation costs.

Randomised control trial: low out-of-pocket cost savings

We selected 50 employment sub-centres to carry out a randomised control trial, in which the insurance scheme was provided to artisans registered to work at 25 randomly chosen sub-centres, each with 20–25 female artisans. The randomisation allows us to control for unobserved factors driving health care seeking behaviour that correlate with the programme participation, as the women in the treatment and control groups differ only in their possession of this insurance.

The low coverage of the policy suggests that the potential out-of-pocket cost savings should be modest and possibly statistically insignificant, and this is indeed the case in our experiment. We find that the full utilisation of the total collected premium revenue led to out-of-pocket cost savings of 11%, but these savings were statistically indistinguishable from 0%.

Changes in health care seeking behaviour

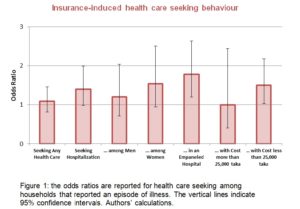

The insurance experiment reveals some alteration in health care seeking behaviour even with the low coverage offered by the programme. We do not find any effect in overall health care seeking behaviour. Since the scheme provides coverage primarily for in-patient care, we do find an impact on hospitalisation among the artisans who were randomly covered under the scheme. The odds ratios are reported in Figure 1. For instance, the odds that women in the treatment group seek hospitalisation are 1.40 times the odds that the women in the control group do so, which is significant at the 10% level.

In-patient care seeking among men does not change, but the odds that women in the treatment group seek hospitalisation are 1.54 times the odds of those in the control group, again significant at the 10% level. This disproportionate gender-specific change in behaviour is intuitive because only women received the insurance.

Treatment household also disproportionately use in-patient services in eligible hospitals — with an odds ratio of 1.78 that is significant at the 1% level — as the insurance scheme makes these hospitals cheaper. The impacts primarily come from seeking health care for relatively small health events that cost less than 25,000 taka (US$312). This result suggests that households use the scheme for health care that is less expensive and therefore provides proportionately higher savings as a fraction of total cost.

Hamstrung by low willingness to pay

The limitation of the programme is the relatively small premium and therefore limited coverage, leading to weak financial protection for beneficiaries. This finding suggests that it may be beneficial to attempt to increase premiums and broaden coverage, perhaps to non-hospital care such as pharmaceuticals and diagnostics. However, beneficiaries showed a reluctance to pay higher premiums. Low willingness to pay is thus a central obstacle to insurance coverage in our study area.

Insurance schemes must anticipate systematic changes in health care seeking behaviour and, preferably, use a piloting phase to learn about them and maximise the effect of the programme. Fortunately, the Government of Bangladesh has been piloting an insurance scheme in selected areas, but the country’s development in this arena is still nascent.