Has the recent financial crisis had an impact on sub-Saharan Africa?

Early in the financial crisis, a common view was that Africa's low level of financial integration may be a blessing in disguise, insulating the region from the direct impact of the crisis. Indeed, it may be that the direct wealth effect has been less important than in other regions that are open in terms of financial flows.

Based on past financial crises (1976-2002), however, we find that African exports are more affected by banking crises in their trade partners and that the relative under-development of financial systems in sub-Saharan African countries, in particular the strong dependence upon trade finance may make them more vulnerable to the disruption of trade finance that comes with a banking crisis (Berman and Martin 2012).

One possible explanation is that during a banking crisis when uncertainty is high, trust and liquidity are low, banks and firms in the importer country first cut exposure and credit to particular countries which are seen as more risky. This would, in particular, affect trade finance through letters of credit, where the importer pays the exporting firm in advance.

It is also likely that during banking crises, financial institutions “re-nationalise” their operations and reduce their exposure to foreign banks and firms. Exporters in countries with a strong financial system may be better able to resist such retrenchment of foreign banks. Clearly, for African firms, which are more dependent on foreign finance, this option may not be feasible. However, our results point to the role that some forms of financial development may play in helping to cope with external shocks such as financial crises in partner countries.

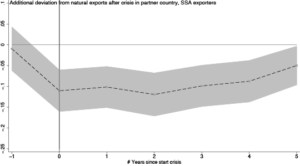

Finally, we distinguish between an income effect (during a banking crisis, income and exports to the country fall) and a disruption effect (a banking crisis disrupts the financing of trade channels). For the average country, the disruption effect is moderate (a deviation from the gravity predicted trade of around 1 to 5%), but long lasting.

Figure 1 Exports after banking crisis in partner country, SSA vs ROW

It is apparent that the disruption effect is much larger for African exporters, as the fall in trade (relative to gravity) is around 10-15 percentage points higher than for other countries in the aftermath of a banking crisis. We find that the vulnerability of African exports in the short-run does not comes from a composition effect, i.e. from the fact that primary exports are disrupted more severely than manufacturing exports. On the other hand, the dependence of African countries upon trade finance seems to explain the vulnerability of African exporters to banking crises in partner countries.

The findings imply two broad policy implications in the present context of the financial crisis in Europe. From a short-term macroeconomic policy perspective, they point to the importance of the trade impact for both African countries and remote countries (which may at least partly be the same). From a more long term and micro perspective, it suggests that developing and strengthening the role of the government through the implementation of trade policies, trade finance markets and of more generally stable domestic financial markets are crucial in a context of financial turmoil. This may help lower the dependence of exporters of financial conditions in destination countries.

Further reading

Berman, N and P Martin (2012), “The vulnerability of sub-Saharan Africa to financial crises: the case of trade”, IMF Economic Review 60(3), pp. 329-364