Natural resource wealth: Making resource windfalls work for Sub-Saharan African countries

In the oil and gas sector, six of the top ten global discoveries in 2013 were made in Africa. This is all good news, but what does it mean for people in Africa? Unfortunately, most resource windfalls have historically failed to translate into economic development because accountability frameworks and institutions for resource revenue management was lacking.

In Sub-Saharan Africa, despite large natural resource endowments, the impact of recent windfalls has been disappointing. In 2012, total natural resource rents accounted for 16 per cent of gross domestic product in Sub-Saharan African countries, far greater than the world average of 10 per cent. Surging commodity prices over the past decade have endowed Sub-Saharan Africa with substantial increases in government revenues. Nevertheless, due to inadequate policies, low absorptive capacity, and the absence of strong institutions for natural resource wealth management, the transformative impact of natural resource revenues has been limited. Economic growth and development trajectories of resource-rich Sub-Saharan African countries have not been much better than that of resource-poor countries.

Measuring standard of living in Sub-Saharan Africa

Standards of living differ greatly across countries; therefore meaningful comparison requires a reliable benchmark. A well-known measure for standard of living is the Human Development Index. It is a composite statistic of life expectancy, education, and per capita income indicators. Recent attention to social inequality led to the introduction of the Inequality-adjusted Human Development Index in the 2010 Human Development Report. Even with this adjustment, the Human Development Index faces two challenges. First, its limited coverage: the index was first published in 1980, with subsequent updates every ten or five years until 2005. This low frequency prevents researchers and policy-makers from evaluating the impact of short-term volatility in resource windfalls. The second challenge is inequality: an essential dimension for evaluating inclusive growth, the inequality adjustment was only recently integrated into the index. To fill these gaps, we constructed an annual welfare measure covering the period 1963-2007 with annual variables. Our suggested annual welfare measure consists of income (GDP per capita), inequality (Gini coefficient) and health (life expectancy). Welfare is higher in a country with higher income, lower inequality, and longer life span.

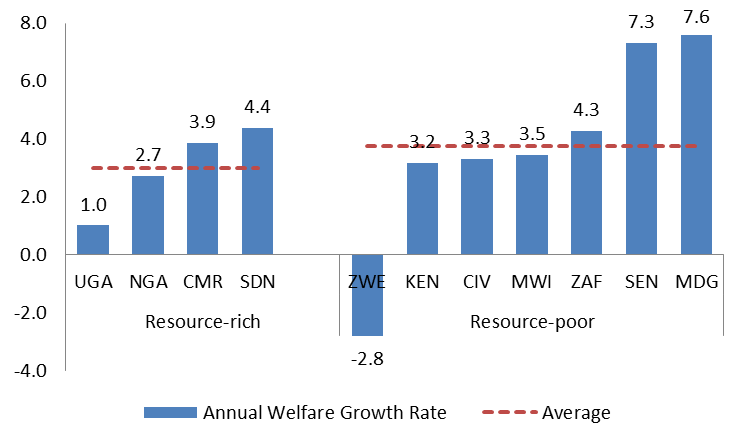

This welfare measure extends our capacity to compare long-term welfare growth rates across Sub-Saharan African countries. Figure 1 presents the annual welfare growth for a number of Sub-Saharan African countries. Results suggest resource-poor countries tend to grow faster than resource-rich countries in Sub-Saharan Africa. Among the eleven Sub-Saharan African countries where historical data are available, the welfare of the four resource-rich countries grew at 3 per cent annually for 1970-2000. In comparison, the welfare of the seven resource-poor countries increased at annual rate of 4 per cent.

Figure 1. Annual Welfare Growth Rates for 1970-2000, Sub-Saharan African countries

Have resource windfalls improved standards of living in Sub-Saharan Africa?

Based on the welfare index computed over the long-time horizon (1963-2007), statistical tests conducted show that resource windfalls improved standards of living in Sub-Saharan Africa. With a sample of 130 countries across the world, resource windfalls significantly enhance welfare, especially with respect to income and inequality. The effect is statistically significant both in the short and the long run. There is a noticeable uptick in income (GDP per capita) after a resource windfall, inequality (Gini-coefficient) slightly decreases, and health (life expectancy) remains almost constant. A decrease in inequality is consistent with Goderis and Malone (2011). Their explanation is based on the Dutch disease argument: resource revenues harm the competitiveness of non-resource export sectors, which often rely on the intensive use of skilled labor. On the other hand, demand for unskilled, labor intensive, non-traded sectors (services) increases. Therefore, given that skilled workers are high income earners, income inequality tends to fall after the resource windfall.

Next, we examine resource windfalls’ impact on a sample of 28 Sub-Saharan Africa countries. The effect of resource windfall is still welfare enhancing but the size is smaller, 20 percent less than the worldwide sample. Refining the analysis by the quality of institutions, we found a much smaller welfare improvement after a windfall shock, 65 per cent less than the worldwide sample. More importantly, we find zero medium-and long-run welfare improvements in the sample of fragile Sub-Saharan states. That fragile Sub-Saharan African countries may have failed to translate resource revenues into improved living standards is consistent with the literature, which emphasises the importance of political institutions in achieving better growth outcomes. Less accountable governments may distort fiscal policy, leading to more macroeconomic instability and worse growth outcomes.

The role of institutions

With better accountability and governance, resource windfalls in Sub-Saharan Africa could achieve the same improvements in welfare observed globally, both in the short and long run. Resource booms can contribute to a lessening of inequality in the short run, due to increases in demand for unskilled workers in the non-tradable sector. Above all, strong institutions and good governance are important pre-requisites for achieving better, more inclusive, growth outcomes after resource booms.

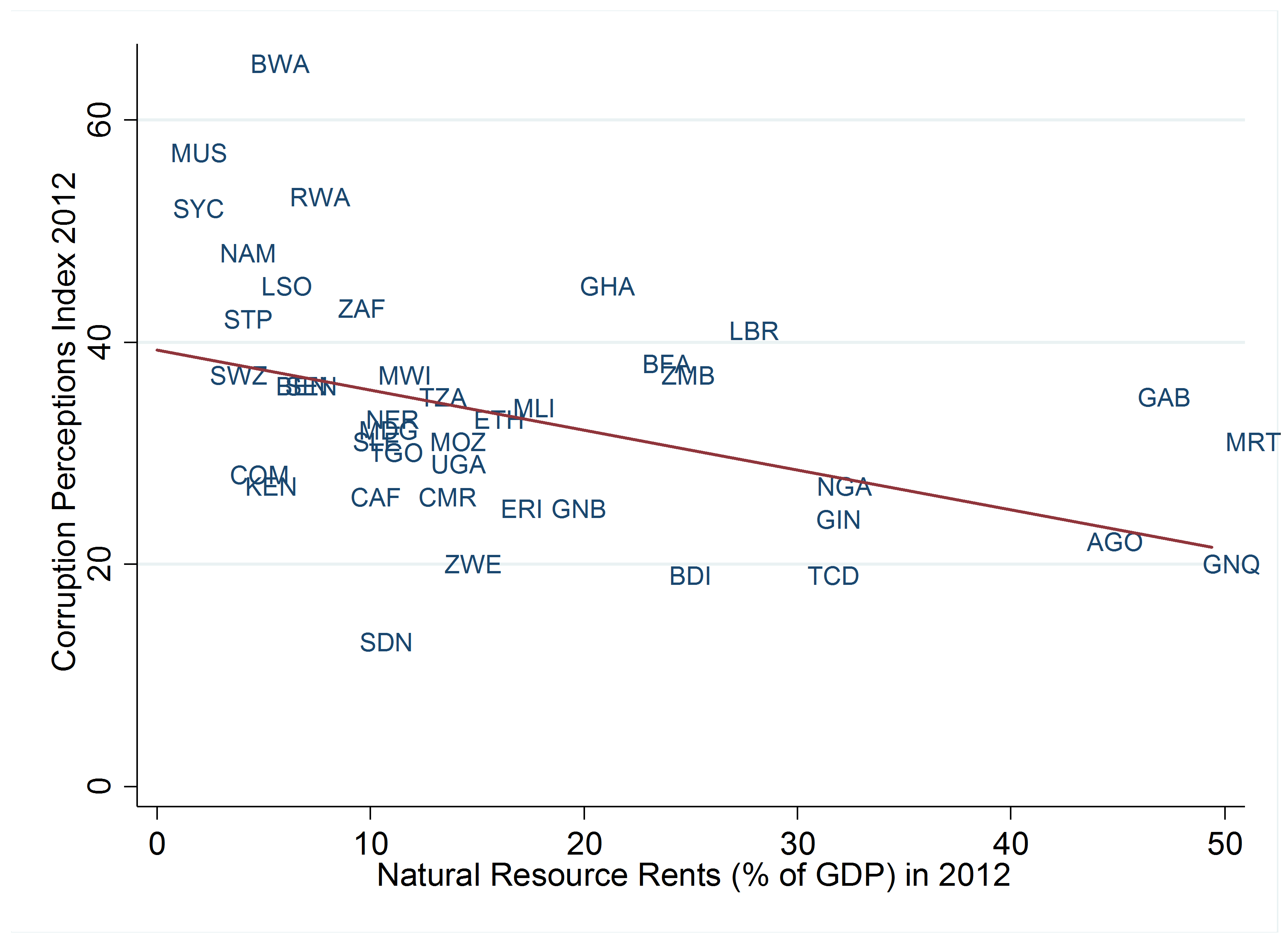

Unfortunately, resource-rich countries in Sub-Saharan Africa tend to have weaker institutions. Figure 2 shows a strong correlation between corruption perception index (0 = perceived to be highly corrupt, 100 = perceived to be very clean) and natural resource rents in Sub-Saharan African countries. Mauritania and Equatorial Guinea for example have the highest natural resource rents as a percentage of their GDP, (49 percent and 48 percent, respectively) and very low control of corruption scores (31 and 20, respectively).

Figure 2. Corruption and Natural Resource Rents in Sub-Saharan Africa

Building stronger institutions that are more effective in managing natural resource windfall is critical, but could take time. In the meantime, however, speeding up public financial management systems’ reforms could help to strengthen transparency for how resource wealth is spent. In most sub-Saharan African countries, the fungible nature of public funds makes it difficult to trace the use of windfall revenues, though much progress is achieved through the Extractive Industry Transparency Initiative. Improved public financial management systems could ensure stronger procedures in the use of public fund in general. More transparent institutions and budget procedures are important to ensuring that resource windfalls translate into welfare improvements. In addition to making a consistent effort to improve institutions through sustained reforms, it is important for public authorities to follow a policy agenda commonly suggested by various international organisations, for more accountability that prevents resource curses: (a) decentralization of government; (b) a greater role for direct citizen participation in decision-making on how natural resource revenues are spent; and (c) cooperation between state agencies and commercial organisations.