Reducing trade costs

The experience of East Asian countries as well as other economies that have successfully used trade to sustain high rates of economic growth over a long period illustrates the high payoff of efforts to lower formal trade costs. Specific efforts to reduce trade costs should become the of focus of international development cooperation

The experience of East Asian countries as well as other economies that have successfully used trade to sustain high rates of economic growth over a long period illustrates the high payoff of efforts to lower formal trade costs. Specific efforts to reduce trade costs should become the of focus of international development cooperation

Trade costs interact with comparative advantage to produce the pattern of specialization and trade that we observe across countries. They affect production and consumption decisions of economic agents all around the world, including poor people in developing countries. Although the relationship between trade costs and poverty is complex and highly specific to individual circumstances — in particular a household’s position as a net producer or net consumer of particular goods — there is clear evidence that reducing trade costs can in some cases lead to lower poverty rates, and improved outcomes for poor producers and consumers in the developing world.

The importance of trade costs

More generally, there is now a plethora of empirical research that documents the importance of trade costs as a factor determining the competitiveness of developing country-based enterprises and national trade performance, including participation on international production networks and diversification into new products and new markets. Specific efforts to reduce trade costs have become the of focus governments and of international cooperation. Donor agencies and the WTO are putting more resources into support for trade facilitation. Given the importance of trade costs and the increased recognition of this importance, it is surprising that they have not received more attention as such at a policy level. One exception is the Asia-Pacific Economic Cooperation (APEC), which adopted two Trade Facilitation Action Plans that committed member economies to reduce trade costs by 10% over the 2002-2010. But the explicit goal of reducing trade costs remains a rarely used tool in international trade policy, both multilaterally and regionally.

In the post-2015 context, the Open Working Group (2014) that was formed to discuss possible Sustainable Development Goals (SDGs) includes calls for a rules-based, open, multilateral trading system, improved Aid for Trade support, better regional and trans-border infrastructure to promote regional connectivity; and lowering tariff barriers for exports of developing countries, including duty-free, quota-free (DFQF) market access for the Least Developed Countries (LDCs). There is little new relative to the approach taken under the MDGs. The only concrete trade performance target proposed, doubling the global share of LDC exports by 2020, is already part of the Istanbul Programme of Action.

Mercantilist bias

The suggested trade objectives have conceptual and operational weaknesses. The mercantilist focus on exports as opposed to trade (both exports and imports) disregards that in practice lack of trade competitiveness is largely the result of domestic policies, including import restrictions. As firms will generally benefit from access to imported inputs that they use to produce exports – or to sell products that compete with imports – the mercantilist bias may misdirect policy attention towards interventions that will have only limited benefit. Moreover, LDCs already have DFQF access to many high-income markets. There are important exceptions such as Bangladesh exports to the US, and the large emerging economies can do more in this area, but research shows that the ‘binding market access constraints’ are often nontariff measures (NTMs), including restrictive rules of origin. What matters then is helping firms overcome applicable NTMs in the relevant markets, both at home and abroad, and more generally to lower their trade costs.

The performance gap

Recent research by the World Bank shows that many countries around the world, including some developing countries, have been very successful in lowering trade costs over recent years. The UNESCAP-World Bank Trade Costs Database provides information on bilateral trade costs inferred from the observed pattern of production and trade using a theoretically grounded approach. Trade costs include all factors that drive a wedge between the producer price in an exporting country and the consumer price in an importing country. The numbers presented therefore cover factors such as international transport, tariff barriers, non-tariff measures, and behind-the-border issues such as domestic distribution and the business environment.

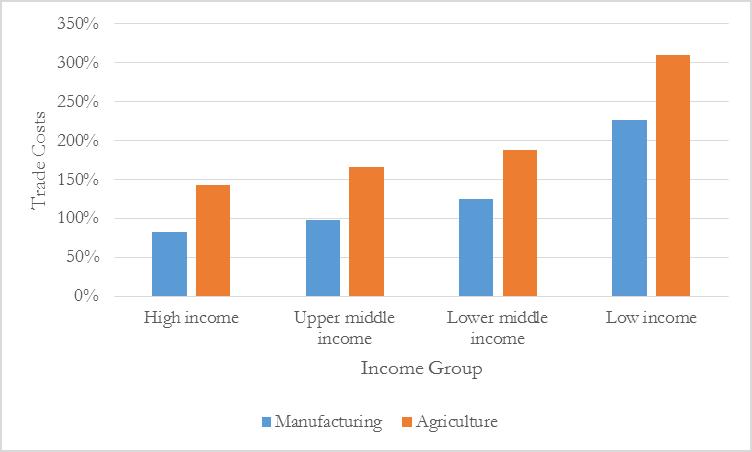

Figure 1 shows the pattern of trade costs by sector for each World Bank income group in 2010. 2 facts are immediately apparent. First, trade costs are decreasing in per capita income. They are lowest in high income countries, and highest in low income countries, and the relationship is stable across all income groups. Second, trade costs in agriculture are substantially higher than in manufacturing for all income groups. This finding is consistent with the fact that global markets for agricultural production remain highly distorted — a severe problem for many developing countries with large agricultural sectors.

The most striking performance gap in terms of trade costs is between the low income countries and all other groups. In fact, some middle income countries — those that have been successful in expanding their trade positions rapidly in the 2000s — have seen rapid declines in their trade cost levels, which is reflected in an average score that is not too different in terms of overall magnitude from what is observed in the high income countries. By contrast, the low income group has trade costs in manufacturing that are 2.8 times higher than for the high income countries, and 2.2 times for agriculture. The trade costs data suggest that low income countries remain marginalized from the world trading system, because the transaction costs of moving goods in and out of those economies are high. If they are to gain fully from the rules-based multilateral system, it is important for low income countries to radically lower their trade costs and become more integrated in global exports and imports.

Figure 1: The pattern of trade costs by sector

Trade costs by sector and World Bank income group, 2010, percent ad valorem equivalent

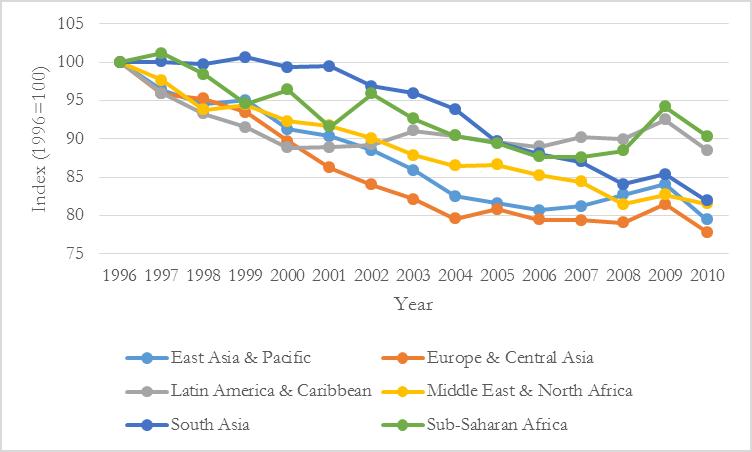

Including a specific trade cost reduction target as part of the post-2015 SDGs

Figure 2 puts the trade costs performance of developing countries in dynamic perspective. This shows that there are two groups. The first has reduced trade costs by around 20% over 15 years — East Asia and the Pacific, Europe and Central Asia, the Middle East and North Africa, and South Asia. While they all have different absolute levels — trade costs in East Asia are lower than elsewhere, for example—their relative dynamic paths have been similar. By contrast, Latin America and the Caribbean and Sub-Saharan Africa have only reduced trade costs by some 10% during the same period. In relative terms, they have lost position in the world trading economy. Clearly, the situation needs to be rectified post-2015 if these regions are to enjoy the kinds of economic and poverty reduction gains that rapidly integrating regions like East Asia have seen in recent years.

Market access constraints in export markets are not necessarily the binding constraint on trade expansion and diversification. In practice autonomous, domestic reforms drive economic development. Trade agreements can help – especially for nations that are land-locked and depend on neighboring countries with sea ports – but the key need is to identify the primary sources of trade costs and to determine what governments should do to address them, and where others can/should help.

These observations suggest consideration be given to including a specific trade cost reduction target as part of the post-2015 SDGs. Nontariff barriers and services trade restrictions in developing countries and inefficient border management and related sources of real trade costs did not figure much in the MDGs and this continues to be the case in the discussions on the post-2015 SDGs. Given the extant research on the links between trade expansion and growth, the importance of trade costs as an impediment to trade and the operation of international supply chains, and the role that services play in overall trade costs (transport and logistics services, related infrastructure), policy attention arguably should focus on lowering trade costs.

Figure 2: Trade costs indices for manufactured goods, by World Bank region

One option would be to set a specific trade cost reduction goal – for example, “Reduce trade costs for firms operating in low-income countries by X percent by 2020”. A key requirement would be to agree on how to measure trade costs and what data and indicators to use. This requires research to develop alternative options that can inform a decision, which should aim to determine how the extant international data on trade costs and related indicators compiled by international organizations on a country-by-country basis can be used to establish a meaningful baseline against which progress can be tracked over time.

A global commitment

A global commitment to a numerical trade cost reduction target would provide a concrete focal point for both national action and international cooperation. It would send an important signal to the international business community that leaders will pursue trade cost reduction initiatives. The new WTO Agreement on Trade Facilitation is an important step forward in this regard, but only deals with one dimension. There are many reasons why trade costs may be high, including own trade policies, nontariff measures at home and abroad, weaknesses in transport and logistics, restrictive services trade and investment policies, etc. None of these are addressed by the new WTO agreement. A trade cost reduction target leaves it to governments to work with stakeholders to determine how best to achieve the target and what should be prioritized. Adoption of a specific target will also help incentivize the relevant international organizations to focus more of their activities on assisting governments to reduce trade costs.