Financing fast-growing cities

Many developing country cities are growing at an unprecedented rate. To respond to this unplanned, rapid expansion, it will be beneficial for city authorities both to expand existing revenue sources and explore new financing options to match higher demand for public services.

-

IGCJ5506-Financing-fast-growing-cities-growth-brief-1706-WEB-v2.pdf

PDF document • 403.96 KB

Introduction

Cities like Kampala, Uganda, will triple in size by the year 2050, according to estimates (Collier, 2017). This is due to high population growth rates and large flows of people from rural areas attracted by the opportunities cities offer. As a result, many developing country city authorities around the world are facing increasing financial challenges. A large number of these countries are also undergoing a decentralisation process, with local and city authorities bearing greater responsibilities for public service provision.

In fast-growing developing country cities, efficient and effective service provision is constrained by limited municipal finance. This brief outlines how city authorities can expand local revenue sources, increase the efficiency of local tax collection, and explore untapped revenue sources, namely land and property tax.

Transfers from central governments are not sufficient to fund the infrastructure and public services needed to support urbanisation. And yet, city authorities in developing countries remain overly reliant on these often constrained and unreliable transfers. Taxes and other fees collected locally are very low: approximately 2.3% of gross domestic product (GDP) in developing countries as opposed to 6.4% in the developed world (Bahl, Linnand Wetzel, 2013).

Given that growing cities cannot and should not rely on central government transfers as their primary source of income, municipal authorities need to better understand how they can expand their own revenue base to provide public services and better support rapid urbanisation.

To support these efforts, it would be advantageous for national authorities to endow their local counterparts with the capabilities to manage their own revenues.

Key messages

- Tapping into diverse, well-administered local sources of revenue can decrease reliance of cities on central government transfers.

When identifying these potential sources of revenue, it is advisable for authorities to prioritise an initial shortlist of options that are within their remit to adjust, while also taking into account administration and compliance costs, to ensure they are both feasible and desirable. - Reforms in local tax administration can generate large increases in revenues.

The introduction of new technologies and the overall modernisation of municipal revenue administration can lead to substantial increases

in the efficiency and effectiveness of tax collection and thus lead to increases in revenues. - Land and property tax represent the largest source of untapped revenue for developing country cities.

Although taxing land is more efficient, administrative and political challenges may make taxing land and property more feasible.

Key message 1 – Tapping into well-administered, diverse, local sources of revenue can decrease cities’ reliance on central government transfers.

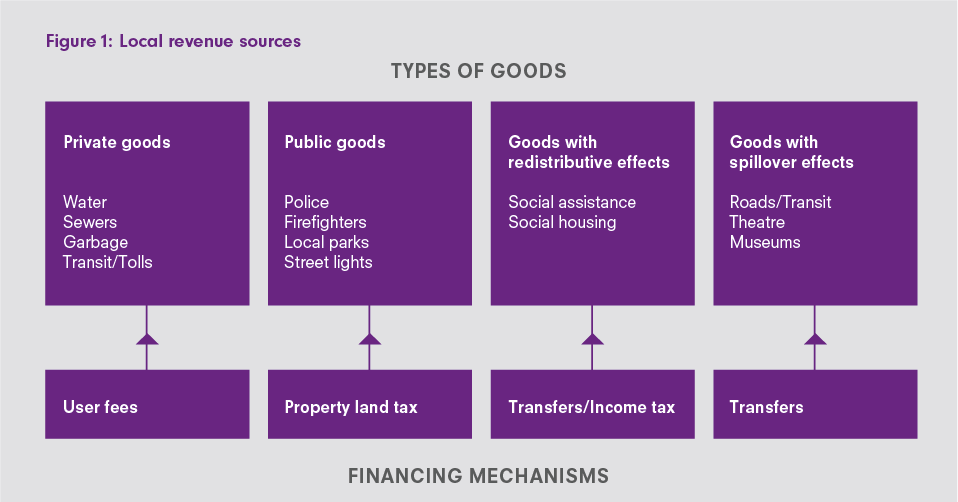

There are over 20 potential principal revenue sources that local governments can explore, summarised into four main categories: revenues from taxes they levy, revenues from non-tax sources they have control over, transfers from central government, and external revenues (Dewvas, Munawwar and Simon, 2008).

As noted, many developing country cities are still overly reliant on central government transfers as their main source of revenue. For example, in Brazil, up to 91% of financing for small municipalities came from intergovernmental transfers in 2006 (Freire and Garzon, 2014).

Central government transfers are in most cases neither large nor stable enough to efficiently and effectively finance a rapidly growing city. In countries like Rwanda, which are going through a process of decentralisation, more responsibilities will be given to local authorities for public service delivery. However, for a number of reasons, transfers from central government may not be able to increase to commensurate levels (Kopanyi, 2015a). In light of this, municipalities will increasingly need to focus on increasing revenues from sources over which they have influence and therefore should provide a more stable flow.

The ability of cities to raise finances depends significantly on the relevant authority’s administrative capacity and on the country’s legislative framework. There may be instances where national legislation does not permit city authorities to raise revenue the way they want. However, it will be beneficial for them to begin working within these frameworks and exploring further sources of municipal revenue, as changing national legislation, which

can still be pursued in parallel, can be a very time-consuming process.

It is not feasible for municipal authorities to try out all options for raising more revenue locally at once. Rather, it is advisable to focus on those with the greatest potential. These are usually sources that are in the city’s mandate and authority to adjust (i.e., without having to change national legislation), and where the largest gains can be made – either because there are a number of large taxpayers involved, there is unrealised potential, or they are administratively easier to levy.

Two important principles to be considered when raising municipal revenues (Freire and Garzon, 2014):

1. It is beneficial for service provision to be clearly linked to the revenue sources required for its financing; and

2. To the extent possible, services can be financed either directly or indirectly by the beneficiaries using them.

A third major principle to take into account when determining other revenue sources is that they are mostly more effective when they are simple and transparent. This is often reflected in the cost of administering the tax or the fee for the authority, as well as the cost of compliance for the user. If these taxes and fees are not well-administered, there is significant risk that they will have prohibitive, distortionary, or unwanted distribution effects (Fjelstad and Heggstad, 2012).

For example, many municipalities like raising revenue through business license fees. However, fees that are too high or complex may make it impossible for small and medium firms to comply. This in turn may either hurt their prospects of survival or result in their evading formalisation so they do not have to pay these fees at all, which in turn lowers the revenue from these sources.

Other examples of fees having adverse effects include charges in excess of cost of provision that are levied on utilities such as water or electricity. While these may be favourable in terms of linking users to services, they could, at the same time, adversely affect the equitable distribution of these services if the fees are too high, rendering poor households unable to access them. However, any subsidies to utility charges must be explicitly funded by other revenue sources to avoid undermining the financial sustainability of utility provision and ultimately reducing access through service interruptions.

With each new fee and tax, the overall system becomes more complex for the authorities to administer but also for the user to understand and comply with. This in itself can have adverse effects on revenue collection as it creates more avenues for potential corrupt practices and may contribute to a general decline in compliance. Therefore, when tapping into new sources, it is advisable for authorities to ensure that the system is transparent, well-administered, and reflects taxpayers’ ability to pay in order to ensure its success in raising revenues overall.

Figure 1: Local revenue sources

Adapted from Slack (2009).

Key message 2 – Reforms in local tax administration can generate large increases in revenues.

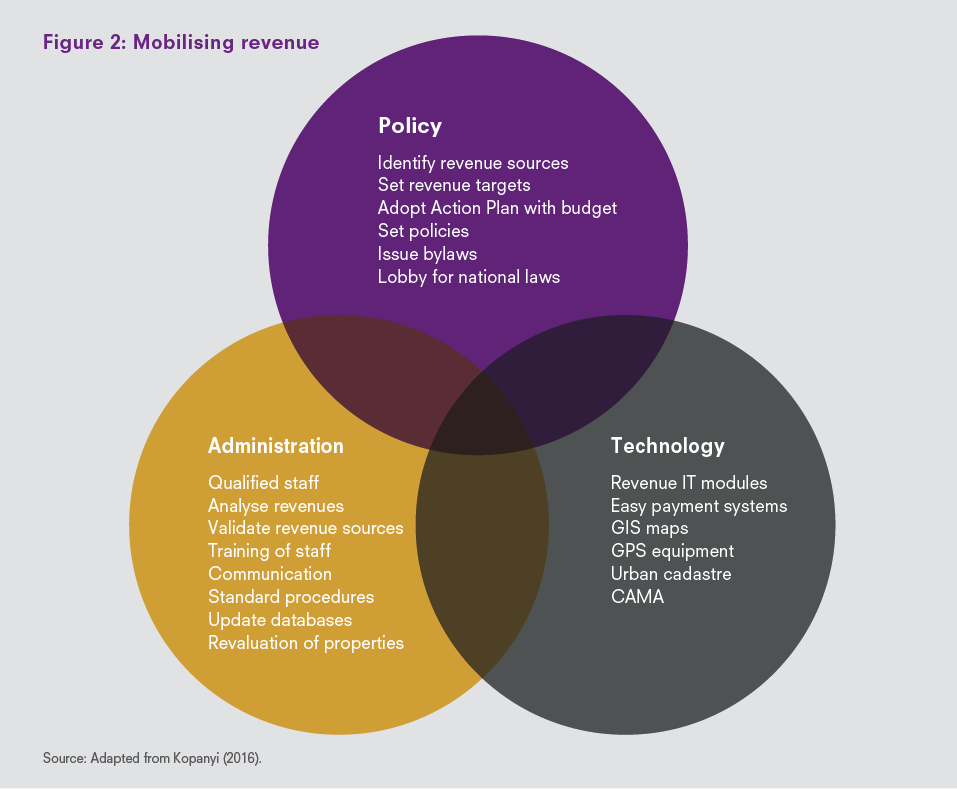

There are large gains to be made from changing the ways taxes are administered. Efficient and effective tax administration is as important as overall tax policy when it comes to raising revenues (Kopanyi, 2015b). The key elements of a successful tax administration scheme include transparency; good communication between the taxpayer and collection authority; reliable and up-to-date databases; and easy registration, filing, and payment for taxpayers.

Improvements are both possible and needed in this area – evidence shows tax collection efficiency in developing countries is below 70%, compared to more than 95% in developed countries (Freire and Garzon, 2014).1

The basic steps for improving revenue administration include:

- Identification of the local tax base – i.e., who is required to pay tax;

- Assessment of their payment obligation – i.e., when and how much they are required to pay;

- Billing and collection – i.e., receiving the required payment from them;

- Enforcement – i.e., imposing penalties and fines should payment not occur;

- Encouraging voluntary compliance – i.e., explaining how the tax will help city residents, of the city, and that it is unfair if some do not pay.

Satellite view of Dar es Salaam, Tanzania. Photo: Getty | Planet Observer/UIG

To carry out any of these steps efficiently, it is necessary to establish street addresses. This is also important for land and property taxes, as addresses tell you where the potential taxpayer is, and the characteristics of their area and property. In light of this, many cities in developing countries, including Dakar in Senegal and Niamey in Niger, are undergoing or have recently undergone exercises to allocate or formalise street addresses (Farvacque-Vitkovic, 2005).

Figure 2: Mobilising revenue

Modernisation and the introduction of new technologies are also allowing for more efficient and effective administration and collection of taxes. The first step is for a city to move its fiscal cadastres – the official registry of taxable land and/or properties – from paper to digital files. In addition, there are now various technologies that support mass valuations for land and property, including geographic information system (GIS) mapping, satellite data, and computer-aided mass valuation systems (CAMA).

In Lithuania, CAMA was introduced for land valuation in 2001, and following its success, was expanded to real estate valuation (Bagdona-Vicius and Deveikis, 2010). Although some of these technologies require up-front capital investments, these can usually be recouped in the first few years thanks to the substantial increase in taxes collected.

Establishing dedicated entities within municipal and local authorities whose responsibility it is to administer local taxes can also improve tax administration. The level of these tax entities’ involvement will vary by country depending on national legislation and government structures. However, evidence has shown that the greater their involvement and the more substantial their responsibilities, the stronger local ownership over financing will become. This in turn substantially improves planning, execution, and overall management of revenues at the city level (Muwonge and Ebel, 2014).

Institutionalising local tax reforms

The Kampala Capital City Authority (KCCA) is one example of how local tax administration can support increases in revenue. In 2011, the agency established a dedicated Directorate for Revenue Collection (DRC), which was staffed with a qualified team mostly drawn from the national revenue authority. The DRC introduced a number of measures that made it easier for taxpayers to submit their payments to the KCCA, such as online filing and submission, updating of databases, and an overall simplification of the tax payment process. It also improved communication by educating taxpayers on how their taxes were being spent on public services and establishing a help centre for taxpayers.

As a result of these reforms, the DRC managed to more than double revenues from

the city’s own sources (Kopanyi, 2015b). Although administrative reforms are usually

one-off changes, institutionalising them within a dedicated directorate can ensure a sustained revenue stream for the future.

Key message 3 – Land and property tax represent the largest source of untapped revenue for developing country cities.

One of a city’s most important assets is the land it is situated upon. As a city grows, so does demand for land. Given that land is a scarce resource, it therefore appreciates in value. Municipal authorities deserve to be the primary beneficiaries of this appreciation by capturing its value through taxation. Furthermore, land and property taxes are attractive as a local revenue source because they are levied on largely immovable assets, making them easier to target.

In developing countries, however, successful implementation of such taxes has been limited. For example, while Canada’s property taxes make up about 38% of municipal finance revenues, in Uganda, the comparative figure is only about 3% (Slack, 2009). This indicates that there is large untapped potential for developing countries to increase their revenues from land and property taxes.

Land and property taxes encourage more efficient land use in cities. They are also considered a fairer form of tax because in general, the appreciation of land value comes from population growth and external public investment, rather than from the land owner’s actions.

An example of this can be found in Accra, Ghana, where researchers found that properties benefitting from tarred roads and concrete drains are nearly twice as valuable as those in areas without these benefits (Awuah et al, 2013). Similarly, in Onitsha, Nigeria, studies have shown a strong correlation between public transportation and other infrastructure, and increases in surrounding land values (Emo et al, 2013).

From an administrative perspective, land and property taxes should also be easier to manage given they are largely levied on immovable assets. Although this does require upfront investments from local authorities on registries of all taxable land and property and their owners, this is likely to pay off very rapidly through increased tax intake. Furthermore, due to the permanent nature of land and property, the resulting revenue stream will be sustainable and will increase as the land appreciates in value.

Land taxation is preferable to property taxation as it is both fairer and more efficient. Due to its fixed supply, increasing taxes on land means that higher taxes should not discourage investment. Conversely, it will provide more incentives to use the land intensively, rather than keeping it underdeveloped or vacant for speculative purposes. This has been the experience for many East Asian countries.

There are two main reasons why these taxes have not been successfully implemented in developing country cities to date: first is the administrative challenge of not having the required data or sufficient organisational and technical expertise, and second is political opposition. Land and property owners, who have not had to pay these taxes in the past, privately capture the full value of the appreciation of their land over time.

Rapid and large increases in these tax rates can therefore elicit strong opposition

from these powerful and vested interest groups. This is particularly the case for vacant land that is held for speculative purposes, which in some cities is actually taxed at a higher rate to encourage investment.

When introducing or revising land and property tax rates, the sequencing and pace of the reforms are key to their potential success. Experiences from a variety of countries that have implemented these reforms suggest that initially broadening the tax base before ultimately increasing the rate is preferable.

If, in contrast, rates were raised first, those who are already paying tax would simply have to pay more at the expense of other ‘free riders’. The tax would also become more inequitable.

In countries that are at the initial stages of introducing a tax, or have failed to revise their tax rates in a while, gradual increases are advisable. For example, in Kampala, the last property valuation to determine the tax rate occurred in 2005. The city has grown rapidly since then and values of both property and land have increased. Research suggests the corresponding potential median increase in property taxes from a new valuation could be up to 300% (Kopanyi, 2015b).

Some practical policies

Developing country cities will continue to grow rapidly and, as a result, so will the demand for public services. To meet this demand, urban policymakers will need to increase and diversify potential sources of revenue in a well-administered and transparent manner.

Short-term reforms

While changing national legislation may be an option, this will need to be considered in parallel to reforms that can be carried out in the short-term by local authorities. The authorities can identify the best possible revenue sources, both in terms of their potential tax take and the feasibility of their implementation.

Examples of such reforms include:

- Updating and digitising databases with relevant information on the tax base.

- Establishing a unique registry for taxable land and property.

- Improving tax collection processes for both the authorities and the taxpayers through modernisation, such as online payment systems and help centres.

- Investing upfront in technology that can streamline revenue administration processes.

Medium-term reforms

In all countries, but particularly those that are undergoing decentralisation processes, it is beneficial for national authorities to endow their local counterparts with the necessary capabilities to manage their own revenues. This increases local ownership of the process and can potentially result in better public service provision. Migration and population growth in cities mean that more resources will need to be managed locally, and the ability of municipal or local authorities to raise their own revenues will be increasingly important.

As local and municipal authorities strive to rely less on central government transfers, they will be able to work towards having land and/or property taxes become their primary source of revenue.

It is advisable to implement reforms in this area in a sequenced, gradual, and transparent manner that is commensurate with the ability of the tax base to pay these taxes. Although political opposition in this respect is inevitable, it is still beneficial to pursue these reforms. Opposition can be mitigated through a transparent and well-communicated reform process.

Woman in Kigali, Rwanda. Photo: Getty | Phil Moore

Further reading and references

Awuah, K.G.B., Booth, C., Hammond, F.N. and Lamond, J.E. (2013). ‘Benefits of Urban Land Use Planning in Ghana’. Geoforum 51: 37-46.

Bagdona-Vicius, A. and Deveikis, S. (2010). Automated Valuation Models in Lithuania. Lithuania: State Enterprise Centre.

Bahl, R., Linn, J. and Wetzel, D. (2013). ‘Financing Metropolitan Governments in Developing Countries: Governing and Financing Metropolitan Areas’. Massachusetts: Lincoln Institute of Land Policy.

Bird, R. (2001). ‘Setting the Stage – Municipal and Intergovernmental Finance’, in Freire, M. and Stren, R. Challenges of Urban Governments. Washington DC: World Bank Institute.

Devas, N., Munawwar, A. and Simon, D. (2008). Financing Local Government. London: Local Government Reform Series.

Collier, P. (2017). African Urbanisation: An Analytical Policy Guide. Oxford Review of Economic Policy.

Emo, F. I., Ayotundo, O.O. and Charles, C.E. (2013). ‘Prioritising Residential Land Value Determinants in Onitsha, Nigeria’. International Journal of Academic Research in Business and Social Sciences 3, no.3: 201.

Farvacque-Vitkovic, C. (2005). Street Addressing and the Management of Cities. Washington DC: World Bank.

Fjeldstad, O. and Heggstad, K. (2012). Anglophone Africa: Local Government Revenue Mobilisation. Norway: CHR Michelsen Institute.

Freire, M. and Garzon, H. (2014). Farvacque-Vitkovic, C. and Kopanyi, M.: Municipal Finances – A Handbook for Local Governments: Managing Local Revenues. Washington DC: World Bank.

Kharas, H. and Linn, J. (2013). ‘External Assistance with Urban Finance Development: Needs, Strategies, and Implementation’, in Financing Metropolitan Governments in Developing Countries. Massachusetts: Lincoln Institute of Land Policy.

Kopanyi, M. (2014). Financing Expansion and Delivery of Urban Services: International Experiences and Rwanda Challenges. London: International Growth Centre.

Kopanyi, M. (2015a). Enhancing the Own Revenues of Decentralised Entities in Rwanda–Policy Challenges and Options in Reforming the Fixed-Asset Tax System. London: International Growth Centre.

Kopanyi, M. (2015b). Local Revenue Reform–Kampala Capital City Authority. London: International Growth Centre.

Martinez-Vazquez, J. (2013). ‘Local Non-Property Revenues’, in Financing Metropolitan Governments in Developing Countries. Massachusetts: Lincoln Institute of Land Policy.

Mccluskey, W. and Franzsen, R. (2013). ‘Property Taxes in Metropolitan Cities’, in Financing Metropolitan Governments in Developing Countries. Massachusetts: Lincoln Institute of Land Policy.

Muwoge, A. and Ebel, B. (2014). ‘Intergovernmental Finances in a Decentralized World’, in Municipal Finances – A Handbook for Local Governments. Washington DC: World Bank.

Slack, E. (2009). Guide to Municipal Finance. The Human Settlements Financing Tools and Best Practice Series. Nairobi: UN HABITAT.

World Bank. (2015a). Ethiopia Urbanisation Review – Urban Institutions for Middle-Income Ethiopia. Washington DC: World Bank.

World Bank. (2015b). Raising Through Cities in Ghana; Ghana Urbanisation Review No. 96449. Washington DC: World Bank.

World Bank. (2013). Planning, Connecting, and Financing Cities–Now. Washington DC: World Bank.

World Bank. (2009a). World Development Report 2009: Reshaping Economic Geography. Washington DC: World Bank.

World Bank. (2009b). Improving Municipal Management for Cities to Succeed; IEG Special Report. Washington DC: The Independent Evaluation Group, World Bank.

Citation

Haas, A. and Collier, P. (2017). Financing fast-growing cities. IGC Growth Brief Series 010. London: International Growth Centre.