Growth brief: Making cities work for development

Cities can be productive and liveable places but poor public services, weak infrastructure, and institutional and legal obstacles to private investment have in many cases undermined their performance.

-

IGCJ3155_Growth_Brief_2_WEB.pdf

PDF document • 573.96 KB

Introduction

In this brief we analyse the potential of cities in the developing world and the interventions required to achieve this potential. This brief is particularly useful for policymakers when formulating urban plans and considering new infrastructure systems.

KEY MESSAGES

1) Cities in the developing world can be both productive and liveable places.

The fundamental advantage of cities is that of scale – the concentration of people enables economic and social interactions to occur more frequently and effectively. This creates the potential for cities to be productive and to offer inhabitants a decent quality of life.

2) To achieve cities’ potential, policymakers must address key issues including land, transport, public finance and regulation.

Making the city work requires investments in residential, commercial and industrial structures, as well as infrastructure. These must be supported by a combination of effectively functioning land markets, appropriate regulation, good public services, and adequate public finance.

3) The implications of failure are deeply felt and long run.

Harnessing the unprecedented growth in urbanisation over the coming generation will require smart policy and hard work. However, in many cases policy failures have undermined city development.

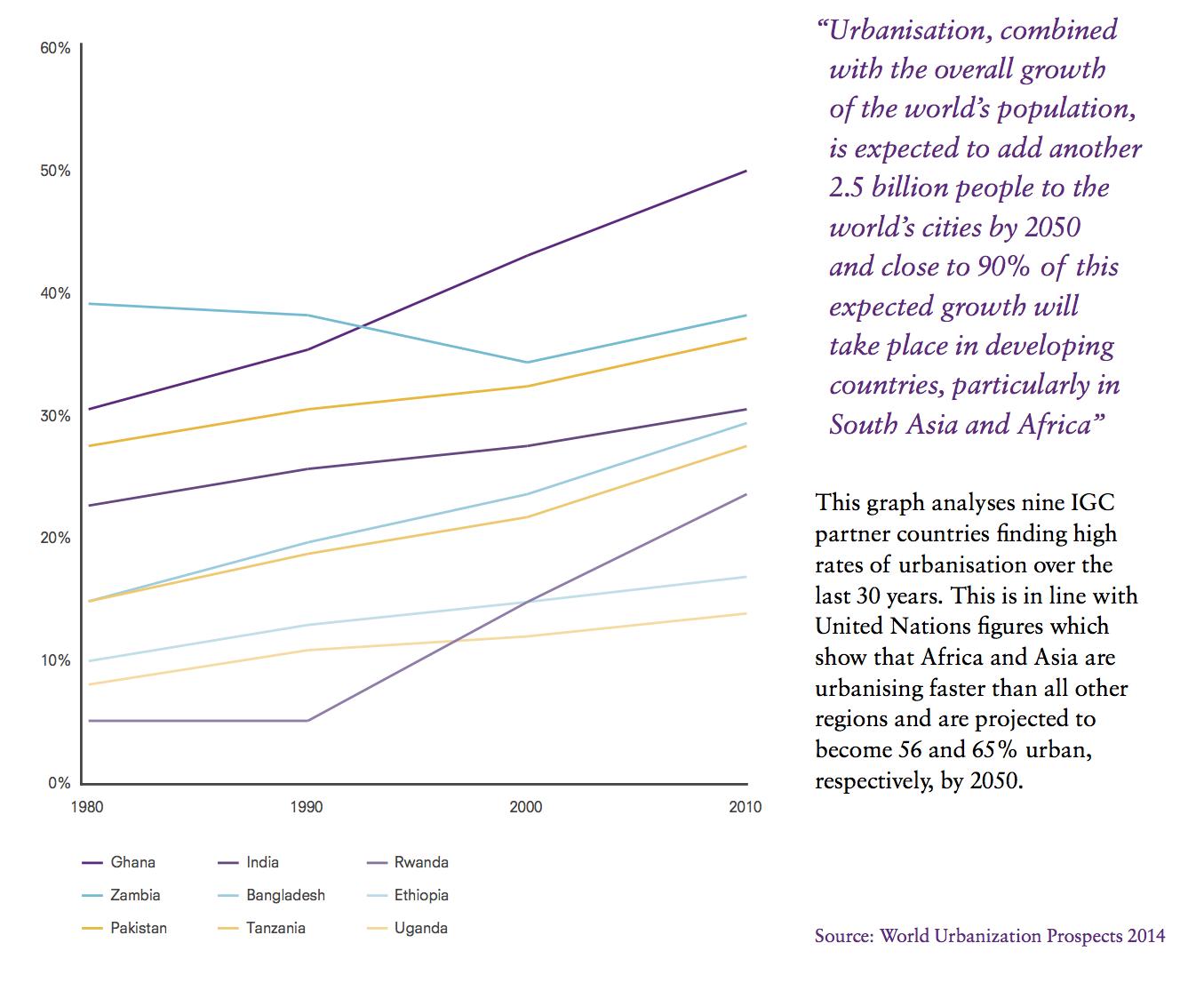

Today, for the first time in history, more than 50% of the world’s population live in towns and cities. The urban population of the world has grown rapidly from 746 million in 1950 to 3.9 billion in 2014. It is expected to surpass 6 billion by 2045. A further 2.5 billion people will live in cities by 2050 and close to 90% of this expected growth will take place in developing countries, particularly in South Asia and Africa.

Urban growth occurs because of the economic advantage of cities. This derives from the benefits of scale – the economic and social advantages of being in large centres of activity where lots of interactions take place. However, reaping these benefits requires large public and private investments and a high level of policy engagement. Public investments are needed to build the infrastructure – transport, water and sanitation, power – and the public services that support urban living. Residential investment is needed to offer dwellings that are of good enough quality, and that enable their inhabitants to access centres of employment. Investment in commercial and industrial activity is needed to create jobs for a rapidly expanding labour force.

Many cities are failing to generate sufficient investment and the consequences are apparent; poor living conditions for many inhabitants and high levels of informality in both housing and employment. Poor infrastructure and poor housing make a city a less attractive place for business to invest, retarding the job creation that is urgently needed. The challenge for policy is to create the environment which harnesses the potential of cities as places to work and to live. This brief explores the sources of this potential, and asks: What does it take to deliver productivity and liveability?

Key message 1 – Urban productivity: Cities in the developing world can be both productive and liveable places

The fundamental advantage of cities is that of scale and density; the concentration of people enables economic and social interactions to occur more frequently and effectively. There is a great deal of evidence that cities have higher productivity than other areas. Studies of developed economies indicate that a doubling of city size (in a cross-section of cities) is associated with productivity being some 5–7% higher. This is large, suggesting that a city of 5 million people has productivity some 30% higher than a city of 300,000. Cities are also centres of innovation and entrepreneurship where new firms develop and new sectors grow. Similar effects have been found in developing countries, although less research has been undertaken and outcomes are mixed. Importantly, the potential of cities is not just to raise productivity in existing activities, but also to provide the environment in which new activities can take root. To be successful, new activities need to draw on the skilled workers and suppliers that can only be found in cities.

Why do cities have this economic advantage? Studies of agglomeration economies point to a number of mechanisms. One is that cities offer large markets. A large local market makes it easier to establish new firms and to grow them to scale at which they are efficient. This makes for more competition, breaking down monopoly power as multiple firms come to compete for customers. As well as offering larger markets, cities also offer more suppliers of the inputs that firms use; the presence of local suppliers means that inputs can be tailored to firms’ needs and supplied rapidly and flexibly.

Figure 1: Urban population (% of total)

These two effects are different sides of the same coin – one firm’s supplier is another firm’s customer. There is a virtuous circle here; suppliers have lots of potential customers and are able to specialise and raise their productivity; firms using these inputs benefit from the specialised goods and services that are available. These mutually beneficial and self-reinforcing effects operate most powerfully in the urban context where proximity enables good communication and rapid delivery of goods and services.

Similar arguments apply in the labour market, and suggest a positive relationship between cities and skills. Firms are more likely to be able to find the precise mix of skills they need if there is a large pool of labour to draw from. Reciprocally, the incentive for workers to acquire specialist skills is greater if there is a wide range of employers to whom the skill can be sold.

These forces lead to the clustering of economic activity, at the sectoral level, and more broadly through the city as a whole. At the sectoral level the combination of numerous specialist skills with the ease of face-to-face interaction supports urban concentrations of services (such as finance, law or film production) and of innovation intensive and high-tech activity. These clusters are common in developed country cities, and also arise in developing countries (such as the technology cluster in Bangalore), and as cities seek to become regional centres for the provision of business services. Manufacturing clusters used to be common in developed countries and are now moving to developing economies (such as the garment industry of Dhaka or the clusters of Sialkot).

Benefits of urban scale also arise in other activities. Public services such as health and education, and aspects of infrastructure provision such as sewerage and electric power can be supplied more cost-effectively to spatially concentrated populations than to dispersed ones. Social networks can be wider and more diverse in urban areas than in small towns or villages.

The key point on the economic potential of cities is that effective scale requires proximity and hence density of economic activity. It is not just the total population of a region, but the concentration of population in an area small enough to constitute an integrated market for labour and to facilitate close business linkages.

Soccer ball production in Sialkot

Sialkot is a large city in north-east Punjab, encompassing almost 2 million people and home to over 135 firms who exclusively focus on producing soccer balls. This unique cluster of firms was discussed by Hausman and Rodrik (2002) and analysed by Verhoogen et al (2014) in an IGC funded project. This cluster produces 30 million soccer balls a year, or about 40 percent of world production, including match balls for the 2014 World Cup, and about 70% percent of world hand-stitched production. In 2000, the exports of soccer balls from this cluster to the US was worth USD $23.2 million and remains one of Pakistan’s largest exports. This cluster provides an ideal setting for innovation – in the last few years Verhoogen and his team improved the efficiency of soccer ball producers by modifying their production technique.

Key message 2 – Urban land-use: Urban land is a scarce resource, and must be used efficiently

High productivity, if achieved, will translate into high wages. But set against this, urban households – even in a well-functioning city – face a particular set of costs. The first of these arises from the fundamental trade-off of urban economics. Productivity requires density, so that people and jobs are close to each other. But greater density implies, other things equal, that living space is expensive and that each person has less of it. This clashes with the fact that living space is a key ingredient of wellbeing. This trade-off can be shifted in two ways – by enlarging the effective area of the city, and by using the existing area efficiently. The former can be achieved by good transport infrastructure, enabling people to travel to jobs and the development of business links across a wider area. We discuss this further in the next section. The latter requires that land is used efficiently, i.e. that it is put to its highest value use (taking into account amenity and social values, as well as private returns). The pattern of land-use shapes the construction of an efficient city, and the location and quality of the business and residential investments necessary for productivity and liveability.

Efficient urban land-use typically involves a pattern in which businesses, particularly those in sectors prone to agglomeration, cluster together, many of them occupying a central business district. Land prices are high in this area, so other businesses may be more dispersed or located at the city edge, and larger cities may contain several major business districts. Residential areas surround the business districts, with land prices generally declining with distance. High rent residential areas near the centre are high density – achieved through a combination of building height and relatively low floor space per inhabitant.

This configuration makes the best use of available land. Businesses get the benefits of density, and workers can get to centres of employment. High land and property prices induce people (occupants and property developers) to use land efficiently. Efficiently operating land markets are central in achieving this allocation, although markets alone are not sufficient; they must operate in an appropriate institutional and policy environment.

Key message 3 – Urban policy: To achieve cities’ potential, policymakers must address key issues including land, transport, public finance, and regulation

Development of the city will be undertaken largely by the private sector, whose investments will be guided principally by the market. Nevertheless, there are two key roles for policy. One is to provide public goods, infrastructure and services without which a city cannot function. The second is to ensure that markets work effectively. This requires a combination of removing obstacles to the market, and appropriate regulation of situations where market failures can lead to socially damaging outcomes.

1. INFRASTRUCTURE AND PUBLIC SERVICES

The provision of utilities, public amenities, and services is crucial for both the productivity and liveability of urban areas. They provide direct benefits to households and firms without which the city is less attractive and less likely to prosper. In addition to providing these benefits, public investments play two further roles in shaping the growth of the city.

The first applies principally to transport. Good transport enables workers to get to firms, firms to reach markets, and facilitates interactions in clusters of activity. The full benefits of transport improvement are greater than those that accrue directly to transport users: it may benefit others by enabling the growth of clusters and consequent increases in urban productivity.

Second, public investments play an important role in coordinating expectations about the growth of the city. Since structures are long-lived, investors – residential developers and firms – need confidence that the particular place where they are planning to invest will prosper. The market is not able to provide this. It offers no certainty about future benefits in a district, and no way of hedging location-specific risk. Without confidence, investment right across the city will be deterred. An urban plan might be intended to provide such confidence, but often such plans are not credible. In contrast, investments in infrastructure are long run commitments to an area. For example, investors in the proximity of a new station or junction might expect that others will choose the same location, generating a cumulative virtuous circle of investment. It follows from this that infrastructure investment needs to lead, not lag behind, the growth of the city.

However, this creates an enormous urban public finance challenge. A local tax base is needed to finance these expenditures. A successful city generates a local tax base, as its economic advantage leads to appreciation of land values. Targeting urban land for taxation offers several advantages.

The first is ethical. Land value appreciation occurs because of the productivity generated by the city as a whole, so the enhanced value is not readily attributable to the actions of any particular land owner. However, much of the increase accrues to the owners of urban land who, while they may have constructed buildings, have not contributed to the overall rise in land values. Therefore, there are reasonable ethical grounds for assigning this value addition to a city authority as the representative of the residents who have collectively generated it. This can be achieved by the taxation of land value on a continuing basis, or by a one-off tax on increases in the price of land.

The second advantage is that a well-implemented property tax is an efficient way to raise revenue. It is relatively easy to collect once a comprehensive land registry is in place. It has little effect on decision making, particularly if the tax base is an estimate of land value, exclusive of structures built on the land. The appreciation of land values can finance all infrastructure required by an efficient city.

2. LAND MARKETS AND RESIDENTIAL INVESTMENTS

Low levels of residential investment are apparent in the squalid housing conditions of many developing cities. In part, this is a direct consequence of low income levels and capital scarcity. But in many cities it is also a consequence of institutional and policy failure.

Private investment in built structures (residential or commercial) requires an environment which has clarity and security of land tenure. This is particularly so as buildings are long-lived, so their development requires that investors have secure title of land for long periods. In many countries such rights are unclear and disputes surrounding ambiguity of title can be difficult and slow to settle. These weaknesses in land rights deter investment and encourage investors to economise on capital by building low quality structures, which are typically low-rise and hence support low population density. They make land and the property constructed on it less marketable, and also less able to function as collateral. An important role for policy is therefore to make sure that these rights are sufficiently clear and enforceable.

There is an important role for regulation of land markets and construction practices, but regulations are often set inappropriately. Regulation – typically controls on the type and quantity of building in a particular place – plays several distinct roles.

One is that regulation can enable markets to work better. For example, it is hard to inspect the construction quality of a building (e.g. its foundations) once the building is complete. Prospective purchasers of the building (or lenders, for whom the building is collateral) need this information. If they know building regulations have been complied with, they will be more secure in their purchase.

Another is to control negative externalities that can arise in cities. Pollution from factories to residential areas can be controlled by zoning. Overload on infrastructure and utilities, and the congestion or service breakdown that can follow, can be regulated by floor-area ratios or other measures to control the number of buildings or people in a neighbourhood. H

owever, appropriate is the key word here. Too often regulations are set at levels that are unaffordable, and zoning is too rigid. The effect is to deter the essential private investment that is needed. If building regulations and standards for plot sizes are set too high then they will simply be ignored. This matters because structures built outside one regulation may then lose other legal protections. In short, decent quality formal sector houses will not be constructed if regulations make them unaffordable: informal settlements will fill the gap.

Achieving appropriate levels of residential investment requires that other sectors and markets, as well as the land market, function effectively. Capital markets and financial intermediation are needed to provide ways of saving for house purchase and financing loans for both commercial and residential construction. Often capital markets fail to play these roles. The mortgage market is very thin as commercial banks are unwilling to lend and specialist mortgage providers have not emerged. High levels of inflation and associated high nominal interest rates have tended to make initial mortgage payments unaffordable. In many countries, particularly in Africa, the construction sector is weak: there are large firms (some of them international) and there is self-build, but small- to medium-size building companies are scarce.1 Associated with this, workers with building skills are often in short supply. Policy to address these issues must be joined-up across government, reaching financial regulation and macroeconomic policy as well as urban management.

3. BUSINESS INVESTMENT AND JOBS

A city’s success depends, ultimately, on its ability to create jobs, this in turn requiring a good business environment. Much of this environment is set by policy at the national level, but there is also a city level dimension. Many of the points have already been covered: infrastructure is needed for moving goods and workers; land needs to be available for development; regulation needs to be consistent with undertaking investment.

The city level business environment has particular importance as each city competes with others – in the region and internationally – for footloose (regionally or internationally mobile) sectors. These are the sectors that are needed for sustained job creation, which are most subject to agglomeration economies, and in which the benefits of scale and high productivity are best attained.2 A city that is high cost – because it fails to use land efficiently, has poor infrastructure and public services, or a poorly housed workforce – will not be attractive to investors in these sectors. Consequently the only economic activity is relatively low value and directed at serving local markets.

Many cities face a serious risk of being locked into these low value activities. The long life of built structures means that a city built around low value activities is ill-suited to provide the density needed for modern manufacturing or service jobs. Such a city has low productivity, incomes, and tax revenues, making it difficult to finance the infrastructure, services and other investments required. The implication is that policymakers need to act soon, and need to see the city as a whole and with a long-term perspective, if they are to realise the full potential of urban growth.

Policy recommendations

Cities can be the greatest drivers of economic growth, creating jobs, raising productivity and constructing decent housing. Yet many cities fail to make the investments (public and private) that are necessary to achieve their potential. If it is difficult to move around, the benefits of economic density will not be achieved. If there are high costs for business, the city will not attract new activities or reap economies of scale. If land and capital markets function poorly, then buildings will be constructed to a low standard. Making the city work requires a combination of effectively functioning land markets, appropriate regulation, good public services (especially transport infrastructure), adequate public finance, and a credible plan of future city development. If the private sector is to undertake investments in a fastchanging city environment, it needs both the market opportunities (such as access to land and finance) and confidence in the future development of the city. In order to reap the benefits of this new urbanisation, governments and city administrators will need to follow this set of recommendations to get the city urbanisation policy chain right.

- All areas of government need to plan now. Urbanisation is already happening across the developing world – there will be 2.25 billion more urbanites in South Asia and Africa by 2050. Planning for this influx requires a coordinated approach across all areas of government.

- Public investments matter, particularly the provision of a functioning transport system. Not only do these investments confer benefits on users, they establish market confidence for potential private investors.

- A local tax base is important. It is particularly effective to target urban land for taxation. It has a powerful ethical basis, and it is relatively easy to collect once a comprehensive land registry is in place.

- Urban land markets must be free to play the role of allocating land efficiently. Land should be able to be developed by those best able to get the highest value – private and social – from the site.

- Efficient land use and investment in structures requires clarity and security of land tenure. This needs to be complemented with improvements in the reliability and speed of dispute resolution through the courts.

- Regulation needs to be appropriate. It should control negative externalities, provide information and signal to investors the likely shape of the city. But it must avoid setting standards that are not affordable.

- The capital market and financial intermediation needs to provide ways of saving for house purchase and financing loans for both residential and commercial construction.

Urbanisation will occur in coming decades, regardless of policy. This makes it all the more important that it is done right, harnessing the potential advantages of cities to generate economic growth. It will require smart policy that is joined-up across all parts of the urban agenda.

References

Brueckner, J., and A. Bertaud (2004) “Analyzing building height restrictions – predicted impacts, welfare costs, and a case study of Bangalore, India”. World Bank Policy Research Working Paper 3290. Available from: http://papers.ssrn.com/sol3/papers. cfm?abstract_id=610334

Gollin, D., R. Jedwab and D. Vollrath (2015) “Urbanisation with and without industrialisation” Available from: http://home.gwu.edu/~jedwab/gjv_ Feb2015.pdf

Hausmann, R., and D. Rodrik (2002) “Economic Development as Self-Discovery”. NBER Working Paper 8952. Available from: www.nber.org/papers/ w8952.pdf

Shiferaw, A., Söderbom, M., Siba, E., and G. Alemu (2012) “Road Infrastructure and Enterprise Development in Ethiopia”. IGC Working Paper. Available from: www.theigc.org/project/roadinfrastructure-and-firm-level-productivity-dynamicsin-ethiopia/

Verhoogen, E., Atkin, D., Chaudhry, A., Chaudry, S., and A. Khandelwal (2014) “Organizational Barriers to Technology Adoption: Evidence from Soccer-Ball Producers in Pakistan”. IGC Working Paper. Available from: www.theigc.org/project/evidence-from-arandomized-experiment-in-pakistan/

Further reading

Duranton, G. (2008) “Viewpoint: From cities to productivity and growth in developing countries”. Canadian Journal of Economics/Revue Canadienne d’Economique, 41: 689–736. Available from: http://onlinelibrary.wiley.com/doi/10.1111/j.1540- 5982.2008.00482.x/epdf

Glaeser, E., and J. Gottleb (2008) “The Economics of Place-Making Policies”. Brookings Papers on Economic Activity, Spring 2008. Available from: www.brookings.edu/~/media/Projects/BPEA/ Spring%202008/2008a_bpea_glaeser.PDF

Henderson, J. V., and H. G. Wang (2005) “Aspects of the rural-urban transformation of countries”. Journal of Economic Geography, 5 (1). 23–42. Available from: http://joeg.oxfordjournals.org/content/5/1/23.full. pdf+html

Lucas, R (1988) “On the mechanics of economic development”. Journal of Monetary Economics, 22. 3–42. Available from: www.sciencedirect.com/science/ article/pii/0304393288901687#

McKinsey & Company (2012) “Urban world: Cities and the rise of the consuming class”. Available from: www.mckinsey.com/insights/urbanization/urban_ world_cities_and_the_rise_of_the_consuming_class

Moretti, E (2004) “IGC Evidence Paper – Cities”. Available from: www.theigc.org/publication/igcevidence-paper-cities/

Overman, H. G., and A. J. Venables (2005) “Cities in the Developing World”. CEP Discussion Paper No 695. Available from: http://cep.lse.ac.uk/pubs/ download/dp0695.pdf

UN-Habitat (2012) “State of the World’s Cities 2012/2013: Prosperity of Cities”. Available from: http://mirror.unhabitat.org/pmss/listItemDetails. aspx?publicationID=3387

About the author

Tony Venables CBE is Professor of Economics at the University of Oxford where he also directs the Centre for the Analysis of Resource Rich Economies. He is also a member of the IGC’s Steering Group. He is a Fellow of the British Academy and of the Econometric Society. Former positions include Chief Economist at the UK Department for International Development, professor at the London School of Economics, research manager of the trade research group in the World Bank, and advisor to the UK Treasury. He has published extensively in the areas of international trade and spatial economics, including work on trade and imperfect competition, economic integration, multinational firms, and economic geography. Publications include The spatial economy; cities, regions and international trade, with M. Fujita and P. Krugman (MIT press, 1999), and Multinationals in the World Economy with G. Barba Navaretti (Princeton 2004).

Citation

Venables, A.J. (2015) Making Cities Work for Development, IGC Growth Brief Series 002. London.