Access to credit and female labour force participation in India

Women’s physical access to microfinance loans from the Self Employed Women’s Association (SEWA) Bank, correlates with the probability of accessing loans, which in turn correlates with the likelihood of working in the long-run.

Financial empowerment and labour

Access to microfinance loans provides resources for home-based work and places financial decision-making power in women’s hands, and therefore has the potential to increase female labour force participation. Additionally, microfinance may also strengthen women’s social networks (Feigenberg, Field and Pande, 2013), which can further reinforce this impact. However, short run experimental evaluations of microfinance loans have not found significant economic impacts for women (Banerjee et al., 2013; Crepón et al., 2011). Practitioners argue that positive impacts on empowerment and job creation only occur in the long-run.

The study

In this study, led by researchers at Harvard and Duke University in partnership with the Centre for Microfinance at IFMR-LEAD, we examine the impact of improving access to microfinance loans on female labour force participation in the long-run (1999 to 2015). Ultimately, the objective of this project is to unpack some of the constraints that prevent women from working and taking full advantage of urban economies.

SEWA Bank

This project has been developed in partnership with one of the world’s first microfinance institutions, SEWA Bank in Gujarat, India. Since 1999, SEWA Bank has sought to expand its services to Ahmedabad, India. A major aspect of SEWA Bank’s expansion strategy is its emphasis on “doorstep banking”. Its system of collection officers, called Saathis, recruit new clients and collect door-to-door loan repayments and savings deposits on a weekly or daily basis. The expansion strategy includes the gradual hiring of over 100 Saathis that service an average of 500 clients each.

Access to microfinance credit: index

Given the cost and duration of travel, loan officers have an incentive to recruit clients as close to their personal residence as possible. This study exploits quasi-experimental variations in access to microfinance loans generated by SEWA Bank’s expansion strategy. The identifying assumption is that, while SEWA Bank may have targeted specific areas of Ahmedabad during its expansion, the location of loan collection officers within small geographical units was random.

We work with a sample of 3,000 SEWA Bank borrowers in Gujarat over sixteen years (1999-2015). The analysis employs an index of access to SEWA Bank based on the number of years a respondent has lived close (350 meters or less) to a Saathi’s residence between 1999 and 2007.

We show that access to SEWA Bank is not correlated with borrowers’ pre-characteristics within small geographical units. This refers to the characteristics of the respondents in 1999, before SEWA Bank’s expansion. Our current set of pre-determined variables include age, household ownership status, labour force participation by category of job, number of children, educational attainment, among other variables.

Findings

The index shows that access to microfinance loans was distributed at random within small geographical units. With this established, we use the index to estimate the causal long-run impact on credit activity, labour force participation and related variables, to shed light on the mechanisms at play.

- Access to SEWA Bank increases the probability of women accessing microfinance loans:

- Access to SEWA Bank increases rates of female labour force participation:

- Access to SEWA Bank increases the participation of women in household businesses:

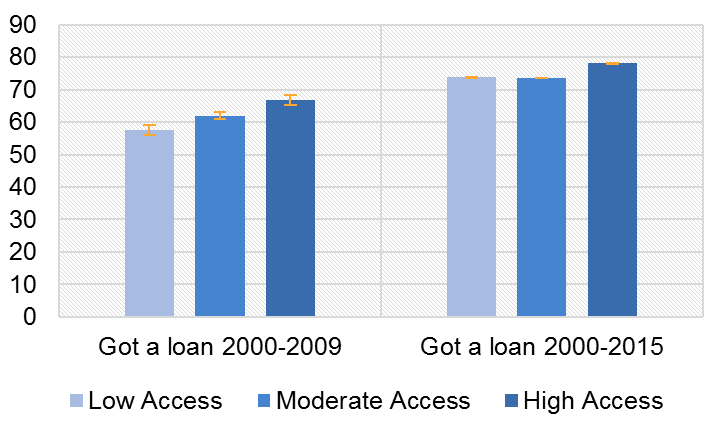

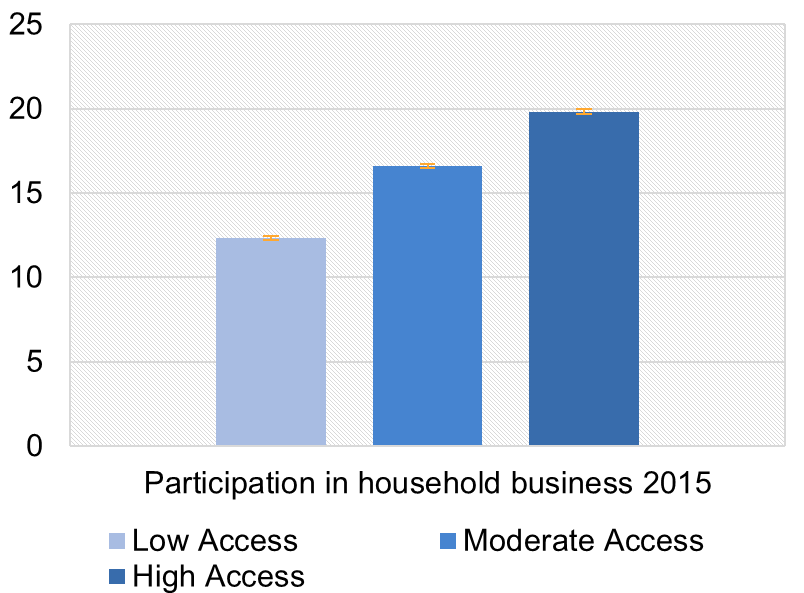

Preliminary findings using data collected both in 2009 and 2015 are shown in graphs 1, 2 and 3. We have plotted the predicted values of each regression for groups with different degrees of access to formal credit. A respondent is considered to have low access to SEWA Saathis if the number of years they lived close to a Saathi, between 1999 and 2007, is equal to zero. Moderate access is defined between one and six years, and high access is between seven and nine years.

As it is expected, Table 1 shows that the number of years a woman lives in proximity to a Saathi has a positive impact on her probability of taking up loan. In the complete study, we also analyse the impact on other credit activity proxies, such as the amount of credit accessed and the number of clients SEWA Bank have approached per year.

In table 2, we show that access to microfinance has a substantial impact on female labour force participation in the long-run. In 2009, when the average age of women in our sample was 45, having high access to SEWA Bank Saathis increased female labour force participation by 12%, compared to women with low access. The same general patterns hold for data in 2015. This is interesting as access to loans significantly increases female participation in household businesses. In fact, being exposed to high access increases participation by 7%, compared to those with low access. We are now working on a further analysis to unpack these mechanisms.