Aid-financed infrastructure promotes foreign direct investments

The link between aid and private investment is not well understood. Could aid-financed infrastructure investments encourage higher foreign direct investment? The authors present the results of a new composite index of infrastructure to estimate direct and indirect impacts of aid for infrastructure on FDI.

Official development assistance (ODA) and foreign direct investment (FDI) are widely perceived as alternative means of supplementing domestic savings and promoting economic development in low and middle income countries. Developing countries that attract FDI are often contrasted with ODA-dependent ones. The argument for FDI is typically considered “compelling” (Stiglitz 2000) as it provides an attractive package of capital, technology, managerial know-how, and access to markets. By contrast, aid critics stress the disincentives of ODA and contend that “successful cases of development happening due to a large inflow of aid and technical assistance have been hard to find” (Easterly 2007: 329).

How aid could promote FDI

The effects of ODA on FDI flows to developing countries are theoretically ambiguous. Positive effects can be expected to the extent that aid increases the productivity of private investments by financing complementary factors of production, such as infrastructure and human capital (Selaya and Sunesen 2012). Arguably, aid could also remove specific bottlenecks that prevent higher FDI inflows. In contrast, aid could have adverse effects on FDI inflows by encouraging rent-seeking (Economides et al. 2008) or crowding out private foreign activity in the tradable goods sector (Beladi and Oladi 2007).

Komanda Bridge Zaire 1995. Encounter Overland Democratic Republic of the Congo

Komanda Bridge Zaire 1995. Encounter Overland Democratic Republic of the Congo

Image credit:DAVID HOLT

The question remains, how exactly could ODA render recipient countries more attractive to FDI? Evidence from earlier studies, employing aggregate aid data, is inconclusive (e.g., Harms and Lutz 2006; Asiedu et al. 2009), and largely neglects the transmission mechanisms through which aid may promote FDI. Aid that is explicitly targeted at improving the recipient countries’ infrastructure endowments could be particularly effective since poor infrastructure is often cited by investors as an important constraint to FDI. Assessing this transmission channel has traditionally been difficult because of data limitations and the lack of a comprehensive measure of the quantity and quality of a country’s infrastructure.

New measure of infrastructure needs

Against this backdrop, we constructed a composite index of infrastructure[1] based on a broad annual dataset of 30 indicators of the quantity and quality of infrastructure for a large number of countries (Donaubauer et al., 2016a). The underlying model closely resembles the well-known approach of constructing the widely used Worldwide Governance Indicators of the World Bank (see Kaufmann et al. 2011 for details).

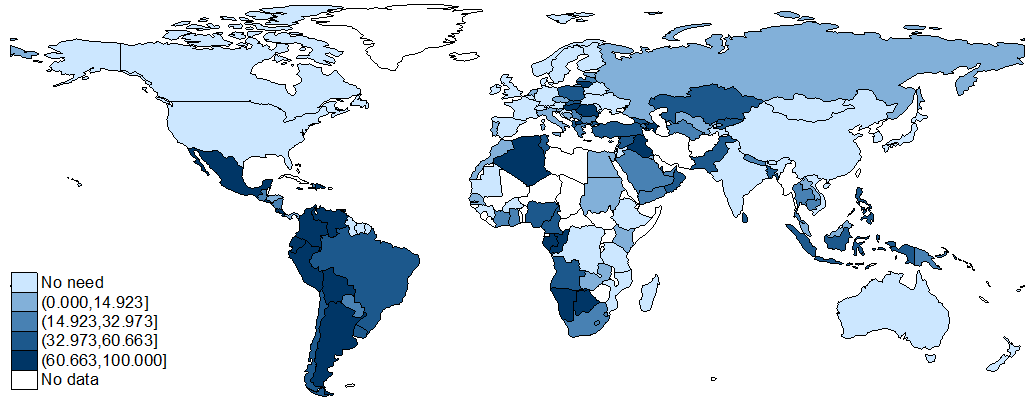

We use the infrastructure index to estimate a recipient country’s specific need for aid in infrastructure at a particular point in time (Donaubauer et al., 2016b). The estimated need for infrastructure is derived from what we term the ‘normal pattern’ of infrastructure endowment of countries, relative to their wealth (GDP per capita), population, and geographic area, based on pooled annual data from 1990-2010. The specific need for aid in infrastructure is then proxied by comparing the expected endowment– given the above noted country characteristics – and the actually observed index of infrastructure. Need is assumed to be zero when the actually observed index value is higher than the value expected from the normal pattern. When the actual index value is below the expected value, the absolute deviation from the normal pattern (on a scale from 0 to 100) is taken as the measure of infrastructure needs.

Mapping the results of this exercise, the figure below points to pronounced infrastructure needs throughout Latin America. The situation in Asia and Africa is much more nuanced once the countries’ endowment with infrastructure is judged relative to their general stage of economic development. For instance, infrastructure in relatively advanced sub-Saharan African countries such as Botswana, Namibia and the Rep. of South Africa is less developed than one would expect according to their stage of economic development; the infrastructure gap appears to be less pronounced in poor countries such as the Dem. Rep. of the Congo, Mozambique and Tanzania.

Figure 1: Mapping the needs for aid in infrastructure

Source: Authors’ calculations.

Notes: Infrastructure needs are obtained as deviations from the normal pattern of the endowment with infrastructure. The map shows the need for aid in infrastructure for the year 2010. The map is coloured according to average quintiles over the 1990-2010 period. The intervals on the left show the respective quintile ranges of the absolute index value of needs for aid in infrastructure, ranging from 0 (no needs) to 100.

Aid allocation and effectiveness

To better understand the critical junctures in the transmission of aid to FDI, our empirical analysis focuses on three key questions:

- Is aid effective at improving the recipient country’s infrastructure?

- Is the allocation of aid, needs-based and targeted at recipient countries with less developed infrastructure?

- Does aid impact on FDI via infrastructure?

The results offer several interesting insights. First of all, aid for infrastructure proves to be effective (and statistically significant) at improving the recipient country’s economic infrastructure endowments. An increase in aid for infrastructure of one standard deviation is associated with an infrastructure improvement of 1.7 index points (or 0.2 standard deviations). In sharp contrast, other types of aid have no significant effect on recipient countries’ infrastructure endowments.

Our findings show that aid for infrastructure, unlike other types of aid, helps attract FDI, both directly and indirectly through improving recipient countries’ endowment with infrastructure.

Second, it appears that aid for infrastructure is well-targeted to the needs of recipient countries. A 1% increase in per-capita incomes (the commonly used indicator of general need) lowers the inflow of aid for infrastructure by 2.4%. More importantly in the present context, we find aid for infrastructure increases by 2.1% (or 1.15 standard deviations) when the gap between the expected and actual endowment of infrastructure widens by 10 index points – a modest, but far from negligible effect.

Taken together, our results imply that aid for infrastructure is effective and is well-targeted to countries where need for such aid is most pressing.

Direct and indirect effects on FDI

Regarding FDI as our dependent variable of principal interest, we find both indirect and direct effects of aid for infrastructure on FDI (Donaubauer et al., 2016b). The indirect effect of aid for infrastructure promotes FDI inflows through its impact on the host country’s endowment of economic infrastructure. The quantitative impact is considerable: A 10-point improvement in a country’s infrastructure, as reflected in our index ranging from 0-100, is associated with an increase of 5.1 percentage points in the ratio of FDI inflows to the host country’s GDP. Figuring in the above noted effects of aid on infrastructure, this finding implies that a 10% increase in aid for infrastructure would increase FDI by about 4.7 percentage points through the infrastructure channel.

Aid for infrastructure also directly impacts FDI inflows, unlike other types of aid. Taking the estimation results at face value, a 10% increase in aid for infrastructure leads to an increase in FDI inflows, in percent of GDP, of 14-15 percentage points (i.e., about 2 standard deviations).

The strong direct effect of aid for infrastructure on FDI suggests that foreign investors anticipate longer-term effects on the country’s endowment that are not yet reflected in our index of infrastructure. This is consistent with Mayer (2006: 45) who argues that aid commitments “can have a large signaling role for foreign investors.” Foreign investors may be confident that aid-financed infrastructure serves them particularly well, compared to locally financed infrastructure. Aid-financed infrastructure may focus more strongly on FDI-related needs, be of superior quality, or be better maintained due to external control and oversight.[2] Such differences between aid-financed and locally financed infrastructure would largely escape our measurement of infrastructure and could be captured directly by the aid variable in our estimations.

Summary

Our findings show that aid for infrastructure, unlike other types of aid, helps attract FDI, both directly and indirectly through improving recipient countries’ endowment with infrastructure. Our estimates are robust to various modifications, specifications, and country samples. Well-targeted aid promotes FDI through investments in infrastructure.

Arguably, other specific categories of aid could also work by removing critical impediments to higher FDI flows in developing countries. Future research could provide a fuller account of country-specific impediments, and may facilitate comparisons of FDI-related needs for sector-specific aid with actual aid patterns. Correcting for mismatches could render aid more effective at promoting FDI, by re-directing aid to the most relevant sectors. This could activate further transmission mechanisms, in addition to aid working through the infrastructure channel.

[1] In the unobserved components model used to construct the index, observed data of each aspect of infrastructure are a linear function of unobserved infrastructure and an error term.

[2] For instance, FDI-related needs may be particularly pressing with respect to sea and air transport, while local authorities may be mainly concerned about roads. Foreign investors may care more about transport and communication networks in the host country’s economic centers, whereas host country governments must also prioritise connections to more remote areas.