Assessing sectoral linkages in the Zambian economy

The Government of the Republic of Zambia (GRZ) has since 1965, endeavoured to minimise the country’s dependence on copper mining through a melange of policies and incentives in the agricultural, industrial and services sectors in its six previous national development plans. In 2018, GRZ launched its 7th National Development Plan (GRZ, 2017) that re-emphasised the need to stimulate and sustain the growth of other sectors, particularly manufacturing and services, which pose some persistent challenges in diversifying the Zambian economy. In a recently published research report, we assessed how different sectors of the Zambian economy interacted, and identified policy interventions to realise balanced economic growth and diversification in Zambia.

Economic highlights

A cursory look at the Zambian economy indicates that the share of services in national output or Gross Domestic Product (GDP) has doubled from 31.8% in 1965 to 62.3% in 2015 (see figure 1 below), and broadly suggests that the economy is diversifying from mining. However, the manufacturing contribution to GDP of 6.8% in 1965 and 8.1% in 2015 was fairly static. The agricultural contribution decreased from 13.7% in 1965 to 7.3% in 2015, after a period of growth peaking at 28.0% in 1995. The stagnancy in manufacturing and agriculture shows that the current pattern of economic diversification through services may not be sustainable.

Figure 1: Output Composition by Sector (1965-2015)

Source: (Chitonge and Kabinga, 2019) based on data from World Development Indicators (World Bank Databank).

Source: (Chitonge and Kabinga, 2019) based on data from World Development Indicators (World Bank Databank).

Note: Share of Industry includes value-added from mining, mainly the processing of metal ores.

A closer look at manufacturing and agro-processing in Zambia

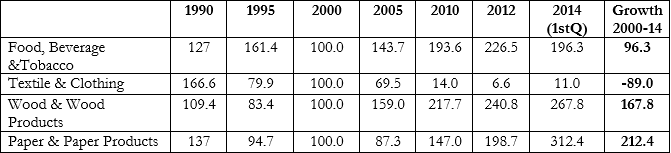

A further interrogation of manufacturing in Zambia reveals that the sector is predominantly made up of the agro-processing subsector. It accounts for approximately 70% of manufacturing value addition (MVA) and has been growing rapidly. The remaining 30% comprises of mineral- and non-mineral based manufacturing. Agro-processing as a subsector encompasses all firms that are involved in food, beverages and tobacco; textiles and clothing; wood and wood products; and paper and paper products manufacture.

Table 2: Agro-processing Production Index (2000=base year)

Source: (Chitonge and Kabinga, 2019), based on Data from National Accounts (CSO, 2015)

Source: (Chitonge and Kabinga, 2019), based on Data from National Accounts (CSO, 2015)

As can be seen in table 2 above, Zambia’s agro-processing sector, excluding textiles and clothing, has been growing rapidly. In light of this, we sought to examine whether growth in agro-processing, in particular, food and beverage manufacturing, has influenced and propelled developments in other sectors like agriculture and services. In addition, we considered what policy reforms are required to ensure that the subsector continues to grow and realise its full potential.

Methodology

Our study analysed both quantitative and qualitative data to get a clearer understanding of these sector interactions in the Zambian economy. Specifically, we analysed the static and dynamic backward and forward interlinkages for each economic sector using 1994 and 2010 input-output tables as well as most recent value-added tax figures for Zambia. The underlying idea is that strong linkages demonstrate better resource alignment and output utilisation among domestic economic sectors, more balanced economic growth and development across time, and vice versa.

To understand the policy environment and associated challenges, we complemented the quantitative analysis with 42 in-depth interviews with agro-processing firm executives, sector association representatives, industry experts, and Zambian-based academics.

Main findings

- We find that the agricultural and manufacturing sectors have strong backward linkages with the rest of the economy, while the services sector exhibited weak backward and forward linkages to the rest of the economy in both 1994 and 2010. This pattern suggests that manufacturing in Zambia, and in particular agro-processing, is natural-resource based - it mostly relies on the agricultural sector for input supplies. However, the weak connections between services and other economic sectors indicates that the economy is lopsided with a highly unsustainable diversification pattern.

- The study also reveals that although the agro-processing sector draws most of its inputs from the domestic agriculture sector, it still relies on imports of non-agricultural intermediate goods. This partly accounts for the weaker linkages between sectors; however, it also presents a remarkable opportunity to strengthen existing linkages in the economy through the local production of intermediate manufacturing inputs.

- Although the growth of retail supermarkets has stimulated not only the expansion of agro-processing in Zambia but also improvements in product quality, the local market for agro-processing products is limited and this is inhibiting the growth of the sector. In this regard, there is need to explore the potential of tapping into regional markets, especially in goods where Zambia has a marked comparative advantage.

- The study also shows that the agro-processing sector is hampered by policy inconsistencies and logistical constraints, which reduce not only the competitiveness of local producers but also act as a barrier to the sector realising its full potential in the region. Key policy and logistical constraints recognised by the actors in the sector include a volatile Zambian Kwacha-United States Dollar exchange rate, regular reversals in energy, tax, and agricultural exports policies, cumbersome export and import processes, lack of coordination between trade and industrial development strategies, and low capacity in the product testing and certification facilities. Specific interventions are needed to address these constraints.

Recommendations

Based on the findings in Chitonge and Kabinga (2019), we recommend that GRZ:

- Implement a local content strategy as a short-term measure to strengthen business and industry linkages in the economy;

- Resolve logistical and infrastructure-related constraints to domestic and regional market access; and

- Strengthen policy coordination to allow for a consistent and predictable macroeconomic, exchange rate, energy, tax, and trade policy environment to prevail.

References

Chitonge, H and Kabinga, M (2019), “Assessing intersectoral linkages in the Zambian economy: The case of the agro-processing subsector”. Draft Research Report for the International Growth Centre (IGC) March 2018.

Central Statistics Office (CSO) (2014), Zambia in Figures: 1964-2014. Lusaka: Central Statistics Office.

Government of Republic of Zambia (GRZ) (2017), Seventh National Development Plan 2017-2021. Lusaka: Ministry of Finance and National Planning.