Enhancing the benefits of formalisation under a new status in Benin

Providing information and assistance to informal firms increases formalisation, but the cost of the intervention is likely prohibitively high

Existing evidence suggests that easing entry regulations and providing information on the formalisation process has had only a very limited impact on the formalisation of existing informal firms, especially with regards to tax registration (Bruhn and McKenzie 2014). One explanation is that although, in theory, formality has advantages in terms of access to business banking, government training programmes and tax certainty, in practice many firms which formalise fail to receive these benefits. As a result, the costs of formalisation exceed the benefits, and so most firms stay informal.

The Entreprenant Programme

Benin, along with 16 other OHADA countries in Africa, revised their commercial law to introduce a new status called entreprenant. This status is designed for micro and small businesses, and registering with this new status is easy, free of charge, and takes only one business day. Formalising means firms gain access to many of the key benefits of formal status, but also makes the firm registered for tax purposes. The World Bank and IFC worked with the Government of Benin to pilot different approaches for how this status should be operationalised, and we use this opportunity to test via a randomised experiment whether offering supplementary services can enhance the benefits of formalising for firms and bring more of them into the formal system. The results are reported in a recent working paper (Benhassine et al. 2016).

Intervention design

We used a listing survey of businesses around Cotonou in early 2014 to obtain a sample of 3,596 informal businesses. These were randomised into four groups:

- A control group of 1,197 firms

- Treatment group 1 received an in-person visit explaining the benefits of formalising, and help with registering if needed.

- Treatment group 2 received the in-person visit, and also facilitated access to government training programs, and support to open a business bank account designed for the entreprenant.

- Treatment group 3, in addition to the services provided to groups 1 and 2, was also offered support in dealing with the tax authorities including tax mediation services.

We later also implemented a subsequent treatment to test whether information alone improved take-up by giving half the control group leaflets explaining the new status. Monthly administrative data on formalisation allows us to trace out the formalisation response, while follow-up surveys one and two years after baseline enable us to measure impacts on firm outcomes.

Results

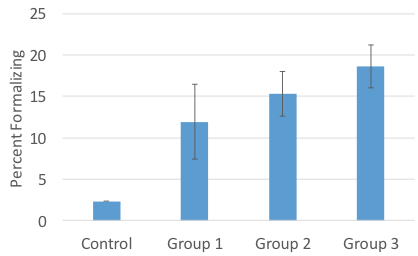

Information alone had almost no effect on formalisation, but adding the supplementary services did lead to large increases in take-up of the new status. The most comprehensive package of services (Group 3) boosted the formalisation rate by 16.3 percentage points (see Figure 1). This rate of tax formalisation is high relative to what other studies have found, and was likely helped by the fact that firms received a tax holiday to begin with. But even the most comprehensive treatment left more than 80% of firms remaining informal. Moreover, since these additional services were costly, the most cost-effective method was treatment 1, which cost $1,237 per additional firm formalised, compared to $2,217 for treatment 2 and $1,678 for treatment 3.

Figure 1 Formalisation rates

Note: Error bars show 95% confidence intervals

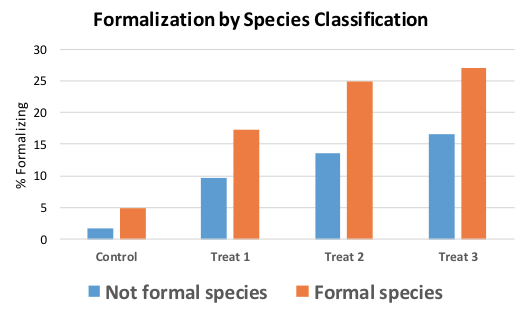

We then used pre-specified tests of heterogeneity in take-up to learn how governments could best target these services. One approach used was the species classification method of de Mel et al. (2010). This involved collecting data in our listing survey for already formal firms, as well as for informal firms, and then running a model that used location, gender, age, education, sector, firm age, business practices, sales, and so on to predict formal status. Using this approach, we ex ante classified 18% of the informal firms in our sample as ‘looking like the formal species’, with the idea that the interventions should work better for such a group. Figure 2 shows the results. The formal species firms are more likely to formalise even in the control group, and the treatment has a significantly larger impact for them – we get 27% of the formal-like firms formalising in treatment group 3.

Figure 2 Targeting formal-like firms can have more success

We find that a few much cruder targeting tools also work well in separating responsiveness to treatment – women are less likely to formalise than men, those without secondary education are less likely to formalise than those with secondary education, and firms operating outside the main Dantokpa market are more likely to formalise than those within the market. Using any of these criteria for targeting can drive down the cost per firm formalised to $500-600. However, this is still expensive relative to business profits and to the tax the government can expect to collect from these firms, and most informal firms still choose to remain so.

Formalising leads to increased participation in business training, more formal accounting, lower tax harassment, and less taxes paid (due to a tax exemption in the year after formalising). However, formal firms are not significantly more likely to obtain business bank accounts or loan financing, do not gain more customers, and have no significant gains in sales, profits, or standard of living.

Conclusion

The new entreprenant status does offer an improvement for those firms that want to become formal, making the process easier and cheaper. However, the existence of this status alone is not enough to induce many existing informal firms to formalise. Our analysis suggests that adding additional services or in-person visits to explain this new status is unlikely to pass a cost-benefit test. Alternative strategies, including targeted enforcement may be needed to bring more of the larger informal firms into the formal system.

References

Benhassine, N, D McKenzie, M Santini and V Pouliquen (2016), “Can enhancing the benefits of formalization induce informal firms to become formal? Experimental evidence from Benin”, World Bank Policy Research Working Paper No. 7900

Bruhn, M and D McKenzie (2014), “Entry regulation and the formalization of microenterprises in developing countries”, World Bank Research Observer 29(2): 186-201.

De Mel, S, D McKenzie and C Woodruff (2010), “Who are the microenterprise owners? Evidence from Sri Lanka on Tokman v. de Soto”, in J Lerner and A Schoar (eds), International Differences in Entrepreneurship, pp. 63-87.

This blog originally appeared on VoxDev