Impact of fiscal policy on inequality and poverty in Uganda

President Yoweri Museveni would like Uganda to be a middle-income country by 2020. As the UN’s Sustainable Development Goals, and Uganda’s own National Development plans, make clear, however, income per capita is only one criterion by which an advanced economy should be judged.

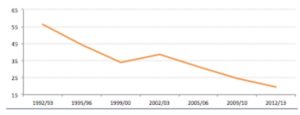

Uganda should strive to lift more people out of poverty as well as close the income gap between the least and most well-off Ugandans. Uganda has made great strides on the poverty front (Figure 1) over the past 25 years.

Figure 1- Poverty Headcount Ratio, Uganda 1992 - 2013

It is one of the few countries in Sub-Saharan Africa that has met the Millennium Development Goal of halving the proportion of people living in poverty. Yet income inequality has remained elevated over the same period (Figure 2).

Figure 2 – Gini Index of Inequality, Uganda 1992 -2013

One of the Government’s primary instruments to stimulate economic growth is fiscal policy: levying taxes, distributing subsidies or administering direct transfers. The impact of individual fiscal policies and programs, however, is not always well understood. Even when fiscal policy stimulates economic growth or greater productivity, for example, it may simultaneously be increasing poverty or inequality.

Image Credit: Flöschen

The Commitment to Equity (CEQ) Institute has developed an internationally recognized methodology to analyse and measure the impacts of fiscal policy on poverty and inequality. To date it has done so in twenty-eight countries; Uganda is the most recent addition. The CEQ framework is not dynamic – it estimates instead the current or “real time” impact of this year’s fiscal policy – nor is it concerned with general equilibrium effects. However, its parsimonious nature, which calls for as few assumptions as possible, lends itself to international comparison and benchmarking as well as providing governments up-to-date advice and suggestions when re-designing their fiscal policies.

History of fiscal policy in Uganda

The Ugandan government’s strategy to tackle poverty and income inequality over the last 25 years can be broken down in two periods. The first period was characterized by an expansion of the provision of in-kind education, healthcare, water and sanitation benefits. After a period of civil war and chaos, the new National Resistance Movement (NRM) Government’s bold and extensive liberalization agenda combined with disciplined monetary and fiscal policy reforms triggered a period of sustained economic growth and trade in the early 1990s. Alongside gains from increased economic activity, the establishment of the semi-autonomous Uganda Revenue Authority led to large improvements in domestic revenue collections. The tax to GDP ratio rose from 6 in 1990 to 13 per cent in 2000. With additional resources at hand, the government formulated a comprehensive Poverty Reduction Plan in 2007 that would increase service delivery drastically. The centrepiece of the plan was the introduction of Universal Primary Education (UPE). Delivery of many of these services was to be managed in a decentralized fashion, funded by transfers from central government. Donors aided these efforts with budget support.

The second period of the government’s fiscal strategy to tackle poverty and income inequality over the last 25 years was characterised by the introduction of targeted cash and in-kind benefits. Responding to chronic inequality among regions caused by political instability and conflict, the government shifted to smaller programmes specifically targeted to reduce regional imbalances in the early 2000s. The first Northern Uganda Social Action Fund (NUSAF) was introduced in 2003, followed by the introduction of the Social Assistance Grants for Empowerment (SAGE) programme in 2009 and the second NUSAF programme in 2010. These regionally focussed, low-coverage programmes are still on-going, but given the large infrastructure investments the government is undertaking it is unclear whether there will be sufficient fiscal space for expansion.

During the second period, taxes (relative to GDP) began to level off, which was one reason the government refocused its policy: infrastructure and investments in productive sectors were prioritized over further expenditure increases on service delivery transfers. This more direct focus on the stimulation of economic growth may shifted fiscal policy away from the pro-poor agenda pursued in the 1990s: in real terms service delivery transfers peaked around 2003, with later adjustments mainly covering increases in the wage bill.

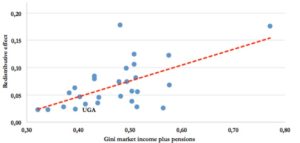

Fiscal policy in Uganda reduces inequality slightly and without increasing poverty

Fiscal policy in Uganda (in fiscal year 2012/13) reduces inequality. However, the redistributive impact is quite small, especially when compared with similar low-income countries in the CEQ Database such as Ethiopia and Tanzania and with the trend observed for 28 low- and middle-income countries (including Uganda) (Figure 3). The small effect is primarily driven by low social spending (as a share of GDP), which in turn may be driven by low revenues from domestic collections and low revenues overall. However, given the amount spent, Uganda achieves more redistribution than other countries with similar spending levels.

Figure 3 – Initial Inequality and Redistributive Effect (around 2010)

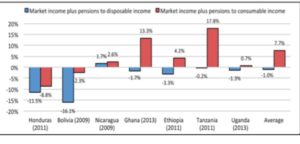

Ugandan fiscal policy leaves the poverty headcount unchanged. Compared to other Sub-Saharan African countries in the sample, such as Ethiopia, Ghana and Tanzania, this is in fact a good result as in the other countries the poverty head count actually increases with their fiscal policy (Figure 4). This is the case in countries where funding of education, health and other programmes comes at the expense of making a portion of the poor net payers into the fiscal system. The Ugandan fiscal policy, however, avoids this pitfall of making the poor poorer.

Figure 4 – Percentage Change in Poverty Headcount with Fiscal Policy

Positive impacts of fiscal policy in Uganda are modest

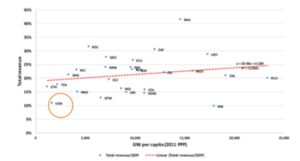

The challenge for Uganda, however, is that its overall expenditures are very low and any positive impacts from fiscal policy are therefore quite modest. The main driver of Uganda’s low expenditures is its low intake of domestic revenue. In fact its tax to GDP ratio, which was 11.6% of GDP in 2012/13 is one of the lowest in the world (Figure 5). The largest source of government revenue is indirect taxes. A number of products which have been identified to make up a large portion of the consumption for low-income households are exempt from these. Personal Income tax is also inequality reducing as the threshold is high enough to protect poorer households. Uganda is the first country to have undergone a CEQ assessment where, because of the exemptions in place, a small proportion of households are not directly affected by the tax system at all.

Figure 5 – Total Revenue to GDP vs Gross National Income Per Capita

Implications for fiscal policy

One of the Ministry of Finance, Planning and Economic Development’s primary targets is to increase domestic revenues. The National Budget Framework indicates that revenues should rise by 0.5 per cent per annum to hit 16.3% taxes to GDP by 2021. The CEQ analysis shows that if improving PAYE tax collection can do this, then poor households are not likely to become any worse off. However, if increases come primarily from VAT and excise tax on goods that are consumed largely by the poor, then there is the risk that poor households will face a proportionally greater burden, potentially making the poor worse off compared to the current situation.

The analysis shows that health and education are the most effective social expenditures in reducing income inequality. This has to do with the fact that both have quasi-universal coverage. In health, Uganda abolished user fees for public health facilities in 2001. School enrollment also increased substantially through the introduction of UPE and the transfer of capitation grants for primary and secondary school students. The universal coverage means that the benefits are generally biased towards larger households, as they will consume more of the service, which in Uganda also tend to be the poorer households.

In sum, the recently completed CEQ assessment for Uganda indicates that the challenge for the Ugandan Government will be to raise revenue without threatening the progress that has already been made on poverty reduction. At the same time, it should increase spending in areas of health and education or other activities that are directly targeted at the poor. This could be, for example, through increasing public works programmes as part of the upcoming large infrastructure investments.

From the Paper: Jellema, Jon, Lustig, Nora, Haas, Astrid, and Wolf, Sebastian. 2016. “The Impact of Taxes, Transfers, and Subsidies on Inequality and Poverty in Uganda.” CEQ Working Paper No. 53, International Growth Centre and Commitment to Equity Institute, Tulane University.