Increasing tariffs to prevent another electricity crisis in Zambia

Zambia’s state-owned power utility company, ZESCO, is consistently struggling to meet demand, plunging Zambia into one electricity crisis after another. The Government of Zambia’s acceptance of ZESCO’s application to increase tariffs is a step in the right direction.

Access to reliable power remains a problem across sub-Saharan Africa. The latest data from the World Bank’s Enterprise Surveys, show that 76.2% of firms in the region still experience electrical outages, on average 8.3 times a month. This has forced over half the firms in sub-Saharan Africa into owning expensive generators, driving up costs of production, and thereby making it harder to survive, let alone export.

Zambia presents a stark example of a country plagued by inconsistent access to power. In 2019, load shedding, the deliberate shut down of electrical power in parts of a power grid, reached up to 16 hours a day (ZESCO 2019). This experience highlighted that Zambia’s state-owned power utility company, ZESCO, has severe difficulties in meeting demand.

The importance of rainfall patterns

Zambia’s electricity outages in 2019 were unprecedented. A survey (Ahmed 2020a) showed that household consumers rated the outages of 2019 worse than those in 2015 and 2016. The electricity crisis last year was caused by very low rainfall in 2018/19. In Zambia, 85% of installed power capacity is hydropower, which is affected by changes in rainfall patterns (Power Africa 2018). The problem is underscored by the recent low levels of water in Lake Kariba Dam, which constitutes 37% of Zambia’s installed power capacity (Energy Regulation Board of Zambia 2019b). With these climate emergencies expected to recur, ZESCO needs to make changes so that supply can consistently meet demand.

One solution is increasing tariffs to invest in generation. In February 2019, ZESCO applied to the regulatory board to increase tariffs (Energy Regulation Board of Zambia 2019a, table 1), and in December 2019, the Energy Regulation Board (ERB) announced it had accepted ZESCO’s application (Energy Regulation Board of Zambia 2019c). Customers now have to pay more for a service they have not been properly receiving. If energy reliability is to improve, however, this is a necessary step in the right direction.

Zambia’s historic electricity tariffs

In 2014, Zambia had the lowest tariffs in sub-Saharan Africa, with the average Zambian tariff only 38% of the median one (Trimble et al. 2016). This was made possible because ZESCO's variable cost of energy generation was minimal. Almost all energy came from renewable hydropower which has no marginal cost associated with generation. On top of this, until the addition of the Maamba Coal Power Plant to the grid in 2016, the costs of ZESCO’s large power plants had been fully amortised.

This policy represented a transfer of welfare to end-consumers then at the expense of end-consumers now. For today’s consumers, it is now apparent that adequate investment in maintenance and new energy generation projects were not being made.

After the last major electricity crises of 2015 and 2016, ZESCO revised its tariffs upwards twice in 2017 (Zesco Ltd 2017). The reasons given included the rising cost of generation and the need for system expansion (Energy Regulation Board of Zambia 2019a).

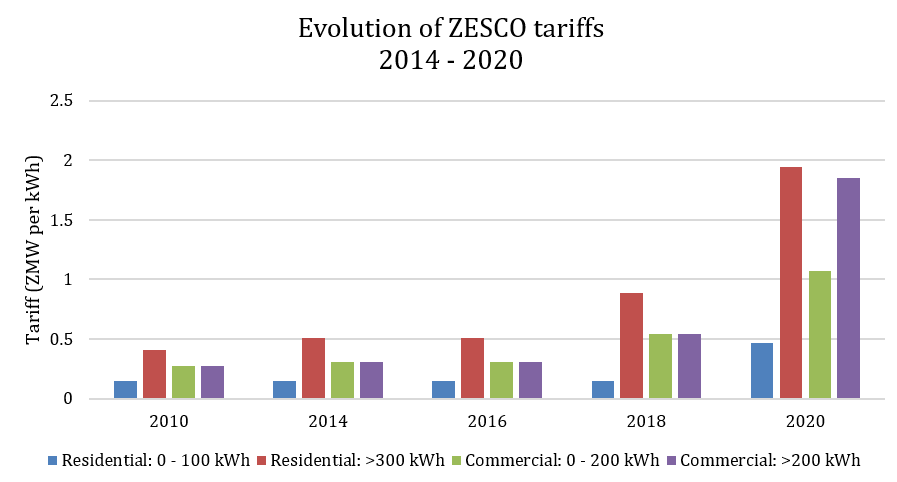

Figure 1 below shows the evolution of ZESCO’s tariffs from 2014 up to the new changes for 2020. The tariffs do not include the fixed monthly charge. The rate for customers with the smallest consumption of below 100kWh had not changed from 0.15 Kwacha (Zambian local currency) since 2010 in nominal terms (Energy Regulation Board of Zambia 2015, p. 50). The ERB approval of the new tariffs has led to a significant increase in charges for all categories of customers.

Figure 1 Evolution of ZESCO tariffs, 2014-2020 (Energy Regulation Board of Zambia 2015, p. 50, 2017, p. 60, 2019b, p. 81, 2019a)

Calculating “fair” tariffs

But what is the right or fair price for electricity? It makes sense to approach this question from three perspectives: system sustainability, distributional equity, and allocative efficiency.

- System sustainability

ZESCO has been subsidising electricity. In 2015, it was estimated that the Zambian power sector loses $300-400 million per annum due to under-pricing (World Bank 2017, p. 5). This make ZESCO a risky entity with which to contract. Were it an attractive off-taker, prospective private developers could theoretically drive down prices for power generation.

From a system sustainability perspective (where the system recovers costs, invests in the future, and provides a reliable energy supply), ZESCO cannot afford to continue to subsidise electricity. Given Zambia’s fiscal crisis, the Government no longer has the resources to support ZESCO.

The ERB commissioned a Cost of Service Study in 2016 with the findings on a cost-reflective electricity tariff due in 2017 (Energy Regulation Board of Zambia 2016). This remains outstanding, so those outside ZESCO and the ERB do not know whether the new tariffs are cost reflective. Still, their increase can only mean better system sustainability.

- Distributional equity

Almost 70% of Zambia’s population is without electricity (Power Africa 2018) and ZESCO’s ability to expand its electrification access is compromised by subsiding existing users. This makes it unfair to those without any electricity for ZESCO to subsidise even their poorest customers. Cost recovery tariffs across the board would enable ZESCO to invest more in on-grid electrification. This would help achieve universal access, to the extent that on-grid electrification is more cost-effective than privately offered or subsidised off-grid electrification. (To the extent that it is not, clear and credible policy should signal to private solar home system vendors areas where ZESCO does not have near-term ambitions to broaden on-grid access.)

A new survey shows that prior to the tariff hikes of 1st January 2020, residential customers with internet would have been willing to pay $0.095/kWh, or 1.4Kwacha/kWh for reliable energy (Ahmed 2020a). To put this amount into perspective, a 50kg bag of mealie meal is around 270 Kwacha. This suggests that approximately 193 kWh is worth a 50kg bag of mealie. The new residential tariffs charge 0.72 Kwacha for the first 300kWh, but 1.94 Kwacha thereafter. This implies that the drop-off in consumption after 300kWh will be steep.

- Allocative efficiency

From an allocative efficiency perspective, it makes sense to consider:

- How higher tariffs would affect the productivity of Zambia’s economy, and,

- The opportunity cost of funds that could have been used to subsidise certain types of customer.

The evidence suggests that the productive sectors of the economy, including mining, manufacturing, finance and property, should be able to weather the recent increases in energy tariffs (Ahmed 2020b).

But would it make sense to subsidise poorer households? As already discussed above, from a distributional equity perspective, no. From an allocative efficiency perspective, the opportunity cost needs to be considered, given that the Zambian government is resource strapped.

Parikh et al. (2012) found that in India, those without electricity or basic services preferred potable water and sanitation services before electricity. Since a third of Zambians do not have clean water and more than half do not have ‘decent’ toilets (Water Aid 2019), it could be expected that the same results might hold for a substantial proportion of Zambia’s population without electricity. After all, dirty water and poor toilets contribute to almost 2,000 deaths a year of children under the age of five in Zambia (Water Aid 2019). By contrast, recent research from Rwanda calls into question whether rural electrification alleviates poverty, with the quantity of electricity consumed and uptake of appliances remaining low (Lenz et al. 2017).

This does not necessarily mean unaffordable electricity for the poor. A cost-effective alternative to the Government providing expensive on-grid connections, is to allow the private sector to sell off-grid solar units to rural communities, which are appropriately scaled and priced for their customers’ needs (Ahmed 2017). These small and mobile units are to electrification infrastructure what mobile phones were to telephonic infrastructure - a “leapfrog”, relatively cheap, technology that has circumvented the need for high capital expenditure by governments.

Policy recommendations for ZESCO

- If need be when the ERB’s Cost of Service Study is published, revise ZESCO’s tariffs again so they cover the cost of maintenance, adding new generation capacity, and distribution infrastructure.

- Reduce inefficiencies at ZESCO so that more of the revenue goes towards covering maintenance and new investment.

- Allow the private sector to organically expand its sales of off-grid solar power units, and prioritise government infrastructure investment in clean drinking water, sewage, and rubbish collection before increasing on-grid electrification.

Finally, we reiterate calls for ZESCO to reduce demand at peak hours to alleviate pressure for higher generation capacity for just a few hours in the day. This can be achieved through increasing the differential between off-peak and on-peak tariffs (Ahmed et al. 2019). ZESCO should also incentivise greater energy efficiency with the use of capacitors to reduce reactive power use by penalising customers for low power factors (Ahmed 2020b).

References

Ahmed, I (2017, July 31). "After off-grid electricity, what chance off-grid water?", Financial Times.

Ahmed, I (2020a), "The cost of power outages to Zambia’s manufacturing firms, households and the climate", Grid Reliability & Operations Conference.

Ahmed, I (2020b), The political economy of the energy mix in sub-Saharan Africa – A case study of Zambia. University College London.

Ahmed, I, M Baddeley, D Coffman, J Meikle, M Oseni and G Sianjase (2019), The cost of power outages to Zambia’s manufacturing firms (Issue June).

Energy Regulation Board of Zambia (2015), Energy regulation 2014.

Energy Regulation Board of Zambia. (2016), "Request for expressions of interest: Electricity cost of service study and determination of economic cost-based tariffs", African Development Bank Group.

Energy Regulation Board of Zambia (2017), Energy sector report 2016 (Issue May).

Energy Regulation Board of Zambia (2019a), Call for comments on Zesco’s application to revise electricty tariffs and connection fees for 2019 (Issue April).

Energy Regulation Board of Zambia (2019b), Energy sector report 2018.

Energy Regulation Board of Zambia (2019c), Public notice - Board’s decision on ZESCO’s application to adjust electricity tariffs and connection charges for the year 2019.

Lenz, L, A Munyehirwe, J Peters and M Sievert (2017), "Does large-scale infrastructure investment alleviate poverty? Impacts of Rwanda’s electricity access roll-Out programme". World Development, 89: 88–110.

Malunga, J (2019, October 1), "Consumers’ maximisation-of power worsening load-shedding - Kapata", News Diggers,

Parikh, P, S Chaturvedi and G George (2012), "Empowering change: The effects of energy provision on individual aspirations in slum communities", Energy Policy.

Power Africa. (2018). Power Africa’s engagement in Zambia.

Trimble, C, M Kojima, I Perez-Arroyo and F Mohammadzadeh (2016), "Financial viability of electricity sectors in sub-Saharan Africa - Quasi-fiscal deficits and hidden costs", in Energy and extractives global practice group (No. 7788; Policy Research Working Paper, Issue 7788)

Water Aid (2019), "Zambia", Water Aid Website.

World Bank (2017), "Combined project information documents - Electricity Services Access Project P162760" (Vol. 1).

Zambezi River Authority (2019), "Lake Kariba weekly levels in metres", Lake Levels.

ZESCO (2019), "Countrywide load-shedding schedule October 2019 revised".

Zesco Ltd (2017), "Revision of electricity tariffs in 2017 (Issue May)".