Industrialising Africa: Why China’s investments matter for Africa

Many African countries remain in search of structural transformation and Chinese resources and experience could be a significant contributor to industrial development on the continent.

Since the onset of the China-Africa debate, focus has been on the consequent opportunities and challenges for African development, and particularly, for industrialisation. Scholars not only considered the competition China posed to new industrialisers in Africa, but also at how Chinese technology could facilitate manufacturing on the continent.

In recent years, the debate has shifted away from these core development questions towards issues like debt, with accusations of debt-trap diplomacy made against Chinese financial institutions, and the geopolitical rivalry between China and ‘the West’. While relevant and important, these topics are only a partial view of China-Africa economic relations and neglect a key side of the discourse – structural transformation.

China’s contribution to economic transformation across Africa

China has played a multifaceted role in the economic transformation of African countries, and broadly, its (net) contribution has been positive. Except for a handful of mature African producers (chiefly South Africa) that have seen competition from Chinese manufacturers, other African countries have benefitted from investment by Chinese manufacturing firms, and by being able to purchase affordable Chinese machinery. Furthermore, African workers and firms have managed to learn skills and adapt technologies acquired through contact with their Chinese counterparts.

Impact of Chinese investments in industrialising Africa

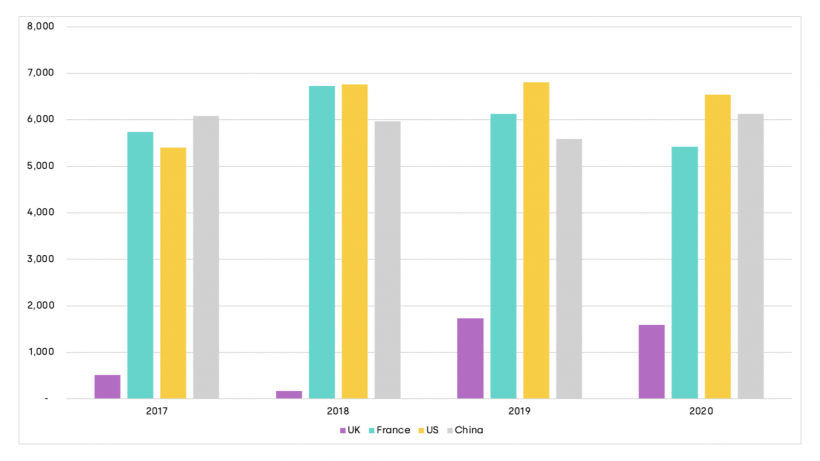

There are two main channels through which Chinese firms contribute to African industrialisation. The first direct channel is through investment. In considering the main investors in Africa, the latest World Investment Report shows that countries with the highest FDI stock in Africa are the UK, France, Netherlands, the US, and then China. Except for the UK, which invests very little in manufacturing on the African continent, and Netherlands (for which there is no Africa-specific data available), the other countries all invest in manufacturing. In fact, as Figure 1 shows, French, American, and Chinese investments in manufacturing are comparable in terms of volumes and trends. Through this investment, companies from these countries build up the sector, support skill improvement of workers. and contribute to the development of African manufacturing firms through their linkages. There are more similarities than differences between Chinese and other foreign firms, when it comes to investment outcomes, labour regimes, and Corporate Social Responsibility (CSR).

Figure 1 Trends in FDI stock in manufacturing in Africa, selected countries

Note: This figure illustrates that while FDI stock trends have fluctuated, Chinese FDI stock in Africa is comparable to other key investing nations like France and the US with UK FDI stock being a fraction of these.

Source: UK data – UK Office of National Statistics; France Data – Banque de France; US Data – Balance of Payments and Direct Investment Position Data by the Bureau of Economic Analysis; China data – China’s Ministry of Commerce Statistical Bulletin of China’s Outward Foreign Direct Investment.

FDI data, however, may not always provide a full picture of Chinese investment in a country. Much of the Chinese investment in African countries is not FDI, but rather ‘translocal’ (investment by foreign nationals registered in a specific country) and therefore not reported in FDI statistics. Moreover, some Chinese firms, especially smaller-scale ones could be unrecorded. Studies have shown the various ways in which Chinese investment tends to be underestimated in many African countries.

Chinese technologies and infrastructure serve the African context

While China may be investing similarly to other countries in African manufacturing, Chinese investment may differ in terms of the technologies in use. European or American firms may employ very modern, sophisticated technologies that are very productive but do not fit well with African levels of capital intensity. Chinese firms, on the other hand, may be using simpler technologies that work better in the African context, and are cheaper to import. Studies have highlighted Chinese firms’ smaller technological gaps compared to their African counterparts, which means their technologies may be better suited to the African industrial environment.

What is notable about China is not only the share of its investment in manufacturing, but also how the rest of its FDI stock is distributed. For all other major investors, the largest share of FDI stock goes into extractives. For China, the most prominent sector in terms of FDI is construction. This sectoral allocation may be the reason why FDI has provided limited contributions to building Africa’s human capital in recent decades.

China financing industrial zones and developing infrastructure

The second, indirect channel through which Chinese firms contribute to African industrialisation is through infrastructure development. China has played a key role both in financing and in physically building infrastructure. Chinese companies have contributed to the creation of industrial zones in several African countries. Not all these zones are funded through sovereign debt – some, like the Eastern Industry Zone in Ethiopia, are privately financed. The zones are generally open to domestic and foreign investors alike (not only to Chinese). However, Chinese firms very often cluster in these zones with research showing that Chinese firms tend to flock together, investing with others operating along the same value chain.

The performance of these zones in terms of promoting industrial development is mixed. In fact, investing in groups, together with foreign suppliers and subcontractors may not always stimulate the creation of linkages with the local economy. Moreover, the zones are often occupied by very different firms, thus reducing the benefits of agglomeration and horizontal spill-overs through imitation.

Not only do Chinese firms build industrial zones, but they also build basic infrastructure. The majority of China’s financing to Africa is devoted to transport and energy infrastructure, both of which, if well planned are essential to lower production costs for all firms on the continent.

Promoting industrialisation through trade and vice versa

Supporting Africa’s infrastructure development is particularly important in the current context of accelerated continental integration. African nations are committed to building the African Continental Free Trade Area (AfCFTA) to increase trade among each other. Given that African nations trade manufactured products much more among each other than with the rest of the world, boosting intra-African trade will likely promote industrialisation – and the other way around.

African nations are negotiating the ‘soft infrastructure’ of the AfCFTA – the agreements to make sure that intra-continental trade and investment run smoothly. However, for that to actually take place, trade and investment needs to be supported by hard infrastructure – the power plants to generate energy for production, and the ports, railways and roads (including digital ones) to make trade happen.

Building assets rather than accumulating debt with Chinese finance

This consideration can shift our perspective on China-Africa matters. If we ask what China can do for African countries, and we consider that Chinese firms can contribute to the industrialisation of Africa, then most Africa-China debates can be seen in a different light. For instance, Chinese loans to Africa, which have become the main point of concern in many development circles, become a means for building Africa’s infrastructure, and can be seen as building assets rather than accumulating debt. Using this lens, we can shift the debate not on how to borrow less, but on how to finance industrialisation better, more inclusively and more sustainably, in a way that does not prevent African citizens from getting the goods and services they need, and builds productive economies at the same time.

There are still ways to increase the beneficial impact of Chinese firms in Africa – these include but are not limited to, strengthening the creation of linkages between Chinese firms and African counterparts, be they contractors, suppliers or partners; and building managerial skills and mobility of African workers.

The author is grateful to Samiha Chowdhury, Richard Newfarmer, and Dirk Willem te Velde for their inputs and feedback.

The views expressed here are those of the authors based on their experience and prior research and do not necessarily reflect the views of the IGC.

IGC will be co-hosting a panel discussion on Industrialising Africa: Renewed commitment to inclusive and sustainable growth to mark Africa Industrialisation Week 2022.