Interfirm relationships and business performance in Nanchang (China)

In the quest for identifying barriers to firm growth, much attention has been paid to barriers that act at the level of the individual firm. But firms do not operate in a vacuum: business relationships are potentially highly influential.

An experiment in Nanchang, China was conducted to measure their importance. Regular meetings between the managers of young firms increased revenue by 8%, and also improved a broad range of performance measures. Such results suggest that business relationships can be an effective tool for private sector development.

The experiment: regular business meetings and firm performance

In 2013, tens of thousands of young firms in Nanchang, Jiangxi province, China were invited to participate in business meetings. From the pool of applicants, 2,800 were randomly selected as the study sample. These firms were small, but not tiny: on average, they employed 36 workers and had an annual profit of GBP 93,000.

In the main intervention, 2,800 managers were randomly divided into a treatment group and a control group. Within the treatment group, the managers were randomly split into subgroups of ten people. Each subgroup was then tasked to hold monthly business meetings for one year. Managers in the control group were not tasked to hold meetings. All the firms were surveyed before (base-line), immediately after (mid-line) and one year after (end-line) the intervention.

The results

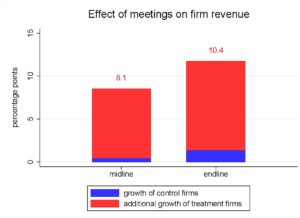

Figure 1 shows the effect of business meetings on firm revenue. The blue bars act as a benchmark by showing revenue growth for control firms that did not participate in the meetings. The red bars measure the additional growth of treatment firms that did participate in the meetings. Growth rates are measured relative to revenue at base-line, that is, the fiscal year before the intervention.

Figure 1 shows large, significant, and persistent revenue effects of the treatment. By the mid-line, revenue increased by only 0.4 percent in the control group, but it increased by an additional 8 percentage points in the treatment group. The bar for the end-line shows that this increase persisted in the year after the intervention. Similarly, large and persistent effects were found for a wide range of firm performance measures: profit, factors of production (employment and fixed assets), as well as inputs of production (materials and utilities). All these effects are statistically significant.

Channels leading to improved firm performance

Significant effects for several intermediate outcomes were also found: a survey-based management score; the number of suppliers and clients; and the probability of borrowing. These outcomes are suggestive of three possible channels by which the meetings may have improved performance:

- Learning from peers leading to improved business management;

- Better firm-to-firm matching leading to establishing more business partners; and

- Improved access to finance.

But these results are only suggestive of the channels. It is also possible that another channel created firm growth, which then improved these outcomes. Below we discuss more direct evidence on the channels.

It matters whom you meet

How did group composition, that is, the type of peers, affect performance? By randomly grouping firms, some firms ended up with better peers than others. Proxying peer quality with size (employment), significant and persistent peer effects were found. For example, being randomized into a group in which the average peer firm was 10% larger persistently increased revenue by more than 1 percent. Similar effects were found for a number of outcomes. This result further confirms that the meetings matter. What’s more, it highlights that the identity of peers matters.

This result further confirms that the meetings matter. What’s more, it highlights that the identity of peers matters

Channels of peer learning

What made the meetings successful? Additional interventions were used to investigate concrete channels. To explore learning from peers, we distributed information about funding opportunities to a subset of managers. We were interested in the extent to which managers shared this information with their peers, that is, the rate of diffusion.

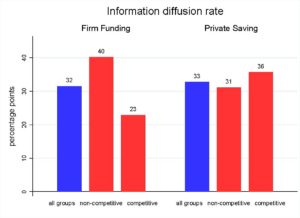

The first set of bars in Figure 2, plots the diffusion rate about a firm funding opportunity; a cash-grant from the government. The first bar shows that managers were 37 percent more likely to apply for this funding if some of their peers were informed, confirming that learning from peers was an active force. The second and third bar separately measure diffusion for "non-competitive" and "competitive" groups, defined by the share of firms in the group who were competitors of each other. Diffusion was lower in competitive groups, suggesting that product market rivalry can hinder learning.

Learning from peers was an active force

The second set of bars plot the analogous diffusion rates of a second funding opportunity, which was a personal savings account. Because this opportunity did not affect a rival firm's performance, competition was not expected to affect the rate of information diffusion. The evidence confirmed this, with equally strong diffusion effects in competitive and in non-competitive groups. These findings establish that learning was an active channel, and also uncovered a new mechanism: that competition can limit the transmission of rival information.

Competition can limit the transmission of rival information

A further mechanism was documented; improved firm-to-firm matching, using another intervention: one time meetings organized between managers from different groups. It was found that more new partnerships were created in the regular meetings than in these cross-group meetings. This confirms that regular meetings reduced the cost of firm-to-firm matches.

Performance gains and policy impact

The estimates were used to conduct a cost-benefit calculation which showed that the average profit gains from the meetings exceeded the associated time cost of the managers by a factor of five. Thus, in this context, business meetings were a low-cost intervention that generated substantial and persistent performance gains.

Thus, in this context, business meetings were a low-cost intervention that generated substantial and persistent performance gains

Therefore, the results suggest that business associations can be an effective tool for private sector development. Further research is needed to fully evaluate the contexts to which these estimates generalize. It can be said that governments and non-governmental organisations interested in improving firm performance should organize regular business meetings for young small and medium-sized enterprises interested in networking.