Money or power? Choosing COVID-19 aid in Kenya

Participants in an experiment comparing demand for cash transfers and electricity subsidies in urban Kenya, overwhelmingly prefer cash given the proliferation of mobile money via platforms like M-PESA and preference for short-term liquidity. Conversely, in rural Kenya, slightly more respondents opted for electricity token transfers given that they face saving constraints with the concern that they might spend money on extraneous items due to social pressure. Electricity consumption increases more with token as compared to cash transfers.

In response to the COVID-19 pandemic, more than 100 countries introduced aid programmes that lowered the cost of utilities such as electricity, water, transport, and mobile money fees. Economists, however, are divided about what kind of transfers – in-kind or cash – best address the unique challenges of public health crises. Cash transfer programmes are often touted for the flexibility they provide recipients, but in places where the transaction costs of paying for utilities are high – especially during crises – in-kind transfers like electricity transfers could be more effective. In which contexts should policy makers choose each of these different policy options? What would the recipients themselves prefer?

To answer these questions, we surveyed more than 3,000 respondents from May through October of 2020 in urban and rural Kenya, and ran an experiment to compare the demand for cash transfers and electricity subsidies. We sorted respondents into four groups:

- The first group was offered three prepaid electricity token transfers, each worth US$ 5;

- The second was given the choice between the same electricity token transfers worth US$ 5 each, and three cash transfers worth US$ 5 each;

- The third was offered the choice between the same three US$ 5 electricity token transfers, and three cash transfers worth US$ 3.50 each.

- The fourth group was a control.

We surveyed respondents before and after all three transfers had been made, to measure the impacts of these transfers on a broad range of socioeconomic outcomes.

Recipients overwhelmingly prefer mobile money over pre-paid electricity tokens

Our main finding is that participants overwhelmingly prefer cash, and are willing to accept a substantial discount to receive mobile money rather than an electricity transfer. This is especially true in urban areas, where mobile money is widespread and transaction costs are low: 96% chose cash in the US$ 5 group, while 87% chose cash in the US$ 3.50 group.

Why might respondents prefer cash so strongly over electricity?

- Mobile money is widespread in Kenya: 97% of households have an M-PESA account, and 68% live within 1 km of an M-PESA agent. The 2013 launch of Lipa-na-MPESA (‘Pay-with-MPESA’) facilitated the use of mobile money for commercial transactions, including purchasing electricity tokens from Kenya Power. It helped further integrate mobile money into the economy, charging no fees for transactions below US$ 2 in value. Since mobile money can be converted to electricity at a relatively low cost, this may explain why many respondents chose cash.

- Our electricity transfers are large, and may be well above what an average household would choose to spend on electricity. The token transfer of US$ 5 represents 2.9 months of average electricity spending in our sample. While electricity top-ups do not expire in the short term, cash may provide households – who have trouble borrowing – with better short-term liquidity.

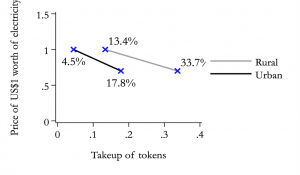

Figure 1: Demand for electricity tokens in choice arms

Demand for US$ 1 of electricity expressed in US$ of mobile money. In an equal trade-off, 13.4% and 4.5% of rural and urban respondents, respectively, prefer electricity. Even when US$ 1 worth of electricity costs only US$ 0.70, only 33.7% 17.8% of rural and urban respondents, respectively, choose electricity.

Demand for US$ 1 of electricity expressed in US$ of mobile money. In an equal trade-off, 13.4% and 4.5% of rural and urban respondents, respectively, prefer electricity. Even when US$ 1 worth of electricity costs only US$ 0.70, only 33.7% 17.8% of rural and urban respondents, respectively, choose electricity.

Some recipients prefer electricity tokens over cash

In rural areas, slightly more respondents opted for tokens: 13% chose electricity in the US$ 5 group, while 33% chose it in the US$ 3.50 group. Why is this? First, some respondents face saving constraints, expressing concern that they may spend the money on something else – due to social pressures, for example. Receiving the electricity directly ensures the money is spent on electricity alone. Furthermore, respondents who do not use mobile transactions may need to purchase tokens in-person, and receiving direct electricity transfers allows them to avoid the travel time required to buy tokens from a vendor.

In related work in Ghana, we find that residents of Accra have an even stronger preference for prepaid electricity tokens. This may be due to the lower penetration of mobile money in this context, as well as the higher transaction costs for purchasing electricity. We therefore emphasise the importance of understanding the local context when deciding what aid programme to implement.

Electricity transfers increase electricity consumption significantly more than cash transfers

Electricity transfers significantly increase electricity usage, by around 30 kWh (worth US$ 3) for the rural sample and 43 kWh (worth US$ 4) for the urban sample. We also observe higher metre balances at the endline survey for both groups. On the other hand, being given the choice between US$ 5 cash or US$ 5 in tokens – a group in which 96% of urban respondents chose mobile money – had no effect on electricity usage. Given that electricity is storable and transaction costs for using mobile money to purchase electricity tokens is low, there is no reason for the electricity transfers in the direct token transfer group to generate a larger increase in electricity usage. Instead, mental accounting, or increased attention to electricity usage due to the treatment, might account for increased electricity consumption amongst the token group.

Optimal policy depends on context

Should policy makers give electricity subsidies or cash transfers during an economic crisis? Based on the different preferences of urban and rural respondents, and on comparing these results to a similar survey in Ghana, we argue that the surrounding context of the local mobile money infrastructure and the transaction costs of topping up electricity are crucial. In Kenya, where mobile money is already widely used, and transaction costs for topping up electricity are relatively low even in rural areas, cash transfers are preferred by most recipients. In other contexts, where mobile money is not yet used by the majority of residents, in-kind transfers like electricity subsidies may generate more benefits.

Editor’s note: This article is based on this IGC project.