Moving Pakistan up the value chain: Opportunities in textiles and garments

Textiles, particularly readymade garments, are a significant and growing component of Pakistan’s Economy. This blog, by the IGC’s Hina Shaikh outlines challenges and promising policy ideas facing Pakistan’s textiles and garments sector. Improving policy and industry incentives for the Garments sector has the potential to act as an engine of growth through both jobs and improved trade balances.

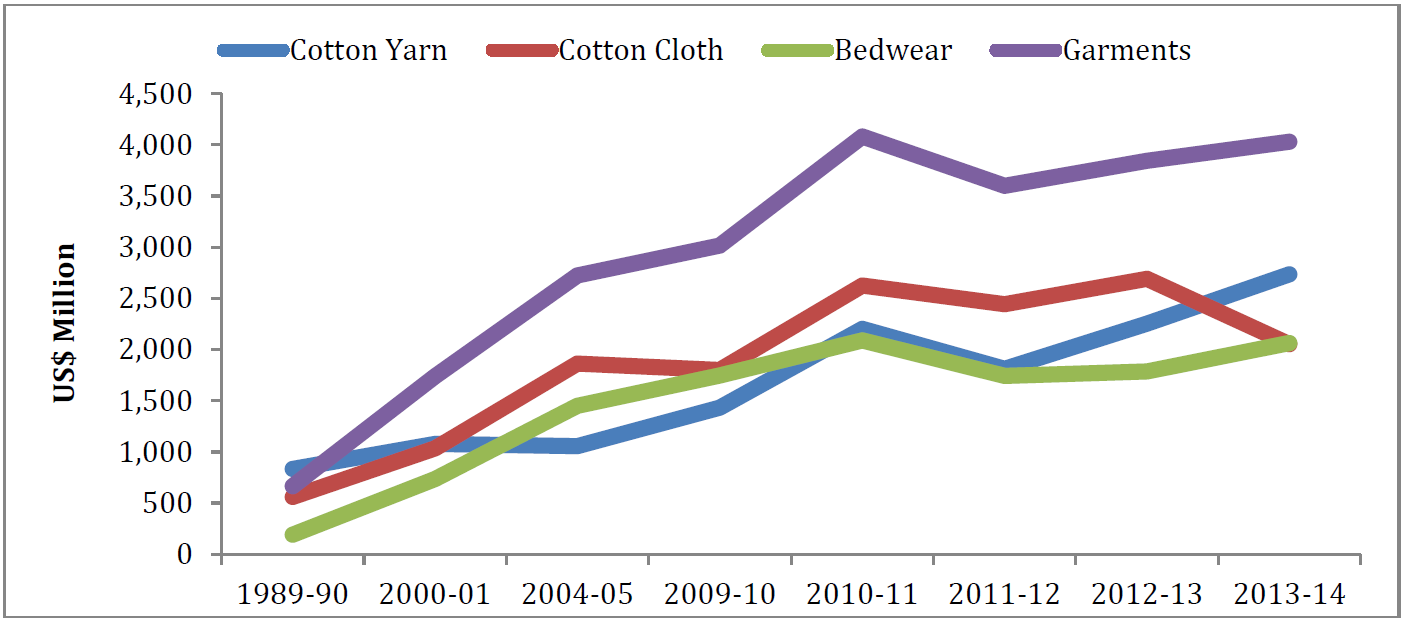

Exports of readymade garments have increased nearly four times in value from 1990 to 2013, from $1 billion (USD) in 1990 to $ 3.9 billion in 2013.

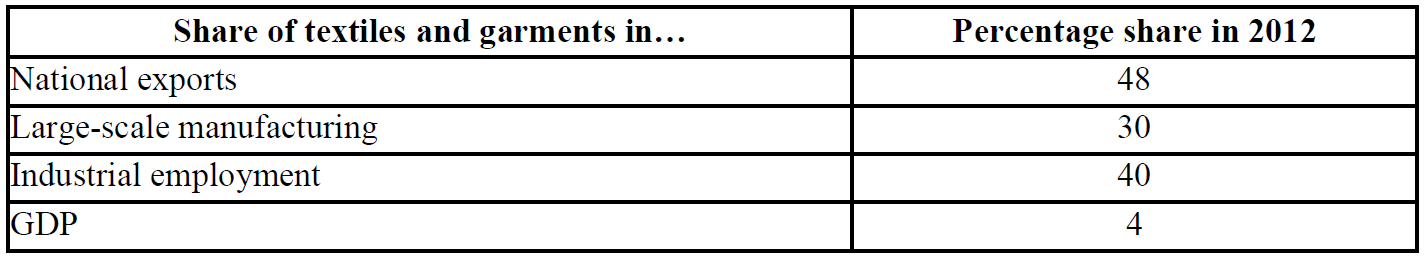

Table: Economic importance of textiles and garments

Sources: State Bank of Pakistan, Ministry of Finance, All Pakistan Textile Mills Association

Figure: Trend in Pakistan’s Textile Exports by Major Categories, in US$ Million

Source: Trade Development Authority of Pakistan (TDAP)

The growth of readymade garment manufacturing represents a progression towards higher value additions in global textiles chains. Take for example, the value of 50,000 kilograms of cotton fibre. As an input to spinning, weaving, and finishing, the fibre could create up to 400 jobs. Using the same fibre in garment manufacturing, on the other hand, could create 4 times as many jobs. The differential impact of financial investments is even greater. $1Million USD invested in spinning and weaving produces $0.27Million worth of exports. The same investment in garments could produce $3.2Million. In sum, garments have tremendous potential for creating jobs and generating exports for Pakistan.

With rising labour and other production costs in China, Pakistan has an opportunity to meet global demand and compete internationally. In line with this, the European Union (EU) recently granted GSP-plus status to Pakistan, allowing duty free access to Pakistani goods. The EU is now the largest importer of Pakistani textiles and garments and accounted for 28 per cent of Pakistan’s total exports in 2012. For the sector to capitalise on this potential, policies incentivising the garment industry need to be realigned.

Pakistan largely failed to benefit from the opening up of the global textile trade in 2005, due to the prevailing industry structure and policies that hindered and reduced export competitiveness. To date, low or intermediate value-added products make up approximately 69 per cent of Pakistan’s total textile exports, relative to the global average of 32 per cent in 2012.

Textile exports have also suffered from Pakistan’s poor security situation. Large Pakistani garment manufacturers face stricter scrutiny by international buyers, and must meet higher standards of compliance to retain or attract large buyers.

Constraints to the Growth of the Garments Sector

Products, Pricing, and Policy

Pakistan’s garment exports have a relatively narrow base, with a few products accounting for the bulk of exports; the top six export products account for over 78 per cent of all garment exports. Export concentration also occurs at the lower end of the price range. For four out of the five most traded products, Pakistan’s average export price is approximately half of the world average export price.

The Government’s protectionist industrial policy over the past many years is a primary reason for this. The decision to protect the local fibre industry and impose high tariff and non-tariff barriers on the import of man-made fibres, yarn, and various fabrics has severely limited the export potential of garments. Garments manufacturers are required to produce and export items without imported yarn, fabric, or special trimmings and accessories. This raises costs and reduces international competitiveness. Additionally, given that man-made fibres now comprise 65 per cent of total fibre consumption in the world, Pakistan’s exporters are excluded from a substantial proportion of the market.

Energy shortage

In 2012, most of the industry in Punjab suffered power outages of 8 to 12 hours a day while the supply of natural gas was suspended for several months in the winter. Many large firms have installed generators to meet their electricity needs, but most small firms are unable to afford this. The energy crisis has significantly raised costs for garment manufacturers and increased uncertainty in production planning. The potential for delays in the production chain also exclude Pakistani firms from buyer’s list of ‘reliable’ suppliers.

Security and Country Risk Perception

Poor security, political uncertainty, and the prevailing law and order situation give international buyers a high-risk perception of Pakistan. Employees from international buyers almost never visit Pakistan and since the importance of such interaction increases as firms move up the price range for products, this makes it very difficult for Pakistani exporters to target the medium-to-upper end of the garments market for any product.

Poor Investment in human resources

The low level of general education in the country translates into poor trainability of the workforce. The shortage of formal vocational training institutions results in a skills gap that firms must fill themselves. Of the large firms in Punjab that we surveyed under a study funded by the International Growth Centre, over 60 per cent complained of a shortage of stitchers, while over 85 per cent reported difficulties in finding middle managers. Most firms felt that poor quality schooling was a significant challenge in training entry-level workers.

Recent Initiatives by the Punjab Government to promote Garments

Due to the export potential of the garment industry and its employment generating capacity, the Government of Punjab has recently undertaken initiatives to help the garment sector in overcoming the constraints identified above.

Skills Development

The Punjab Skills Development Fund (PSDF), a Government-managed entity, has launched the Skills for Garments scheme, designed to address skills shortages in the garments and apparel industry, especially among workers and middle management. Under this scheme, PSDF will be training a large number of individuals using a model where the training is delivered by the private sector using government finances, thus removing the inefficiencies of the public sector.

Developing Garment Clusters

The Punjab Government is setting up a model garments cluster where existing firms can relocate or undertake expansion projects. The Quaid-e-Azam Apparel Park is being developed on over 1,500 acres of land near Sheikhupura, with space for over 100 garment manufacturers and accessories suppliers, dedicated power plants for an uninterrupted power supply to the industrial estate, and common facilities such as effluent waste treatment plants, clean drinking water, and solid waste disposal.

Way Forward

Garments manufacturing is the least energy and capital-intensive industrial activity and is thus well suited for Pakistan’s resource endowment to generate economic growth and employment. However, to fully realise its potential, garments manufacturers must move up the value chain. They must improve quality of management of factory operations, supply channels, and logistics. In order to advance their competitiveness, they must invest in technology and up-gradation and adhere to codes and regulations governing workplace conditions, labour rights and minimum wages. Some of the constraints, such as the security situation and country risk perception, are difficult for the government to address. However, many firms are using information technology not only to improve their production planning and management, but also to overcome the constraint arising from buyers’ unwillingness to travel to Pakistan. Some of the garment manufacturers have also tried to overcome the adverse security situation by opening up offices and warehouses in or near major markets and fashion centers. While garment manufacturers have tried to overcome current constraints in their growth, the government needs to improve their incentives structure and keep its policy consistent, so that this industry can realise its growth potential.

A version of this blog originally appeared in the Business Recorder.