Overcoming barriers to access and agency for women entrepreneurs in India

Despite various policies aimed at fostering women entrepreneurship in India, few women-led businesses reach the same scale as their male counterparts. Traditional gender roles often inhibit women’s agency, risk-taking, and decision making in business, thereby necessitating policies that are specifically aimed at helping women achieve their entrepreneurial potential.

In 2021 Nykaa – a popular Indian beauty, wellness, and fashion e-commerce company became a notable Indian unicorn founded by a woman. Its founder, Falguni Nayar is a former investment banker with no background in big tech. It was all the more remarkable that she managed to build a multi-billion dollar company in an industry that primarily targets women yet has traditionally been run and dominated by men.

While Nykaa’s success highlights the opportunities that lie in tapping into an existing female consumer market; the case for women entrepreneurs trying to reach these markets at the scale achieved by Nykaa are rare. Data indicates that women lead businesses are under-represented in India which ranks third-highest in the entrepreneurship gender gap across the world – only 33% of the early-stage entrepreneurs are women. Although women constitute close to 50% of the country’s population, only 20% of all the proprietary micro, small, and medium enterprises (MSMEs) are owned by women. A number of these enterprises are known to have been registered by women, when they are in fact run by men.

Addressing challenges to women entrepreneurship

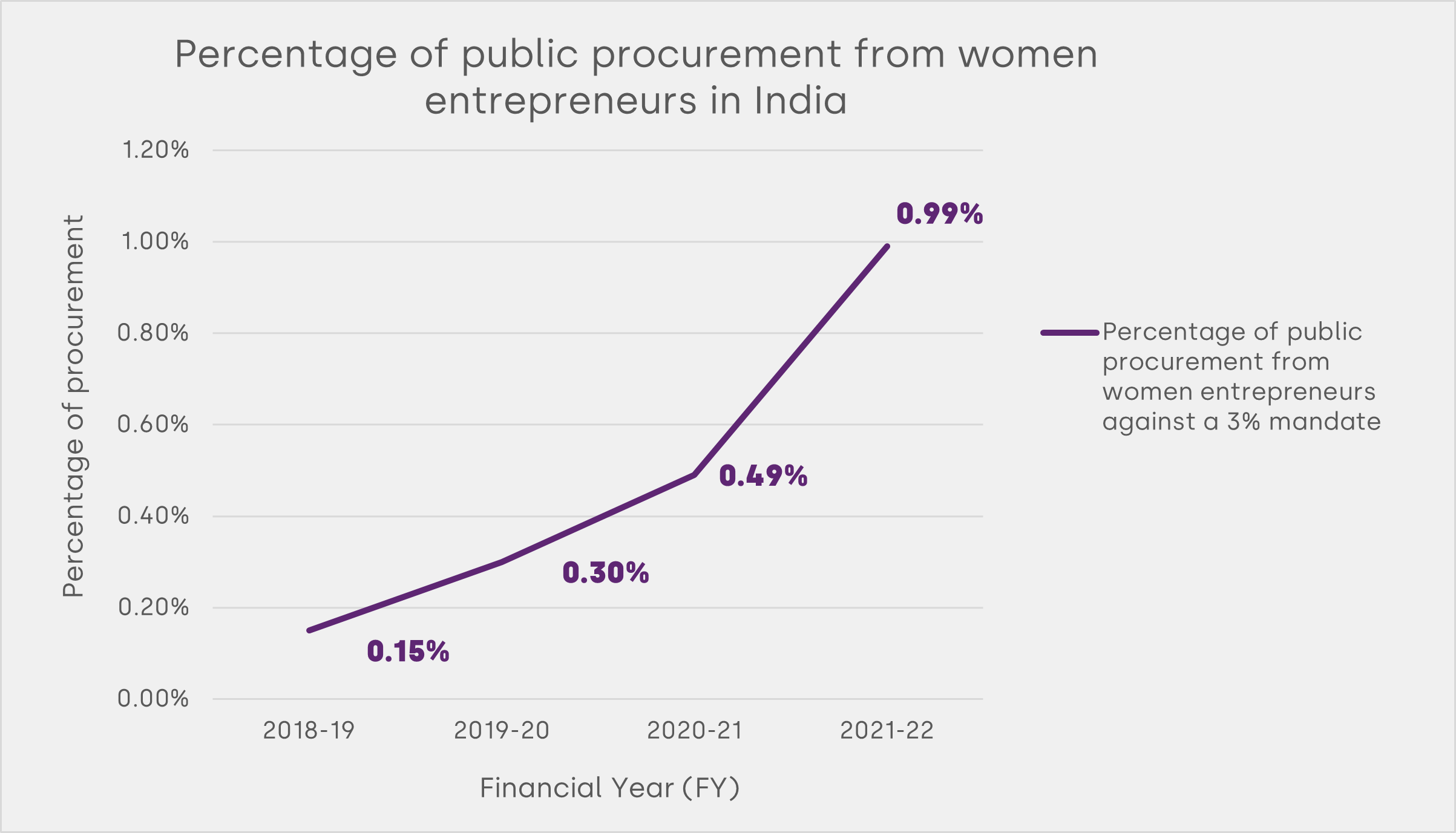

Women entrepreneurs face multiple challenges including unequal access to finance and collateral, lack of training, poor access to mentorship and networks, and inimical treatment from banks. To help women overcome these challenges, the government and private partners have supported women by imparting skills, extending lines of credit, providing incubation facilities, and offering marketing and branding opportunities. In addition, the government also passed the Public Procurement Policy for MSEs Order in 2012 which mandates that 3% of procurement in all CPSEs (Central Public Sector Enterprises) and Central Government Ministries must be done through women entrepreneurs.

Procurement through women entrepreneurs through this policy has only grown from 0.15% in FY 2018-19 to only 0.99% in FY 2021-22 and falls well below the 3% target.

Figure 1: Public procurement from women entrepreneurs in India

Note: This figure illustrates that total public procurement conducted through women entrepreneurs has increased by only 0.84% from FY 2018-19 to FY 2021-22 but still falls short of the 3% target. Based on author’s calculations.

Note: This figure illustrates that total public procurement conducted through women entrepreneurs has increased by only 0.84% from FY 2018-19 to FY 2021-22 but still falls short of the 3% target. Based on author’s calculations.

The government also set up a women-only bank – the Bharatiya Mahila Bank. However, in 2013, it was merged with India’s largest public sector bank in less than five years due to operational inefficiency. Access to finance is a persistent obstacle for women entrepreneurs who only receive 5% of the total credit at all Public Sector Banks provide to MSMES in India.

Creating a conducive policy framework

Owing to the growth of the micro-finance industry, various financing models with women as agents of change have been studied. Despite this, there is little knowledge about policies which help women become better risk-takers and decision makers in business. A suggestive list of policy considerations which can help bridge the gap is detailed as below:

- Alleviating the care burden: Policies to support women entrepreneurs should be examined through the life cycles of women. This should consider the challenges of college education, marriage and related migration, motherhood, and other caregiving responsibilities. Availability of affordable, safe, and reliable childcare facilities and elderly care services for example could greatly help women who are often the primary caregivers in the majority of Indian households.

- Supporting women risk-takers: The multiplier effect of investing in women who then utilise the money earned for not only their business but to also support the wellbeing of the household is well researched in economic literature. However, there is little investigation of policies which enable women to take more risks in their professions or enterprise building journeys. Corporate support for women entrepreneurs returning to work following a business failure, can be one such suggestive measure.

- Using women role models: Research shows that having women role models often encourages women to pursue various forms of entrepreneurship. Evidence also suggests that high-quality mentorship can lead to growth in confidence and aspirations among women. Therefore, policies providing mentoring services and access to supportive networks can be a means of empowering both existing and aspiring women entrepreneurs.

- Promoting women partners in Venture Capital firms (VCs): Financial and mentorship support from VCs can be an effective mechanism for supporting and encouraging more women lead businesses. Reports suggests that in India, only three of the top 20 VCs have at least one woman partner while the rest have none at all. An increase in the number of women partners can be an effective way to support women entrepreneurs. Advancing women investors to focus on consumer goods – where there is an active demand from female consumers – can be another avenue to help investors support female entrepreneurs.

- Increasing access to digital assets: There is growing evidence showing that mobile phones can be an effective medium for undertaking business trainings. Although in India, only 38% of women own mobile phones, compared to 71% of men – highlighting a worrying technological gender gap. There needs to be both normative changes – through societal norms – and economic changes by providing financial support to encourage equal access to mobile technology for both male and female entrepreneurs.

- Creating networks: Building supportive networks of and for women that help them pool their risk and grow. Research demonstrates social networks which include other entrepreneurs are stronger predictors of women’s entrepreneurship globally than academic attainment or household income.

A 2019 report estimated that women run enterprises could potentially create 150-170 million jobs in India by 2030. For this to materialise, policymakers, lending institutions, corporate bodies, business accelerators, and other ecosystem partners must work collectively to support more women entrepreneurs. This is imperative if the successes of women-led companies like Nykaa are to become the norm.