Promoting FDI through financial market development in host and source countries

Financial market development of both source and host countries can shape and drive flows of financial direct investment over time.

The question of whether better-developed local financial markets attract FDI is particularly relevant for host countries that have remained on the sidelines in the global competition for FDI such as many developing countries in sub-Saharan Africa. Yet this question has received scant attention so far. Prominent surveys of the literature on the determinants of FDI inflows, including Chakrabarti (2001) and Blonigen (2005), do not even cover the host countries’ financial market development.

Limitations of previous literature

The few existing empirical studies consider financial market development on just one side of the source-host pair. This leaves unclear whether what matters for FDI is financial market development in the host countries, in the source countries, or in both host and source countries.[1] Studies addressing financial market conditions exclusively in host countries tend to neglect that foreign investors can be credit constrained at home. This can inhibit their ability to invest abroad so that financial market development in the source country is also relevant. Typically, the existing literature also ignores that multinational enterprises may switch between local and foreign funding; the effects of financial market development in the host and source countries are thus likely to be heavily interdependent.

Role of financial markets: three hypotheses

Against this backdrop, we test three hypotheses on the effects of financial market development on bilateral FDI stocks:

- First, we expect that financial market development in the source country encourages outward FDI. FDI involves high fixed costs upfront since an affiliate has to be established or acquired in the host country. The availability of external financing renders it easier to cover the fixed costs of undertaking FDI. Hence, better-developed financial markets in the source country are likely to result in higher outward FDI.

- Second, we expect that better financial market development in the host countries attracts FDI to these countries. This is because foreign companies often finance part of their investments in the host country. Local financing, for instance, serves as a hedging device against exchange rate fluctuations. Well-functioning financial markets in the host countries do not only reduce the costs of external finance for firms, they may also facilitate interactions between foreign and local firms and help foreign investors overcome informational asymmetries by sharing local knowledge on risks and market opportunities.

Third, we expect the effects of financial market development in the host country on bilateral FDI to depend on financial market development in the source country. Specifically, less developed financial markets in the host country may discourage FDI primarily from source countries with relatively weak financial markets, whereas FDI from source countries with highly developed financial markets may be hardly affected.[2]

Chinese ships, in Monrovia, Liberia

Image source: Stefan Jürgensen

We estimate gravity-type models to assess the effects of financial market development in the host and source countries on bilateral FDI stocks simultaneously, allowing for the effect of financial market development in one country of the country-pair to be conditioned by financial market development in the other country. In contrast to the existing literature, we use a composite index, based on a comprehensive set of financial indicators, to capture the stability, depth, and efficiency of financial systems as well as access to finance. Our analysis covers a larger and more globally representative sample compared to existing studies, comprising 43 (traditional and non-traditional) source countries and 137 host countries over the period 2001-2012.

Empirical findings

Our baseline estimations for the full sample of host countries include both developing and developed economies. Here, we find strong empirical support for the first and second hypothesis: bilateral FDI increases when financial markets are more developed in both the host and source country. Moreover, it appears from these estimations that financial market development in both countries of a pair plays a similarly important role. A one standard deviation improvement in financial market development in host and source countries is predicted to increase bilateral FDI stocks by 8.7% and 7.8%, respectively. For the full sample we find no compelling evidence that financial market development in source and host countries depends on each other as hypothesised above.

However, it would be premature to conclude that better developed financial markets in the source country of a pair are neither complements nor substitutes for less developed financial markets in the host country. We do find evidence for a conditional relationship if we restrict the analysis to developing host countries. As noted, the question of whether better developed local financial markets help attract FDI is particularly relevant for host countries that have remained on the sidelines in the global competition for FDI. At the same time, it is mainly in developing countries where financial market conditions are often deficient so that there exists greater potential to reform financial markets and, thereby, attract higher FDI.

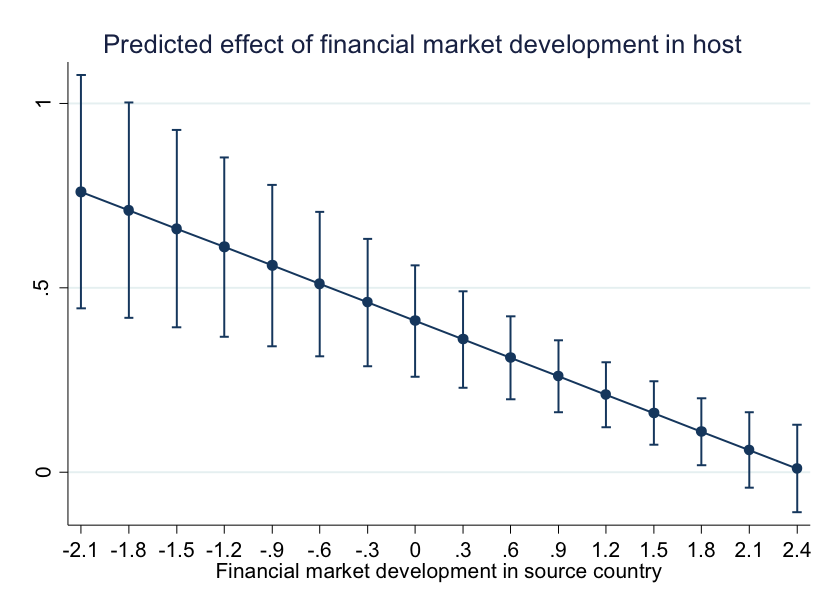

Indeed, the effects of financial market development in developing host countries are stronger than those for the full sample in the baseline estimations. Surprisingly perhaps, this applies not only to financial market development in the host country but also to that in the source country. Furthermore, we find that financial market development in the developing host country and financial market development in the FDI source country function as substitutes for each other. Figure 1 plots the effect that a one unit change in financial market development in host countries, which is approximately equal to its standard deviation, has on bilateral FDI stocks across the relevant range of financial market development in source countries.

Figure 1. The conditional effect of financial market development (Pseudo-Poisson one-step regression).

At very low levels of financial market development in source countries, the effect of improving financial market development in host countries is very large at about 75% (but with a wide 95% confidence interval around it). Considering actually observed financial market development in source countries, the vast majority of observations are in a range where the effect is well below 50%. At very high levels of financial market development in source countries the effect becomes practically zero and statistically insignificant.

Implications for developing countries

Our finding of conditional effects has ambiguous implications for developing host countries. On the one hand, it suggests that poor financial market development in developing host countries can be compensated for by highly developed financial markets in the FDI source countries. Clearly, given that financial markets are still very underdeveloped in various developing countries, this is encouraging news. On the other hand, it also suggests that the pay-off to better develop financial markets in developing host countries is not as large as policy makers might expect if the country’s major FDI source countries themselves have highly developed financial markets. Future research should analyse whether similarly conditional effects prevail with regard to other FDI determinants such as physical infrastructure in transportation and communication.

[1] Desbordes and Wei (2014) provide a notable exception. We complement and extend the work of Desbordes and Wei in several ways; for details, see Donaubauer et al. (2016; https://www.ifw-members.ifw-kiel.de/publications/financial-market-development-in-host-and-source-countries-and-its-effects-on-bilateral-fdi/kwp_2029.pdf).

[2] Indeed, Desai et al. (2004) find that affiliates of US-based parent companies increase internal borrowing from parent companies to offset most of the reduction in external borrowing due to poor financial market conditions in the host countries. In other words, poor financial market development in the host countries is associated with more FDI in the form of intra-company loans. However, adverse effects on FDI become more likely when parent companies are based in source countries that are financially less developed than the United States, i.e., where it is more difficult to offset financing constraints in the host countries.

References:

Blonigen, B.A. (2005). A review of the empirical literature on FDI determinants. Atlantic Economic Journal 33(4): 383-403.

Chakrabarti, A. (2001). The determinants of foreign direct investment: Sensitivity analyses of cross-country regressions. Kyklos 54(1): 89-114.

Desai, M.A., C.F. Foley and J.R. Hines Jr. (2004). A multinational perspective on capital structure choice and internal capital markets. Journal of Finance 59(6): 2451-2487.

Desbordes, R. and S.-J. Wei (2014). The effects of financial development on foreign direct investment. World Bank Policy Research Working Paper 7065. Washington, DC.

Donaubauer, J., E. Neumayer and P. Nunnenkamp (2016). Financial market development in host and source countries and its effects on bilateral FDI. Kiel Working Papers 2019. Kiel Institute for the World Economy.