The compliance challenge: Raising property tax revenues in Kampala

Property taxes are an important potential source of revenue for cities. Faced with limited municipal revenues and rapidly growing populations, taxes on the value of land and property can offer a significant source of funding for cities to provide local services and to tap into financing for larger investments. Recent improvements to the tax administration system in Kampala have expanded the property tax net and raised revenues. But despite these significant improvements, 66% of potential revenue remains uncollected. In this blog, we explore potential reasons for low tax compliance in the city.

Property taxes (or rates) in Kampala, levied on the annual business or rental income of properties in the city, are a significant source of revenue for the city, providing necessary financing for critical public investments. These taxes made up over one-third of the Kampala Capital City Authority (KCCA)’s own source revenues in 2018/19.

Since 2014, the KCCA has successfully expanded the property tax net through a mass enumeration of properties in the city collecting ownership information, GIS coordinates, and property attributes for over 300,000 properties in the city. Now that the tax net has been expanded, the city faces a new challenge – raising compliance with property taxes for properties in this roll. Low compliance may reflect a number of factors, including weak means of enforcement, high tax liabilities, and low tax morale. Our study explores these potential factors in more detail by examining KCCA administrative tax data and focus groups with taxpayers.

The current state of compliance

Property tax compliance in Kampala is extremely low. Last financial year, less than one in ten billed properties paid their taxes on time. As a result, only 29.2 billion UGX was collected from an expected 85.9 billion UGX of revenues. Of course, these figures may be particularly dramatic for this financial year where we have seen delays in the roll out of valuation rolls for three divisions in the city, and the outbreak of COVID-19 which has dramatically affected payments since April 2020. However, these figures do highlight an ongoing challenge of property tax compliance in the city.

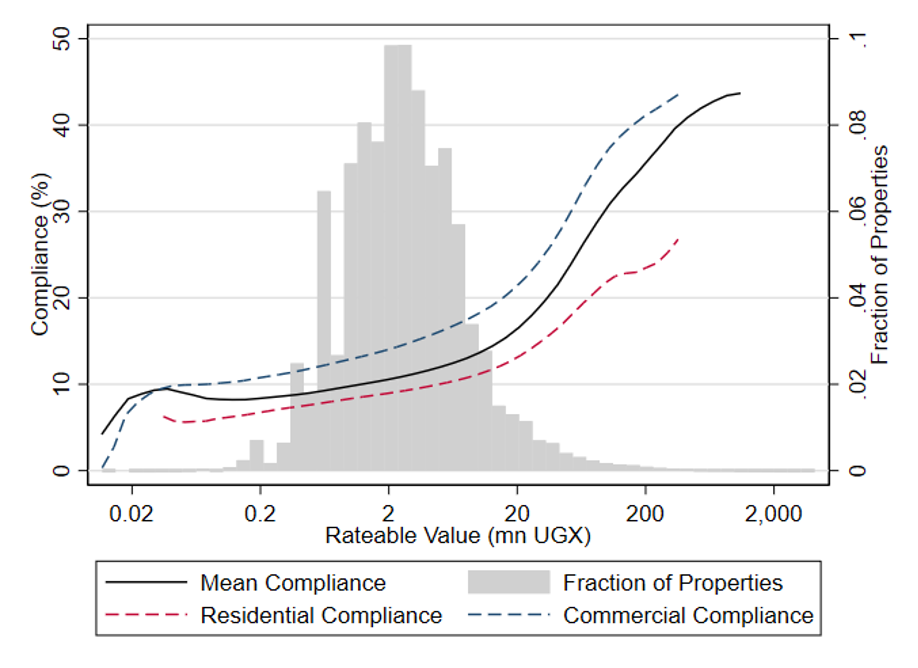

Figure 1 below highlights a key trend emerging from the data – a higher rate of compliance in payments for high value properties. This may be due to government’s focus on targeting high valued taxpayers, the higher opportunity cost for high valued properties to be locked up by government for failing to pay, or simply because high valued properties are owned by individuals with a higher capacity to pay.

Figure 1: Compliance rate by current rateable value and property type.

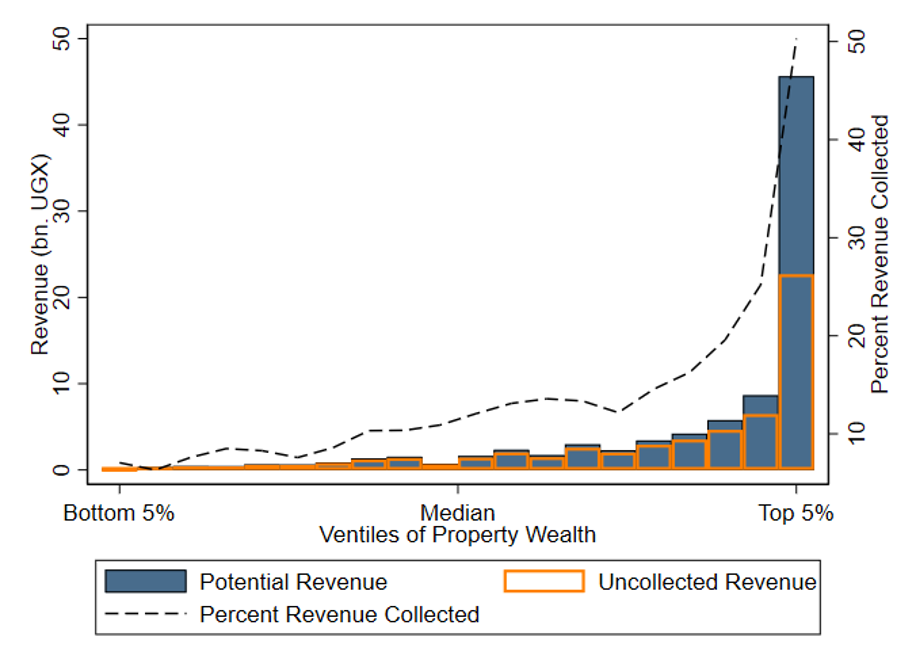

While owners with the most property wealth (measured by total taxable value of all properties owned) are most likely to comply, they also represent the largest source of uncollected revenue, as can be seen in Figure 2. As such, targeted policies towards raising compliance of wealthier property owners is likely to generate the greatest returns for government.

Figure 2: Potential revenue collection by taxpayer property wealth. Here, high wealth property owners represent a large share of the potential revenue (solid bars), in fact the top five percent of property owners are responsible for more than half of all demanded property rates. While the compliance rate of these top property owners is much higher than any other group of owners (dashed line), they also represent the largest uncollected source of revenue (hollow bars).

Declared determinants of compliance

In February 2020, in collaboration with the Kampala Capital City Authority (KCCA), we conducted preliminary focus groups with taxpayers to discuss key areas of concern relating to property tax payments. When asked to give recommendations on how to improve implementation of property taxes, four common themes appeared; relationship management, poor communication, errors in valuation, and service delivery.

“Show us love, we shall also pay taxes with love”.

Currently, there appears to be a poor relationship between KCCA officials and taxpayers, negatively affecting taxpayer willingness to pay. On separate occasions respondents referred to the KCCA as ‘enemies’. Engagement between the city and citizens is seen as limited, and the engagement that does exist is often claimed to be rude and forceful.

“It is disrespectful for KCCA not to work with local leaders”

To improve relations, respondents commonly suggested involving locally elected village officials and increasing means of communication with citizens.

At the same time poor communication creates misinformation that can confuse or demotivate taxpayers. There was a significant level of confusion around which properties are exempt from rates, payment due dates, tax liabilities, and the role of different taxes being imposed on rental income. Roughly half of our respondents who claim to know when payments are due state that it is December, while the other half state June, and a significant amount simply do not know when they are due. Given this, it’s not surprising that many taxpayers do not pay their rates on time.

Inaccurate registry data means that some individuals are notified with irrelevant or inaccurate information, and others are not notified at all. Many respondents note that text message reminders often have mistakes in terms of listed names/liabilities, increasing confusion.

“They can send different messages reading differently. So, one can’t decide which one to clear, … so it confuses.”

At the same time, many taxpayers believe their properties to be overvalued. Common complaints with the recent valuation process include that valuations assumed full occupancy of buildings, and that vacant or owner-occupied properties were incorrectly valued when they should have been exempt. Individuals noted that mistakes often came from KCCA staff valuing properties without consulting owners.

“There is no way you can do valuation before asking me how much I charge for the house, or how big the house is, and you just tell me I have to pay”.

Finally, service delivery, if poorly implemented or simply not salient, can lower tax morale because taxpayers believe there is no reciprocity for paying their rates. Overall respondents were unsatisfied with public good provision.

“Property rate is good in general but the way it is spent is the problem. There is no service delivery - we pay tax and still pay for garbage collection, … we work on our roads”.

While respondents knew that KCCA collects property rates, most were uncertain whether the KCCA is responsible for spending them and how expenditures were allocated. Many respondents think that revenues from property rates are simply used to pay for government salaries, with limited benefits to citizens.

“Our money is just taken but we are not sure how it is spent”

Next steps for research

While administrative data and recent taxpayer discussions signal some key areas for policy concern, there is need for further data collection to get a more representative picture of taxpayer attitudes, and more rigorous research to be able to causally identify the impact of different policies on taxpayer attitudes and compliance levels. With this, the city can design and implement policy to both raise revenues and improve relations with its citizens.

Disclaimer: The views expressed in this post are those of the authors based on their experience and on prior research and do not necessarily reflect the views of the IGC.

This blog summarises the project Public reporting and property tax compliance: A field experiment in Kampala, Uganda.