The costs of building exporter-buyer relationships in Myanmar

Despite Myanmar’s recent economic and political liberalisation, the country’s exports remain low. One reason could be the costly search process between foreign buyers and local exporters. Alleviating such costs should be a priority for the government of Myanmar to boost exports.

Since 2010, Myanmar has implemented political and economic reforms aimed at spurring growth and increasing the country’s participation in the global economy. Despite these reforms, Myanmar’s exports remain low and the trade deficit is widening. Part of the explanation for this poor performance lies in the fact that establishing successful export relationships is difficult and takes time.

Understanding and alleviating the difficulties that Myanmar exporters face in finding foreign buyers for their products is a key step in generating export-led growth. Specifically, if the matching process between exporters and foreign buyers is costly, Myanmar may not have reached its export potential due to missing relationships between exporters and buyers. At the firm level, if some exporters have higher abilities at finding foreign buyers, or can be found more easily by buyers, they may have an advantage in the market.

In a recent International Growth Centre (IGC) research project, I explore the Myanmar bean export sector with the aim of quantifying the sources of heterogeneity across exporters. Are the largest exporters successful because they are more productive on the supply side or because they are better at building and maintaining relationships with foreign buyers? What consequences do these results have for thinking about export promotion? How costly is the matching process between exporters and buyers?

The findings

- The importance of exporter-buyer relationships

95% of the bean exporters surveyed for the project reported that for each of the bean types they export, their top buyers found them and that they did not have to conduct any outreach activities to build a relationship with them. However, exporters do try to find new buyers. 70% of exporters travelled once or more abroad in the year before the interview was conducted to find buyers there.

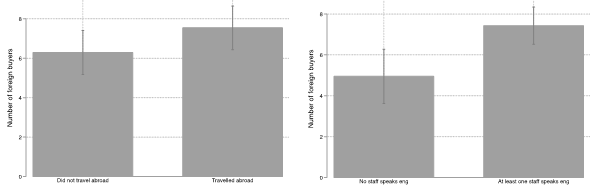

The left panel of the figure below shows that exporters who do travel abroad to find buyers sell to a larger number of buyers, although the difference is not statistically significant. The right panel shows that exporters who have staff who speak English are also likely to sell to a wider range of foreign buyers. This difference is statistically significant. Similarly, surveys reveal that exporters who sell to many buyers are more likely to have a website or have an office in downtown Yangon.

These statistics show that firms are willing to make significant investments to serve buyers. Exporters declare communicating with their top buyers mostly over the phone or by email but meet on average three times a year despite the length of their relationship with these buyers.

Decomposing an exporters’ total sales into the number of buyers he sells to and the mean quantity sold to each one of these buyers reveals that about 40% of the variation in the distribution of exporter size in the beans sector can be attributed to the number of relationships exporters have with buyers. This highlights the importance of building connections with buyers for explaining an exporter’s success.

- Export prices and buyer-exporter relationships

Analysis of the transaction data shows that within a week, there is significant price dispersion across transactions of the same type of beans. Moreover, analysis of prices and buyer-exporter relationships in the data shows evidence of buyers paying a high cost to find exporters and build a relationship with them:

- Newly entering buyers pay on average US$13 higher prices per metric ton of beans compared to continuing buyers (the average price is US$800 per ton). They are also likely to have higher search costs for exporters and this result is consistent with that assumption.

- This gap in prices reduces over time. For every year of a buyer’s experience, the average price at which the buyer purchases beans reduces by US$2 per metric ton. As buyers accumulate experience in the Myanmar bean export market, they should be able to source beans at lower prices.

- While there are more than 150 bean exporters available in any given year, the median foreign buyer only makes purchases from three different exporters. This is surprising as buyers are always looking for the lowest price and so the same three exporters are unlikely to always have the lowest available price on a given order.

- About 40% of buyers in a given year are new entrants and 23% of exporters are new in the market, so turnover on both sides of the market is high.

- Buyers who on a given year buy beans from a wider range of exporters pay lower prices: Supplying beans from one more exporter over the course of the season reduces the average transaction price by US$1.9 per metric ton.

- Exporters who sell at lower prices to a given buyer are more likely to have a higher market share with that buyer.

Competitive import sourcing

These last two results are consistent with buyers sourcing the beans through a small-scale competitive bidding process with the exporters they have built a relationship with. Interviews with foreign buyers unveiled the mechanism through which they source beans from Myanmar: Upon receiving an order from a final buyer, generally in India, they run a competitive bidding process with all the exporters they work with by calling them individually and asking them to submit a price quote for the order. Buyers select the exporter who offers the lowest price and sign a contract for the order. Thus, buyers who know and work with more exporters buy the beans at lower prices on average.

The description of this process is used to build a model and estimate buyers’ search costs from the data. The model is too detailed to explain in full here. Briefly, buyers face a trade-off when searching for more exporters to build a relationship with. On the one hand, they need to pay a cost to search for more exporters. On the other hand, including more exporters in their buying set allows them to source beans at lower prices on average over the course of the season.

Buyer search costs

The distribution of estimated buyer search costs is reported in the table below. The median search cost for new buyers is about US$2,600 and US$1,700 for continuing buyers. These costs are somewhat aligned with the process buyers need to go through to find exporters and begin a relationship with them: First, find the contact information of an exporter, schedule several meetings, conduct due diligence over the experience of the exporter, and visit the factory where the beans will be processed. The estimated search costs are therefore relatively high.

While these search costs are estimated solely in the beans export market, there is no reason why they should be any lower in other sectors, especially those where the goods are differentiated as they would probably require an even longer vetting process of a given exporter.

Policy implications: Export promotion

This project takes the sector as a benchmark to show that matching between exporters and buyers is costly. As such, these results suggest that there is room for the government to conduct export promotion activities. Supporting firms in their efforts to find buyers abroad by reducing search costs, giving exporters more visibility in world markets, and increasing trust between traders should be important goals for the government of Myanmar and the Ministry of Commerce more specifically.

Editor’s Note: This blog is part of the IGC’s 10 year celebration series. This blog is linked to our work on trade and industrialisation.