The effect of financial literacy on the financial policies of firms

Can education play a role in economic development through improved corporate practices? Several studies conducted with micro and small firms in developing countries point to this direction. But what about large firms? As large firms contribute to a sizeable share of the value created in a country, the potential effect of managers’ education on large firms’ performance can have an amplified impact on the overall economy.

Human capital, defined as the set of skills, talent, and knowledge of people, is an increasingly important economic resource. One of its multiple dimensions is managerial human capital. An economy with higher levels of managerial human capital can more easily rely on the business sector to achieve economic progress. Recent studies suggest management quality is indeed associated with firm level productivity and profitability (Bloom et al. 2012).

The importance of financial expertise

One important dimension of managerial human capital is financial expertise. Financial literacy has been shown to impact revenues and survival rates of small and micro-entrepreneurs in the context of developing countries (Drexler et al. 2014, Anderson-Macdonald 2014). However, very little is known about the role of financial education in large firms’ managerial practices and its impact on firm financial policies. Although this gap in the literature is present for both developed and developing countries, it may well play a crucial role in less developed environments. In our research project, we conduct a randomised controlled experiment in Mozambique, where we teach financial management to executives of large firms in order to evaluate the impact of financial education on large firms.

Our research contributes to the existing knowledge in this field in three different ways:

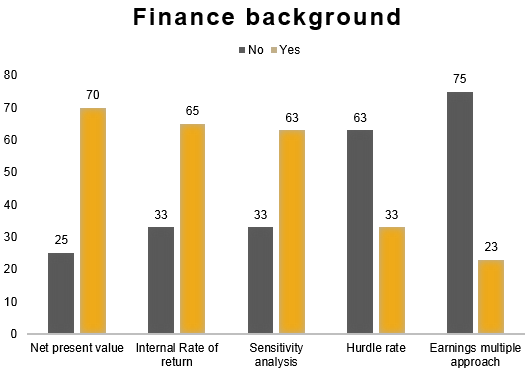

- We provide detailed evidence on financial practices and their relationship with executives’ financial education. We find there is substantial heterogeneity in the financial experience of Chief Executive Officers (CEOs) in Mozambique. About 50% of the CEOs in our sample have a background in finance, either by education or work experience. By analysing financial practices of firms with and without financial expert CEOs, we find large differences in their practices as well. Figure 1 shows some financial practices related to capital budgeting and valuation by firms that are led by a financial expert CEOs vs. a “regular” CEO. We find significant differences between these two groups. While a large majority of CEOs with a background in finance are making use of sophisticated valuation techniques such as Net Present Value (70%) or conduct sensitivity analysis (63%), this is relatively uncommon for CEOs without such a background. Only 25% of CEOs with no financial background use Net Present Value and only 33% of them perform a sensitivity analysis in their capital budgeting calculations. At the same time, they are more likely to use less sophisticated valuation techniques such as hurdle rates (63%) or multiples valuation (75%). This evidence is consistent with the existing literature documenting relationships between managers’ literacy and financial or accounting data outcomes, such as firm value.

- Although there is previous evidence on the link between financial literacy and firm performance, the direction of causality has been difficult to establish. For this reason, we have conducted a randomised controlled experiment, where we offered managers the possibility to attend an MBA-like module in financial management. In this way, we are able to assess, in a causal manner, the relationships between financial literacy on both corporate practices and firm performance. In addition, we have combined survey and financial data outcomes to better understand the mechanisms behind such relationships.

- We focus our analysis on large firms, where more complex management and decision-making structures are in place, and for which the potential impact of the intervention is larger.

Figure 1: Financial literacy and financial policies of managers of large firms in Mozambique

Our intervention

We offered managers of large firms operating in Mozambique the opportunity to participate in an 18-hour Executive-level Programme in Finance in Maputo. This training - “Finance and Strategy – Value Creation in Emerging Markets” – promoted under Imperial College Executive Education branding, was specifically designed to accommodate the reality of a developing economy, such as Mozambique. We focused the training on features dimensions managers had previously identified as being the most challenging during the exploratory stage of our project. The topics covered were capital budgeting (project valuation), capital structure, working capital management, and risk management.

The teaching materials were also adapted to the context, including case studies of Mozambican firms (e.g. Mozal). Lastly, participants were highly encouraged to present their view and in-class discussion followed a hands-on approach. Upon enrolment, we randomly allocated the participants to one of the two editions. The first and second editions took place on May 2017 and November 2018, respectively. Participants allocated to the first edition compose the treatment group while participants in the second edition serve as the control group. The course was taught both in Portuguese, the official language of Mozambique, and in English since some executives were from other nationalities.

During the 15 months period both groups were contacted in order to collect financial data and to conduct follow-up surveys on financial practices. We then measured the effects of the treatment by comparing the firm level outcomes of the treatment group with the same outcomes for the control group.

Improving firm performance

Treated firms reported high intentions to change financial policies after the participation in the programme:

- 92% of the firms intended to adjust their working capital management,

- 85% intended to change their risk management,

- 64% intended to change valuation techniques, and,

- 64% intended to change their capital structure.

The survey also reveals that a sizeable fraction of firms are not able to independently adjust their capital structure (25%) or risk management practices (20%) because they are subsidiaries of other firms and these policies are set somewhere else in the business group.

When we compare differences between the means of treatment and control groups, we find a large and significant difference for changes in working capital management and changes in capital structure. We do not find statistically significant differences for changes in risk management or valuation techniques.

Finally, we make use of accounting data to validate the survey evidence and to analyse potential implications for firms’ efficiency. We find significant effects in net working capital levels, changes in net working capital, and average collection period. We also find some evidence that managers change their capital structure after the treatment. Importantly, the effects on overall firm performance are economically relevant: return on assets increases up to 18 percentage points for the treated group compared to the control firms.

Conclusion and policy implications

Our randomised controlled trial shows that the financial education of managers has a large impact on firm performance. We show that this relationship acts through the adoption of financial practices that promote value creation. Such evidence suggests that managerial human capital, namely financial expertise, can contribute to improved financial practices of firms as well as decision-making, ultimately affecting economic development. Our results support the need for educational interventions and financial literacy programmes, as well as incentives to improve financial management practices in corporations.

References

Anderson-Macdonald, S (2014), “The impact of marketing (versus finance) skills on firm performance: Evidence from a randomised controlled trial in South Africa”, Stanford University Working Paper.

Bloom, N, C Genakos, R Sadun, J Van Reenen (2012), “Management practices across firms and countries”, NBER, Working Paper No. 17850.

Drexler, A, G Fischer, A Schoar (2014), “Keeping it simple: Financial literacy and rules of thumb”, American Economic Journal: Applied Economics, 6(2): 1-31.