The promise and pitfall of technology: Evidence from tax collection in Ghana

Information technology (IT) systems are potentially transformative tools to increase local tax capacities. However, they must be carefully designed not only to increase tax collection but to minimise unintended outcomes. From a field experiment in Ghana, we find that technology improves local tax collection by expanding the effective tax base and improving compliance. However, the technology also appears to increase the bargaining power of tax collectors to extract more bribes, particularly from lower-income households.

In recent decades, many developing countries introduced decentralisation as part of broader governance reforms. A critical prerequisite for a well-functioning decentralisation regime is the capacity of the decentralised administrative units to raise sufficient taxes to provide essential public goods and services. However, most local governments in the developing world have weak tax capacity and cannot deliver on their mandates adequately.

Need for an adequate local tax capacity for decentralization in Ghana

In Ghana, for example, local tax proceeds are low, constituting just about 20% of all local government revenues or 1.6% of GDP (Government of Ghana, 2014 1). Added to this, the cost of the collection is relatively high in most local governments.

As a result, local governments in Ghana tend to depend on central government transfers, the District Assemblies Common Fund (DACF). There have always been delays in DACF disbursements. However, the situation is getting worse, with this year's DACF yet to be disbursed. Moreover, it is widely acknowledged that the DACF is inadequate, and local governments cannot continue to depend on it as the primary source of revenue. As Hon Hajia Mahama put it, "the days of overreliance on the disbursement of the District Assemblies Common Fund are gone" (Daily Graphic, 10 October 2020).

Leveraging IT to increase local tax capacities

The deployment of IT systems is widely held as a potentially transformative tool to increase local tax capacity. (Dzansi et al. (2019) outlined the potential channels through which an appropriately designed IT system can increase the tax capacity of local governments. However, there is little rigorous evidence on the returns to such investments and the potential pitfalls.

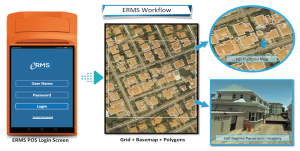

In view of the above, we worked with the La NKwantanang Madina Municipal Assembly (LaNMMA), one of the local governments in Ghana, to evaluate the effectiveness of one such IT system – the Enhanced Revenue Mobilisation System (ERMS). In this experiment, we focused on the bill distribution and tax collection aspects of the ERMS. To this end, we randomly assigned half of the tax collectors to the old manual system. We provided the other tax collectors point-of-sale devices with ERMS functionalities to aid and track their distribution of bills and tax collection (Figure 1).

We tracked productivity and constraints faced by each tax collector, the number of bills distributed, and tax collected per bills distributed. We also conducted audit surveys with property owners, recording if they received any bills, payments made, and amounts paid, if any.

Findings

A key takeaway from this field experiment is that appropriately designed IT systems do increase tax capacity, but they must be carefully designed to minimise potential unintended outcomes. Consistent with the widely held views on the revenue potential of IT systems, we find that the ERMS increases tax collection by 85%. Our analysis suggests that the increased tax collection occurs partly because the ERMS allows tax collectors to navigate the field better and spend 50% less time on bill delivery. As a result, they delivered 25% more bills than their counterparts who relied on the old manual approach.

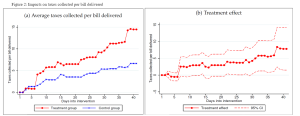

Related to the above, the tax collectors spend the extra time available to learn more about taxpayers' ability and willingness to pay and reorganise their efforts accordingly. For example, we find that the property owners in the treatment group are more likely to be positively selected on higher income, liquidity, and taxpayer awareness index. Consequently, the tax collectors in the treatment group collected 117% more per bill distributed relative to their colleagues in the control group (Figure 2).

IT systems can be double-edged swords

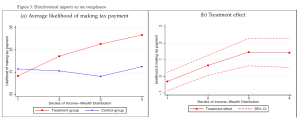

Thus far, the message is: technology improves local tax collection. It does so by expanding the effective tax base and improving tax compliance. Quite interestingly, technology also improves the progressivity of the local tax system. More specifically, we find that the likelihood of making a formal tax payment increases by 12.06 percentage points amongst the wealthier households. We do not detect any discernible impact amongst the poorer households (Figure 3).

Disconcertingly, however, the technology appears to increase the incidence of bribes, particularly among lower-income households. We find suggestive evidence that technology leads to increased bribery, mainly in the bottom quartile of the income-wealth distribution. In expanding the capacity of the tax collectors, the technology inadvertently increases the bargaining power of tax collectors to extract more bribes from poorer households.

Policy implication

IT systems hold a promise to increase the capacity of local governments to identify, assess, and effectively mobilise tax revenues. The evidence from the deployment of the ERMS clearly demonstrates that appropriately designed IT systems can cost effectively increase tax mobilisation. However, it is imperative that particular attention is paid to minimising unintended outcomes such as extortion of bribes at both the design and deployment stages of such IT systems. For example, real-time monitoring of tax collectors should be built into the IT systems. This should be complemented with unannounced spot checks. Moreover, incidences of bribery and other forms of malfeasance should be thoroughly investigated and dealt with in a manner that dissuades both the tax collector and taxpayer from bribing and cheating.

1. Government of Ghana (2014) Internally Generated Revenue Strategy and Guidelines, Issued by Ministry of Finance and Ministry of Local Government and Rural Development, Accra.