The road to monetary union in East Africa

On 30 November, the heads of state of the partner states of the East African Community (Burundi, Kenya, Rwanda, Tanzania and Uganda) met in Kampala to approve the Protocol for the Establishment of an East African Monetary Union. The Protocol – the EAC equivalent of Europe’s Maastricht Treaty – offers a roadmap for monetary union and provides the enabling legislation for the regional institutions, including an East African central bank, which will usher in a single East African currency by 2024.[1]

Compared to the fanfare with which, in 2007, the same heads of state committed themselves to fast-tracking monetary union by 2012,[2] the launch of the Protocol was a modest affair. In part this reflected the reality that the half-decade of debate leading up to the launch of the Protocol has proceeded against the backdrop of the sobering morality play of the Eurozone crisis. This was, in many respects, perfect timing for the EAC negotiators: the travails of Europe have served to focus the mind on a range of critical issues of implementation and operation, on questions of cross-border surveillance, of the design of macroeconomic convergence criteria, the structure and operation of the institutions of a putative union, and so forth. But it also served a more important purpose, namely to emphasise that monetary union has rather little to do with monetary policy per se; it is a fundamentally political step that entails profound issues about the pooling and ceding of fiscal, economic and political sovereignty. Not surprisingly, then, as the idea of East African monetary union has moved from a vague aspiration closer to a firm commitment, so the initial exuberance has given way to (very) cautious pragmatism. The convergence criteria embedded in the Protocol are extremely demanding; the horizon for eventual monetary union is attenuated and highly conditional, while the concept of ‘variable geometry’ – that individual EAC members may not qualify or may choose to opt out of monetary union – is now fully entrenched in the Protocol. The prospect of a single currency zone within the otherwise single market of the EAC is now clearly an option.

A second reason for caution has been the profound changes to the dynamics of the East African Community, changes that were difficult to envisage during the five years of detailed preliminary analysis carried out by the EAC central bank governors (on which IGC-Tanzania has been an important advisor). Most fundamentally, the discovery and development of substantial natural resources across the region – from oil in Uganda and Kenya and the enormous aquifer in Turkana, Northern Kenya, to the offshore natural gas reserves of the Indian Ocean basin off the coast of Tanzania – will decisively reconfigure the equilibrium towards which partner states must eventually converge. The balance of gains and losses within a putative union, for individual partner states and the region as a whole, has shifted radically. And to reinforce this point, even the anticipated membership of the EAC is set to change in a manner not originally anticipated: the original five partner states – the ‘big three’ countries of Kenya, Uganda and Tanzania along with Rwanda and Burundi – are set to be joined by South Sudan and Somalia,[3] while the prospect of the DRC joining is not impossible.[4]

This sobriety was, to an important degree, anticipated in work carried out by the IGC for the EAC central bank governors as they drafted the Protocol (Adam et al. 2012). The IGC work focused on how countries might conduct exchange rate (and hence monetary) arrangements in the transition to monetary.

The central theme of this work – now integrated into the Protocol itself – was how partner states should seek to position themselves on an uncertain and potentially long glide path to eventual monetary union and the introduction of a single currency managed by a single supra-national central bank without jeopardising the significant progress towards macroeconomic stability they have achieved in the last two decades.

The core components of this process include a coherent and credible set of macroeconomic convergence criteria, sustained and structural fiscal discipline, and a set of union-wide institutions capable of coordinating national economic policies during the convergence phase and beyond, of implementing and enforcing robust macroeconomic surveillance and of operating effective financial sector regulation.

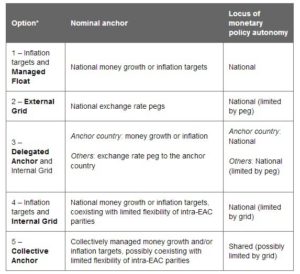

But an equally challenging question is how best nominal exchange rate arrangements should be configured to support this process (see Table 1). Here the lessons from Europe are informative but not necessarily applicable. The core European economies have long revealed a preference for heavily managed exchange rate arrangements, from almost immediately after the collapse of the Bretton Woods system. From early on, national currencies were free to float relative to third-party currencies but only provided that they remained close to each other, and by the early 1990s the core European currencies were more or less in lock-step around the Deutschmark.

Table 1 Options for exchange rate management in the EAC during the convergence phase

Notes: *The bold italics show descriptive short-hands for these options.

Source: Adam et al. (2012).

In sharp contrast to the European countries, the large countries of the EAC have spent more than a decade operating flexible exchange rate regimes, and these have underpinned successful macroeconomic stabilisation. Tight exchange rate commitments would therefore not be appropriate for the EAC for a convergence phase that is likely to be of uncertain duration. Nor is any single member of the EAC naturally poised to play Germany’s role of delegated anchor. For these reasons, systems that feature tight exchange rate commitments, like the external grid operated by the countries of the Gulf Cooperation Council, or that combine such commitments with a delegated anchor, as in the Eurozone, are not appropriate for the EAC. The IGC work favoured, instead, the maintenance of a float system during the convergence phase, in which national authorities continue to operate existing frameworks in which monetary aggregates or inflation targets, rather than exchange rates, serve as the anchors for inflation. The final conversion phase – in the final months before full monetary union – would then feature what might be called a collective anchor system. Partner states would commit to a grid of intra-union exchange-rate parities, supporting these with possibly coordinated intervention where needed, but continuing to anchor the overall system through monetary aggregates and/or inflation targets.

Monetary union in East Africa is far from a done deal, and for many setting the high bar for convergence set out in the Protocol is very welcome, for whilst the costs of delaying a move to monetary union are likely to be mild, the risks associated with precipitate union are numerous and substantial. So while progress towards a new regional currency, with all the implications this brings, may be slow and the ultimate objective many never in fact be achieved, the path on which the Protocol places the region has already generated enormous positive spill-overs in the areas of policy cooperation and coordination between partner states. These are most immediately visible in the areas of monetary and financial sector policies; rapid progress is being made in areas such as the harmonisation of cross-border settlement systems, information exchange, regulatory behaviour, and discussion on reserve pooling and policy coordination. Similarly, as countries engage more deeply with the broader questions of macroeconomic and structural convergence, similar payoffs will emerge in the domain of fiscal, trade and labour market policies. Perhaps most importantly of all, however, the experience of setting down the road to monetary union while the crisis in the Eurozone unfolds not only reinforces the point that successful economic and monetary union requires member states to relinquish sovereignty to a much greater degree than was, perhaps, initially thought, but also provides some lessons to the EAC states on how this deep political bargain can be secured.

Further reading

Adam, C, P Kessy, C Kombe and S O’Connell (2012), “Exchange Rate Arrangements in the Transition to East African Monetary Union”, IGC Working Paper 12/0458.

Notes

[1] The Protocol is available on the East African Community website at http://www.eac.int/.

[2] The heads of state are almost the same group as in 2007, except for President Kibaki of Kenya who has been replaced by President Kenyatta.

[3] Negotiations are well under way with South Sudan while the Heads of State considered Somalia’s application to join the EAC at their Kampala summit.