Transforming Myanmar’s energy sector

Myanmar, like other developing countries, will continue ramping up its energy production to meet growing demands for consumption. This blog argues that fuelling economic growth requires expanded electricity access and reforms to pricing structure and policies for Myanmar.

Economic growth requires energy. Energy fuels industry and manufacturing, improves livelihoods, and connects markets. Consuming more energy is part of transforming into a modern economy: over time, economies which grow continue to do so while using more energy.

This is highly relevant for the cluster of low-energy, low-income countries found around the world. Most of these countries are in Africa; a few are in Asia. Myanmar is one.

Electrifying Myanmar: Grid & off-grid needs

Myanmar is in energy poverty. Per capita levels are one-fourth of India’s, one-tenth of Vietnam’s, or nearly one-hundredth of America’s. Structural transformation will need energy to power activity, be it in manufacturing, industry, or services. For users, electricity not only frees up time, but also enhances human capital and leisure.

Electrifying Myanmar rests on a substantial policy effort. While energy is fundamental, guaranteeing access to modern forms is not easy. A planned large-scale grid expansion is the most cost effective approach, but has its own shortcomings. Connecting to the grid is expensive and must be done in one upfront payment. The country is rural and lacks density, making an off-grid component essential.

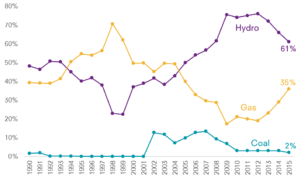

Where should a country source its electricity from? Experiences from other countries in the region can guide the way forward. Myanmar, like other Mekong subregion countries, benefits from an abundance of hydropower. A valuable source of cheap electricity, but one laced with a seasonality problem: generated electricity falls during the dry season, resulting in rolling blackouts. Weening dependence off hydro marks a fundamental challenge for Myanmar in the absence of other arrangements like border trading.

Regional lessons

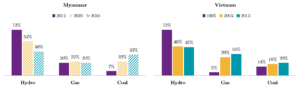

Vietnam’s story is informative. Remarkably, Myanmar in 2012 aligned with 1995 Vietnam on several key statistics: income per capita, electricity consumption per capita, and share of hydropower in electricity generation. Given similar starting points, the figure below maps the potential trajectory for Myanmar’s energy product mix going forward, with a comparison to Vietnam’s approach.

Figure 1: Energy mix a comparison of Vietnam’s experience with Myanmar’s potential

Vietnam quickly dropped its dependence on hydropower through a large increase in gas. If Myanmar continues as projected, it will do so through greater use of coal (although recent discussions indicate significant changes to this plan; this is just one scenario). Three-quarters of Myanmar’s domestic natural gas is sent for export and new gas fields are not expected to produce for several years, curtailing the available supply for generating electricity. The government is exploring options to get around this crunch; LNG-swap contracts or direct LNG imports are receiving the most traction. Vietnam, without abundant natural gas reserves, resorted to importing natural gas for thermal power.[1]

Figure 2: Myanmar’s electricity generation by source

Pricing reforms: Financing electricity

From the big picture question on what makes an ideal electricity mix we can switch to another fundamental question: how should electricity be priced? Tariff pricing is a ripe yet contentious area for reform. Price rises, ubiquitous in their unpopularity, bring people to the streets.

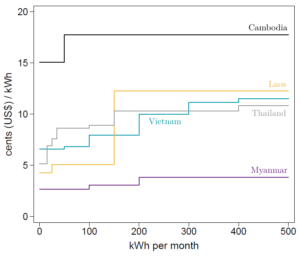

Figure 3: Regional price check

Myanmar has some of the cheapest electricity in the world[2]. Each unit of electricity is sold below cost. And this isn’t a shallow subsidy; the gap between actual revenue and cost recovery is upwards of 40%. Starving the state-dominated sector of money has stunted infrastructure and made electricity unreliable.

Vietnam, Laos, and Thailand offer aspirational reform models. Thailand price discriminates based on time of day, helping manage peak demand; Vietnam has a steady rise in price as consumers become richer. Extra kinks for Myanmar’s largest residential consumers is necessary.

Averting public backlash to tariff reform requires constant and clear communication. Myanmar raised rates in 2014, adding an extra jump for users above 200kWh a month. The public was notified only days before, and the untrue narrative of electricity becoming more expensive for the poor ran rampant. Explaining who will be affected and how those who can afford it should pay closer to the actual costs of electricity should comprise the main dialogue.

Prices should embody the social costs of consumption: pollution and greenhouse gas emissions.

Like deciding on an ideal electricity mix, the motivations behind tariff reform aren’t only financial. Prices should embody the social costs of consumption: pollution and greenhouse gas emissions. Countries on the cusp of a rapid scale up in energy use can consider taking a different, greener, path than their developed counterparts. They still face tight budgets and squeezed capacities, but clean forms of energy are now a genuine alternative. A decade of relentless improvement has brought down the costs of renewables to near-parity with traditional sources. Myanmar has tremendous solar potential in its central dry zone, with wind also looking attractive in parts of Rakhine and Ayeyarwady.

Conclusion

In sum, countries are presented with a menu of issues to address. A starter might include revisiting how electricity is priced. A meatier main course would address bigger challenges of increasing access to modern forms of energy and meeting expected future demand. The dessert, with its sought-after sweetness, is how to do all of this in a green way.

[1] Going forwards, the projected electricity mix for Vietnam actually sees significant increases in coal.

[2] For residential rates. Industrial rates are on the higher-end of the distribution for neighbouring countries.