Why reliability matters in expanding access to electricity in Sub-Saharan Africa

It is almost a cliché to state that electricity supply is a critical infrastructure. Without it, the quest for sustained and inclusive growth is sure to falter. Yet, across sub-Saharan Africa (SSA), access to this critical piece of infrastructure is limited. Currently, two in five Sub-Saharan Africans lack access to electricity (IEA, 2018)

While policymakers across the region recognise the private sector as the engine of growth and job creation, the very ingredient to power this growth and job creation engine is inadequate. In fact, inadequate electricity infrastructure ranks among the top two impediments to firm growth in SSA (World Bank, 2017). Access to finance remains the largest obstacle in this regard.

The electricity sector is neither financially viable nor reliable

The electric utility sector in much of SSA is neither financially viable nor reliable. According to Trimble, Kojima, Arroyo, and Mohammadzadeh (2016), 37 of the 39 electricity sectors in SSA are not financially viable. Further, tariff revenues are not enough to cover operating expenses in 20 of the 39 electricity sectors. In this context, utilities find it difficult to maintain a reliable supply of electricity, sometimes resorting to rolling blackouts.

When a utility resorts to rolling blackouts, customer tariff payments fall – either because they are unable or unwilling to pay. For example, frequent blackouts can reduce customer goodwill towards the utility and erode the social norm of paying tariffs. Alternatively, rolling blackouts can reduce customers’ income so that they are less able to pay their tariffs. Worse still, it can serve as a convenient pretence to default on tariff payment. There is thus a risk of a negative feedback loop between unreliable electricity supply and non-payment of tariffs. If such a vicious cycle exists, utilities can be caught in a “revenue trap” and thereby find it difficult to provide reliable power in the long-run.

Towards financially viable and reliable electricity in Ghana

We use evidence from Ghana to demonstrate how building a resilient and financially viable electric infrastructure goes beyond extending access. It is critical to balance access expansion with reliability concerns. Extending access without the corresponding investments to ensure reliability can undermine the financial viability and the long-term sustainability of the electricity sector.

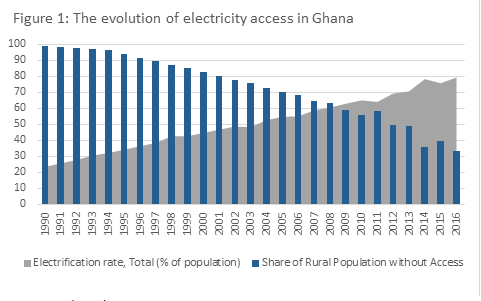

Starting in the mid-1980s, successive governments of Ghana championed extending electricity access to the majority of Ghanaians. As is evident from Figure 1 below, Ghana has been relatively successful: The share of the rural population without access fell to less than one in three as of 2016. However, amid the rapid electrification, Ghana experienced a series of power crises. The latest started in late 2012, compelling the Electricity Company of Ghana (ECG) to institute load shedding in 2014. It was not until late 2016 that this “dumsor” was declared over.

Source: IEA (2018)

Source: IEA (2018)

Methodology: Estimating the impact of unreliable electricity

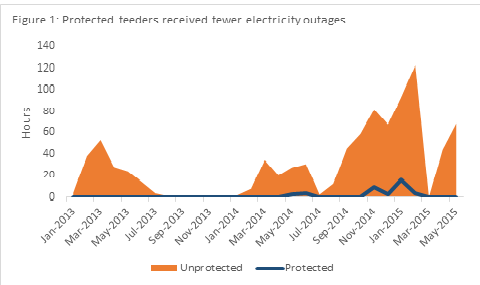

We examine the link between financial viability and reliable electricity supply. An important institutional feature in Ghana is that ECG “protects” the distribution electricity feeders that serve critical infrastructure, such as major hospitals and military installations, from rolling blackouts. If a household happens to be served by the same feeder, it will receive fewer blackouts than a household served by an “unprotected” feeder.

We use the presence of “protected” and “unprotected” feeders to estimate the causal impact of reliability on household tariff payment. We study a set of households that are in similar neighbourhoods but experience different outage rates.

Findings: Unreliable electricity supply is a threat to financial viability

We find that during the latest power crisis in Ghana, customers who happened to be served by protected feeders experienced relatively more stable power supply than the customers served by unprotected feeders (Figure 1). During the peak of the power crisis, beginning April 2014, the typical household in our data that was served by unprotected feeders experienced dozens of hours of load shedding per month. The experience of an average household on a protected feeder is markedly different. As shown in Figure 1, households located on protected feeders enjoy a relatively more stable supply of electricity.

Most importantly, after controlling for other potential factors that could possibly influence payment of tariffs, we find that customers on protected feeders, who experienced a relatively more reliable electricity supply, accumulated much less unpaid tariff balances. Households on unprotected feeders paid 4.3% less of the new tariffs over a 15 month period. This translates into a 16.5% increase in unpaid balances for customers served by unprotected feeders as compared to those served by protected feeders.

Implications: Access, reliability, tariffs and financial viability

The evidence implies that even if the prevailing electricity tariffs fully reflect the costs of generating and delivering electricity to homes and industry, an unreliable electricity supply can undermine the financial viability of the electricity sector. While we welcome the current drive to expand electricity access across SSA, this drive needs to be balanced with corresponding investments to ensure the reliability of the grid to promote the payment of tariffs.