Will West Africa’s common external tariff protect consumers?

The lofty objective of ECOWAS is to promote economic integration in West Africa. The much anticipated uniform tariff for ECOWAS economies is due to become reality in January 2015, but questions about its implementation still need to be addressed

The lofty objective of ECOWAS is to promote economic integration in West Africa. The much anticipated uniform tariff for ECOWAS economies is due to become reality in January 2015, but questions about its implementation still need to be addressed

In line with a global movement toward customs unions, the Economic Community of West African States (ECOWAS) is introducing a common external tariff (CET). The same customs duties will apply to all goods entering ECOWAS members, regardless of which country within the area they are entering. ECOWAS is due to implement this CET in early January 2015. While West Africa’s immediate priority remains the elimination of Ebola, the probable welfare effects of the CET warrant substantial attention if poverty alleviation remains a common ECOWAS goal.

The CET’s adoption requires careful preparation and communication by enforcing ministries. Changing tariffs will affect the prices of goods, many of which comprise core purchases of poor households. Ebola's effects on consumer welfare, such as negative income effects from declining economic activity, heighten the required sensitivity. In addition, the CET’s adoption will prompt a reaction from firms and producers, as external competition from imports will change.

Part of ECOWAS’ new tariff regime includes “special protection measures”. Governments will have to explain and justify this policy’s design, as well as why some goods are or are not exempt from changes. Finally, in the interest of economic development, future CET negotiations should address appropriate tariff measures for the smaller ECOWAS economies.

Since its establishment in 1975, ECOWAS has formulated ambitious regional integration targets. Treaty revisions in 1993 stipulated a common market, including a CET, but progress has lagged. Only in 2006 did members agree on the four levels of tariffs to be adopted. After several delays, integration’s momentum accelerated when the European Union required ECOWAS representation as a single customs union in the much anticipated EU Economic Partnership Agreement (EPA).

Nigeria’s actions have determined much of this trajectory. In 2004 Nigeria proposed a fifth band at 50% on specific goods for regional development, and a fifth band at 35% was approved in 2013. Furthermore, the CET includes an “exceptions list” of about 300 products eligible for exemption from the new tariffs. The former Nigerian Import Ban list includes over 200 products on this list. The agreed date for implementing the CET is now January 2015.

Revenue and welfare effects for Liberia

In a very heterogeneous group like ECOWAS—economically dominated by a hegemon pushing for high protections such as those above—the smaller countries will be most severely affected as regional integration deepens. This includes Liberia, one of the small ECOWAS Members. Liberia will have to substantially increase its tariff across-the-board to implement the CET: 45% of goods imported into Liberia have current tariff rates below those specified in the CET for each good; only 25% have rates above it. Many of these products dominate poor households’ consumption, implying a large impact on welfare due to higher prices.

IGC research estimates that applying the five band CET and eliminating any product exemptions from tariffs will almost double Liberia’s average tariff level if no products are exempt from tariffs. It also finds that price changes from adjusted tariffs will make rural and urban households’ current costs of living 6% and 3% more expensive, respectively. The difference between household costs reflects the greater share of non-tradable expenses (like services) in urban household consumption. In Liberia this is not a trivial difference.

Special Protection Measures

To mitigate the adjustment effects, in October 2013 a list of “Special Protection Measures” were introduced. One Special Protection Measure is the Import Adjustment Tax (IAT), which allows members to apply an extra tax on imports from non-ECOWAS members beyond the CET’s 0%-35% range. Members can apply an IAT of up to 20 percentage points on a maximum of 3% of imported goods (as defined by the World Trade Organization product classifications) for 5 years. This 3% comprises approximately 177 goods out of a total 5899 defined in the CET.

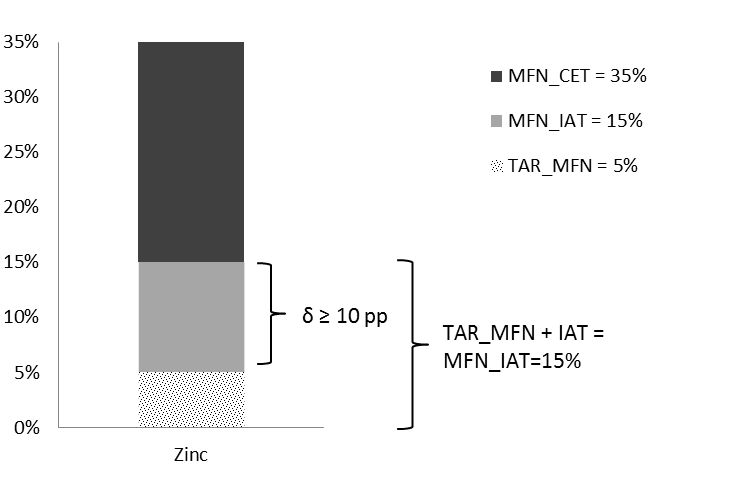

The rationale of this measure is to protect important or nascent sectors. However, a major disadvantage for smaller members is that the IAT can only be used when the tariff is above the common external tariff; countries that currently apply tariffs below those in the CET cannot use an IAT. Figure 1 illustrates the alternative — an IAT application for an upward adjustment, in the case of zinc imports (an intermediate good not produced in Liberia) — into Liberia from non-ECOWAS members.

For zinc, Liberia currently applies a 5% tariff rate, while zinc’s CET rate is 35%. Thus, compliance with the CET would require increasing Liberia’s current rate by at least 10 percentage points. By doing so, Liberia would stay within 20 percentage point range of the CET. That is the minimal adjustment possible. As the regulation stands, this minimal adjustment is not an option; Liberia would have to apply a new tariff of 35%, which raises prices much more than that of 15% (5% plus an IAT of 10 percentage points).

Figure 1: Import Adjustment Tax applied to zinc imports

Figure 1: An Import Adjustment Tax application for an upward adjustment, in the case of zinc imports to Liberia from non-ECOWAS members

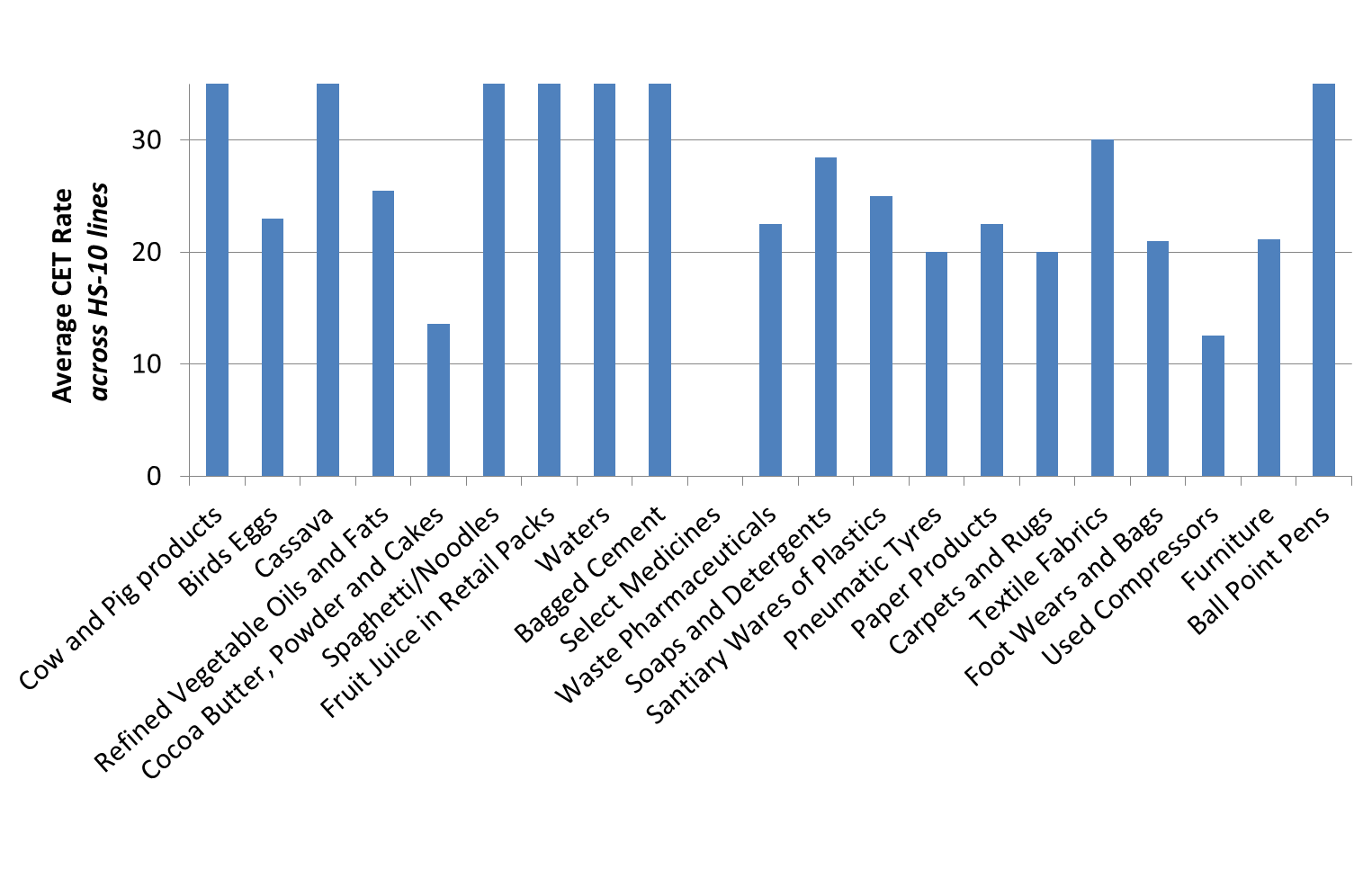

The exceptions list stipulated in the Special Protection Measures Regulation offers no useful solution to upward adjustment. For current tariffs below the CET, members can apply the IAT to items on the abovementioned exceptions list, apparently largely handpicked by Nigerian producers’ associations. Figure 2 shows the CET for products that are on both the CET exceptions list and the former Nigerian Import Ban List.

Figure 2: Common external tariff rates on a sample of imports on the Nigerian Import Ban List

NOTE: Not included here: Bird and Poultry Products, Glass Bottles, Used Motor Vehicles, Telephone Voucher Cards, and Toothpicks, as they are not on the CET exceptions list.

Asymmetric benefits

The products on the exceptions list already have high CET tariffs. When combined with the CET’s fifth band of 35%, this structure adversely affects the smaller ECOWAS economies that export less complex products but import manufactured goods, mostly from non-ECOWAS members. Manufactured goods will have much higher tariffs (10-35%) under the CET than raw materials (5%), giving plenty of leeway for trade diversion as manufactured goods previously imported from non-ECOWAS partners will now be sourced from customs union partners. Prices of imported food like rice, which weighs heavily on the consumption basket of the poor, will also rise.

Meanwhile, current regulation fails to discuss how current tariff exemptions, or waivers, will be treated. One immediate priority should be to correct this ambiguity, especially for products comprising a high share of household consumption, such as rice. Whether or not waivers are permissible certainly affects any assessment of the CET’s effects on prices. As a second priority, members should push to re-enter negotiations to amend ECOWAS regulations to permit the application of the IAT to Most favoured nation (MFN) duties below the CET, as explored above.

Towards a better common trade policy regime

With the January date approaching, transparent communication of the CET will be immediately essential. So will clarifications of the technicalities of applying the Special Protection Measures. Next, the low-income countries would benefit from pushing for a renegotiation of the CET. As the smaller low-income members have similar production and tariff structures, they would also benefit from closer cooperation and developing a common stance. Doing so is essential for these smaller countries to achieve the potential gains from ECOWAS trade integration.