Winners or losers? The COVID-19 impact on Zambian manufacturing firms

The demand- and supply-side shocks on Zambian manufacturing firms caused by the COVID-19 pandemic have had mixed effects on firms’ sales and exports. In a recent survey of firms’ experiences, government response measures have reportedly been unaligned to these needs and thus underutilised as a set of support services. As a part of an ongoing IGC project on the manufacturing industry post-COVID-19, this article provides fiscal-sensitive recommendations for how the industry can bounce back and boost the country’s overall economic growth and recovery.

While manufacturing firms in Zambia have not been spared by the devastating effects of the pandemic, neither have they lost out completely. Other industries such as tourism, hospitality, wholesale and retail trade, and restaurants and bars have borne the brunt of the impact of the COVID-19 pandemic, owing to their greater exposure to human interface. That interface caused a disproportionate disruptive effect on their activities from pandemic containment measures – a side effect spared to manufacturing. Broadly speaking, while most manufacturers were hit by impact from demand- and supply-side shocks induced by containment measures, some gained from increased demand and production of essential commodities such as personal protective equipment (masks, gloves, and gowns) bolstered by the pandemic.

Based on a survey of a unique purposive sample of manufacturing firms registered with the Zambia Association of Manufacturers (ZAM), we assessed firms’ perceived economic impacts of COVID-19 on key performance variables, focussing particularly on the differentiated effects on exporters and small firms. Our findings also explore manufacturing firms’ perceived effectiveness of government policy responses aimed at mitigating the impact of the pandemic on businesses. Given the critical role that manufacturing can play in advancing Zambia’s socioeconomic development, this article considers policy adjustments, within fiscal limits, that can help the industry quickly rebound post-COVID-19 and realise its potential of delivering inclusive and sustained economic growth.

Varied impacts on manufacturing firms

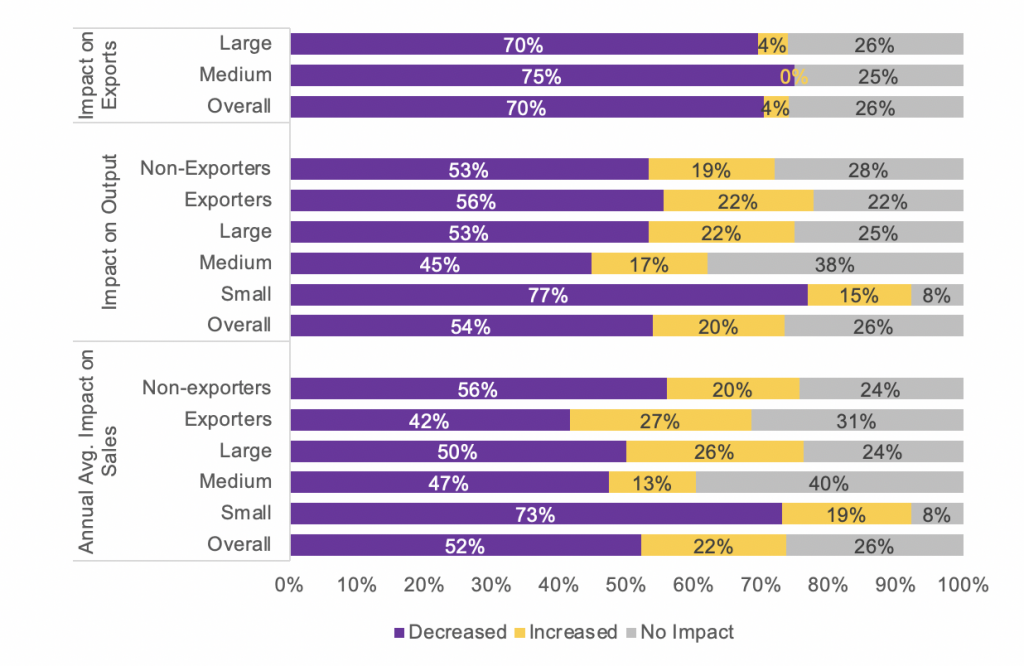

The pandemic has generated both winners and losers, but by and large, firms within and across manufacturing sub-sectors are mostly losers. Most manufacturing firms – 52% on average – experienced decreases in sales of 34% on average, while 22% of firms experienced an expansion in sales of 64% on average. Likewise, in nearly each sub-sector, the majority of firms saw a decrease in sales. Conversely, the majority of firms in textiles, clothing, and leather products (50%) indicated increases in sales, thus seemingly gaining from the pandemic. In the same vein, the impact on industrial production has not been uniform. Manufacturing output contracted for most firms (54%) by 39% on average during the year, and expanded for a select few (20%) by 38% on average.

Supply chain disruptions remain the major source of the negative impacts on firms. On exports, the impact has largely been negative. For 70% of exporters, exports contracted by 35% on average in 2020. Only 4% of exporters experienced an expansion in sales, averaging 43%. The impact on employment has been more attenuated with the majority of firms reporting no changes in employment.

A higher percentage of small-sized firms were negatively affected by the pandemic in terms of sales (73%), output (77%), and supply chain disruptions (77%), compared to medium and large firms. However, when it comes to employment, small firms shed off less workers (three on average) compared to medium- and large-sized firms who shed off four workers on average in 2020. Further, small firms recorded lower average growth in sales (91%) and lower average declines in output (42%) and sales (38%) compared to medium-sized firms. The differential effects on exporters’ sales and output were more tempered, except for the impact on employment where exporters laid off more part-time workers relative to non-exporters.

Figure 1: COVID-19 impact on sales, output, and exports in 2020, relative to 2019 Source: Impact of COVID-19 on manufacturing firms survey data, Jan-Feb 2021

Source: Impact of COVID-19 on manufacturing firms survey data, Jan-Feb 2021

Limited effectiveness of government policy responses

Generally, the study finds low awareness of government policy measures intended to attenuate the impact of the pandemic on firms. The majority of manufacturing firms surveyed (56%) were unaware of any COVID-19-related government policy responses. Uptake has also been low; amongst the 45 firms that were aware of the policy responses, a considerable majority (48%) were discouraged from applying because they did not think they would be successful. Some firms did not find the measures appropriate (12%), while others simply did not need them (15%). Moreover, out of the 12 firms that applied, only one-quarter were successful, and amongst these, only one-third found the interventions effective.

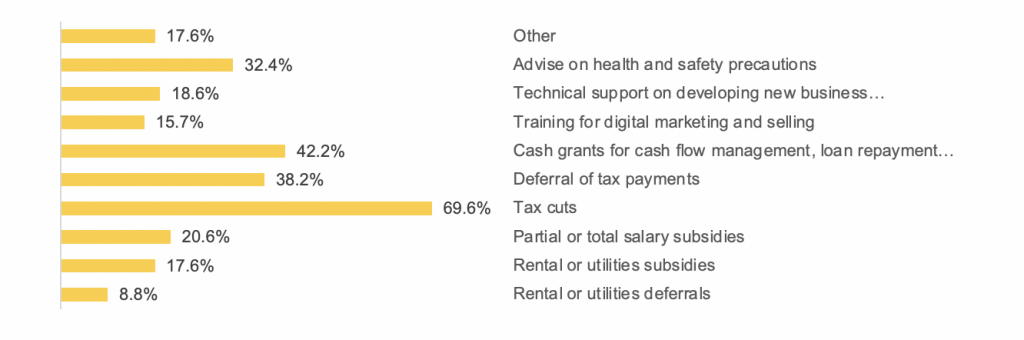

Part of the problem is the mismatch between government policy responses and firms’ needs. Figure 2 sheds light on the type of support firms deem more suitable. In order of respondents’ preferences, 70% indicated tax cuts, 42% cash grants for cash flow management and loan repayments, 38% deferral of tax payments, 32% advice on health and safety precautions, and 21% partial or total salary subsidies.

Figure 2: Additional support required to mitigate the impact of the pandemic Source: Impact of COVID-19 on manufacturing firms survey data, Jan-Feb 2021

Source: Impact of COVID-19 on manufacturing firms survey data, Jan-Feb 2021

Adjusting policy measures: Caught between a rock and a hard place

While the roll out of vaccines, relaxation of containment measures, and opening up of many countries gives hope of a rebound in consumer demand, risks still remain for a return to well-functioning supply chains and an overall rebound in manufacturing growth. The continued mutation of the virus coupled with the lagged distribution of COVID-19 vaccines in developing countries suggests we are not yet out of the woods. The road to economic recovery will be tremulous. Thus, there is need for continued policy support. In fact, the IMF (2020) cautions against prematurely withdrawing policy support as this risks setting back recovery. Moreover, measures need to be well-designed and targeted at the most vulnerable firms if they are to be effective. This entails providing policy support with the most potential to mitigate the impact on firms, safe guard jobs, and ensure the quick recovery of the manufacturing industry post COVID-19.

Notwithstanding, the government may not be able to meet all firms’ fiscal needs owing to fiscal constraints that have been exacerbated by the pandemic. This places limits on the type, extent, and duration of government policy support. Measures have to strike a fine balance between ensuring fiscal stability and cushioning the impact of the pandemic on firms. Bounded by these constraints, we propose the following policy adjustments:

- Increasing awareness of the existing stimulus packages: The government, in collaboration with the ZAM, should sensitise its members of the available stimulus packages and their objectives so as to increase the uptake.

- Building sustainable domestic supply chains: To address the impact of regional and global supply chain disruptions on manufacturing activities, the government must support reshoring of supply chains with suitable local substitutes. To ensure effective implementation, impediments to firm competitiveness such as inadequate productive capacities and limited access to affordable finance must be addressed by enhancing schemes targeted at financing manufacturing activities as well as providing technical and business support services.

- Engaging neighbouring countries to facilitate exports of manufactured goods: Whereas the restrictions on cross-border movements have somewhat been eased, to manage the risk of future lockdowns, the government must engage its neighbouring countries for bilateral agreements to allow for the seamless movement of Zambian exports in the same way imports were allowed to transit through neighbouring countries during previous lockdowns.

Editor’s note: This article is based on this IGC project.