Africa Industrialization Week 2020: Industrial development, trade, and COVID-19

Following Africa Industrialization Week 2020, we take stock of trends in African industrialisation, as well as look at the ways that COVID-19 has disrupted industries, trade, and supply chains.

Each year since 1990, African leaders, key stakeholders, and pan-African organisations meet on the 20th of November to celebrate Africa Industrialization Day (AID), which kicks off a full week of organised events to discuss ways to stimulate industrial transformation in Africa. But why is AID important? According to the African Union (AU), AID “represents a unique platform to enhance international cooperation and dialogue on the pan-African industrialisation agenda, and to raise awareness of the opportunities and challenges associated with this innovation to drive” (Africa Industrialization Week, AU, 2019).

How has industrialisation progressed in Africa?

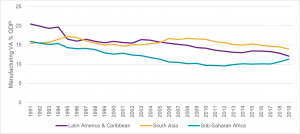

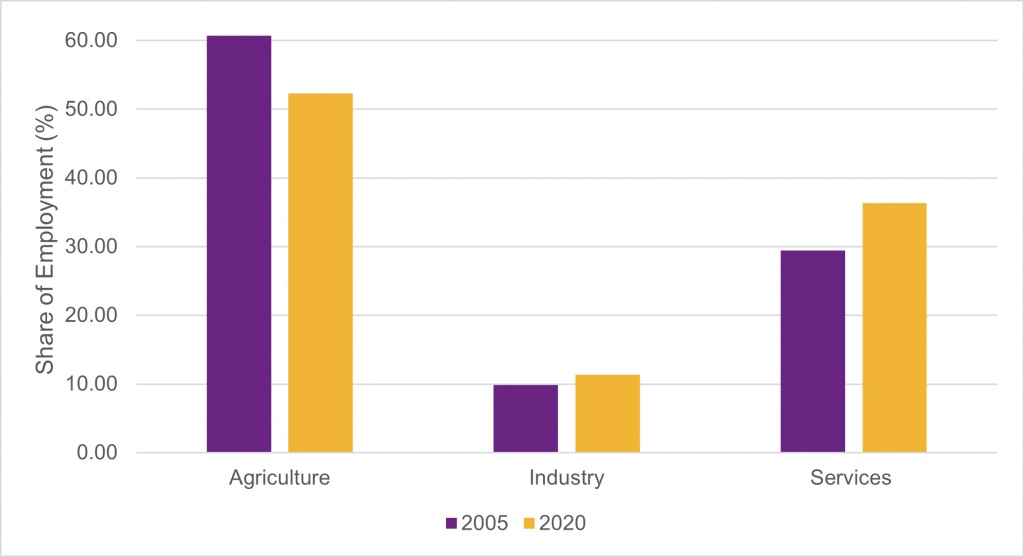

Industrialisation is defined as the process of an economy shifting its resources and workers from primarily subsistence agriculture into sectors that exhibit higher levels of productivity and technological progress. This results in mass production of goods and services, the creation of productive jobs, and improvements in living standards. This process is known as structural change, and historically, it has been driven by industry. The manufacturing sector was instrumental to Europe’s economic transformation, and more recently has been the engine of the Asian growth miracle. In sub-Saharan Africa, value-added manufacturing as a share of GDP has declined over time since the 1990s, even with economic growth rates exceeding 5% in many African countries pre-COVID-19 (see Figure 1.a). The aggregate share of people employed in industry is also historically diminutive, with around 10% of the total workforce of sub-Saharan Africa employed in industry in 2005, compared to 60% employed in agriculture (see Figure 1.b).

Between 2005 and 2020, the share of agricultural workers dropped by 52%. Many of these workers were absorbed into service industries, mainly characterised by informality and low productivity (increasing the share of workers in industries to 37% in 2020). Dani Rodrick (2015) has defined the phenomenon “premature deindustrialisation”; i.e. a continuous fall of manufacturing shares of employment and value addition. Evidence of premature deindustrialisation trends have been observed in Africa and Latin America, although significant variation across countries and sectors do exist. At much lower levels of income, Africa may be facing fewer opportunities to industrialise through manufacturing compared to earlier industrialisers. This is attributed to the evolution of automation technologies and the expansion of capital-intensive manufacturing firms. Limited industry in the continent can also be explained by firm uncompetitiveness, inadequate infrastructure, and the dominance of small firms.

Figure 1: Manufacturing, value added (% of GDP) and SSA sector employment shares (Source: World Bank Databank, 2020)

A.

B.

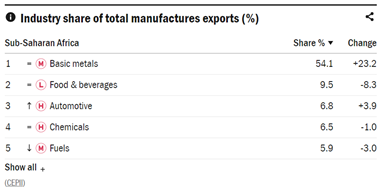

Manufacturing share of exports, on the other hand, has expanded over time from 35.5% in 2008 to 48.9% in 2018, with exports having become increasingly integrated into global value chains (GVCs) (IAP UNIDO, 2020). However, relative to other regional share of manufacturing exports (e.g. Europe at 89% and the Americas at 77.7%), Africa’s manufacturing contributes significantly less. The linkage rates of manufacturing in recent years have become more heavily skewed towards resource-rich countries. Africa’s participation in international trade is also largely defined by exporting raw materials and low-value manufacturing; for example, basic metals account for 54.1% of total manufacturing exports (Figure 2).

Figure 2: Industry share of total manufactures exports (%), IAP UNIDO, 2020

Regional markets are likely to become more crucial in the pursuit of export-oriented industrialisation, particularly in the post-COVID-19 era. Evidence shows that increasing African intra-trade through Regional Value Chains (RVCs) provides African manufacturing firms economies of scale and linkages to value chains connected to the global market. The initiation of the African Continental Free Trade Area (AfCFTA) can offer an even greater opportunity for countries to widen their access to global supply chains and export higher value goods and services. However, integration is currently underdeveloped, with the share of intra-African exports only accounting for 17% of total African exports, compared to 59% in Asia. With that being said, there are some positive trends taking place in some regional economic blocs. In the East Africa Community (EAC) for example, Uganda’s share of exports to EAC grew from a tenth in 2005 to a third of all exports by 2017 (IGC, 2020).

How has COVID-19 affected industries, trade, and supply chains?

Africa is experiencing an unprecedented economic crisis due to the COVID-19 pandemic. Whilst most countries on the continent are not reintroducing the strict lockdown measures that were in place during the spring, economic activity still remains severely curtailed by a reliance on the global economy and external demand. Service industries, including tourism and hospitality, as well as natural resource extraction, are the most affected, though manufacturing also remains particularly exposed via global trade linkages. Development outcomes are being threatened and policy responses are constrained by limited resources, jeopardising any long-term recovery.

International trade has fallen, with the WTO predicting a 9.2% decline in 2020. The implementation of the AfCFTA, originally planned for July 2020, has been delayed until 2021. By aiming to create a single, competitive, and richer African market, the agreement could foster regional integration and intra-African trade that could help spur industrialisation. The pandemic has, instead, placed a spotlight on the cross-border challenges the agreement hoped to resolve. Tight border restrictions and COVID-19 testing requirements have prevented informal trade (Bouet & Laborde 2020) and further delayed the transportation of goods across countries.

Africa is a net importer of many products, including essential goods such as pharmaceuticals and food. This made their reliance on global supply chains particularly salient during the peak of the COVID-19 crisis. For these essential goods, many national governments decided to liberalise import restrictions whilst introducing export controls. In Uganda, Rauschendorfer and Spray (2020) found that imports of intermediate and capital goods were severely affected by the pandemic, largely as a result of the closure of Chinese factories. Subsequently, this work highlighted the impact that continued import restrictions could have not only on the firms that rely on these inputs for production, but also the hundreds of domestic firms intricately tied through complex networks of supply and distribution.

Many firms in developing countries have experienced prolonged closures, a reduction in sales, as well as the need to restructure employment (World Bank, 2020). African manufacturers could face a decline in output of around 10% in 2020, threatening their survival and leading to long-lasting consequences in the sector (McKinsey, 2020). In Ethiopia, industrial park firms, largely focused on producing light garments, were severely affected by the pandemic. Around 10% of those surveyed had to close, and over three quarters experienced a decline in sales and production (Krishnan et. al, 2020). The firms oriented towards the domestic market appeared more widely affected than those oriented towards exports. In all cases, difficulties in the availability and price of foreign inputs, followed by the availability of labour, were listed as the biggest difficulties, with widespread pessimism about the outlook.

Foreign investment into Africa is likely to decline substantially in 2020. UNCTAD have reported a 21% decline in inflows during the first half of the year, with resource-intensive economies suffering a larger drop (UNCTAD, 2020). However, FDI inflows into Africa were already declining in 2019, suggesting deeper issues than the impact of the pandemic. Africa’s role in GVCs is largely as a provider of inputs to internationalised industries, which are suffering from a lack of global demand. The level of greenfield investment into manufacturing activities in Africa, particularly in those sectors which are GVC-intensive, is expected to fall significantly (UNCTAD, 2020).

National governments in Africa have introduced policies to assist businesses during the pandemic, including finance, liquidity, and tax support. In Ethiopia, support accessed by industrial park firms seems asymmetrical between those exporting and those not, perhaps due to issues of awareness and design. Such support will be crucial for the survivability of the sector, and in Ethiopia’s case, critical to ensure continued progress as part of its industrialisation agenda.

Read our other blog for Africa Industrialization Week 2020, which highlights conversations we had with three experts, here.