Cashless economics: The new wave of mobile money

2017 marks the 10 year anniversary of M-PESA, the digital wallet that transformed financial inclusion and banking starting first in Kenya spreading through much of East Africa. In March of this year, the IGC held a ‘Sub-Regional Workshop on Mobile Money in West Africa’ to explore the challenges and opportunities facing West Africa, as they seek to replicate Kenya’s success with mobile money.

This past March, the IGC and the Bank of Sierra Leone co-hosted the Sub-regional workshop on Mobile Money in West Africa, the first major regional policy event to be held in Sierra Leone since it was declared free of Ebola in January 2016.

The workshop was attended by a cross-section of government and private stakeholders, ranging from mobile network operators, commercial and central banks, telecoms, and regulators. Representatives came from the Gambia, Ghana, Guinea, Liberia, Mozambique, Nigeria, Uganda, and of course, Sierra Leone.

Building on a series of high-level research and policy presentations, attendees were split into working groups, structured to enable cross-country and cross-sectoral learnings. Attendees worked together brainstorming solutions to the challenges of scaling networks, developing partnerships, regulating emerging products, and establishing capital requirements.

[caption id="attachment_16217" align="aligncenter" width="640"] M-PESA stand[/caption]

M-PESA stand[/caption]

Image credit: Fiona Bradley

The focus of the workshop was sharing lessons and challenges that different countries faced, were facing, or would face in the future, depending on the sector's level of development. Given the success of mobile money adoption in East Africa, there are many important lessons that Sierra Leone and its neighbours can learn from as they seek to follow in East Africa's footsteps.

Mobile penetration: A first-mile problem

The population of Sierra Leone is just over 6 million. At present there are 13 commercial banks operating in Sierra Leone, and together, they host approximately 600,000 bank accounts. According to the World Bank’s Global Financial Inclusion Database, 14.1% of Sierra Leoneans (age 15+) have an account at a financial institution – meaning more than 85% lack a formal bank account. Comparable data from regional neighbours the Gambia, Ghana, Guinea, Liberia, and Nigeria varies slightly, but almost without exception, formal financial inclusion remains under 50% for the region.

Mobile financial services are increasingly being seen as the solution to this problem of financial inclusion, based on the success of mobile money in banking the unbanked in other parts of Sub-Saharan Africa. Mobile money in East Africa for example has been shown to allow households to better mitigate economic shocks, invest, and save. Though the sector in West Africa is not developed to this level, provision of credit through mobile money is becoming a reality in other parts of the continent, and West African policymakers can see potential future benefits of investing in and properly regulating the sector now. However, mobile phone penetration in Sierra Leone and other parts of West Africa can be even lower. While financial access data is regularly measured and available, mobile phone ownership data are difficult to find, and accuracy is often highly questionable. Most data look at the ratio of SIM cards to adults in the country, which may fail to accurately capture individuals who may own several SIMs. Digging deeper, estimated internet and data usage figures for West Africa, which may be a better estimate for actual penetration, range from 2.1% in Sierra Leone to 18.9% in Ghana.

Low levels of internet and mobile penetration represent a ‘first mile’ problem facing large swathes of households in rural West Africa. For researchers, limited access to good quality data further complicates the process of identifying evidenced-based policy solutions to facilitate faster scale-ups, particularly in remote, and rural regions.

M-PESA: A masterclass in scaling

In Kenya, the speed of M-PESA’s adoption was driven by a variety of factors. One particularly important factor stemmed from M-PESA being launched through Safaricom, Kenya’s largest Mobile Network Operator (MNO). This produced strong network effects, or a kind of bandwagon-effect. Households wanting to reap the benefits of mobile money will select providers with the largest existing networks. Thus, network effects, in this instance have been important in accelerating the momentum of M-PESA’s adoption, which now approaches critical mass with over 90% of Kenyans having access to a mobile wallet. Without network effects generated by one large market leading MNO, regulators face additional hurdles from interoperability, or the difficulty of regulating mobile transactions over multiple platforms. Having one dominant MNO worked well in the case of Kenya, as Safaricom was committed to ensuring its agents were well-trained and highly disciplined. This helped to ensure that service quality remained high. In other markets, having multiple MNOs that compete on price and customer service quality may prove more optimal, despite trade offs on speed of adoption that resulted from network effects.

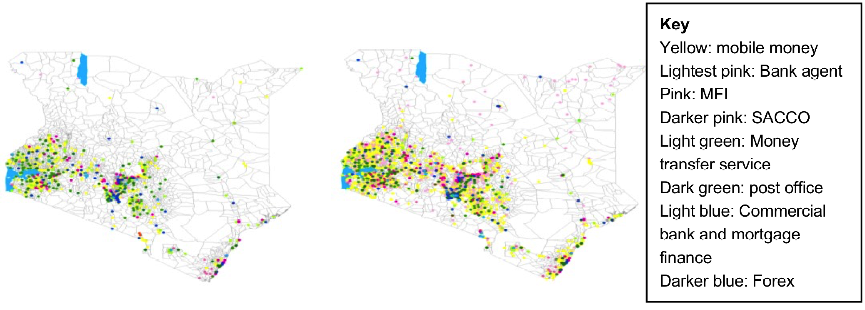

A second, but equally integral component of M-PESA’s success was the decision by Safaricom to diverge from traditional retailing banking models of market entry. Instead of locating agent outlets in high-density areas alone, Safaricom took a blanketing approach, roll out began across a wide cross-section of Kenya, and density was built up over time along with growth in the customer base, as illustrated in Figure 1 below.

Figure 1: Financial service points, 2007 - 2011 - Map of Kenya, showing spread of M-PESA over time

Source: Based on research by William Jack and Tavneet Suri

The strategy clearly worked and it's plausible that a similar model could work in West Africa, too. There are also broader lessons here for updating the model of traditional financial institutions to reach previously unbanked populations. Mobile wallets could reduce fixed costs needed to expand access through traditional brick-and-mortar banks

Old dog: New tricks

Since its launch in 2007, the initial M-PESA product, a mobile bank account, has diversified with newer financial products and services. The most well-known is M-Shwari, a savings and credit product provided to existing M-PESA customers. The newest product, M-Akiba, who's launch was delayed a second time this April is expected to be the first of its kind - a government treasury savings bond - exclusively traded on mobile platforms.

Mobile money has substantially lowered transaction costs for financial transfers. This has resulted in mobile money being used not only for informal transfers, loans and remittances, but also for formal transfers, including salary payments.

In Sierra Leone, during the Ebola outbreak, hazard payments made to emergency response workers were paid through mobile money. There are a natural host of challenges attendant with recruiting, training, and coordinating any kind of emergency response, but given the high fatality risk to carers that is caused by Ebola, incentivising response workers was a particularly acute challenge. The Sierra Leonean National Ebola Response centre, in partnership with Airtel, Africell, and Splash Money worked with UNDP to set up a harmonised mobile payment platform to speed up the delivery of hazard pay to workers.

Similar innovations in other contexts reflect the adaptability of mobile money as a tool for development. In Ghana for example, funerals can be financially crippling expenditures for households. Ghanaian funerals are lavish family affairs often featuring highly bespoke (read: expensive) caskets for the deceased.

Ghanaian Fisherman's coffin

Image credit; Photo RNW.org

Average funeral costs are estimated between $15,000 and $20,000. The growth of mobile money coupled with demand for cheaper insurance plans has led to a unique collaboration between MTN and Hollard Insurance to offer low-cost mobile insurance plans, called mi-life.

Next steps: Proliferation requires coordination across diverse stakeholders

Taking into account the challenges of growing the mobile money sector in West Africa now and those faced by East and Southern African countries in previous years, conference attendees of the sub-regional workshop broke into country-specific groups to discuss next steps and action points. While countries varied in their balance between wanting to regulate the sector and wanting to maintain openness to stimulate financial inclusion, common challenges were identified and addressed, including efforts to foster the growth of agent networks, liquidity constraints, interoperability, and coordination between players in the sector.

Each group left with a concrete road map outlining key challenges and next steps tailored to their home country and were able to see emerging challenges as opportunities through the experience of other countries. Roadmaps presented preferred policy strategies on taxation, customer protection, regulatory frameworks, agents, and cross-border issues, and actions to be taken to implement these strategies. Countries proposed MOUs to improve coordination, the creation of relevant working groups, and re-assessment of policies and regulations limiting the desired growth of the sector, for example. In assessing the varying experiences of and advances made by Kenya, Uganda, and Mozambique, there was general agreement that the mobile money sector in West Africa must mature before considering options such as credit, agent exclusivity, and MNO interoperability, and as such roadmaps recognised short, medium, and longer term actions and reviews of policies.

As the volume and velocity of mobile transactions accelerates, cross-border regulation over transactions and particularly remittances represents a critical area for future research. Other areas for work include improving access to capital for new agents, incorporating mobile money into the payment of government worker salaries, and expanding financial literacy programmes to support customer protection efforts as access to mobile money products accelerate.

Countries pledged to continue sub-regional and regional communication in order to prepare the ground for cross-border transactions and to continue learning from common challenges and opportunities as mobile money grows across the sub-region. The proven ability of mobile financial services to improve much-needed financial inclusion and the possibilities of easily facilitating financial transactions means that the expansion of the sector in West Africa could be a critical game-changer to watch new and over the coming years.