The Chinese are here: An analysis of import penetration and firm performance in Sub-Saharan Africa

In the early 1990s, most of the imports into Sub-Saharan Africa (SSA) originated mainly from Western economies such as the US, UK, France, and Germany. 25 years later, the share of imports from the UK had decreased to 2.3% in 2015 from 13.9% in 1990, while that of the US to 4.6% in 2015 from 13% in 1992. On the other hand, China’s share of total imports in SSA rose to 16.5% from just 1.1% over the same period[1] (WITS 2017). The region has also witnessed drastic changes in patterns of trade, with most countries moving away from importing products such as footwear and light manufactured goods to more sophisticated and higher-technology goods.

There have been increasing concerns about the emergence of China in these markets, especially regarding the potential threats for domestic firms and the local labour force. Nonetheless, the presence of China in SSA can also be viewed as an opportunity for domestic firms. In general, trade can facilitate knowledge exchange and technology advancement through investment and exposure to new goods. However, the access for domestic firms in SSA to productivity-enhancing inputs and to foreign markets is still heavily limited by poor internal and external trade infrastructure.

Access to ports is essential

Improved transport infrastructure decreases the costs of interregional and international trade, thereby encouraging competition and facilitating firms’ participation in international trade. SSA countries have high transportation costs due to poor infrastructure networks and access to ports is particularly relevant for most of them since they represent the primary trading connection with the rest of the world. Better access to ports could improve firms’ participation in international trade activities, not only by increasing the probability of exporting but also by facilitating the penetration of imported inputs of production in cities located in the hinterland, thus fostering the economic development of remote areas. In this study, we examine firstly how Chinese import penetration affects performance of SSA manufacturing firms. We also provide evidence of how port accessibility moderates the relationship between firm performance and import penetration.

Firms, trade, and infrastructure in SSA

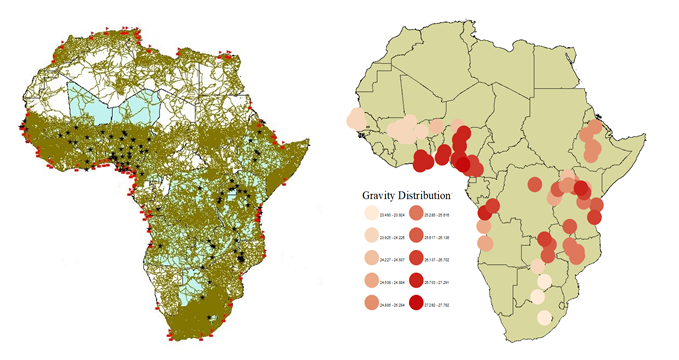

We use a rich panel dataset on firms for 19 SSA countries between 2004 and 2016, building city-industry level measures of import competition and inputs from China. As shown in Figure 1, to determine the overall proximity and accessibility of cities to trade infrastructure, we use GIS network analysis and road network data to measure the driving distance between firms and several ports. We then estimate the overall ports accessibility index (PAI) for all cities based on their distance to ports, their economic size, and other bilateral factors that facilitate or impede trade and transportation between cities and ports such as national borders, shared language, legal systems, past colonial relationships and participation in common trade agreements and currency unions.

Figure 1: Road connections between cities and ports, and distribution of ports accessibility index

We aim to infer the causality of Chinese imports on SSA firms’ performance by looking at the interaction between the exogenous depth of waters in ports in SSA and the technological shock in the development of container ships size since the mid-1990s.

Findings: Increase in productivity and skills of domestic workers

Our findings show compelling evidence of the positive effects of Chinese imports on productivity. Increased Chinese penetration enables surviving firms to increase their share of skilled workers by almost 4%, thereby allowing firms to shift production from low-skill to high-skill-intense products. The effect is not homogenous across SSA firms. Firms located further away from ports benefit more from Chinese imports, highlighting the importance of transport infrastructure in SSA countries. These findings suggest that Chinese imports have triggered a pro-competitive effect for firms with lower access to ports and have resulted in a catch-up in performance for less productive and less trade-exposed surviving firms.

Better infrastructure that decreases the cost of intra-national transports to ports increases competition by providing better access to foreign intermediaries, with consequent benefits for firms located in remote areas. These findings highlight the importance of transport infrastructure in SSA countries and suggests that gains from Chinese import competition could be uniformly distributed across remote regions that are usually not exposed to international markets.

A blessing or a curse?

Our findings show that Chinese imports in SSA can be viewed as an opportunity for increasing firm performance as they serve as a stimulus for skills upgrading and employment. The policy implications of our findings stress that concerns about labour displacement and possible firm closures should not completely inhibit governments from encouraging domestics firms to embrace foreign competition and imports of inputs from China, given the positive effect on productivity and skills of workers. It is therefore important for SSA economies to invest in improving road networks and trade infrastructure in order to encourage firms to engage more effectively in international trade and to foster economic development in remote areas

Reference to the paper:

Darko C, G Occhiali and E Vanino (2018), “The Chinese are here: Firm level analysis of import competition and performance in Sub-Saharan Africa”, FEEM Working Paper No. 14.2018. https://ssrn.com/abstract=3180528

Data extrapolated from the World Bank World Integrated Trade Solution (WITS) dataset on exports, import and tariffs (https://wits.worldbank.org)