Commodity price shocks in times of crisis: Securing growth in sub-Saharan African economies

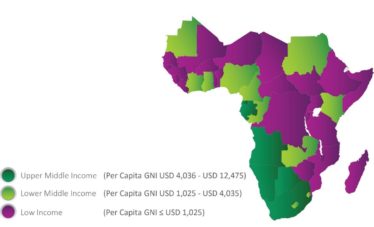

Sub-Saharan Africa faces the lowest growth forecast registered by the region since 1994. The recent commodity price plunge has investors worrying over prospects of the region’s major economies. Depressed export earnings constrain an already limited capacity to buffer shocks. The region needs to deepen its credit markets, particularly in its low-income countries, to improve governments' resource mobilisation capacities.

Source: StratLink Africa Ltd, World Bank

Forecasting crisis

It is said that by the time everyone is shouting “Crisis!”, the crisis has likely already occurred. Conventional opinion is, by its very nature, behind the curve. In the context of commodity pricing, delayed forecasting can lead to economic shocks. Could sub-Saharan Africa be blind to an impending crisis?

The mood at the launch of the IMF sub-Saharan Africa Regional Economic Outlook in October 2016 was far less optimistic than other launches in the recent past. The Fund slashed its growth forecast for the region to 1.4%, from a forecast of 3.0% in May 2016. This is set to be the lowest growth forecast registered by the region since 1994. This reflects the extent of the wreckage inflicted by the plunge in commodity prices in Africa, and the toll it is taking on the region’s growth engines. This is compounded by uncertainty over how long commodity prices will remain low, as well as the extent to which they are likely to deteriorate Africa’s long-term growth prospects.

Image credit: Cristiano Zingale (kouam)

Uncertainty over the region’s major economies is the dominant concern for most investors. The doom loop, fostered by a rigid foreign exchange rate policy, has done little to inspire hope. Nigeria has failed to haul itself out of recession. Angola has incurred the double whammy of low oil prices and soaring inflation. In South Africa, growth seems to have seized, demonstrated by the Reserve Bank revising 2016’s growth forecast upward to 0.4%[1], in September 2016.

Risk, shock, and crisis

There is one major, yet less cited, risk facing the region that most low-income economies confront when executing counter cyclical fiscal policy. The risk occurs when depressed export earnings constrain already limited capacity for fiscal response to buffer the shocks incurred by the existing compromised macro-economic environment, resulting in economic crisis.

The risk occurs when depressed export earnings constrain already limited capacity for fiscal response to buffer the shocks incurred by the existing compromised macro-economic environment, resulting in economic crisis

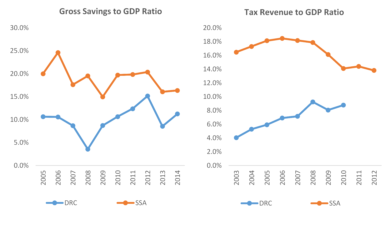

This explains why in May 2016, the government of the Democratic Republic of Congo, proposed a 22% slash on the 2016 budget[2]. Structural weaknesses, such as a shallow reserve of savings, modest revenue mobilization capacity and an already widening budget deficit, undermined DRC’s capacity for fiscal manoeuvring in combating a crisis on the scale experienced over the last two years.

This scenario is not unique to the country ─ in May 2016, Liberia slashed its 2016 budget by 11% on the back of below target domestic revenue[3], whilst in October 2016, Sierra Leone made public plans for austerity measures expected to rake in up to $69 million in savings[4].

Source: World Bank Development Indicators

Commodity price shock: undermining growth

Low income countries have been on the forefront of sub-Saharan Africa’s economic emergence over the past decade. Between 2005 and 2015, they accounted for 53.6% of the region’s growth in Foreign Direct Investment. In the same period, they accounted for 21% of sub-Saharan Africa’s GDP growth. This has the risk of being heavily undermined by an insufficient mitigation strategy for a commodity price shock.

Even if macroeconomic conditions were to improve, the region’s recovery may be slower than expected, compromised by a crisis hangover in economies that fail to weather the downturn. What’s more, these low-income economies exhibit relatively higher vulnerability to economic shocks than their lower-middle and upper-middle-income peers in the region due to already existing economic challenges. For instance, 64.6% of the urban population in low-income economies live in slums, against an average 55.3% in the sub-Saharan Africa region.

Poor growth in consumer demand combined with the risk of social tensions being triggered by the demographic burden of a large unemployed youth population, indicates a daunting road ahead for sub-Saharan African economies.

The economic downturn also threatens to further deteriorate already underutilized human capital, potentially resulting in rising unemployment and income depression. Poor growth in consumer demand, combined with the risk of social tensions being triggered by the demographic burden of a large unemployed youth population, indicates a daunting road ahead for sub-Saharan African economies.

Remedying the original sin

The challenge of the ‘Original Sin’, as postulated by Barry Eichengreen, Ricardo Hausmann, and Ugo Panizza, ─ the inability to borrow from abroad in domestic currency as well as facing obstacles to securing long-term debt domestically ─ remains a key impediment for most low-income economies in mitigating macro-economic shocks that depress revenue mobilization. There is a need to step up efforts to deepen credit markets in these countries to facilitate the capacity for governments to mobilize resources domestically.

There is a need to step up efforts to deepen credit markets in these countries to facilitate the capacity for governments to mobilize resources domestically.

The crucial role of credit and credit ratings

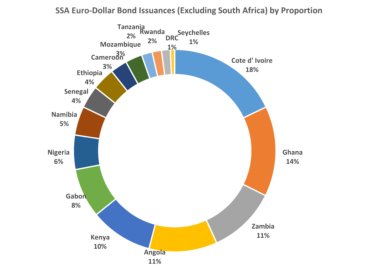

Sub-Saharan Africa experienced a past decade of fairly robust Euro-Dollar bond (U.S.-dollar denominated credit issued by an overseas company and held in a foreign institution outside both the U.S. and the issuer's home nation) issuance. However, this was predominantly in favour of lower-middle and upper-middle-income economies, with low-income economies accounting for a modest 12% of the volume of issuance.

Source: Bloomberg

Mitigating shock in times of crisis

There are two important considerations for low-income economies going forward. First, the issuance of Euro-dollar bonds to low-income economies, such as Ethiopia and Rwanda, has provided a significant psychological boost to peer economies to tap into international markets. It also importantly establishes mechanisms to catalyze the growth of domestic bond markets.

Securing credit ratings has been a significant factor in helping demystify the region’s low-income economies’ macroeconomic environment to investors. Many investors are beginning to appreciate the favourable macroeconomic trends in sub-Saharan Africa, such as the general decline in inflation over the past four decades.

Second, it will be important for economies to explore new approaches in widening the net of domestic credit markets to mobilize resources to cushion economies against the volatile macro-economic environment.

For instance, the Kenyan government is exploring cell phone enabled bond issuance. It would allow citizens to invest as little as $30 and potentially widen the country’s reach in mobilizing revenue. It promises to be an interesting experiment in crowd funding and may present a viable approach for other economies in the region.

Generating growth in crisis

Sub-Saharan Africa is grappling with a plunge in commodity prices at a time when macro-economic events of the recent past have defied economic orthodoxy. Five years since the end of the Great Recession, an upturn in advanced economies remains elusive. Growth has been sluggish at best globally. Alvin Hansen’s hypothesis on secular stagnation, a scenario characterized by “sick recoveries” of economies emerging from a slump, seems to be gaining ground. Sub-Saharan Africa is not immune to this abysmal post-crisis recovery. Therefore, it is crucial that the region begins to rigorously interrogate the adequacy of its policy response in light of its depressed commodity prices.

[1] https://www.resbank.co.za/Lists/News%20and%20Publications/Attachments/7489/MPC%20Statement%20September%202016.pdf

[2] http://af.reuters.com/article/drcNews/idAFL5N1832J7

[3] http://www.reuters.com/article/liberia-budget-idUSL8N1594S4

[4] http://www.vanguardngr.com/2016/10/sierra-leone-slashes-spending-huge-austerity-drive/