Debt relief for pain relief: Public finances and COVID-19 in low-income countries

As public health systems and economies grind to a halt, it is becoming increasingly clear that the impact of COVID-19 will reverberate throughout the global economy for years to come. Prior to this emergency, multilateral organisations were already warning that debt sustainability in low-income countries was deteriorating. Now, the World Bank and IMF have called on bilateral creditors to support debt relief. This is urgently needed as low-income countries are at an immediate risk of a debt crisis whilst simultaneously facing an urgent need to support public health needs and their economy. The COVID-19 pandemic is a global challenge which requires international cooperation and coordination.

Rising vulnerabilities

Recent analysis by the World Bank and IMF found that in 2019, 43 low-income countries were either experiencing, or at a high risk of experiencing, debt-related distress - a little over double the number in 2013. Debt distress is when a country has experienced difficulties in servicing its debt or is extremely close to doing so. Practically, this means a government that has missed a repayment or is in the process of debt restructuring. Those at high risk are generally countries where the external debt burden is large enough to cause concern, but who have so far avoided any formal distress. That can mean falling into crisis if there are large capital outflows, currency devaluations or a fall in export earnings, all of which look likely for low-income countries in 2020.

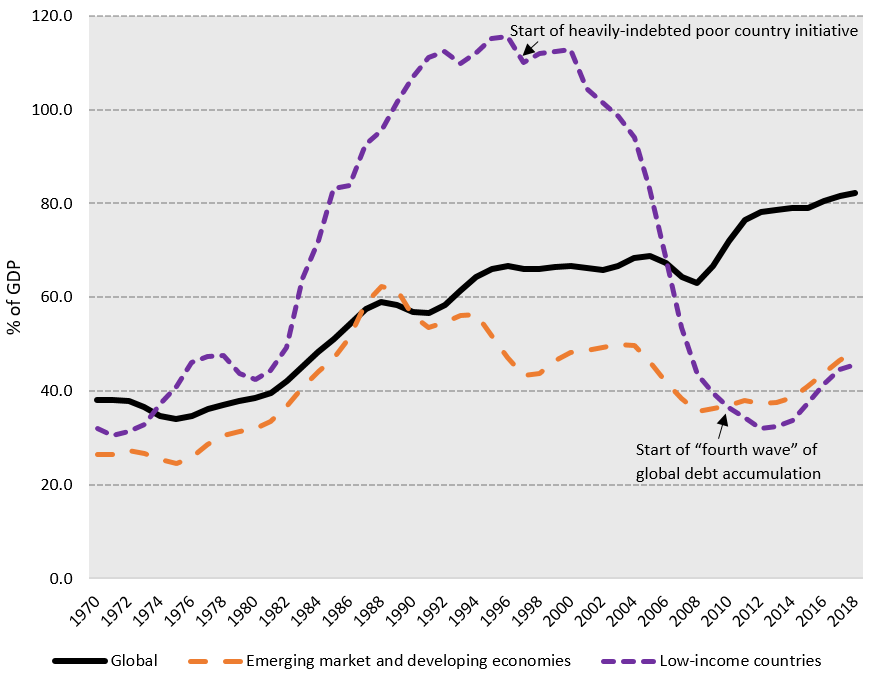

Government debt has been increasing worldwide since 2010

Data source: World Bank (2020)

Data source: World Bank (2020)

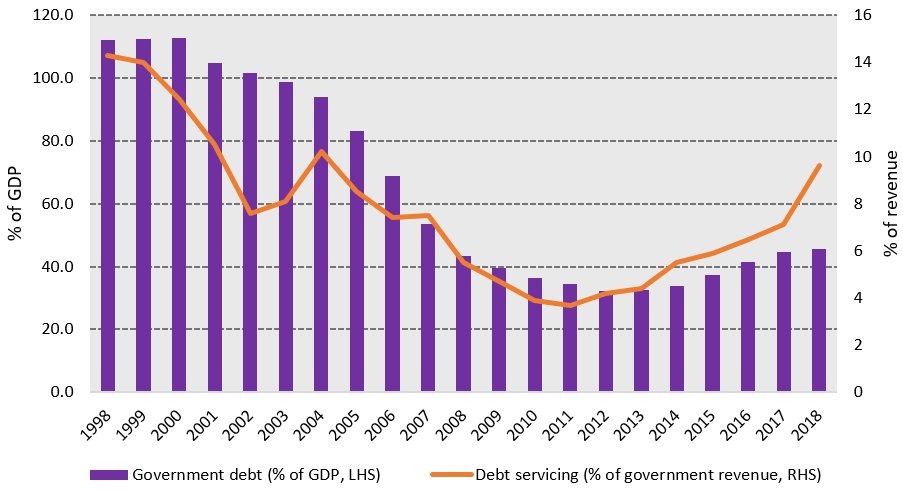

The World Bank have dubbed this latest period of global debt accumulation as the “fourth wave” -marked by a uniform increase in government debt over the past decade (World Bank, 2020). It is characterised by a higher share of government revenue being directed towards repayments, particularly for low-income countries, who have seen external debt servicing costs rise from 3.9% of government revenue in 2010 to 9.6% in 2018 (chart below). As this share of revenue increases, governments are forced to either cut expenditure, for example in health or public investment, or borrow more in order to maintain the same level of public services.

External debt servicing costs are increasing in low-income countries

Data source: Jubilee Debt Campaign (2019), World Bank (2020)

Data source: Jubilee Debt Campaign (2019), World Bank (2020)

One explanation for more expensive debt is the source of credit. There has been a shift away from concessional borrowing from multilateral and Paris Club creditors, i.e. European countries, Japan, USA. Instead, more lending has come via non-concessional sources such as China, non-Paris Club members, external commercial lenders, and domestic markets (ODI, 2019). As this is non-concessional, it comes with higher interest rates which increases debt servicing costs. Low-income countries now owe a higher proportion of their debt to external sources, making them more vulnerable to external shocks such as currency depreciation and capital outflows, as well as worsening economic distress in times of financial crises (World Bank, 2020).

Economic contagion

To overcome the challenges posed by the COVID-19 pandemic, high-income countries have scaled up health services and provided extensive targeted economic and social support. If low-income countries are to follow this approach, they will need to mobilise substantial resources in order to increase spending and address the health, economic and social challenges it poses. For the many low-income countries already burdened with high levels of debt, financing such a response will be difficult without global assistance. This is becoming increasingly remote as high-income nations turn inwards, become less generous and exaggerate the economic and health risks being faced by low-income countries.

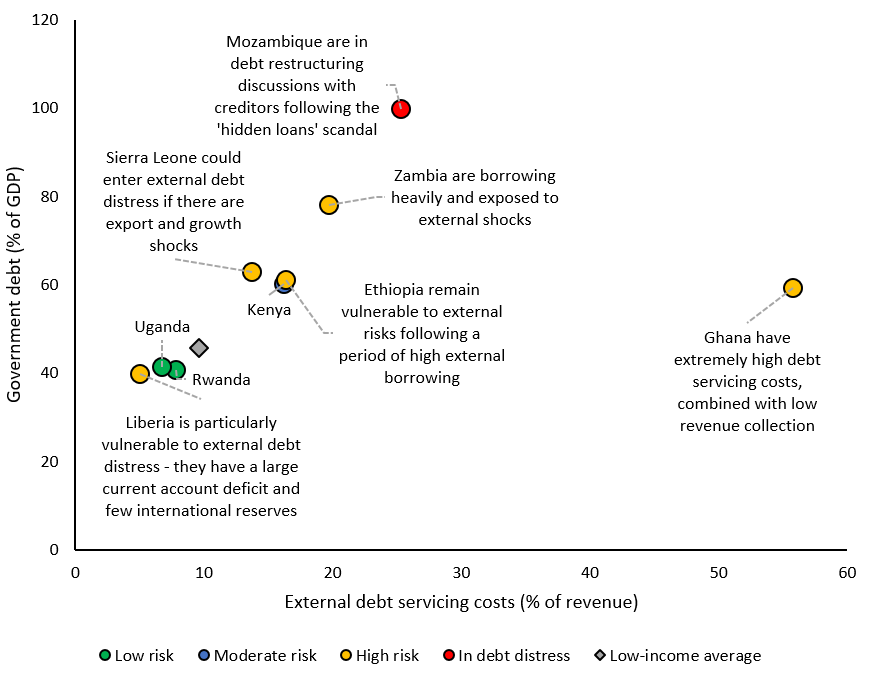

This risk has been illustrated in the chart below for IGC-countries based in sub-Saharan Africa (SSA). Of these, most of them are facing a high risk of debt distress because of vulnerability to changes in the external environment. Those further along the X-axis are already seeing a large share of their revenue being eaten up by their external debt burden. Countries higher on the Y-axis have a limited capacity to borrow further. As the impact of COVID-19 continues to hit the global economy, most of these countries will shift up and along the graph.

Risk of debt distress (as measured by IMF-WB) and the burden of debt is high in many SSA countries

Data source: Jubilee Debt Campaign (2019), World Bank (2019), IMF (2020)

Data source: Jubilee Debt Campaign (2019), World Bank (2019), IMF (2020)

As the recent estimates suggest that economic growth in Africa is likely to fall from 3.2% to 1.8% in 2020 as a result of the pandemic, government revenue is also likely to decline, making the risk of debt distress even greater in the coming year (UNECA, 2020). For oil and commodity exporters, the revenue and output loss are expected to be more severe. There have been large falls in oil and copper prices (FT, 2020a, 2020b). Countries such as Zambia, Sierra Leone, Ghana, and Mozambique, heavily reliant on such commodities for export earnings, are at the forefront of this. Liberia, whilst not as dependent, is particularly vulnerable as they already suffer from a large current account deficit and low international reserves. Ethiopia, Kenya, Rwanda, and Uganda generally earn less from hard commodities and are more reliant on soft agricultural commodities. How these markets develop is less clear but there has already been a reduction in coffee prices, a popular commodity in East Africa (FT, 2020).

At the same time, global finance is drying up. There has been a dramatic outflow of capital from developing economies which is making finance more expensive. It has caused volatility in exchange rates and an appreciation of the US dollar, making it more expensive for countries to service their foreign currency debt obligations. With shrinking international reserves, and less capacity to build them up due to falling export earnings, developing countries will struggle to insulate themselves from these shocks (World Bank, 2020).

Navigating the pandemic

International support therefore needs to be proactive and bold. The number one priority is providing frontline health services. Secondly, reducing the length and severity of any economic fallout will need to be sustainable, requiring that financial stability and liquidity is maintained. This means providing low-income countries with the financing they need. Government deficits will rise as expenditure and revenue move in opposite directions, but this should not force low-income countries into prolonged indebtedness, or worse, financial crises. Whilst the underlying causes of debt vulnerability and high debt levels still need to be addressed, now would not be the right time to impose strict fiscal discipline or conditionalities.

The IMF and World Bank have called on bilateral creditors to suspend debt payments for low-income countries, something which must be actioned as soon as possible. This is critical to providing immediate relief, ensuring stability in financial markets and making sure no low-income country is burdened by excessive debt overhang or future repayments. This can be complemented by a scale-up of the Catastrophe Containment and Relief Trust (CCRT) which provided IMF debt relief during the Ebola crisis. Emergency loan financing can help but must ultimately be repaid. The G20, having pledged $5 trillion towards the global economy, must make specific commitments to how this will support low-income countries. One estimate suggests that $100 billion (5.6% of SSA GDP) of financing is urgently needed to address the crisis in sub-Saharan Africa. International actors must act, or risk economic and human catastrophe.

Disclaimer: The views expressed in this post are those of the authors based on their experience and on prior research and do not necessarily reflect the views of the IGC.

References

Financial Times (2020a). Copper hits four-year low as investors dash for cash. Accessible: https://www.ft.com/content/c0df1c48-69e6-11ea-a3c9-1fe6fedcca75

Financial Times (2020b). Oil prices hit lowest level in 17 years as demand plunges. Accessible: https://www.ft.com/content/d63d0618-6928-11ea-800d-da70cff6e4d3

Financial Times (2020c). Why coffee has been caught up in the coronavirus sell-off. Accessible: https://www.ft.com/content/fb7dce2a-4741-11ea-aee2-9ddbdc86190d

Financial Times (2020d). Official warn Africa is at ‘break the glass’ moment. Accessible: https://www.ft.com/content/07716a2b-2ba5-44aa-80ff-13d5eafb4bad

IMF (2019a). Macroeconomic Developments and Prospects in Low-Income Developing Countries 2019. Accessible: https://www.imf.org/en/Publications/Policy-Papers/Issues/2019/12/11/Macroeconomic-Developments-and-Prospects-in-Low-Income-Developing-Countries-2019-48872

IMF (2019b). Catastrophe Containment and Relief Trust. Accessible: https://www.imf.org/en/About/Factsheets/Sheets/2016/08/01/16/49/Catastrophe-Containment-and-Relief-Trust

IMF (2020a). Global Debt Database. Accessible: https://www.imf.org/external/datamapper/GG_DEBT_GDP@GDD

IMF (2020b). How the IMF can help countries address the economic impact of coronavirus. Accessible: https://www.imf.org/en/About/Factsheets/Sheets/2020/02/28/how-the-imf-can-help-countries-address-the-economic-impact-of-coronavirus

Jubilee Debt Campaign (2019). Crisis deepens as global South debt payments increase by 85%. Accessible: https://jubileedebt.org.uk/press-release/crisis-deepens-as-global-south-debt-payments-increase-by-85

Overseas Development Institute (2019). Low-income country debt: three key trends. Accessible: https://www.odi.org/blogs/10801-low-income-country-debt-three-key-trends

Reuters (2020). G20 leaders to inject $5 trillion into global economy in fight against coronavirus. Accessible: https://www.reuters.com/article/us-health-coronavirus-g20-saudi/g20-leaders-to-inject-5-trillion-into-global-economy-to-fight-coronavirus-idUSKBN21D0XL

Support Economic Transformation – Overseas Development Institute (2020). A $100 billion stimulus to address the fall out from the coronavirus in Africa. Accessible: https://set.odi.org/wp-content/uploads/2020/03/A-100-billion-stimulus-to-address-the-fall-out-from-the-coronavirus-in-Africa.pdf

UNECA (2020). Economic impact of the COVID-19 on Africa. Accessible: https://www.uneca.org/sites/default/files/uploaded-documents/stories/eca_analysis_-_covid-19_macroeconomiceffects.pdf

World Bank (2019). Debt sustainability. Accessible: https://www.worldbank.org/en/topic/debt-sustainability#2

World Bank (2020). Global Waves of Debt: Causes and Consequences. Accessible: https://www.worldbank.org/en/research/publication/waves-of-debt