Projecting the impact of COVID-19 on exports in Ethiopia

Agriculture exports will likely be the hardest hit, impacting poor rural livelihoods most. Domestic demand needs to be stimulated and protected.

Ethiopia is the second most populous country in Africa, home to more than 110 million people and one of the fastest growing economies. Growth averaged more than 10% annually over the past decade and a half, leading to substantial poverty reduction. Agriculture production and productivity increased rapidly, leading to swift growth in exports. However, this trend began to show signs of slowing down, prompting the government to change gears in its growth drivers. Since 2018, the country entered a reform period to realign incentives and encourage supply and private sector-driven growth.

It is amidst this transition that the COVID-19 pandemic hit. Ethiopia has been fortunate to have relatively low infection, morbidity, and mortality rates. As of 19 June 2020, three months since the first case was confirmed on 13 March, there have been 4,070 confirmed cases and 72 deaths. So far, the toll of the virus on the health sector has not been heavy.

One proposed explanation for the relatively low morbidity and mortality rates is the high proportion of youth in the population. Close to 70% of the Ethiopian population is under the age of 30. However, it is important to note that these circumstances can quickly change: The health situation can deteriorate to overwhelm the weak health infrastructure.

Meanwhile, the economy is facing pass-through effects from the global economy and slowdown effects from the containment measures to date. In this blog, we look a bit deeper at the impacts of the pass-through effects, particularly the trends in exports.

Ethiopia’s key exports

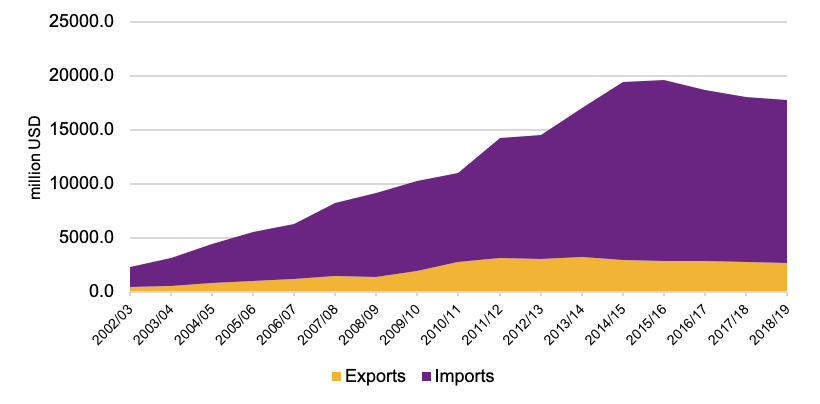

In the past two decades, exports covered an average of 22% of imports annually. This has declined in the last three years with a slight decline in the value of exports. Ethiopian exports are highly concentrated on a few - mainly agricultural – products: In 2018/19, six commodities (coffee, oil seeds, chat, pulses, flowers, and textiles) accounted for 80%of export earnings. The traditional major export - coffee - accounts for close to 30% of export earnings.

Figure 1: Ethiopia’s Export and Import Demand 2002/03 – 2018/19

Source: National Bank of Ethiopia

Source: National Bank of Ethiopia

Supply response rather than demand has constrained the export sector. With increases in production and productivity, exports have been growing significantly in the past decade and a half, averaging 13% until they started declining around 2015.

Given the domination of agriculture in export earnings, the significance of export earnings to large numbers of smallholder agricultural households cannot be understated. Close to five million agricultural households rely on coffee alone for their primary source of income. Empirical evidence also suggests that export growth is significantly and positively related to poverty reduction (Chala, 2010; Bigsten, 2003; Suzuki, 2018).

Shocks to Ethiopia’s export market

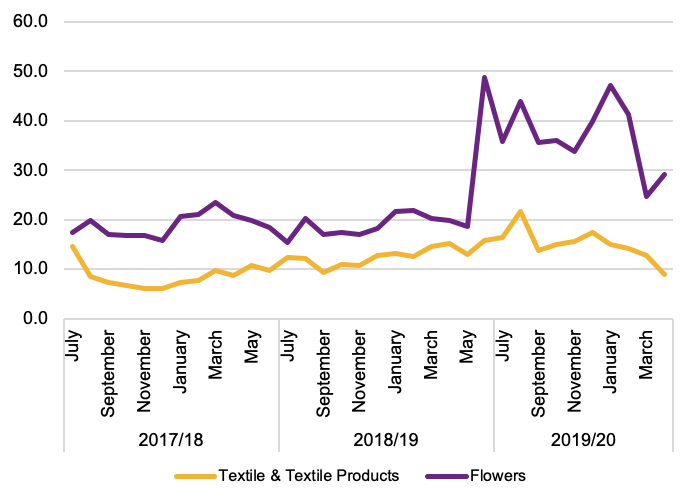

Our analysis draws on the diversity of the shock in the external export markets (as shown in Figure 2, below). In the past few months, certain export products have suffered significantly, possibly due to the pandemic.

- Flowers

Ethiopia is the second-largest exporter of flowers to Europe and the sector employs close to 150,000 people. The global demand for flowers fell sharply with containment measures, which resulted in the cancellation of events. This in turn led to a decline in the global demand for cut flowers, precisely during the boom spring season for flower exports for Mother’s Day and other events like weddings.

In addition, closed passage-ways in Europe and the Middle East disrupted trade. Ethiopian large flower exporters reported cancellations of orders and completely stopping exports in April. Flowers are being destroyed and being used as compost as a result.

- Merchandise

Export of merchandise goods in the first ten months of the fiscal year increased by 12.7%, compared to the same period last year, due to targeted measures to increase exports in traditional export items. This does not mean that this positive picture will continue, as orders are likely to weaken.

- Textiles

Textile exports have rapidly increased, averaging 31% annually since 2010, with the establishment of industrial parks and a policy focus to develop the manufacturing sector. Out of a total of 14 industrial parks, nine have specialised in textile and apparel. The sector has grown to become the country’s sixth major export, with a steady demand.

This sector has also faced the pass-through impacts of the pandemic. In one of the large industrial parks (Hawassa Industrial Park), close to 14,000 workers have been given paid leave, partly due to a fall in external demand. This worsens the already high unemployment rates in urban areas.

To mitigate the impact, firms in industrial parks have shifted to the production of Personal Protective Equipment (PPE) - particularly masks, sanitisers, and protective suits. Hawassa Industrial Parks, for instance, increased the production of facemasks from 10,000 to 20,000 pieces per day in April.

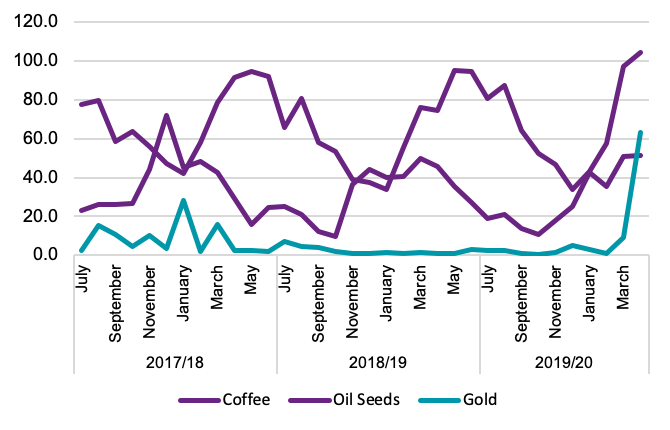

- Commodities

Commodities, such as oilseeds and pulses, have shown recent declines. For oilseeds, a 15.3% decline between January and February; for pulses, a 9.5% fall between February and March. The other major export items have not yet suffered due to the pandemic. Coffee and gold exports have shown increases in the first quarter of 2020, which mitigates the overall impact on export earnings.

For coffee, the rise in exports was most likely due to a lag between export orders and shipment. However, between March and April, coffee exports fell by 7%. Informal discussions with exporters indicate that new orders have indeed been declining, implying that we will see the effects in the coming months.

Figure 2: Trends in Exports of Major Commodities (million USD)

Source: National Bank of Ethiopia

- Services

Service exports have suffered much more than merchandise exports. Net receipts in transport services fell sharply to USD 2.6 million from USD 89 million in January (97% fall), representing the lowest net transport receipts in a long time. Transport services are dominated by the performance of Ethiopian Airlines, which experienced a collapse in passenger transport due to the pandemic. The flagship carrier adjusted its strategy to cater to the increased demand for cargo transport, which increased due to the global response to the pandemic. Thus, net transport receipts recovered to USD 40 million in March 2020.

The other service export, travel services, fell to USD -1.9 million (representing net payment) in March 2020 from USD 32 million in February. Again, this is due to a dramatic fall in travellers as a result of the pandemic.

Methodology: Projecting the future impact of COVID-19

To estimate the effects in the coming months, we employ a multiplier analysis. For an economy-wide analysis of exports shocks, we make use of the latest Ethiopian Social Accounting Matrix (SAM) and a SAM based multiplier model. We employ the SAM developed by the Ethiopian Policy Studies Institute (PSI) and European Union (EU), which utilised different micro and macro datasets from 2016.

The SAM contains 61 activities, 71 commodities, six factors of production, three types of taxes (direct, indirect, and import), six households, and one account each of trade margins, saving-investment, enterprises, government, and the rest of the world accounts. For our analysis, we simulate the direct and indirect effects of the pandemic on the economy as a shock passing through reduced exports.

We experiment with two different timespan scenarios for which the pandemic is assumed to last: Three months (based on actual data taking the worst-case scenarios of actual export changes between January and April 2020) and six months (based on projections). The choice of commodity is based on their importance in earning and the number of households engaged in the supply chain.

In general, we anticipate the decline in exports to be caused both by a fall in demand and by disruptions in the supply chain and global trade. Currently, we observe that demand is falling for the selected commodities and some international trade disruptions are reported. As the pandemic spreads domestically, we also expect domestic supply chain disruptions.

The findings: Shocks to agriculture exports renders the rural poor the most vulnerable

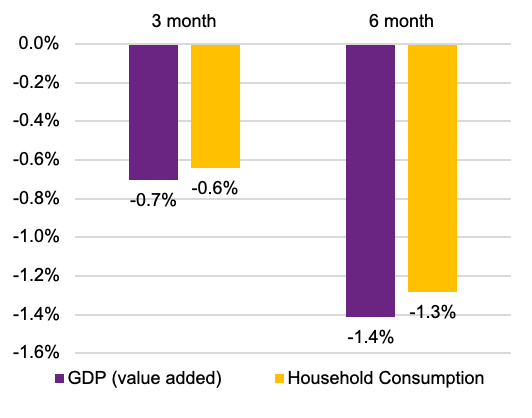

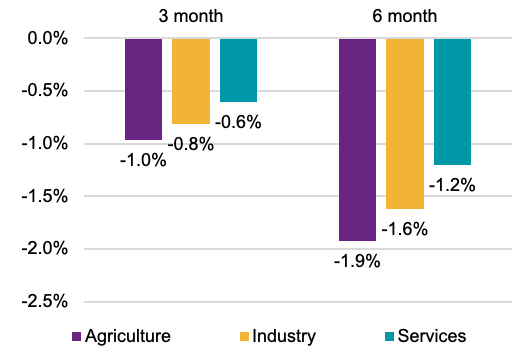

As shown below in Figure 3, a COVID-19 induced shock on exports modestly reduces the gross domestic product (GDP) and overall household consumption (Figure 3a). Given the primary nature of Ethiopia’s major exports, it is no surprise that agriculture is the hardest hit sector, followed by industry and services (Figure 3b).

Figure 3: Projected Impact of COVID-19 by Sector

a. GDP and Household Consumption

b. Agriculture, Industry, and Services

b. Agriculture, Industry, and Services

Source: SAM Based Multiplier Analysis

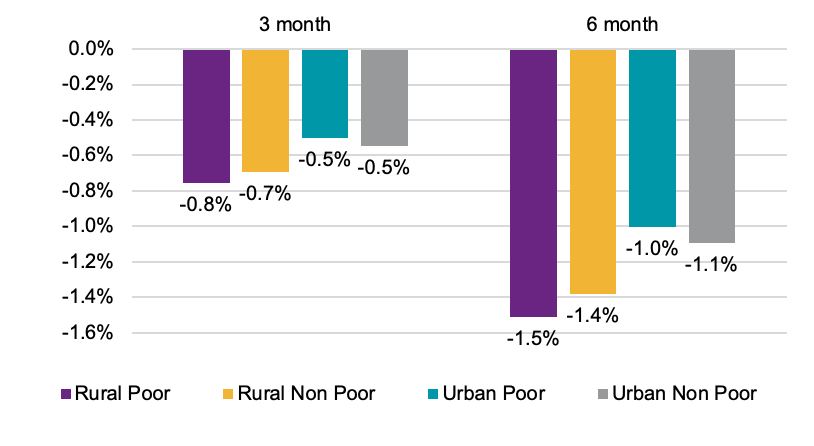

While Ethiopia’s exports involve a number of actors across the value chains, a shock in exports impacts rural households the most. Particularly, the rural poor are even more affected than the non-rural poor. The poor might be relying on seasonal activities (ploughing, weeding, harvesting, loading, etc.) for their livelihoods in addition to crop and livestock production.

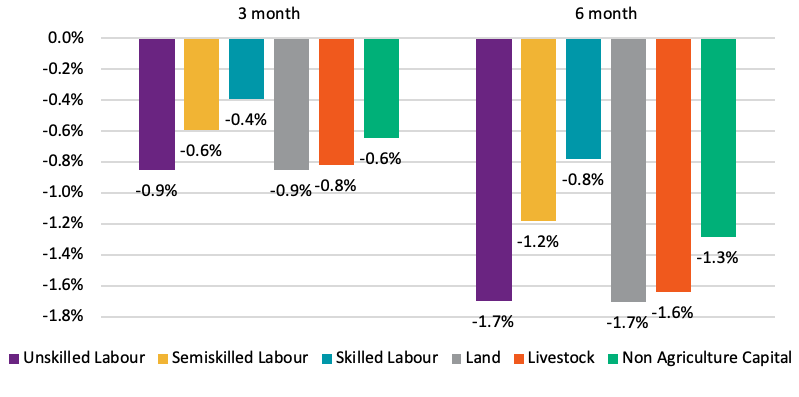

Just as the shift towards cash crops over the last decade in Ethiopia had large poverty-reducing impact, the shock from export cash crops may see some households fall back into poverty. Following the relatively bigger negative impact of the shock on the agriculture sector, as expected, land and unskilled labour are more severely affected.

Figure 4: Projected Shocks: Households, Labour, and Land

a. Rural/Urban and Poor/Non-Poor Households

b. Labour and Land

b. Labour and Land

Policy recommendations: Mitigating economic shock

- Move towards domestic demand substitution.

The foreign exchange market reforms that are supporting depreciation of the official exchange rate will send a powerful price signal in favour of consumption of domestic production. Removing restrictions on the consumption of export crops could mitigate the effects of the fall in demand for exports on domestic producers and would also be timely.

For example, only the best quality coffee can be exported by law. Removing this restriction temporarily will help producers and traders to make use of the domestic market to mitigate loss in income. This can mitigate the impact on rural coffee-producing households who are mainly poorer.

- Remove price restrictions on exports to encourage production.

Most exports have limited domestic market potential. The government imposes price restrictions on some export commodities to avoid the under-invoicing of exports. In order to encourage exports, lifting such restrictions can help, especially as the exchange rate black market premium narrows.

- Maintain supply chains from production to the domestic market or to the border.

Ensuring transport and transit routes are clear, while taking the necessary sanitary measures, can help mitigate the shock coming from supply chain disruptions, including across borders within Ethiopia as producers seek creative new market opportunities under the stress of the economic shock. Anecdotal evidence suggests some adjustment from the garment sector in targeting production for the domestic market. It will be important to substitute production to support mitigation of the impact.

- Keep monitoring export trends for changing circumstances.

As indicated above, total export earnings have increased due to increases in certain commodities. It is important to ascertain if the trend continues or not to plan mitigation measures proactively. Fortunately, Ethiopia’s agricultural exports are likely to experience gradual recovery, given export destination countries are gradually re-opening their economies.

Disclaimer: The views expressed in this post are those of the authors based on their experience and on prior research and do not necessarily reflect the views of the IGC.