Does South-South FDI Pay?

Can South-South FDI, or investment flows between institutionally comparable partners better stimulate growth through backward linkages?

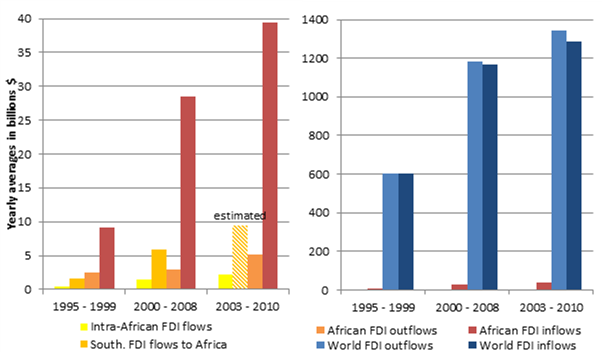

When it comes to foreign direct investment, much of the concern both in the public and in the academic community centres on investment flows moving from developed to developing countries, but there is now an increasing trend of developing economies exchanging investment flows amongst themselves. One might expect such south-south exchanges to better adapt to local economies and therefore be more useful. Take Africa for instance: FDI inflows from African economies are small, compared to worldwide FDI flows (Figure 1). The bulk of FDI inflows into African countries originate from industrialised, Non-African countries.

Figure 1 – FDI flows, Africa and the World, 1995-2010

Source: UNCTAD FDI/TNC database (www.unctad.org/fdistatistics). – UNCTAD, World Investment Report, 2010 and 2011.

FDI inflows from other developing countries, let alone other African countries, are generally much smaller. Yet they have grown considerably, accounting in the late 2000s for some 8-9 billion US-$ per year from all developing countries, thereof 2 billion US-$ per year from African countries. The question remains however, how far local economies of the African host countries benefit from such Southern investments, relative to other foreign investments. Can they, for example, expand trade more easily, due to the emergence of closer local linkages between the Southern multinational enterprises and the domestic suppliers, the so-called backward linkages? At best, closer backward linkages could even open up a powerful avenue of sharing knowledge and experiencing spillovers.

All FDI is not created equally

However, not all FDI has similar effects; certain types of investment support such linkages better than others. Among these, market-seeking FDI, aimed at opening up a new market to a multinational, is better at generating backward linkages than FDI seeking for new resources, new assets, or improved efficiency (Dunning 1998, Amendolagine et al. 2013). Similarly, joint ventures and investments in highly autonomous subsidiaries, rather than investments in fully owned subsidiaries and in subsidiaries with little autonomy, are better at generating local linkages (Belberdos et al., 2001; Kiyota et al., 2008; and Jindra et al., 2009), as are multinationals, locating far from home and seeking to offset higher trade costs they experience, relative to those at a smaller geographical distance (Rodriguez and Clare, 1996). Moreover, backward linkages are more likely to occur from FDI to those domestic suppliers that have a higher capital-labour ratio, higher wages and a higher productivity level than others (Javorcik and Spatareanu 2009).

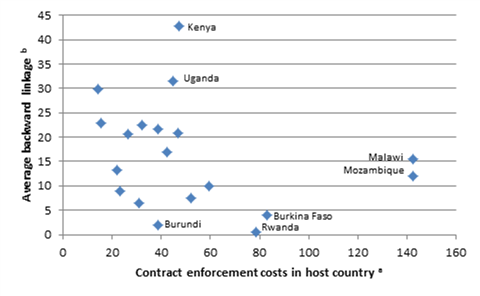

In addition, the business environment of the host country, particularly its institutional framework, can determine the strength of backward linkages. Institutional quality directly affects the security of private sector transactions (e.g. contract enforcement; see Figure 2), and affects the functionality of the public sector – strong institutions can reinforce ethical behavior (e.g. control of corruption).

Figure 2 – Institutional quality levels and backward linkage

a In percent of a respective debt. – b Share of host country input in total input of MNEs.

Source: Pérez Villar and Serič (2015).

Smaller institutional distance facilitates stronger linkages

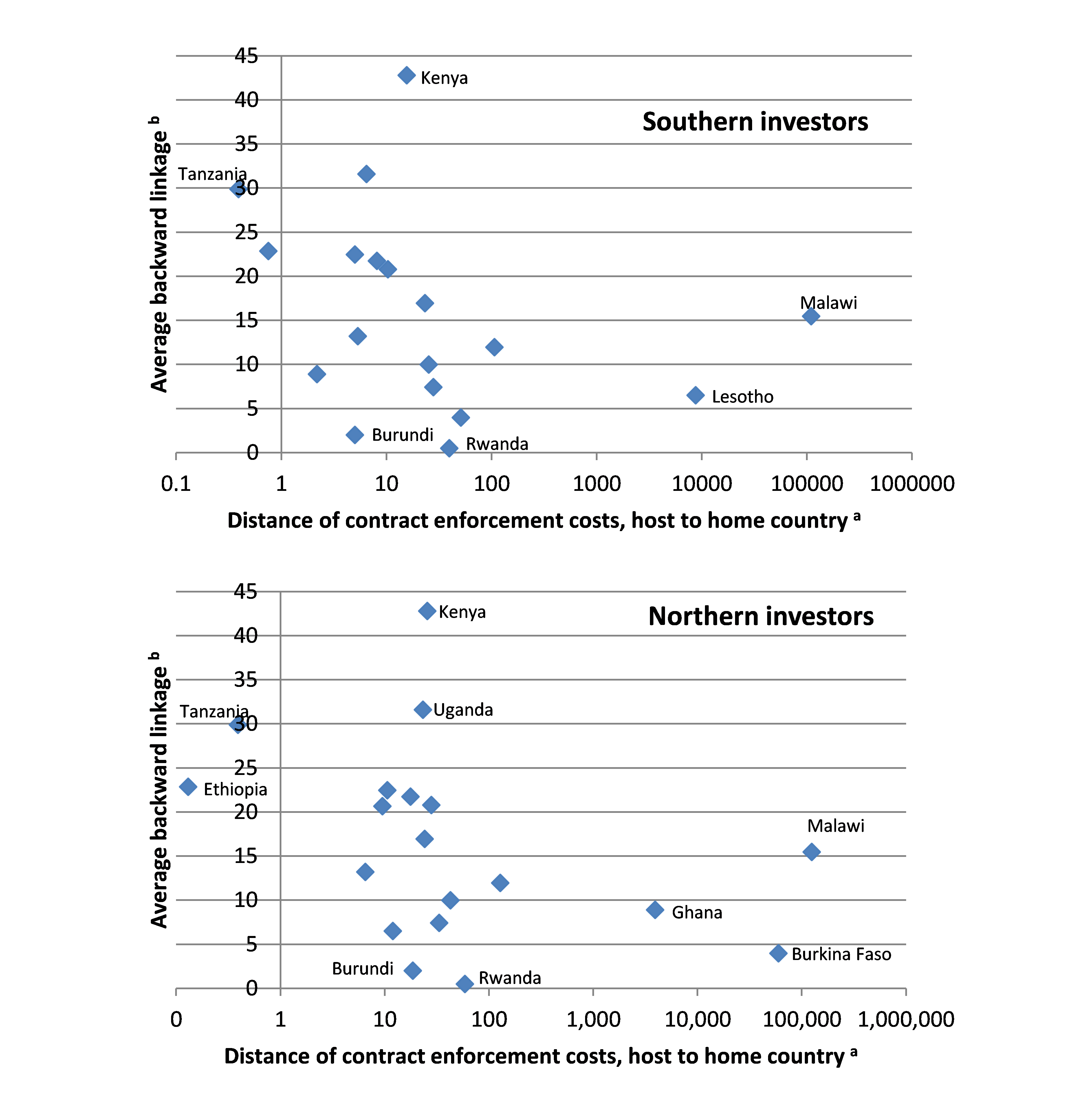

In a recent study, Pérez Villar and Serič (2015) go one step further in analysing this institutional effect on domestic linkages by also taking the investors’ home country institutions into account. They argue that what matters in particular is not so much the host country and home country institutions, but rather the similarities or dissimilarities between them. So-called institutional distance is a major factor in establishing linkages.

they find institutional proximity to matter strongly: linkages from the multinational investment to the local economy were indeed stronger over smaller institutional distances.

Affinity to institutions that are similar to those at home is expected to allow multinationals to better adapt to host environments, facilitating better networking with local firms, and rendering local supplier interactions less risky. In other words, the smaller the institutional distance, the lower the transaction costs to foreign investors, and the larger the linkages to the domestic economy (Figure 3).

Figure 3 – Institutional distances and backward linkages

a In percent of a respective debt. – b Share of host country input in total input of MNEs.

Source: Pérez-Villar and Serič (2015).

The direction of the distances must also be considered. If a foreign investor faces worse institutions in the host country than at home, he may benefit from negative home experiences that come at least close to those in the host country. If the institutions abroad are, however, better than at home, then his negative home experience will not be of any use for him (Aleksynska and Havrylchyk 2013). At any rate, investments originating from other Southern countries might exert a stronger impact on the local economy than other foreign investments.

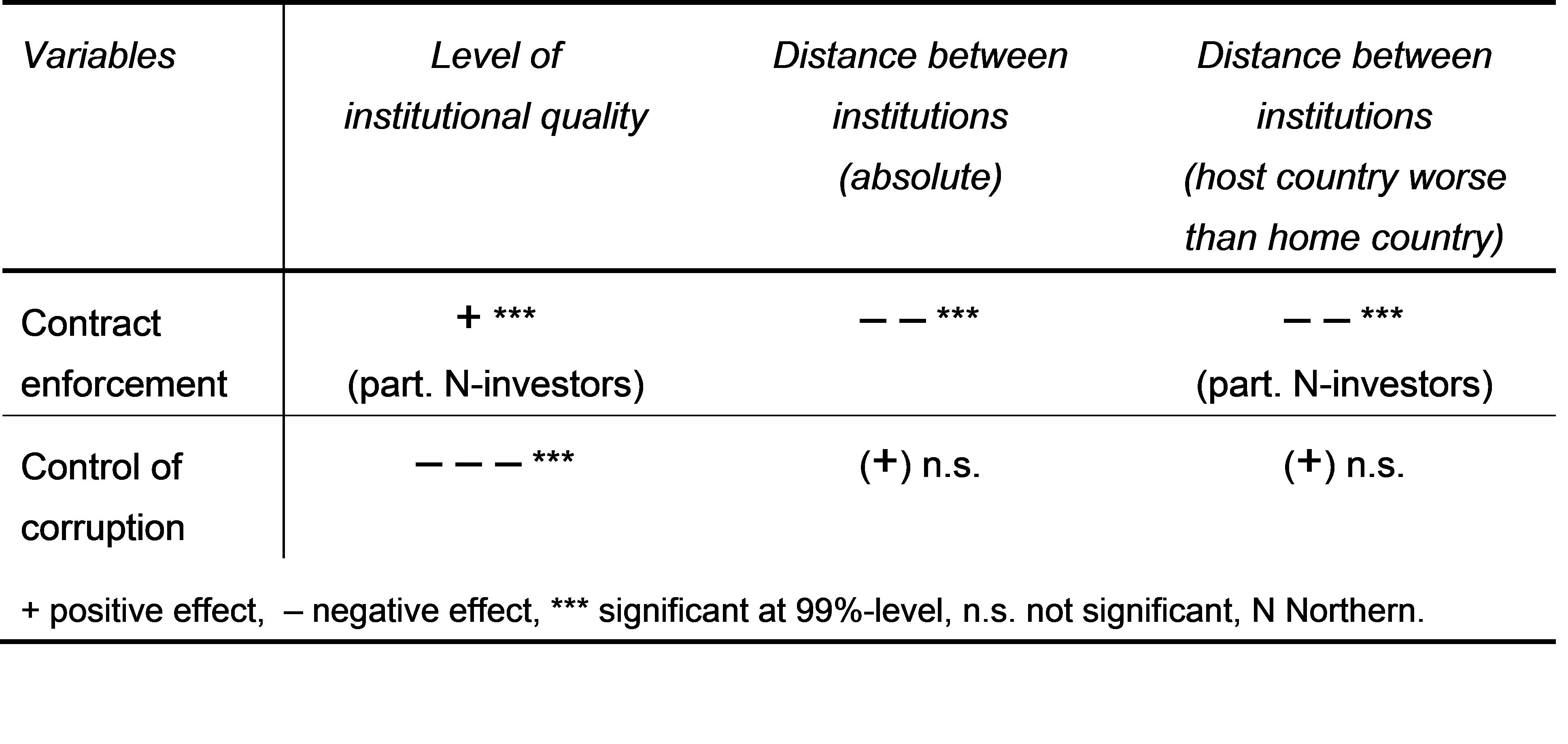

Pérez- Villar and Serič (2015) analyse these relationships by using firm-level data in a cross- section of 19 Sub-Saharan countries provided by the 2010 UNIDO Africa Investor Survey. They take an indicator of contract enforcement to proxy institutional quality regarding security of private sector transactions. And they take an indicator of corruption control to proxy the well-functioning and ethical behavior of the public sector. For each indicator, they study the impact of (i) institutional levels in the host country, (ii) absolute institutional distances between host and home country, and (iii) institutional distances in case host country institutions are worse than those in the home country (Table 1). In their estimates, they also control for various other variables that might potentially influence the relations between multinational investors and the local economy, such as characteristics of the multinational and the local firms, and such as sharing a common border, a common language, a common religion or a common colonial past.

Table 1 – Institutional variables and their effects on backward linkages

For the indicator of contract enforcement, Pérez-Villar and Serič (2015) find good institutions in the host country to considerably and significantly increase the interaction of a multinational with the local economy. Moreover, they find institutional proximity to matter strongly: linkages from the multinational investment to the local economy were indeed stronger over smaller institutional distances. However, it seems that this proximity mattered more for investors from Northern, industrialised countries than for investors from other Southern countries.

The results for the indicator of corruption control, however, are somewhat puzzling: worse control of corruption in host countries resulted in greater interactions and linkages with the local economy. Familiarity with corruption in home countries did not seem to have any impact on linkages. A possible explanation may be that investors in countries with a high degree of corruption require investment flows more urgently than those in less corrupt countries, and additionally, that in such environments, local suppliers are more necessary to guide foreign investors through the corrupt bureaucratic thicket.

Now, let’s get back to the questions from the beginning, do host African countries really benefit more from investments made by other Southern countries, and can they expand their local economy better by interacting with multinational enterprises that are more comparable to host institutions? The answer is somewhat mixed. On the one hand, higher levels of security for investments mean that all investors, regardless of their origin, are ready to interact with the local economy as a result of increased confidence in private sector transactions. On the other hand, more corrupt and inefficient public institutions in host countries mean that investors have to depend more on local suppliers to act as door-openers to important decision-makers. Finally, institutional proximity seems to be more important for investors from Northern, industrialised countries. Southern investors investing in Southern countries, may either be less picky or more experienced, and thus able to take the host environments as they are and still interact with the local economy.

From a politicians point of view, there is scope to better integrate multinational investors into the local economy. Policies should aim to improve overall institutional structures to reduce investors’ perceived risks, particularly for contract enforcement, and more specifically, by offering matchmaking strategies, and by familiarising investors with formal and informal ways of doing business in their chosen host country.

References

Aleksynska, M. and O. Havrylchyk (2013), FDI from the South: the role of institutional distance and natural resources. European Journal of Political Economy 29:38-53.

Amendolagine, V., A. Boly, N. D. Coniglio, F. Prota, A. Serič (2013), FDI and Local Linkages in Developing Countries: Evidence from Sub-Saharan Africa. World Development 50:41–56

Belderbos, R., Capannelli, G., Fukao, K. (2001), Backward Vertical Linkages of Foreign Manufacturing Affiliates: Evidence from Japanese Multinationals. World Development, 29(1): 189-208.

Dunning, J.H (1998), Location and the multinational enterprise: A neglected factor? Journal of International Business Studies. 1998:45-66.

Javorcik, B.S and Spatareanu M. (2009), Tough Love: Do Czech Suppliers Learn from their Relationships with Multinationals? Scandinavian Journal of Economics. 111(4):811-833.

Jindra, B., Giroud, A. and Scott-Kennel, J. (2009), Subsidiary roles, vertical linkages and economic development: Lessons from transition economies. Journal of World Business. 44(2):167-179.

Kiyota, K., Matsuura, T., Urata, S. and Wei, Y. (2008), Reconsidering the Backward Vertical Linkages of Foreign Affiliates: Evidence from Japanese Multinationals. World Development. 36(8):1398-1414.

Pérez-Villar, L., and A. Serič (2015). Multinationals in Sub-Saharan Africa: Domestic Linkages and Institutional Distance. International Economics, 142, 94-117.

Rodriguez-Clare, A., and Alfaro, L. (2004), Multinationals and Linkages: An Empirical Investigation, Journal of LACEA Economia, Latin American and Caribbean Economic Association.

UNCTAD FDI/TNC database (www.unctad.org/fdistatistics).

UNCTAD (various years). World Investment Report. New York and Geneva: United Nations.

UNIDO (2012). Africa Investor Report 2011. Towards evidence-based investment promotion strategies. Vienna: UNIDO