Flexible payment plans for improved access to off-grid energy in Pakistan

There are approximately 144 million individuals in Pakistan who reside in either completely off-grid areas – areas that are too far away to connect to the grid - or in ‘bad’-grid areas where load shedding exceeds 12 hours per day (IFC, 2015). Households and businesses in off-grid and bad-grid areas spend an average of 14% of their monthly disposable income on kerosene oil, candles, and other alternative sources of energy.

Access to renewable energy

Recent evidence from Rwanda and Bangladesh has shown small, solar-powered kits can have significant positive effects on household welfare and energy expenditures. Pakistan is relatively well endowed with renewable energy sources; yet access to clean, renewable energy is rare. For instance, solar energy is consumed by approximately 3.8% of households nationwide and is nearly non-existent in Punjab, Sindh and Balochistan.

According to the IFC report, cost remains one of the biggest barriers in the take-up of alternative energy sources, such as solar electricity, in Pakistan. Consumers prefer to make small, incremental purchases to meet their energy needs and are reluctant to make large upfront investments, such as those typically required for solar systems.

Pay-as-you-go energy solutions

One energy provider in rural Sindh, EcoEnergy (EE), aims to meet these needs by providing Pay-As-You-Go (PAYG) solar solutions, allowing individuals to pay only for what they need and can afford. Monthly payments are typically comparable to what villagers spend on energy. The PAYG product has a strong enforcement feature: The solar kit is remotely disconnected when credit expires. Since there are no financial penalties for late payments, disconnections represent a pure loss for the provider.

The study: Behavioural innovations to improve the sustainability of PAYG solutions

We first test if increasing the flexibility afforded by PAYG leads to improved payment performance. We do this by varying whether payment is explained as a minimum monthly amount or as an equivalent total amount that can be paid more frequently: Weekly, bi-weekly, or at other frequencies for the solar kit to remain functional.

Second, we test the individual constraints to repayment such as inattention, forgetfulness, and lack of self-control. We use another soft-touch intervention similar to the ones that were effective in improving medical screening rates and voter turnout in the United States (US). Specifically, we ask customers to formulate a plan for the subsequent payments and to circle the payment dates on a calendar that can be displayed at the clients’ home or place of work. In formulating this plan, clients need to think about possible issues in repayment and the strategies to overcome them.

Our study involved randomly varying the terms of the product to 727 new EE clients in rural Sindh between March and December 2018. Nearly a quarter of the sample had no access to electric power. The remaining had access but experienced more than ten hours of load-shedding a day. An average customer experienced approximately five instances of inactivity (disconnection) in this period, with each instance lasting an average of five days a month.

Results: The benefits of flexibility and payment implementation plans

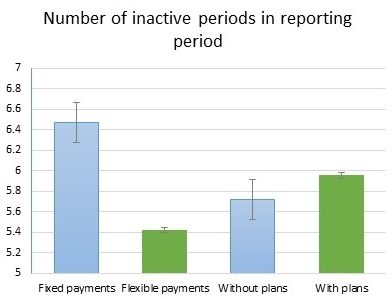

We find that providing information on flexible payment options to this sample improved repayment behaviour: Clients are likely to pay on time and experience one fewer instance of inactivity. On the other hand, implementation plans do not improve repayment behaviour on average (see figure 1).

Figure 1 – The number of inactive periods experienced by intervention type

Notes: Bars show the 95% confidence intervals.

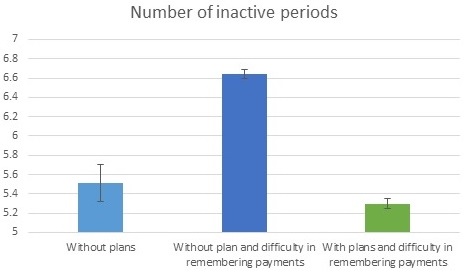

These overall results mask interesting variation. Consistent with the fact that almost 40% of the sample believes forgetfulness is the main challenge to timely payments, we find that the implementation plans significantly reduce the number of inactive periods in the sub-sample of clients who reported difficulty in remembering to make payments on time. It is entirely likely that intention plans increase saliency of payments by enabling clients, who typically face difficulty in remembering to pay, to operationalise their intentions to make top-up payments on time (see Figure 2).

Figure 2 – The number of inactive periods experienced by individual characteristics (with intention plans)

Notes: Bar show the 95% confidence intervals.

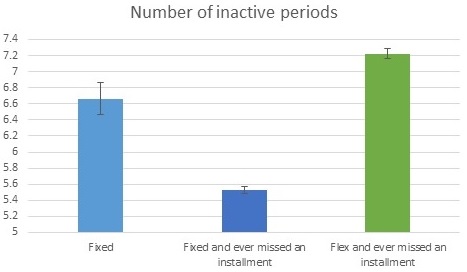

In line with this reasoning, clients with a history of missing other payments experience a higher number of inactive cycles under the flexible payment treatment than under the discipline of a fixed contract treatment (see Figure 3).

Figure 3 – The number of inactive periods experienced by individual characteristics (with payment type)

Notes: Bar show the 95% confidence intervals.

Implications: Innovating for improved energy access

These results speak to an important, broader question in the literature on optimal contract design in developing countries and the need to pay attention to the characteristics of people when designing them. The interventions tested in this study are soft-touch and non-intrusive in that they make a desired payment schedule salient but non-binding. However, our findings point towards the promising role that these easily scalable behavioural interventions can play in improving the repayment performance of clients with particular characteristics.

Editor’s Note: This blog is part of the IGC’s 10 year celebration series. This blog is linked to our work on Energy for all.