How mobile money can empower women: Evidence from Africa

Mobile money has had a major impact in expanding access to and increasing utilisation of financial services amongst women in Africa. The uptake of mobile money has brought benefits such as greater shock-resilience, poverty alleviation, and stimulating women entrepreneurs. However, narrowing the gender gap in the uptake of mobile money still requires grappling with affordability of mobile devices, low digital literacy levels, and educational disparity.

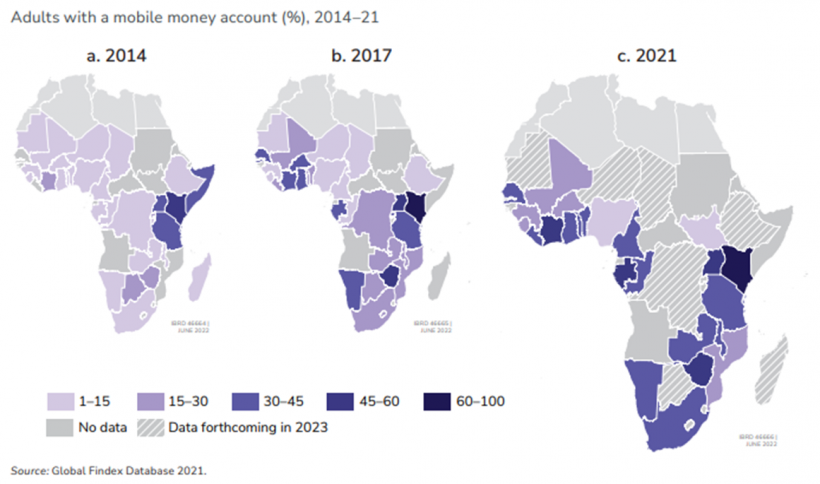

Mobile money refers to a pay-as-you-go digital medium of exchange and store of value that uses mobile money accounts. This is facilitated by a network of mobile money agents independent of the traditional banking network. Despite being initially concentrated in East Africa when it was introduced in 2007, mobile money has since grown and spread to Western, Central, and Southern Africa (Figure 1). Between 2012 and 2021, active mobile money accounts grew by 800% on the continent from 22 million in 2012 to 183 million in 2021.

Mobile money has allowed women to access finance more easily. Women’s use of mobile money services has been associated with various benefits including promoting women’s empowerment, increasing investment for women owned enterprises, and reducing extreme poverty. While gaps in access to financial institutions persist in Africa, mobile money is narrowing gender gaps.

Figure 1: Percentage of adults with a mobile money account in Africa between 2014-2021

Note: The figure shows the country-wise increase in the percentage of adults with a mobile money account in Africa, between 2014-2021. In 2014, most countries had 1-15% of adults with an account, while this has increased to around 30-45% of adults in 2021. Source: Global Findex Database 2021

Why mobile money matters more for women

The benefits of mobile money extend beyond the convenience it provides. By promoting innovations that mitigate poor infrastructure and reduce transaction costs barriers to accessing financial services, mobile money allows for participation of more people in the financial sector. This is especially true for those underserved by the traditional banking sector, including women.

Shock resilience

In Kenya, mobile money was found to help mitigate household risk. Having access to a mobile money account facilitates access to larger amounts of money through a larger network of people when a household faces a shock. Therefore, households with a mobile money account are less sensitive to shocks and are more resilient to risk and consumption. The impact of increased access to remittances through mobile money is especially crucial for women, who are more likely than men to be confined to their homesteads due to traditional caring responsibilities.

In Niger, cash transfers through a mobile money were used to respond to droughts, leading households to diversify crops and distribute risk. This was particularly true for women, who switched to cash crops in response. Additionally, by enabling more privacy and control over funds, mobile money enabled women to increase spending on nutritious food, benefitting not only the women but also the overall household.

Reduction of poverty

In the long-term, better access to mobile money services increases household consumption and savings, resulting in reduced poverty. By providing increased financial resilience, mobile money could increase savings and, in effect, future consumption. This effect has been observed to be larger for female-headed households.

Mobile money can lead to occupational shifts for women into more secure or productive forms of employment. For example, one study conducted in seven developing countries found that female mobile users were 7.6% more likely to be self-employed than non-users, and were 6.3% more likely than male non-mobile users to be self-employed. Female mobile money users were also 7% less likely to experience irregular wages, and 4.8% less likely than male non-mobile money users. Not only does a regular wage and source of income through self-employment contribute to women’s resilience to shocks, but this can also improve their consumption, contributing to poverty alleviation.

Stimulating women entrepreneurs

Mobile money has been found to facilitate a transition away from subsistence agriculture to business and enterprise amongst women. By increasing the efficiency of allocation of consumption over time, mobile money allows for more efficient allocation of labour. Moreover, mobile money could reduce the need for women to engage in multiple part-time occupations by providing them with a larger risk-sharing network through remittances and savings, facilitating their transition into business.

In Uganda, disbursing microfinance loans through mobile money relative to cash led to an increase in the value of business capital and profits. Mobile money enables more privacy for women and increases their ability to resist the pressure from their spouses to share the received loan. As a result, they have more control over reinvesting in their businesses, increasing business capital value and potentially, profits.

Mobile money can be an important tool for the economic empowerment of women, and positively impact the economic outcomes of women and households.

Gender gaps in mobile money use persist

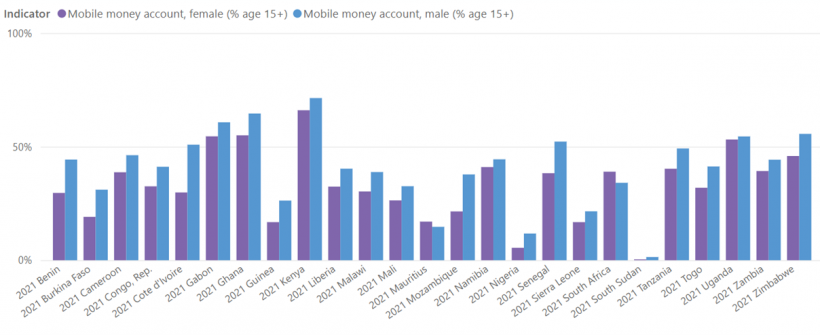

Despite the tremendous growth in mobile money and their known benefits for women, uptake has not been uniform. Across Africa, women continue to lag in adoption. While this gap is minor in more mature markets, it is wider in ‘new’ markets. For example, in Cote d-Ivoire there is a 20 percentage point difference between men’s and women’s ownership of a mobile money account and 12 percentage points in Senegal. In contrast, there is only a 5 percentage point difference in Kenya, and only a 2 percentage point difference in Uganda. Women, especially in the newer markets, continue to miss out on the benefits provided by mobile money services.

Figure 2: Percentage of men and women who have mobile money accounts in Africa in 2021

Note: The figure shows a country- and gender-wise distribution of the percentage of men and women over the age of 15 who have mobile money accounts. Kenya has the highest percentage of adults with mobile money accounts, and Sudan the lowest. Figure generated by author using Global Findex Database 2021.

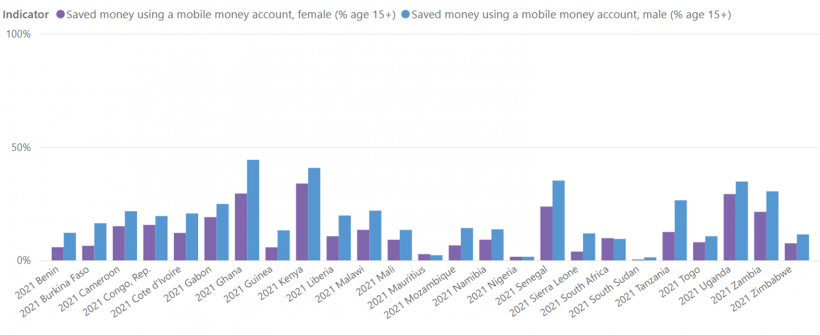

In addition to lower usage, there is limited diversity in the services that women use with mobile money relative to men. Women are less likely to use mobile money to pay bills, transfer money to savings, and receive money from customers than men. This is driven both by a lack of awareness and lower confidence in utilising digital services among women. This trend is observed even in mature markets like Uganda, Kenya, and Ghana.

Figure 3: Percentage of men and women who saved using a mobile money account in 2021

Note: The figure shows a country-wise distribution of the percentage of men and women over the age of 15 who had saved money using a mobile money account in Africa. The highest percentage of those who saved with mobile money accounts are men in Ghana, and the lowest is women in Sudan. Figure generated by author using Global Findex Data 2021

Narrowing the gap

Several factors contribute to women’s lower uptake and usage of mobile money services. These include women’s lower access to mobile phones, literacy levels, levels of income due to less employment opportunities, sociocultural barriers, and low digital literacy levels. Narrowing the gender gap in financial service access and utilisation requires addressing these factors.

As of 2020, there was a 13% gender gap in mobile phone ownership across Africa. Increasing women’s access to mobile phones is crucial for creating an enabling environment for women to take up mobile money services. Mobile phones are the gateway to mobile money services. Therefore, the gender gap in mobile phone ownership contributes to the lower usage of the services observed in women. Furthermore, lower awareness of mobile money and its relevance to their lives is part of the barriers to closing the gender gap in mobile money services usage.

Doing so entails the continuous development of innovative mobile money services which address the needs of female customers but are also user-friendly for users with lower literacy. However, this challenge is less pronounced in mature markets where the gender gap is driven more by gender disparities in education and employment. In the long term, addressing underlying factors like low literacy and digital literacy as well as creation of employment opportunities for women can facilitate improvements in their general interface with digital services, including mobile money.

Lack of affordability in some cases has also contributed to the lower usage of mobile money by women. For example, in Tanzania during the COVID-19 pandemic, an increased levy on mobile money saw women being more likely to revert to cash transactions. Women are more price-sensitive to changes in mobile money services pricing. Therefore, ensuring affordability of the services is necessary for keeping women engaged with these services.

Increasing women’s awareness of mobile money services, providing innovative services that meet the needs of female users of mobile money, increasing their confidence in utilisation of the services and addressing the underlying drivers of lagged mobile money uptake and use such as low literacy levels and economic opportunities can help close the gender gap in mobile money utilisation, and offer a way towards inclusive growth and development.

In sum, mobile money has created new opportunities for women – but African policymakers, like those in other developing countries, have more work to do to widen access.