How coffee can drive economic growth

In 2012, coffee accounted for almost 30% of Rwanda’s total export revenue. Considering national targets to increase export revenues by 18%, a few simple measures to improve the performance of the sector could have substantial effects on the country’s economic growth

In 2012, coffee accounted for almost 30% of Rwanda’s total export revenue. Considering national targets to increase export revenues by 18%, a few simple measures to improve the performance of the sector could have substantial effects on the country’s economic growth

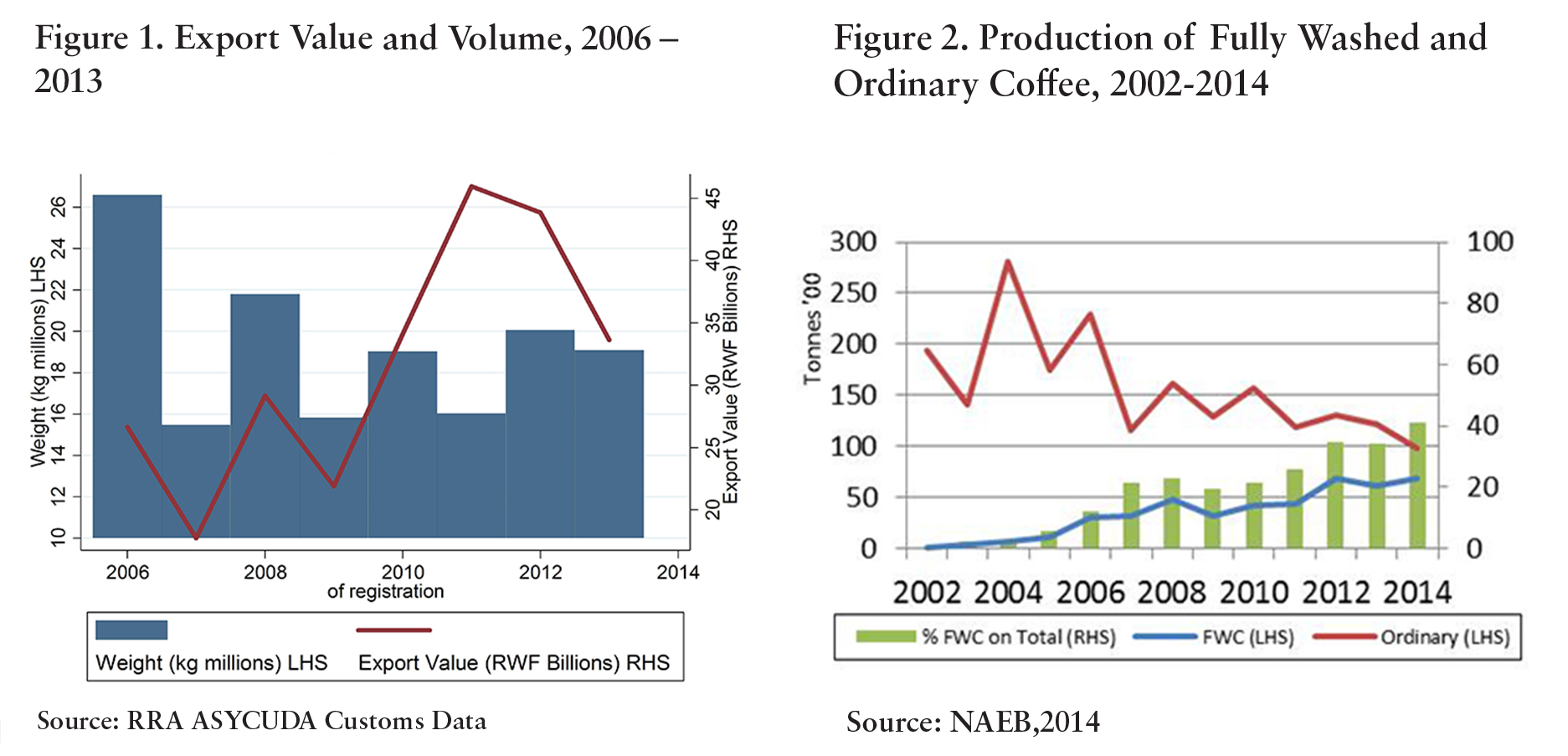

Rwanda, like some other countries in East Africa, produces some of the best coffee in the world. This creates the opportunity for Rwanda to increase its exports through value addition. Yet, since 2006, the Rwandan coffee sector has seen a gradual decline in export volumes though this was offset by a strong world price of coffee. Between 2006 and 2012, coffee export volumes fell from 26m kg to 20m kg. In contrast, the world price of coffee has climbed from $2.50/kg in 2006 to a peak of $6.06/kg in 2012, offsetting the effects of the fall in production.

The cost of a cup

One way to more sustainably increase revenues from coffee is to increase the percentage that is fully washed (which has grown dramatically since 2002 but is currently just 30-40 percent of exports). A recent study by Rocco Macchiavello and Ameet Morjaria found that, on average, the price of fully washed coffee is around $4.45/kg, whereas ordinary coffee earns just $3.05/kg. This means that for each kg of coffee that is processed in a coffee washing station rather than in a farmer’s house, Rwanda earns an additional $1.40 in export revenues. Consequently, if Rwanda were to double the amount of coffee exported as fully washed coffee, holding constant total coffee export volumes and world coffee prices, it could expect a 10-20% increase in coffee export revenues This would amount to an additional 3-6% increase in total export revenues.

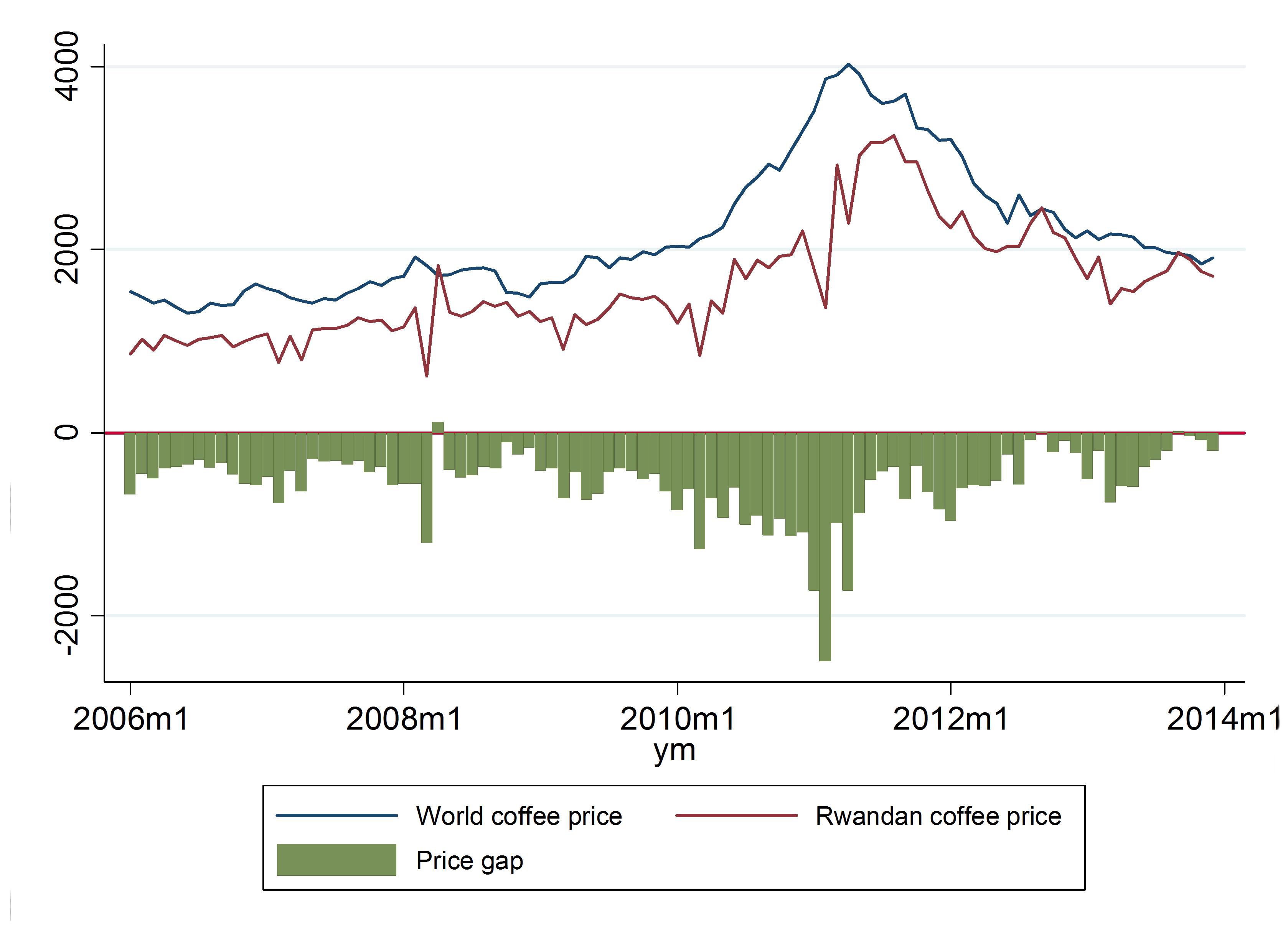

Despite the high grade of Rwandan coffee, the effective coffee export price (calculated by dividing the export value by the weight), has fallen consistently below the world price of coffee (the green bars in Figure 3). Between 2006 and 2012, both the Rwandan and the world price of coffee grew sharply. Since 2012, there has been a gradual price reduction for both. The IGC study found some evidence that the gap between the Rwandan and world price of coffee has narrowed since 2011. One interpretation is that Rwandan’s are managing to upgrade to higher value coffee. Indeed, both the percentage of coffee that is fully washed has risen from 0% in 2002 to 40% in 2014 (Figure 2).

Trading up to premium coffee

However, fully washing coffee is only half of the story in creating quality coffee. FWC guarantees consistent coffee without defects, which can thus be branded, pre-ordered, and sold with a premium. In order to guarantee quality coffee, the government has begun to put in place infrastructure and training. If this is achieved the export price will go up, community incomes increase, and the possibility of direct trade and private financing will be unlocked. This has been demonstrated with success in countries such as Ethiopia and Costa Rica.

Figure 3. Rwandan Vs. World Price of Coffee (RWF/kg)

As a small producer Rwanda’s coffee export price cannot influence the world price of coffee. Price fluctuations are a fact of life. However, to reduce the vulnerability of the Rwandan coffee sector to price shocks there are a number of possible mitigation strategies.

Some of the best coffee in the world

One way to reduce the susceptibility of Rwandan producers to world price fluctuations is to increase the percentage of Rwandan coffee sold as high quality speciality coffee. This is because niche coffee is bought by higher income consumers who are less responsive to changes in prices. By contrast, low value coffee is often sold in commodity markets with high price variability. Rwanda is fortunate to produce some of the best coffee in the world so upgrading quality has an enormous payback that can better weather demand shocks, should they occur.

Rwanda might consider encouraging the expansion of the East African Commodity Exchange to include commodity level coffee. A commodity exchange can help mitigate the risk of compressed sales prices by attracting a more diverse market of buyers to the region, to encourage stronger price competition for regional exports. While this does not fully insure against supply and demand shocks, it at least brings better, more stable, prices to farmers through access to a larger pool of potential buyers and the potential to access sales prices averaged across the harvest season. However, when selling to the commodity exchange is compulsory it can damage coffee quality.

The recent IGC-Ministry of Agriculture-NAEB conference brought together representatives from multiple countries in the region and elsewhere to discuss knowledge sharing in the sector and the Rwanda draft coffee policy. Ultimately the goal of the conference, and indeed the draft coffee policy, is to produce better coffee and at better conditions for Rwanda.

3 problems, 3 options

The IGC’s Coffee Value Chain Study by Rocco Macchiavello and Ameet Morjaria identifies 3 problems in the sector and 3 options, each of which is being closely reviewed by the Rwandan Government:

- Firstly, lack of contract enforcement has meant that, despite the potential for higher prices from fully washed coffee, farmers continue to process coffee at home. Our researchers are diagnosing a market failure whereby price signals are not transferred to the farmer because of a lack of trust between farmers and coffee washing stations. The IGC study proposed solution is to strengthen the relationship between stations and farmers by helping the two parties to create firm contracts that both sides will honour – and to the benefit of both the stations and the farmers. This may involve new technology which would track purchases, sales, and inventories with the goal of encouraging farmers to sell cherries on credit to coffee washing stations.

- Secondly, access to working capital for coffee washing stations remains a constraint to growth. The study proposes establishing a system of value chain finance. The financier should use “contracts” that stations have signed with buyers to disburse loans to stations. When the station delivers coffee to the buyer, the buyer repays the loans directly to the financier.

- Thirdly, poor managerial practices among some coffee washing stations has led to underutilisation of installed washing capacity. The study proposes new ways to raise the productivity of existing coffee washing stations, including encouraging private management firms to run stations, and training managers.

In 2012, coffee accounted for almost 30% of Rwanda’s total export revenue. Considering national targets to increase export revenues by 18%, improving performance of the sector could have substantial effects on the economy.