Industrialising Africa: The role of services

Services play an increasingly large role in industrialisation and growth. In Africa, services, including intra-regional services trade, must be emphasised in industrialisation policy going forward. Africa has the opportunity to use the services sector to orient growth in a more sustainable and balanced way, as was in Asia, Europe, and North America earlier.

The particulars of industrialisation have changed extensively since Nicholas Kaldor’s study on the “laws of growth” in the 1960s. Manufacturing was seen as the engine of growth because it exhibits increasing returns to scale, productivity-enhancing spillovers, and international tradablity, which increases pressures for competitive upgrading. Industrialisation in this view is characterised by the movement of economic resources—capital and people—from the agricultural sector to the sector.

More recent research, however, puts a crucial gloss on this picture for the case of more recent episodes of industrialisation. For instance, it is a little-known fact that during the “golden age” of Factory Asia in the early 2000s, when China and other countries experienced rapid growth in their per capita incomes, it was not only their manufacturing sectors that were driving growth—some services sectors also had a crucial contribution to make. Indeed, some models of economic growth, such as Paul Romer’s endogenous growth framework, put some services at the epicentre of economic growth: research and development, for example, is a key part of the services sector that generates ideas and designs to engender productivity.

What do these insights mean for Africa? On the one hand, it is important to learn from recent examples of industrialisation – numerous countries in East and Southeast Asia, Chile and Costa Rica in Latin America, to name a few From Africa, Mauritius is on the cusp of high-income status in the current World Bank country income classification, so it provides an example closer to home of a country that has seen rapid and sustained increases in per capita income—the objective of industrialisation.

Services in Africa

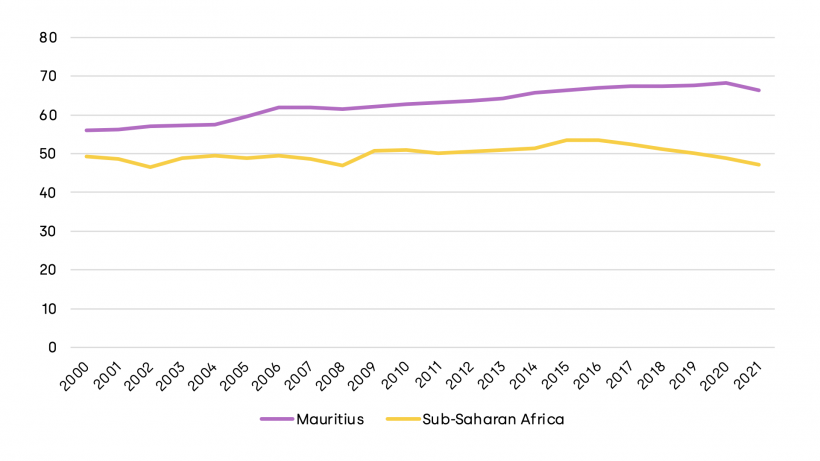

Figure 1 shows the evolution of services value added as a percentage of GDP (total value added) over the last two decades in sub-Saharan Africa as a whole, and in Mauritius. The starting positions are relatively similar: the proportion of services in GDP was already higher in Mauritius than in the continent as a whole in 2000, but not dramatically so. The main difference in the figure is the growth path over time: in Mauritius, account for an ever-growing proportion of economic activity, while the proportion is stuck, or even declining in sub-Saharan Africa. The difference since 2021 had become pronounced—nearly 70% in Mauritius versus just under 50% in sub-Saharan Africa.

Figure 1: Services as a percent of GDP, Mauritius and sub-Saharan Africa, 2000-2021.

Note: The figure maps the evolution of services as a percentage of GDP in Mauritius (blue), against the rest of sub-Saharan Africa (orange) between 2000-2021. While services in both started off in similar positions, Mauritius steadily expanded services as a percentage of GDP, while the overall proportion for sub-Saharan Africa dipped by 2021.Source: World Development Indicators

While there is much in the growth trajectory of Mauritius that is particular to its own special case and may not be replicable elsewhere—in particular, the role of the financial services sector—there may nonetheless be some general insight that emerges from Figure 1, as well as from the cases of Asia and Latin America. There is growing evidence that the industrialisation and growth agenda is increasingly a services agenda. In part, this change is due to shifts in consumer preferences towards services. Technological change also plays a large role, and in particular the fact that more and more services are tradable under one of the four modes of supply recognised by the World Trade Organization.

Global value chains in Africa’s trade

What role do services play in Africa’s trade today? An important lens through which to ask this question is participation in Global Value Chains (GVCs). A GVC-based understanding of trade emphasises the value-added contributions of different sectors in the production of gross exports. It therefore allows for the indirect use of, for example, services value-addedto produce manufactured goods exports. This process occurs when a manufacturer purchases services as intermediate inputs, as is common in the case of financial services, transport, research and design, and many other producer services sectors.

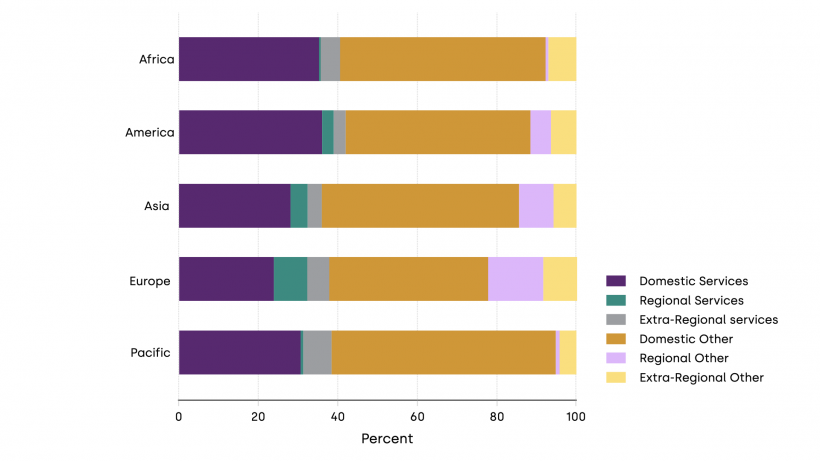

Figure 2 shows that in proportional terms, services already account for a large part of Africa’s exports when both direct and indirect exports are included. The proportion is around which is higher than all other continents except North America. What is striking, however, is the very small role played by intra-regional services value-added in the total. That is, services inputs in African exports are primarily sourced locally, whereas other parts of the world—particularly Asia and Europe—source them much more frequently from regional suppliers (i.e., service providers in the same continent).

Figure 2: Breakdown of gross exports by value added origin, percent, by continent.

Note: The figure shows the continent-wise breakdown of the percentage of gross exports by value added origin. Source: Shepherd (2022)

Boosting regional trade and services growth is key to Africa’s industrialisation

It is no secret that intra-regional trade is low in Africa relative to other parts of the world, but the result bears repeating for the case of services in the context of possible future specific commitments in that area under the AfCFTA Services Protocol. Of course, boosting intra-regional trade is not an end in itself, but rather part of an overall effort to increase integration with the global economy, which of course includes regional trade. Indeed, the force of economic gravity means that holding other factors constant, countries tend to trade more with their neighbours than with distant countries. A question for Africa, therefore, is whether barriers to regional services trade are relatively high by world standards. For the moment, there is little evidence in this direction, and it is likely that policies vary substantially across the continent.

Looking forwards, it will be important to give services an increasingly prominent place in discussions of Africa’s industrialisation. While the characteristics of services vary at a sub-sectoral level, there are cases of important services that exhibit similar characteristics to those traditionally believed to be growth-promoting in the case of manufacturing: increasing returns to scale, productivity spillovers, and international tradability. Africa has the opportunity to pursue a more balanced industrialisation path—between industry and services—than was the case in Asia, or Europe and North America earlier. Doing so would allow the continent to unlock the benefits of industrialisation in terms of sustained increases in per capita income and the improvements in material circumstances that come with it, but potentially with a more sustainable path in terms of environmental responsibility. Focusing on policy changes that could jumpstart the engine of services sector growth should be an important part of overall discussions on Africa’s industrialisation.

IGC will be co-hosting a panel discussion on Industrialising Africa: Renewed commitment to inclusive and sustainable growth to mark Africa Industrialisation Week 2022. The views expressed here are those of the authors based on their experience and prior research and do not necessarily reflect the views of the IGC.