Making land administration work for African cities

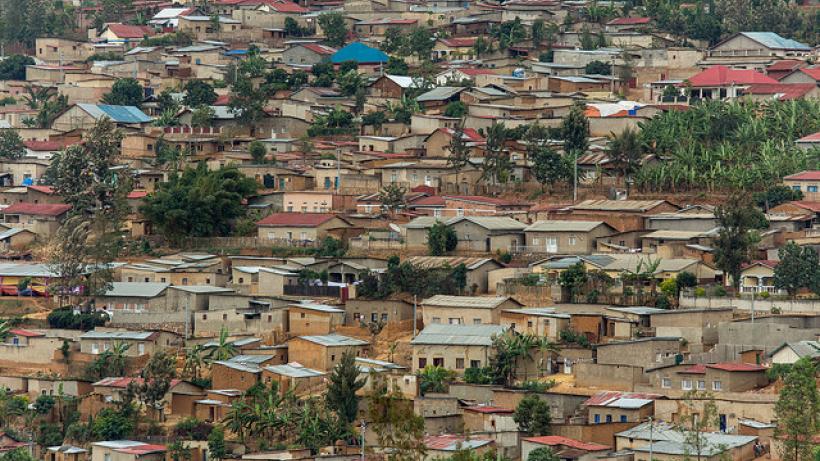

Rapid urbanisation has created a strong need to improve land administration in many African cities. Emerging research and policy experiences in countries such as Rwanda can guide policymakers across the continent as they seek to do this.

Policy debates about land are often highly removed from the practical apparatus that determine how land is actually used – maps, records, and valuation systems. This has contributed to a collective lack of scrutiny over practical and administrative problems that really matter. Many sessions at the recent Land Policy in Africa Conference, co-hosted by UNECA, AfDB and the African Union, brought land administration under particular focus to discuss recent innovations.

For cities across Africa, the stakes surrounding the success or failure of land policy are enormous. Prosperous cities really make the most of their land, both to bring people and firms together into productive clusters, and to fund public investments on the basis of land value appreciation. Yet many African cities are not using land in this way.

Land issues in African cities

Many African cities struggle to generate dense central clusters; instead, land-use sprawls outwards in a disconnected and fragmented way. For example, 30% of land near the centre of Harare and Maputo is currently unbuilt (Lall et al. 2017). Furthermore, instead of African city authority rightfully claiming the massive land-value appreciation from urbanisation through taxation, this appreciation is going into the hands of a few lucky landowners. Taxes on land and property represent under 1% of total tax revenues in most African countries, compared to over 6% in the OECD and far higher in many East Asian countries. (Franzsen and McCluskey 2017, Kopanyi and Murray 2016)

Weak land administration

The practical conditions that actually enable clustering and taxation to occur are effective administration of land rights. In particular, for firms to be able to form productive clusters in certain areas of a city, they need to be able to buy land on a land market. A land market, in turn, requires a transparent and trusted land record, updated after transactions occur so that they generate accurate valuation. Valuation serves the bases not only for a functioning land market, but also for a functioning tax system.

Yet developing this administrative apparatus has been challenging in many African countries. In part, this is due to exorbitantly expensive and complex systems to record, value, and transfer land. In Lagos, the process of obtaining a formal land title can cost up to 30% of the price of property construction, and registering formal transactions costs between 12-36% of the property’s value (Lall et al. 2017). Unsurprisingly, ordinary residents turn to informal or semi-formal systems instead. The majority of African urban residents live in informal settlements.

Why does the cost of formal land administration remain so high?

Often, lower-cost and more flexible systems are shunned in favour of expensive colonial legacy infrastructure and imported state-of-the-art technologies, unsuited to local income-levels. These expensive systems frequently serve to create rents for vested interest groups, which in turn frustrate change. However, as demonstrated throughout the conference, significant advances are being made to create more flexible, innovative, and fit-for-purpose land administrations.

Registering land rights – Rwanda’s successful experience

In recording land rights, Rwanda in particular has led the way. In its 2009-13 Land Tenure Regularisation Programme, Rwanda formally registered almost all 10.3 million land parcels in the country. This was achieved through a large-scale and participatory registration process. Communities came together on a particular day to identify and demarcate their plots from aerial or satellite photographs. This was achieved with the help of trained para-surveyors from the local community, rather than professional cadastral surveyors.

The scale and participatory nature of the programme were crucial to its success. Registration at scale can reduce costs by approximately 20-fold through avoiding repeated on-site visits. Open participation built public trust in the Rwandan registration process, and helped to cost-effectively resolve disputes at a local level. Land was mapped and surveyed at a cost of $6 per parcel, compared to over $3,000 per parcel as estimated by some surveying companies in Tanzania (Ali et al. 2014).

Furthermore, having undergone cost-effective land registration, Rwanda is now implementing on-going reforms to decentralise administration. This will make it easier and cheaper to formally register transfers at the local level and is crucial to prevent land from becoming effectively deregistered upon transfer.

Valuing land – new technologies and research

In valuing land, new technologies may enable extremely cost-effective alternatives to long and laborious methodologies practiced by a small enclave of valuers and surveyors. At the conference, Daniel Ayalew Ali presented World Bank research on one such example of low-cost remote property valuation in the city of Kigali. This uses a combination of satellite data, (e.g. on location and building height) and administrative data (e.g. proximity to local infrastructure). This valuation technique was found to provide ‘good enough’ prices to underpin a functional property tax system. The research found that if a 1% property tax were implemented based on these values, government revenues would roughly triple relative to Kigali’s current lease fee system. The cost of the valuation exercise was well under one-tenth of the annual increase in revenues that would come from a 1% property tax based on these values.

Flexible, low-cost and innovative methods of land administration are being developed in African cities. The challenge for policymakers will be to make sure vested interests do not frustrate these innovations – they are of huge importance in making a success of African urbanisation.

References:

Lall, S, J Henderson and A Venables (2017), “Africa’s cities: Opening doors to the world”, Washington, DC: World Bank.

Franzsen, R and W McCluskey (2017), “Property tax in Africa: Status, challenges, and prospects”, Lincoln Institute of Land Policy.

Kopanyi, M and S Murray (2016), “An effective property tax regime for Rwanda”, IGC Working Paper. C-38403-UGA-1

Ali, D, M Collin, K Deininger, S Dercon and J Sandefur (2014), “The price of empowerment experimental evidence on land titling in Tanzania”, CSAE Working Paper, WPS-2014/23.