One year on: Zambian economy during COVID-19

On 18 March 2020, Zambia reported its first COVID-19 case. One year later, like the rest of the world, the pandemic has had unprecedented effects on many aspects of life. The economic effects have been particularly significant, most aptly demonstrated at the macro level by Zambia becoming the world’s first COVID-19-era sovereign debt default.

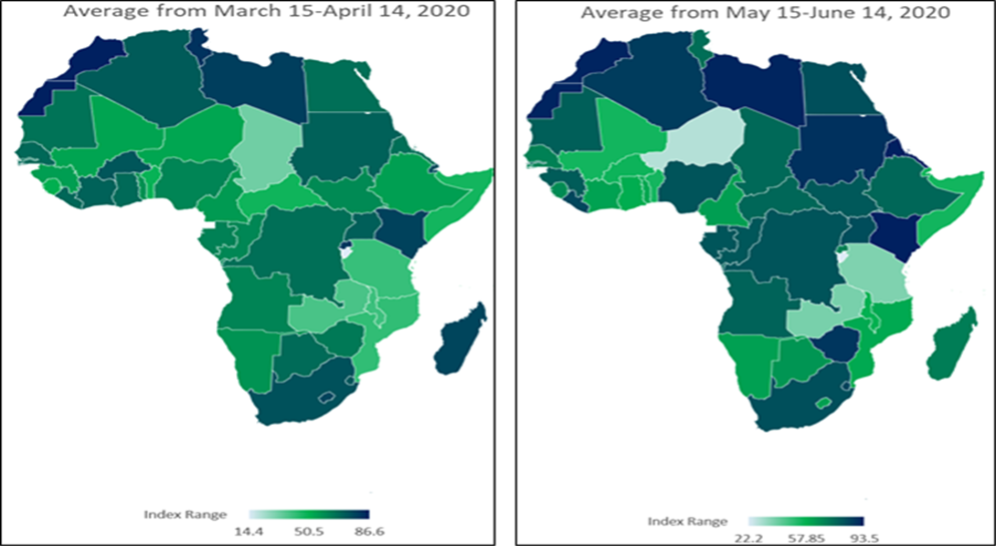

The COVID-19 policy responses that a country adopts have become a proxy indicator for state capacity. Like other countries, the Zambian government adopted COVID-19 policy measures to forestall the progression of the virus in the population. Rating the country’s policy response to the pandemic, the Oxford lockdown stringency index consistently rates Zambia’s response as moderate, relative to other countries in the region (see Figure 1). Although Zambia never imposed a nationwide lockdown (as was the case in South Africa, Botswana, Zimbabwe, Uganda, and Rwanda), measures that were taken included short-term border closures (the Zambia-Tanzania border was closed for 5 days) and constrained economic activities (closing of bars, restaurants, nightclubs, cinemas, and casinos through mid-May), schools were also closed, but outside of this most businesses (the majority which are informal) remained open.

Figure 1. Zambia’s COVID-19 containment strategy and policy response

Source: Resnick et al. 2020.

The COVID-19 tradeoff

The question of the efficacy of national lockdowns in developing countries remains an open one. Some researchers point out that in many developing countries the economic effects of lockdowns can quickly overwhelm the health effects. Developing countries have unique characteristics – such as high levels of informality, limited fiscal space to provide income support, and housing arrangements that make social distancing difficult – that have the potential to reduce the effectiveness of lockdowns and social distancing mandates. Early in the pandemic, economic simulations already estimated that, of the 9.1% of the population projected to fall into poverty during the pandemic, 65% of them could result from the lockdowns directly.

This is not to suggest that the COVID-19 tradeoff is between lockdowns or no measures at all. Some researchers have, for instance, proposed the idea of smart containment within a framework of active learning – an approach that uses data to drive containment strategies. Others have proposed age-based containment policies to take advantage of Africa’s young population, given the disproportionate impact of COVID-19 on the elderly. Zambia’s containment strategy appears to be less a reflection of strategic and ethical tradeoffs, and more reflective of the country’s constrained fiscal position.

COVID-19 Effects: External shocks and global transmissions

One facet COVID-19 revealed was the Zambian economy’s continued vulnerability to external shocks. The effects of the pandemic were initially transmitted through the impact on major external trading partners, particularly China, and the volatility in demand for copper – Zambia’s primary export.

- Over 2020, copper export earnings declined by 14.8% over the same period in 2019. This is despite a 16.5% increase in copper export volumes.

- COVID-19 led to disruptions in the supply value chain, especially for products coming through South Africa, one of Zambia’s main trading partners, which has been in and out of lockdown for most of 2020.

- The first half of 2020 registered a 30% decline in imports compared to the corresponding period in 2019. Export earnings also declined by 15.8% over the first half of the year.

- Non-traditional exports, an important sub-sector, declined by 17.9% due to a collapse in demand and trade disruptions.

(National Budget Address, 2020)

The tourism sector was hit particularly hard. By August 2020, Zambia had not received any international tourists since March. During the first half of 2020, international passenger arrivals declined by more than half a million due to suspensions in international travel. This decline was compounded by a drop in occupancy rates in hotels and restrictions on large gatherings. A World Bank survey of households in Zambia found that 71% of respondents in the tourism sector reported experiencing a job loss as opposed to only 8% in the agricultural sector. In contrast, in 2019, the industry contributed 7% of GDP (USD 1,701 million) and 7.2% of total employment (469,000 jobs).

Non-COVID-19 factors: Internal constraints

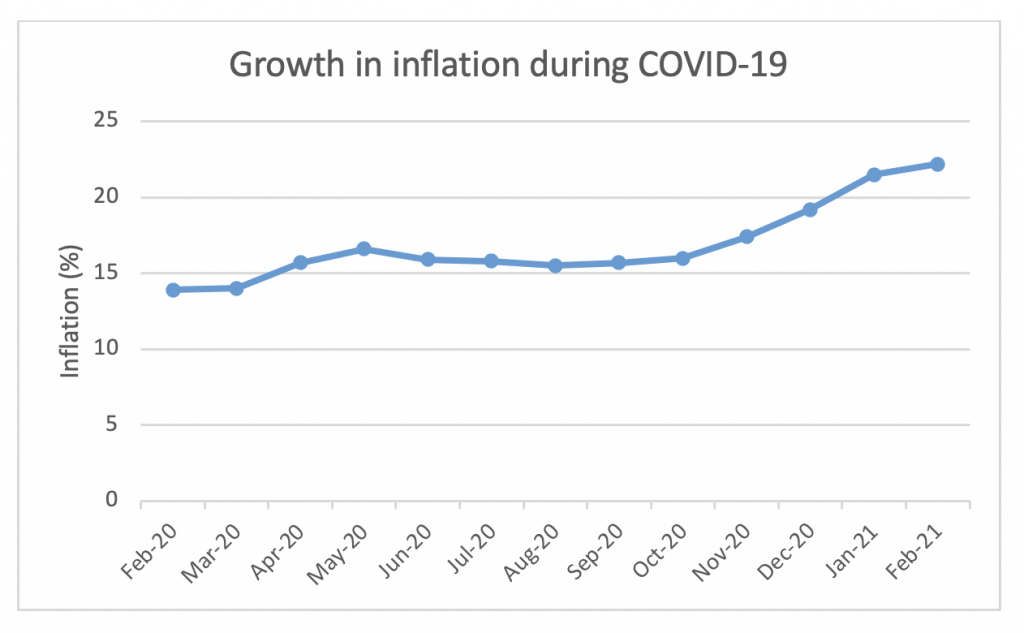

Internal factors have been a significant contributor to the current economic climate, particularly structural constraints that limited the ability of the Zambian government to respond to the crisis. Chief among these is the debt crisis that resulted in Zambia becoming the world’s first COVID-19-era debt default. The currency has depreciated sharply against major convertibles, which contributed to inflation that has steadily increased since the pandemic began (see Figure 2). This inflationary pressure is the primary transmission route through which Zambians have experienced the pandemic. In a World Bank survey, when asked the primary reason for household food insecurity, 40% of households indicated the increase in prices as the primary reason, second to a lack of access to cash (a sign of income constraints) (27%). Both of these reasons were ranked higher than factors related to containment, such as restrictions on movement (9%) and market closures (6%).

Figure 2. Growth in inflation during COVID-19

Negative Growth: Zambia enters Recession

During the COVID-19 pandemic, the Zambian economy entered one of its deepest recessions in history, shrinking by 4.2% in 2020. This was the first time since 1998 that the Zambian economy has contracted. The implications of negative economic growth are highly consequential for any economy, but particularly significant for a developing country. Negative economic growth means that many jobs have disappeared and risks wiping out the savings of households, reducing their resilience to future shocks. A shrinking economy also results in lower tax revenues that constrain the government’s ability to fund public goods and services. Per-capita income has declined, and the gains in poverty alleviation witnessed over the last decade have also been undermined.

Temporary recessions are not uncommon, and many countries will experience losses to growth due to COVID-19. What is concerning in the Zambian case is that the recession goes beyond the containment measures (which were moderate) and reflects vulnerabilities to external shocks and unfavorable internal macroeconomic decisions, with potential long-term implications.

Ideas on How to Bring Back Growth

Bringing back growth remains central to Zambia’s post-COVID-19 recovery agenda. If Zambia is to build back better, it is important that strategies to revitalise growth be placed at the center of policy. Three aspects will be key to achieving this:

- Growth needs to be private sector led: Stimulus needs to focus on increasing the productivity of the private sector and creating an enabling environment for private-sector firms. Current indicators such as the high level of non-performing loans point to a struggling private sector, for which stabilising the macroeconomic environment will be key. COVID-19 has accelerated the use of technology, especially the use of electronic payment platforms. This is low-hanging fruit that the private sector should look to take advantage of. The government also needs to focus on long-term constraints such as filling skill gaps in the labour force and the reform of labour market regulations. These are currently a deterrent for formal sector employment.

- The government must balance health, monetary and fiscal policy: A top priority should be the containment of the virus. The roll out of a vaccination programme will be key to achieving this goal; sectors such as tourism will struggle to recover otherwise. However, both monetary and fiscal policy need to adjust. On the monetary policy side, the exchange rate and inflation rate need to be stabilised. On the fiscal side, a cogent debt management strategy must be operationalised. Another avenue is to enhance domestic revenue mobilisation by making existing tax instruments, such as the Value Added Tax (VAT), more efficient and simultaneously improving tax compliance. This is one way of mobilising revenue without choking the private sector by increasing taxes.

- Growth should be inclusive: From 2005 to 2015, Zambia experienced a golden decade of growth. While growth was high, it was not always inclusive – national poverty rates declined, but inequality increased. Experts are already warning of a subsequent pandemic of inequality characterised by a K-shaped recovery with top-income earners bouncing back stronger and low-income earners worse off, widening inequality. The recovery, despite limited resources of the government, needs to prioritise tackling inequality. Investment in education and social services will be important in achieving this.

Disclaimer: The views expressed in this post are those of the authors based on their experience and on prior research and do not necessarily reflect the views of the IGC.