Peace or conflict? The impact of private investment in African countries

Private investments can ameliorate or exacerbate conflict in fragile countries depending on the extent to which they are subtractive or additive to the local capital stock.

Research themes: State

Private sector involvement in peacebuilding processes has been promoted and aided since the early 2000s, especially by multilateral agencies. Evidence of this interest is traceable in official strategies and reports such as the current UN Peacebuilding Fund 2020–24 Strategy which argues that “increasing engagement with the private sector, for example by expanding pilots with social impact investment bonds, encouraging SMEs to invest and employ in higher risk areas […] is a key goal for the next few years”. This explicit call for private sector involvement in fragile countries illustrates its importance in understanding the impact it can have on conflict and the wider society and environment.

For this reason, we leveraged our on previous studies (Sonno, 2020; Sonno and Zufacchi 2022) and systematised the available evidence concerning the effect of private investments on civil conflicts in developing countries, by focusing on multinational companies in the African continent.

Why multinational companies?

We focus on multinational companies for three reasons: (1) it is technically simpler and more accurate to study a few large firms than a continuum of very small ones; (2) the peace impact of these firms is typically more significant than local firms; (3) the investments of multinationals are an important feature of African economies. The latter is demonstrated by the fact that in 2019, FDI inward stock in Africa reached the record value of US$ 953 billion. This is approximately 38% of the entire continent’s GDPin 2019, and approximately 3% of the worldwide FDI inward stock.

Within this study, our analysis is divided into three blocks:

- Understanding what existing evidence and literature tell us about the peace impact of private sector investments in fragile and conflict-prone countries.

- Capitalising on this literature using existing granular and geo-localised data to develop a harmonised framework about multinational companies’ peace outcomes;

- Identifying a future policy agenda in the field by building on the insights in the quantitative analysis.

Little and divided understanding of private investments’ peace impacts

Related literature is surprisingly little and severely divided on the peace impacts of private investments. A large strand of the literature provides evidence about the positive peace impacts of these investments through their local effects on the economy (better jobs, technological transfer, and growth more generally). Private investments then may have a positive peace impact by increasing the opportunity cost of conflict. Another equally important part of the literature focuses on the negative peace outcomes generated by private investments through rent-seeking activities and general exploitation. There is, thus, no clear evidence on the impact of private investments.

Identifying conditions for impacts

Drawing on the data and analysis of Sonno (2020) who geolocates multinational enterprises on the whole African continent for more than a decade, we present evidence about the impact of private investments on peace outcomes. To start with, we provide summary statistics about private investments in Africa. Most importantly, we show the majority of multinational companies’ investments are not in primary industries (agriculture, forestry, and mining), demonstrating that their activity in Africa is not limited to extractive sectors.

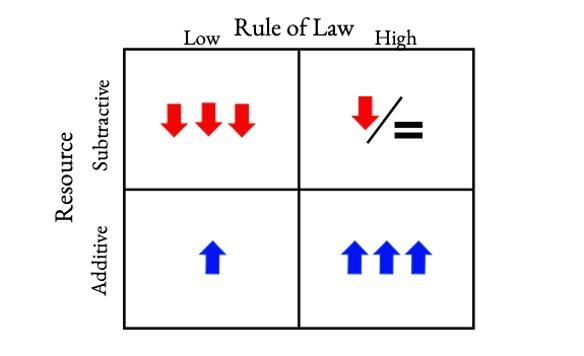

In a descriptive analysis, we find that, on average, private investments in Africa have a negative peace impact – in particular, they seem to increase the likelihood of riot events. However, there is substantial heterogeneity. We therefore, propose a harmonised framework of peace impact consisting of a matrix (see Figure 1) with two dimensions: (1) the extent to which the investment subtracts or adds resources to the local capital stock, i.e., resource balance, and (2) the state capacity in the area, i.e., rule of law. Broadly speaking, additive investments have a positive balance on the local capital stock (even when they subtract resources), while subtractive investments subtract resources. Investments in sectors like agriculture, forestry, and mining, but also low-skill manufacturing, and retail distributors are, on average, resource subtractive. Among resource additive are investments that are more likely, on average, to increase the level of resources in a given area, for example by increasing human capital (through education and health), providing high-skill jobs (such as in ICT), or provide general services to the area (for example electricity, gas, water supply).

The matrix shows how private investments might be peace-negative when they subtract resources from the region. Nonetheless, this negative effect is mitigated in countries with higher state capacity. On the other hand, investments are linked to a positive peace effect when they increase the local capital stock. This in turn can be amplified in countries with particularly high rule of law. The key takeaway from this framework is that firms’ activity and decisions have a core bearing on peace dynamics. As a result, influencing firms to do resource-additive investments may be an important cost-efficient strategy to improve stability and ultimately peace.

Our study then explains in an accessible and non-technical way the instrumental variable analysis developed in Sonno (2020). A positive causal link between the activities of multinational enterprises and violent conflicts is documented, particularly in sectors with scarce resources, especially land. In Africa, farming is the primary source of food and income for the majority of the population. Therefore, on average, land-intensive activity on the part of multinationals increase local grievances and these often escalate to violent actions. Importantly, these effects are magnified in areas targeted for large-scale land acquisitions. In other words, consistently with the framework provided, it is shown that this causal peace-negative relationship is driven by companies that work in resource subtractive sectors, in particular land-intensive ones.

Policy implications

The impact of private investments on conflict is not obvious. This framework reconciles the described division in the literature on the topic. On the basis of these considerations, our study then identifies three policy areas in need of greater focus:

- Monitoring investments and their subtractive/additive nature, in order to understand their impact on individual incentives and potential (compensating) remedies. In other words, if a given investment has a negative resource balance (subtracts more resources than it adds), then one should aim at increasing the amount of resources it leaves in the area.

- Investing in state capacity which, through regulations and monitoring, can offset potential subtractive behaviours and reduce peace negative events.

- Developing a set of alternative policies, grounded on cooperation, incentives, public image of private firms, and NGOs. Specifically, we delineate ways through which normative appeals and cooperation on peace could be fostered, and through which normative compliance by companies could be ensured.

This article is a part of our escaping the fragility trap series. The views expressed here are those of the authors based on their experience and prior research and do not necessarily reflect the views of the IGC.