Reforming India’s energy market: Towards centralised production

To improve efficiency and integrate renewable energy, a centralised economic dispatch model is recommended. A real-time energy market with gate closure should also be introduced. Such market reforms require robust market monitoring and surveillance.

An energy market design that enables buyers to meet their energy requirements, while allowing sellers to adjust their energy output closer to real time, is the need of the hour in India. This would not only improve overall efficiency of the energy market, but also facilitate the integration of renewable energy sources into production. The day ahead time horizon in energy production holds great potential for reform in market design. A centralised energy generation dispatch based on merit order (i.e. in order of the lowest to the highest bid price), at as large a geographic scale as is feasible (i.e. state level, regional, and finally national level dispatch) is recommended, with certain caveats.

The study

My recent paper examines the existing power market design in India, explores the scope of efficiency improvement, and suggests the way forward, with a focus on the potential large-scale penetration of renewable energy sources.

Key questions:

- how to use the existing energy generation resources in India in the most cost-effective manner?

- how to sustain and gainfully utilise the existing capacity (e.g. flexible generation, transmission, etc.)

- how to create new capacity considering the rapid growth in increasingly affordable renewable energy?

Energy generation and dispatch in India: Decentralised versus centralised systems

Electricity distribution companies in India self-schedule (i.e. request power from) the generating stations with whom they have long-term contracts. As each distribution company operates in its own silo (typically, the license area within a state which it serves), it remains oblivious to cheaper options of power procurement (e.g. those located outside of the state it serves).

This decentralised dispatch model is different from the gross pool-based, centralised economic dispatch model, in which generation is determined by the variable cost or bids, from the lowest to the highest. The centralised model is considered to be more economically efficient than the decentralised model.

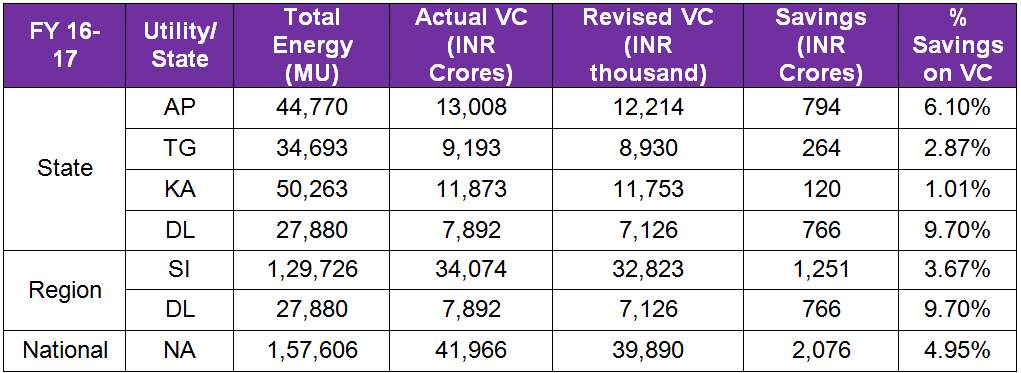

The test

To test this hypothesis, an empirical study was carried out involving four Indian states: Delhi, Karnataka, Andhra Pradesh and Telangana. A comparison was conducted of the variable costs under the existing decentralised dispatch system, compared to the re-ordered, centralised dispatch method at the State, regional and national level. The test revealed substantial savings.

Methodology

The test assumed that there are no generation or transmission constraints in increasing or decreasing the dispatch of any specific generating station. Based on economic theory and international experience (e.g. ERCOT), an energy-only market with a gross pool-based, and centralised economic dispatch model, appears to be the best way to integrate large amounts of renewable energy, with risk management being ensured through financial instruments. In the case of India, while this dispatch model is recommended, it is suggested to have a judicious mix of energy and capacity markets.

Implications

Transition to such a market design will necessitate re-structuring of the electricity generation contracts. In the existing system, a generating company recovers the full fixed cost for its generating station if it declares, it is available for generation on an ‘average’ basis during 85% of the time in a year – please note that such recovery of fixed cost is irrespective of actual generation from such generating station. This study recommends that a part of the generation capacity could be allowed recovery of cost as under the existing system whereas the balance cost could be recovered if it is able to generate during the buyer's hours of need (and not on an average basis). At the same time, there is a need for introducing financial contracts alongside the current system of physical generation contracts. Future contracts could also be designed around these concepts. Further their duration should be seven to ten years unlike the existing contracts which are for twenty-five years or more.

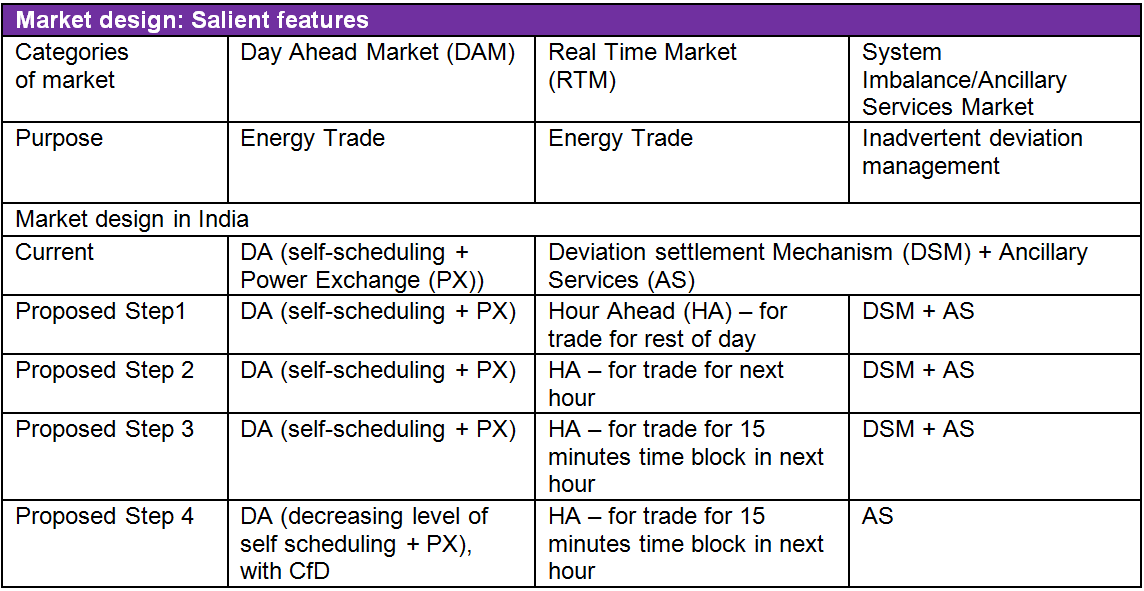

The real-time energy market

In India, the Deviation Settlement Mechanism (DSM)/Un-scheduled Inter-change (UI) mechanism seeks to meet real-time ‘energy’ requirements, as well as last mile inadvertent ‘imbalance’ settlement. A real-time energy market, with the concept of gate closure (that is, with the provision for closing one hour before the actual time of dispatch, the option to revise generation schedule for the generators or drawl schedule for the buyers) should be introduced. Furthermore, once the hourly market matures, India could think of reducing gate closure time to 15 minutes. Alongside this, the ancillary services mechanism should be strengthened and graduated from the current administered framework to a market based system. The real-time energy market together with market-based ancillary services will eventually obviate dependence on DSM/UI mechanism.

In the process of unleashing market forces in the day ahead, as well as providing access to real-time segments, a need would arise for adequate safeguards against market failures. Accordingly, market monitoring and surveillance need be strengthened to mitigate market manipulation and gaming.

Policy recommendations

- The study recommends a gross pool-based, centralised economic dispatch model on a day ahead basis, with certain caveats.

- It is recommended to have a mix of long and short-term contract The long-term contracts could be in the range of seven to ten years, with provision for the recovery of a certain pre-specified percentage of the total fixed cost, based on an average availability. Part of the capacity should be recovered based on generation during hours of need. This contracting structure could help design a mix of energy only market and capacity market.

- For the real-time market, reliance on the DSM/UI mechanism for energy trade should be discouraged. A real-time energy market with gate closure (one hour before the time of operation) should be introduced. This will eventually reduce market participants’ dependence on DSM/UI for energy trade. At the same time, the existing ancillary services framework should be further strengthened and graduated to a market based mechanism. This will dissuade market participants from leaning on the DSM/UI mechanism for handling inadvertent deviation and system imbalances.

- An important component of market reforms, as reflected in international experience, is robust market monitoring and surveillance. India should give equal emphasis to this aspect as it pursues reforms in the market design of the energy sector.