Reforming property tax valuation in Sierra Leone

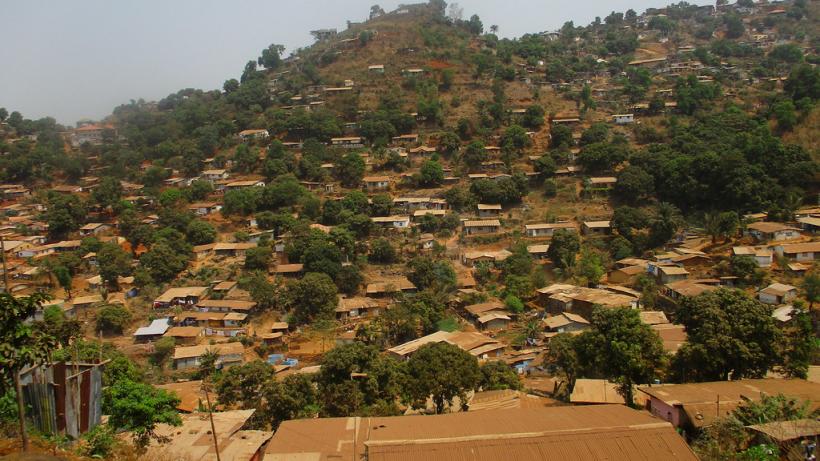

Across sub-Saharan Africa, ineffective property valuation presents a serious hurdle to strengthening local property taxes. Between January and August 2019, the International Growth Centre (IGC) co-piloted a simplified approach to property valuation in Freetown, Sierra Leone, that combines both surface area and easily-observable characteristics to arrive at an estimate of market value. Several important lessons emerged from the pilot, both for the city-wide scale-up and for other jurisdictions interested in pursuing similar reforms.

Like many cities in sub-Saharan Africa, Freetown currently operates an obsolete property valuation method inherited from the colonial era (Jibao, 2017). With the recent election of Mayor Yvonne Aki-Sawyerr in March 2018, there appears to be a unique window of opportunity for reform. The Mayor has made revenue mobilisation a central pillar of her reform agenda, with the ambitious target of increasing tax revenue five-fold from Le 7 billion to Le 35 billion by 2020 (FCC, 2019).

Property valuation for taxation

As effective property taxation depends on efficient property valuation, updating Freetown’s manual floor area-based valuation method is at the heart of the reform efforts. Property valuation typically falls into one of two categories: Market-based or surface area-based approaches.

Market-based approaches have the benefit of ensuring that owners of the most valuable properties face the highest tax liability. However, in the absence of a well-developed real estate market, data on property market values is often not available, and market-based valuations become highly subjective (Zebong, Fish and Prichard, 2018).

Surface area-based methods have the advantage of being transparent, but may neglect qualitative aspects of buildings (such as location and structure quality) that are major determinants of value. Surface area-based approaches thus run the risk of contributing to relatively regressive taxation (Zebong, Fish and Prichard, 2017).

Based on these considerations, the African Property Tax Initiative (APTI) at the International Centre for Tax and Development (ICTD) has developed a simplified hybrid method of valuation that uses both surface area and easily-observable characteristics to arrive at an estimate of market value. Termed “points-based property valuation,” this method assigns a standard number of points to buildings based on their surface area, and then adds or deducts points for positive or negative property characteristics, respectively (Fish, 2018).

Piloting a points-based valuation in Freetown

Between January and August 2019, the IGC Sierra Leone Programme, in partnership with the ICTD, implemented a proof of concept pilot project to introduce and refine the points-based system in Freetown. During the course of the pilot, enumerators collected property characteristics from over 11,000 buildings in two wards in Freetown, while staff of the Freetown City Council (FCC) Valuation Department collected data on rental values for a sample of 2,000 properties randomly selected from all wards in the city. This sample was used to calibrate the points-based system with available rental market data.

Additionally, technicians were hired to measure the floor area of each property using a computer-aided mass appraisal (CAMA) technique. Throughout the pilot project, qualitative interviews were conducted with members of the reform team and the FCC Valuation Department to identify key lessons learned for the city-wide scale-up.

The necessity of high-level political leadership

High-level political leadership, in the form of the Mayor’s “Transform Freetown” agenda, was a major enabler of the pilot project’s success. Residents frequently cited their support of the Mayor’s agenda when interacting with enumerators and expressed the hope that they would see tangible benefits in their own neighbourhoods.

It appears that situating the property tax reform in a broader narrative of transformation and service provision made it more palatable to residents and increased their willingness to share important information. The Mayor’s popularity, coupled with the Transform Freetown agenda, seemed to provide a crucial window of opportunity during which residents were willing to give her administration “the benefit of the doubt” that expanded property taxation would enable enhanced service provision.

This anecdotal evidence aligns with the experience of other jurisdictions in sub-Saharan Africa, where the provision of salient public goods and services is an important contributor to the development of an effective social fiscal contract (Besley, 2019). The current widespread lack of public goods and services thus provides ample opportunities to improve voluntary tax compliance, the effect of which will be evaluated as part of the research phase of the city-wide scale-up.

Reducing indicator subjectivity through field testing

Although the majority of indicators in the valuation survey were based on objectively observable characteristics, there was initially a substantial amount of variation between individual enumerators and between the enumerators and backcheckers. Some backcheckers, for instance, found up to 60% error in the values entered by enumerators. Most of this discrepancy can likely be attributed to the subjectivity inherent to some of the indicators.

For instance, the definition of a good condition street, or a roof in a poor state of repair, differed between individual valuers and between valuers and backcheckers. Harmonising definitions, even for seemingly objective characteristics like window type, required extensive field testing and open communication between the various stakeholders involved.

Local expertise is the driver of success

The FCC Valuation Department faced a number of challenges to being fulling engaged in the reform process, stemming largely from a latent suspicion that the reform, which promises to automate much of the valuers’ current workload, may put their livelihoods at risk. Additionally, full implementation of the points-based valuation methodology requires a high degree of familiarity with information technology (IT) platforms that some senior members of the Valuation Department currently lack.

Overcoming these challenges required an extensive period of training and relationship building between the reform team and the Valuation Department to build the level of trust necessary to proceed with the pilot project. Subsequently, the contextual expertise of the Valuation Department was essential both to (1) refining and harmonising indicator definitions and to (2) securing a reliable sample of property rental values needed to calibrate the points-based system. Therefore, taking measures to enhance collaboration with local experts in the Valuation Department furthered the success of the overall pilot.

References

Besley, T. (2019). State Capacity, Reciprocity, and the Social Contract, London: London School of Economics. Accessible: http://www.lse.ac.uk/economics/Assets/Documents/personal-pages/tim-besley/working-papers/state-capacity-reciprocity-and-the-social.pdf

FCC (2019). Transform Freetown: An Overview, 2019-2022, Freetown: Freetown City Council. Accessible: http://fcc.gov.sl/wp-content/uploads/2019/01/Transform-Freetown-an-overview.pdf

Fish, P. (2018). Practical Guidance Note: Training Manual for Implementing Property Tax Reform with a Points-Based Valuation, Brighton: International Centre for Tax and Development.

Jibao, S. (2017). Sierra Leone. In R. Franzsen and W. McCluskey (Eds.), Property Tax in Africa: Status, Challenges, and Prospects, (364-376), Cambridge, MA: Lincoln Institute of Land Policy.

Zebong, N., Fish, P. and Prichard, W. (2017). Valuation for Property Tax Purposes, ICTD Summary Brief Number 10. Brighton: International Centre for Tax and Development.

Zebong, N., Fish, P. and Prichard, W. (2018). True Values, RICS Land Journal, June/July, 24-26.