Rethinking climate finance to solve the sustainable urbanisation challenge

Climate finance in its current form is unlikely to solve the “financing gap” for sustainable urbanisation in developing cities and may even serve to exacerbate inequalities between rich and poor countries.

Unaddressed climate change can result in the shrinking of the world economy by 18% in the next 30 years with losses being disproportionately greater in developing countries. Cities in developing countries, particularly, are facing dual vulnerabilities of climate change and rapid urbanisation with limited resources. While densely populated cities in Africa and Asia likeJakarta, New Delhi, Lagos, and Karachi are most at risk of natural calamities and extreme weather events, they are also the least equipped to deal with them.

Investments undertaken today may determine whether cities become engines of sustainable growth and safe havens from climate catastrophes or remain on a path of unplanned growth, congestion, and pollution. However, many developing country cities face challenges when it comes to financing these vital investments. Responding to rapid urbanisation in developing countries while addressing and adapting to climate concerns requires large and urgent investments in municipal infrastructure and services. Since COP-2009, climate finance has been deliberated to ensure that adequate resources are allocated to achieve the ambitious mitigation and adaptation objectives outlined in various global agreements.

The United Nations Framework Convention on Climate Change (UNFCC) defines climate finance, as the raising of funds from public, private, and alternative sourc es to reduce emissions, encourage adaptation, and enhance resilience. Since the Paris Agreement, there has been an explicit focus on encouraging high emitting, richer, countries to make additional resources available to developing countries. However, the climate change funding commitments remain unfulfilled. Since 2009, wealthy nations have failed to meet their commitments to the US$ 100 billion climate finance goal, leading to mistrust among nations

In its current form climate finance faces the following challenges for developing country cities:

- Climate finance is skewed towards mitigation rather than adaptation

- Stringent requirements for accessing concessional climate finance disproportionately impact developing countries

- Systemic issues impede cities in developing countries from accessing all forms of finance, climate related or otherwise

Climate finance is skewed towards mitigation rather than adaptation

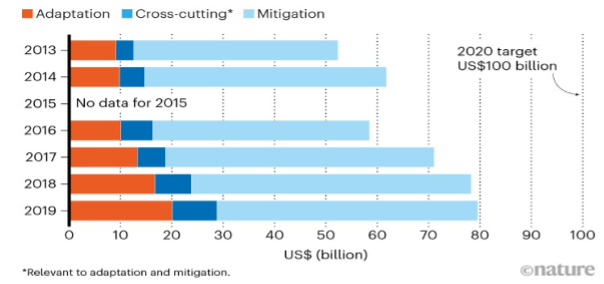

Climate finance is predominantly focused on mitigation, whereas adaptation and “loss and damage” resulting from climate change are underfunded despite being considerable challenges for developing countries. Although the discussion on “loss and damage” was a major win from COP-27 there has been no concrete conversation on adaptation and the promised ‘global goal on adaptation’ remains undefined. This is in turn impeding the mobilisation of finance and implementation. For example, b etween 2010 and 2018, global public adaptation finance was only 6% of international official development assistance (ODA) (US$1.3 trillion). Figure 1 below highlights that adaptation funding is still a much smaller share of overall climate finance in developing countries.

Figure 1: Climate finance expenditure trends

Notes: Although allocations to adaptation have increased, the bulk of public climate financing to developing nations still goes to mitigation projects, rather than to supporting people to adapt to climate change. Source: Timperley 2021

Donors tend to favour mitigation projects for two main reasons:

- The success of mitigation projects is easier to quantify and measure. For high-income countries, this reinforces the domestic political narrative around climate mitigation efforts. The benefits of this spending are also global, and therefore partially experienced in the donor country.

- There is a return on investment. For example, investments in solar farms and electric cars is viable because there are tangible profits that can be accrued. Adaptation funds to vulnerable countries do not generate direct revenues but provide a public good, and thus the return on investment remains low.

Stringent requirements for accessing concessional climate finance disproportionately impact developing countries

In line with the focus on mitigation rather than adaptation, data shows that debt-creating instruments account for almost 60% of climate finance, while76% of climate multilateral loans are non-concessional.

Cities in developing countries struggle to access non-concessional finance and face debt sustainability issues. Furthermore, the physical and economic losses of climate change diminish the capacity to repay existing debt. This creates a vicious cycle, whereby the accumulating debt inhibits adaptation and resilience investments, further aggravating climate vulnerability. In addition, due to the increased risk of climate-related calamities, the cost of borrowing is greater in vulnerable countries, thus lowering the fiscal space available to invest in climate action.

This is particularly stark during emergency needs such as climate-induced disasters. On a recent IGC panel on the impacts of climate change on human wellbeing in developing countries, Pakistan’s Federal Secretary for Investment in the Prime Minister’s Office bemoaned the fallibility of climate financing. He explained that while a lot of money seems to be available, none of it is accessible for issues like the recent floods. In Pakistan, despite the country’s high emissions and low GDP per capita, accessing concessional international climate finance (CF) requires them to meet stringent qualifying criteria.

This is also applicable when it comes to mitigation. An IGC study on recent developments in climate finance in Pakistannotes that most renewable energy-related initiatives receive funding from private equity and market-rate debt because it is expected to provide an adequate return on investment. However, mitigation initiatives in less developed nations are not able to access the lower interest rates that could arise from tax-exempt green bonds issued in more developed countries, and by virtue of the expected return, are not viable options for concessionary finance either – leaving them caught in the middle.

Systemic issues impede cities in developing countries from accessing all forms of finance, climate related or otherwise

Developing country cities face numerous challenges in attracting finance more broadly as highlighted in this working paper on financing sustainable urban development and this UNFCC Report. This serves to reinforce inequalities between who can and can’t access certain climate financing instruments. Issues include:

- Funding being negotiated at the national level gives cities extraordinarily little leverage to advocate for localised needs and interests.

- A lack of investment in fiscal management at the municipal level renders many developing country cities inherently uncreditworthy. They equally have limited capacity to identify, design, and package ‘bankable’ projects

- The funding landscape and application processes are fragmented and complex to navigate.

Without tackling these underlying issues, developing country cities struggle to access climate finance, just as they struggle to access financing for business-as-usual activities. This is before considering the additional restrictions that climate finance imposes, such as tight criteria for what makes a project “green” or the need for improved data, monitoring, and evaluation to determine whether executed projects meet these requirements. If there is to be equitable access to climate finance in the future, focus must be placed on addressing these underlying issues.

Insufficiencies in the climate and development financing systems impede the ability of developing countries to combat climate change. Inadequate resources , a lack of accessible funding for adaptation in developing countries , and the vicious cycle between debt and climate vulnerability are among the most significant barriers. It is imperative to i mprove our comprehension of climate risks to reimagine the management of climate-related finances and focus on adaptation.

To learn more about sustainable urbanisation, read IGC growth brief on Sustainable urbanisation in developing countries: Cities as places to live and Sustainable urbanisation in developing countries: Cities as places to innovate, trade, and work. You can also register for the conference hosted by IGC in collaboration with World Bank on Poverty Reduction.