Zambia's debt crisis is affecting its ability to collect tax

Zambia’s debt contraction has not increased growth and growing debt servicing costs have weakened the economy and in turn stifled tax revenue collection. This has left the country in a vicious cycle where it needs to borrow to finance economic development.

Zambia was the first country to default on sovereign debt during the pandemic. It is now the test case for addressing developing country debt in a post-COVID-19 world. This is happening in a shifting landscape for low-income countries (LICs) debt that looks very different from the debt crises of the 1980s and early 2000s that many developing countries got caught up in. Three main things have emerged from this evolving landscape. First, there are flaws in the international sovereign debt system for developing countries as there is no clear system for countries to follow. Second, the type of debt held by LICs like Zambia has changed, shifting from concessionary bilateral debt to commercial debt such as Eurobonds. Finally, the rise of China as a major player in the LIC debt market is probably the biggest and most significant change. Consequently, the process of debt restructuring for Zambia is proving long, painful, and protracted.

There is often a temptation to focus on symptoms and not causes when addressing development challenges, especially for challenges like unsustainable debt which stem from a variety of causes. We explore one of the reasons why countries like Zambia repeatedly find themselves in debt – a limited ability to collect tax.

Using debt to finance economic development

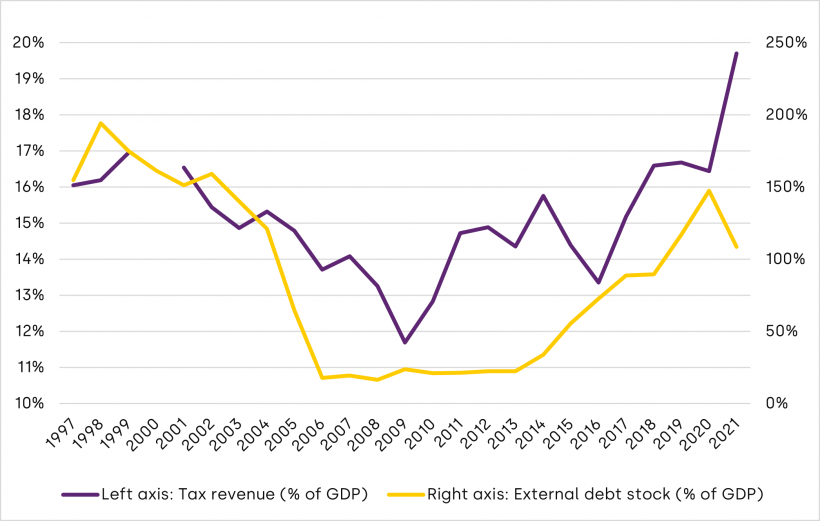

It is easy to understand why developing countries like Zambia resort to debt as a means of financing development. Like many developing countries, Zambia struggles with low tax collection and only collected 19.7% of GDP in 2021 (Figure 1). This is far less tax than is needed to finance development. Low tax collection limits the government’s ability to provide the public goods and services that citizens need. These needs range from recurrent expenditure to fund the healthcare and education systems to larger capital outlays for infrastructure such as roads. Debt financing is seen as a means of bridging this gap especially for large infrastructure projects, and this was what Zambia resorted to.

Figure 1: Zambia's tax- and debt-to-GDP ratios

Notes: Zambia’s tax revenue as a proportion of GDP fell continuously from about 16% in 1997 to 11.7% in 2009 after which it rose gradually with a major dip in 2016. Debt also fell steadily from 1997 to 2005, remaining relatively low until a resurgence in external borrowing in 2014. Figure generated by author using relevant indicators from this World Bank data.

Debt increasing faster than tax revenue

Debt when managed correctly is a legitimate avenue for financing this gap. Debt contraction can, however, quickly become uncontrolled and unsustainable, unleashing a vicious cycle where a country doesn’t collect enough tax and so it borrows to finance the gap. It then runs up its debt levels which result in increased borrowing costs as interest payments escalate and debt servicing increases as a proportion of the government’s budget. The Zambia case is a typical illustration of this. Zambia is projected to spend 30% of its revenue on debt payments between 2022-2024. Debt is ultimately repaid from tax revenues, but it is quicker to contract debt than to expand the tax base. This means debt tends increase at a faster pace than revenue mobilisation leading to a downward spiral.

This is the very situation that Zambia finds itself in. In 2005, Zambia reached the Highly Indebted Country Completion Point (HIPC) that led to the cancellation of most of its debts. This was after a protracted debt crisis that started in the 1970s and peaked with debt at almost twice of Zambia’s GDP. Figure 1 shows that Zambia’s debt fell from 1997 to 2005 and remained relatively low until 2013. There was then a resurgence of external borrowing in 2014 which marked the beginning of a dramatic transition of Zambia’s creditor composition toward China and the private sector. Although Zambia's creditors are currently a mix of bilateral and multilateral institutions, China is the largest single bilateral lender among them, with US$ 5.5 billion worth of debt stock owed by Zambia, accounting for around 30% of Zambia’s annual GDP in 2020. In Africa, Zambia is one of the outliers, pulling far ahead of other countries in the extent to which Chinese loan commitments dominate its loan portfolio (see Figure 2).

Figure 2: Chinese lending to Zambia by lender (in US$ million)

Notes: Chinese lenders held 13 per cent of the African continent's debt in 2019. Angola, Djibouti, Republic of the Congo and Zambia are clear outliers. Zambia’s Chinese aggregate loan commitments amounted to 43 per cent of GNI. Source: Brautigam (2022).

In Figure 1, Zambia’s tax-to-GDP ratio follows a similar pattern to its debt-to-GDP ratio, falling over the 1990s. Zambia’s economic growth was low at this time and the tax-to-GDP ratio mirrors this. The tax-to-GDP ratio begins to rise post 2009. The combination of a better performing economy and reforms in tax administration and modernisation of the tax system contributed to increased efficiency and greater revenue collection. One inevitability is that debt tends to increase at a much faster rate than tax mobilisation. In 2020, Zambia missed its first payment on US$ 42.5 million worth of Eurobond debt sparking the current debt crisis.

Rising debt limits the economy and hampers tax collection

Debt affects revenue mobilisation in several important ways. Revenue mobilisation is directly affected by debt constraining the economic environment in a way that leads to low economic growth. Low economic growth means less tax to collect. These are some of the channels that debt affects tax collection. Domestic government debt crowds out the private sector by limiting the funds available to borrow. This constrains the private sector’s ability to grow the economy, create jobs, and generate revenues that can be taxed. Debt also increases the risk of fiscal crises by creating an unstable macroeconomic environment. External debt repayments put pressure on the exchange rate contributing to it deteriorating and making imports more expensive thereby contributing to higher inflation. This, in turn, contributes to lower growth. Further, debt creates a crowding-out effect, where the government’s high interest payments and repayments consume a significant portion of the government's revenue, leaving less room for the country’s self-financed public investment. This creates a greater incentive to borrow to finance public investment and thus, beginning the cycle again.

Better taxation is the long-term solution to the debt problem

The long-term solution for avoiding debt traps it to adopt measures that reduce Zambia’s reliance on external borrowing. This includes adopting more fiscally prudent policies, such as controlling public spending and being parsimonious with government expenditure. A better international framework governing the contracting of debt also needs to be developed. To ultimately end the debt dependency, Zambia must prioritise domestic revenue mobilisation. This will require a concerted effort to increase tax compliance, enhance enforcement, and widen the tax base.