Trade costs and potential: Removing barriers to growth in Pakistan

Reducing trade costs and barriers remains an important means of accelerating the economic growth of a country. Today’s blog illustrates the concept of trade costs and compares Pakistan’s trade cost indicators with those of its regional neighbours.

International trade is costly. Exporters bear a plethora of fixed and variable costs, such as documentation, transportation, border delays, tariffs, and non-tariffs. In the last two decades, multilateral negotiations under the auspices of World Trade Organization (WTO) have driven down tariffs to historical lows. Improvements in shipping connectivity and the IT revolution have drastically reduced transportation and communication costs. Reduced costs have, in most countries, influenced the nature, direction and composition of trade flows.

Better connectivity and trade agreements could unlock the benefits of trade for Pakistan

To date, Pakistan’s trade regime has been mainly MFN (Most Favoured Nation) in nature. It is still not party to most of the ongoing negotiations on regional integration or the constitution of mega trading blocks. If the emerging international trade architecture reduces trade costs and diverts existing trade flows, it could have a negative impact on comparative advantage of Pakistan’s exporting sectors.

Pakistan is believed to have enormous potential for increasing its international trade. At present, this potential remains untapped due to high trade costs. A recent study conducted at the Commonwealth Secretariat, London shows that in 2013, Pakistan under-traded with the former British colonies to the tune of 400%: its exports to these countries amounted to $4 billion, against a potential of around $20 billion. Another similar investigation by the Global Trade Analysis Project (GTAP) predicts that a reduction in trade costs in Pakistan to the level of those of Singapore could increase Pakistan’s GDP by $10 billion, create 2.2 million jobs and reduce poverty by 5%. The best time to harness this unexploited potential was ‘yesterday’, and the second best time is ‘now’. However, to do so requires an innovative policy response in line with the current developments in the domain of trade facilitation.

Measuring the costs of trade

Trade costs include all the factors that drive a wedge between the producers’ price in the country of origin and the consumers’ price in the country of destination. Most trade costs are difficult to observe and measure directly; most studies therefore, compute them indirectly. The burgeoning scholarly and technical literature on trade policy analysis uses geographical distance between trading partners as a proxy for these costs.

Global Trade Analysis Project (GTAP) predicts that a reduction in trade costs in Pakistan to the level of those of Singapore could increase Pakistan’s GDP by $10 billion, create 2.2 million jobs and reduce poverty by 5%.

Multilateral institutions, however, have developed various indices to compare these costs across countries. For example, the World Bank uses a logistic performance index (LPI), which is based on a survey of business enterprises. Similarly, the United Nations Conference on Trade and Development (UNCTAD) employs the liner shipping connectivity index (LSCI), which is computed using various components of maritime connectivity.

Trade costs: How Pakistan ranks

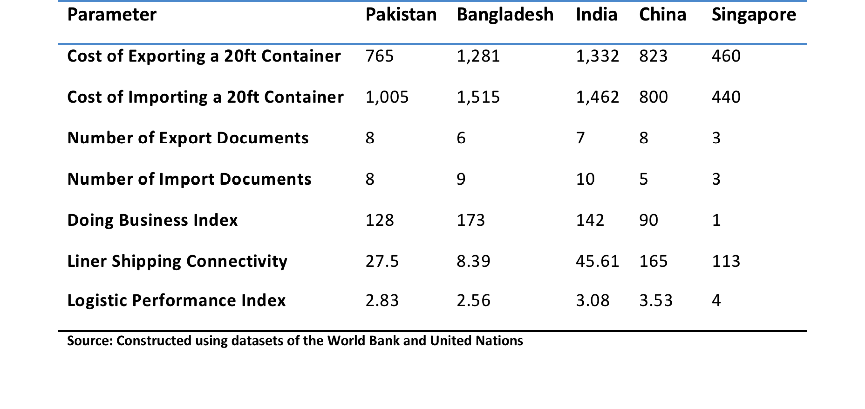

Table 1 presents some of the indicators reflecting different aspects of the costs of trading. It compares the relative rankings of Pakistan with that of regional economies, India and Bangladesh. Despite performing well on costs of exporting, and ‘ ease of doing business’, Pakistan still has much ground to cover on improving its shipping connectivity and logistic performance.

Table 1: Commonly used trade cost indicators

Notes: Data from China and Singapore serves as a benchmark of global leaders in trade facilitation.

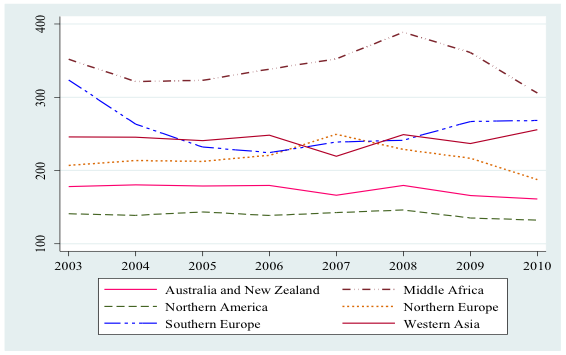

These indices are informative to a certain extent. A fuller picture, however, emerges from the World Bank’s recently released bilateral trade-cost dataset, spanning 178 countries. The dataset measures the trade-depressing effects of national borders, relative to the costs of domestic trade. Exploration of this dataset indicates that Pakistan’s bilateral trade costs are relatively higher than those of most developing economies. Moreover, costs vary widely between trading partners, as do Pakistan’s export shares to various markets (Figure 1, Table 2).

It appears that the costs of exporting are lower for trading with the economies of North America, Europe and with Australia and New Zealand. This can be explained by the relatively higher shipping line connectivity of these countries. By contrast, trade costs are highest for the counties located in Middle Africa (most likely due to the landlocked nature of these economies).

Figure 1: Evolution of Pakistan’s trade costs between different regions over time

Source: Author’s work using bilateral trade cost dataset of the World Bank

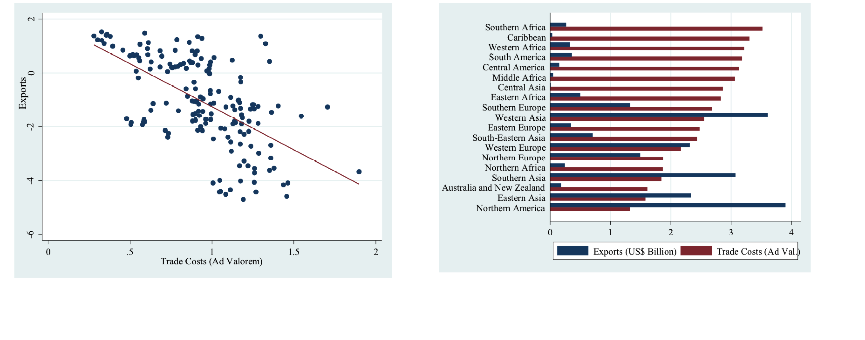

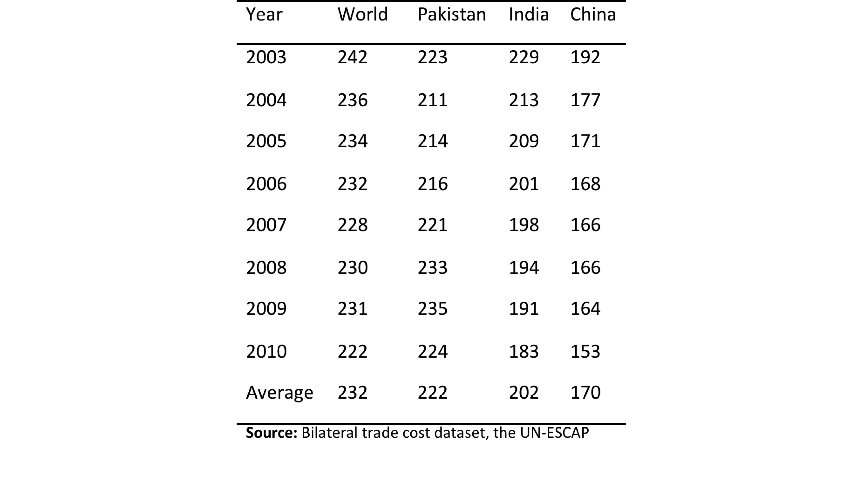

Although Pakistan’s trade costs decline over time, the decline is uneven across countries. Overall, Pakistan’s trade costs have almost been stagnant (Table 2). By contrast in India and China, costs are continuously falling; the drop is much more pronounced for China than India. Export volumes vary inversely with the trade costs. As a result, Pakistan’s exports are concentrated in regions with lower trade costs (Figure 2 and Figure 3).

Greater connectivity has the potential to reduce costs, incentivise higher trade volumes and expand product mixes

A key insight from this data is that some of the trade cost indicators in Pakistan are much more promising than those of its neighbours. For example, Pakistan ranks relatively higher on the World Bank’s ‘Doing Business Index’. The cost of exporting or importing a 20-foot container is around 35% lower in Pakistan than in India or Bangladesh. Moreover, Pakistan’s border-clearance procedures ranked among the most efficient in the developing world. However, bilateral trade costs are relatively higher in Pakistan and vary enormously across its trading partners, as does Pakistan’s export share to various markets.

Figure 2: Trade volume varies inversely with trade costs |

Figure 3: Concentration of exports to low trade cost regions |

Notes: Trade volume is measured in billions of US dollars, while trade costs are measured in ad valorem equivalents (normalised with 100 to make the corresponding bars comparable)

Source: Calculations using bilateral trade cost dataset, the UN-ESCAP and Trade flows from WITS

Pakistan still has the potential to reduce trade costs significantly by improving shipping connectivity and enhancing its logistics performance. Considerable investment in infrastructure to link major seaports and international airports to the hinterland could reduce domestic trade costs. Similarly, policy incentives to attract more shipping lines to navigate Pakistan’s ports could drastically reduce international trade costs. This reduction in domestic and international trade costs will incentivise more firms to export and encourage existing exporters to expand their volumes and widen their product mix.

Table 2: Average bilateral trade costs

Currently, various efforts are being made at national, regional, and multilateral forums to facilitate trade flows. Pakistan needs to actively engage in these initiatives to benefit from the changing patterns of world trade. Two recent initiatives are the WTO’s trade facilitation agreement (TFA), and the US-led mega trading blocks in Asia and Europe (TPP, TTIP, and REC). Active involvement in these programmes could improve the comparative advantage of Pakistan’s export-oriented firms.

Pakistan still has the potential to reduce trade costs significantly by improving shipping connectivity and enhancing its logistics performance.

Accession to the WTO’s trade facilitation agreement (TFA) may not generate many trade gains, as Pakistan has already implemented most of the provisions of the agreement unilaterally. Additionally, most trade costs faced by Pakistan’s exporters are induced by non-tariff measures, namely infrastructure, and connectivity challenges. These issues are not addressed in the TFA, which focuses on streamlining border clearance procedures.

Conclusion

Any meaningful trade facilitation warrants active policy responses at the domestic and bilateral levels. This will mean signing trade deals with the countries of high-trade-cost regions. Otherwise, Pakistan’s trade will continue to grind forward with the handbrake on.