Resource discoveries, FDI bonanzas, and local development: Evidence from Mozambique

The natural resource price boom of the 2000s and the accompanying discoveries, many of them in sub-Saharan Africa, revived economists’ interest in the effect of natural resources on development. One notable insight is that discoveries themselves should be of interest to economists as they have their own economic consequences before extraction happens. Indeed, recent research suggests that when economies unpredictably discover a lot of oil, investment flows in right after the news shock hits, creating an expectation-driven pre-boom boom. This is certainly an aspect of the resource boom which needs to be taken into account when analysing the effects of natural resources on economic development.

- In the first part of our project we looked at what happened to foreign direct investment (FDI) when a developing country makes a giant oil or gas discovery, an event which is unpredictable due to the uncertainty of exploration. We found that FDI inflows boom in the two years following a giant discovery. Most importantly, this is not a boom in FDI directly related to the extraction of natural resources but a bonanza of diversified FDI projects from manufacturing to services and construction. Our estimates suggest that FDI inflows increase by 73% and that this is driven by a 37% increase in the number of projects and a 17% increase in targeted sectors. Our results can thus be interpreted as evidence for news-driven FDI, highlighting FDI bonanzas as a development opportunity for resource-rich economies.

- In the second part of our project, we explored the local impact of such FDI booms by looking at the case of Mozambique. The latter is a case in point as in late 2010, news of large natural gas discoveries off its coast created much fanfare among development economists and policymakers as it became clear the country now had an incredible opportunity to grow out of poverty.

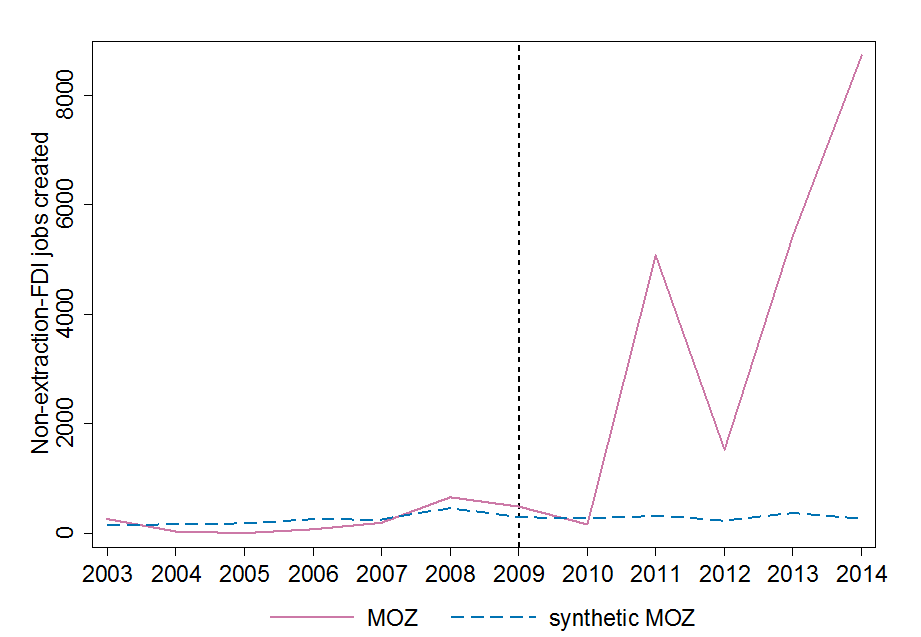

Data from UNCTAD suggests that foreign investment did start flowing in right after the discovery. Mozambique’s FDI inflows boomed from 2010 onwards and in 2012 Mozambique received 15% of all sub-Saharan African FDI. In 2013-2015, FDI amounted to 70% of its GDP, the highest share of all African countries. According to fDi Markets, 100 greenfield non-extraction projects have been recorded from 2009 to 2014, 45 of which in Maputo. These were worth around $21 billion and created 25,500 jobs, mostly in construction, manufacturing, and services. A synthetic counterfactual analysis suggests that none of this would have happened without the gas discovery. Indeed, the number of jobs created by non-extraction FDI in the synthetic control, a weighted average of FDI jobs in countries with no discoveries that mimics Mozambique before 2010, remains flat around 500 per year (Figure 1).

Has the boom in FDI projects across Mozambique really increased employment, or are these numbers inflated by foreign multinationals? To check whether these job numbers are accurate we delved into Mozambique’s Household Surveys (Inquérito sobre orçamento familiar, 2002 - 2008/09 - 2014/15). We matched information on individuals’ jobs to FDI projects across cities, sectors and year and estimated the impact of these FDI projects on jobs using a triple diff-in-diff model. We found that one additional FDI project in a particular city and sector, e.g. a new British bank in Beira or a new South African supermarket in Tete, created at least 434 jobs on average. This suggests that FDI to Mozambique from 2009 to 2014 created around 43,400 jobs, or 3% of all jobs in the country. This number is even higher than the 25,000 jobs initially announced by the multinationals and may point to indirect job creation. We also found that the average wage in a particular city in a particular sector increased by 0.8% with each extra FDI project. The flipside is that such an increased demand for workers and higher wages may have attracted migrants in search of new job opportunities. This would explain why we find no evidence that FDI inflows had any effect on the employment rate across cities.

Mozambique’s recent experience with FDI thus provides some micro-evidence for the pre-boom boom identified across countries. Our plan is to dig further into the data to identify the spillovers FDI may have on local business creation and skill acquisition to improve our understanding of FDI’s ability to contribute to economic development.