Growth brief: Transforming the economic lives of the ultra-poor

A livelihood programme providing productive assets and skills training to the poorest women in Bangladesh village economies helps them move into more stable self-employment and achieves significant reductions in poverty.

-

Growth brief: Transforming the economic lives of the ultra-poor

PDF document • 389.66 KB

Introduction

Despite considerable progress in recent decades, nearly 1 billion people worldwide live below the international extreme poverty line of $1.90 per day. A group that has been particularly hard to reach with anti-poverty programmes are the ‘ultra-poor’. With low assets and few skills, the ultra-poor work largely in insecure wage labour, do not participate in modern economic growth and have been difficult to target with credit and human capital policies.

This brief describes key findings from a rigorous seven-year evaluation of the first livelihood programme targeting this group, BRAC’s ‘Targeting the Ultra-Poor’ programme in rural Bangladesh. It also includes recommendations for policymakers and future research.

KEY MESSAGES

1) Job choices available to women in poor rural villages are limited and related to poverty levels. Wealthier women can access more stable and productive work, while the ‘ultra-poor’ work irregular, poorly-paid jobs.

Wealthier women can access more stable and productive work, while the ‘ultra-poor’ work irregular, poorly-paid jobs.

2) Combining large-scale asset transfers and skills training provides the ultra-poor with access to self-employment and increases earnings by 37%. Seven years after implementation, earnings, consumption, and savings gains are sustained or increasing.

Seven years after implementation, earnings, consumption, and savings gains are sustained or increasing.

3) Benefits for the ultra-poor do not come at the expense of other households. Within programme villages, households that do not receive transfers maintained consumption and savings and increased business assets.

Within programme villages, households that do not receive transfers maintained consumption and savings and increased business assets.

4) The poorest face barriers – rather than being unwilling or unfit – to engage in similar jobs as wealthier women. Average benefits of the programme are 5.4 times its cost. High internal rates of return suggest the poorest face barriers to accessing more productive jobs.

Average benefits of the programme are 5.4 times its cost. High internal rates of return suggest the poorest face barriers to accessing more productive jobs.

5) BRAC’s approach can be scaled up and successfully adapted to different contexts. Results from similar programmes suggest ‘big-push’ livelihood programmes can help the ultra-poor onto a sustainable path out of poverty.

Results from similar programmes suggest ‘big-push’ livelihood programmes can help the ultra-poor onto a sustainable path out of poverty.

Despite considerable progress in recent decades, nearly 1 billion people worldwide live below the international extreme poverty line of $1.90 per day. A group that has been particularly hard to reach with anti-poverty programmes are the ‘ultra-poor’. With low assets and few skills, the ultra-poor work largely in insecure wage labour, do not participate in modern economic growth and have been difficult to target with credit and human capital policies.

Key message 1 – Job choices available to women in poor rural villages are limited and related to poverty levels

For the 896 million people1 living below the international poverty line worldwide today productive employment activities are essential for increasing incomes and moving poor households out of poverty. Yet, the choice of jobs available to the poor is often limited. Even within poor communities, often only wealthier individuals have the most stable and productive jobs, while the ‘ultra-poor’ depend on jobs with lower and more irregular incomes.

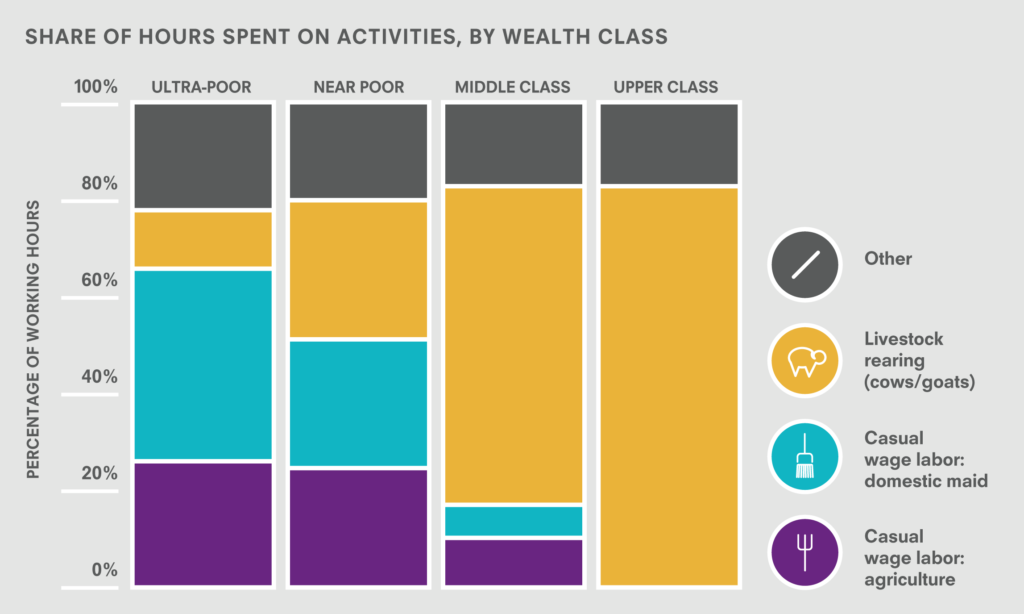

This study of BRAC’s ‘Targeting the Ultra-Poor’2 programme (Bandiera et al. 2015) considers the employment opportunities and choices of women in different wealth classes in 1309 villages across Bangladesh’s most vulnerable districts. In these village economies, the choice of jobs is limited and women effectively choose between casual wage labour in agriculture or working as a domestic maid, and self-employment in livestock rearing. Before the intervention, there is a clear division in employment activities by wealth class. As shown below, the poorest women are far more reliant on casual wage labour, while women from wealthier households are predominantly engaged in livestock rearing.

This division is important for two reasons. Firstly, hourly earnings for wage labour are lower than those for livestock rearing – while there is variation across space, on average hourly earnings in livestock rearing are more than double those for wage labour. Secondly, those engaged in livestock rearing work consistently throughout the year, whereas demand for agricultural labour is seasonal. As a result, women in poor village communities are constrained in the employment opportunities they can access, and it is the poorest who work in the lowest-paying jobs and face irregular income streams throughout the year.

Figure 1: Share of hours spent on activities, by wealth class

Key message 2 – Combining large-scale asset transfers and skills training provides the ultra-poor with access to self-employment and increases earnings by 37%

Several programmes aiming to increase the incomes of ultra-poor households by improving access to capital or skills have had disappointing results. It has long been recognised that relaxing capital and skills constraints may alter the occupational choices of the poor and help them exit poverty (Schultz 1979, Banerjee & Newman 1993). However, anti-poverty programmes addressing capital or skill constraints have provided limited evidence of transformative change (e.g. Crépon et al. 2001, Karlan & Valdivia 2010).

In contrast to previous interventions, BRAC’s ‘Targeting the Ultra-Poor’ programme pioneered a ‘big-push’ approach in Bangladesh; combining large-scale business asset transfers and complementary skills training. This comprehensive livelihood programme targets the most disadvantaged women in the selected communities who are receiving neither anti-poverty government transfers nor microfinance lending.

Relative to the initial levels of wealth and skills among participants, the programme represents a large transfer. From the menu of business assets available, all households chose to receive livestock. The combined value of livestock received by each beneficiary was USD1403, nearly double the baseline wealth of the ultra-poor, and far more than these households can access via informal credit markets. A training programme of equivalent value was also provided over two years to train and support recipients in working with livestock and to increase the benefits they reap from the assets.

In response to the programme, targeted women shifted their working hours from casual wage labour towards livestock rearing, increasing both total hours worked and earnings. After four years, the ultra-poor increased hours devoted to livestock rearing by 361%, while hours devoted to maid services and agricultural labour fell by 36% and 17%, respectively. Working 22% more hours and 25% more days, earnings increase by 37%.

Female labourer in Naogaon District, Bangladesh © BRAC

This transition into more stable occupations resulted in significant improvements in consumption, savings, and poverty levels. Four years after the initial transfer – and two years after direct programme support ended – the programme resulted in a 9% increase in per-capita non-durable consumption and a decline of 8.4 percentage points in the number of households living on less than $1.25 per day4. Household cash savings increased nearly ninefold, the value of household assets more than doubled and the household saving rate increased by 25 percentage points from an initial value of close to zero. The value of land owned by the ultra-poor rose by 220%, the value of productive assets tripled, and beneficiaries became more engaged in credit markets. As such, the programme initiates a process of self reinforcing growth out of poverty.

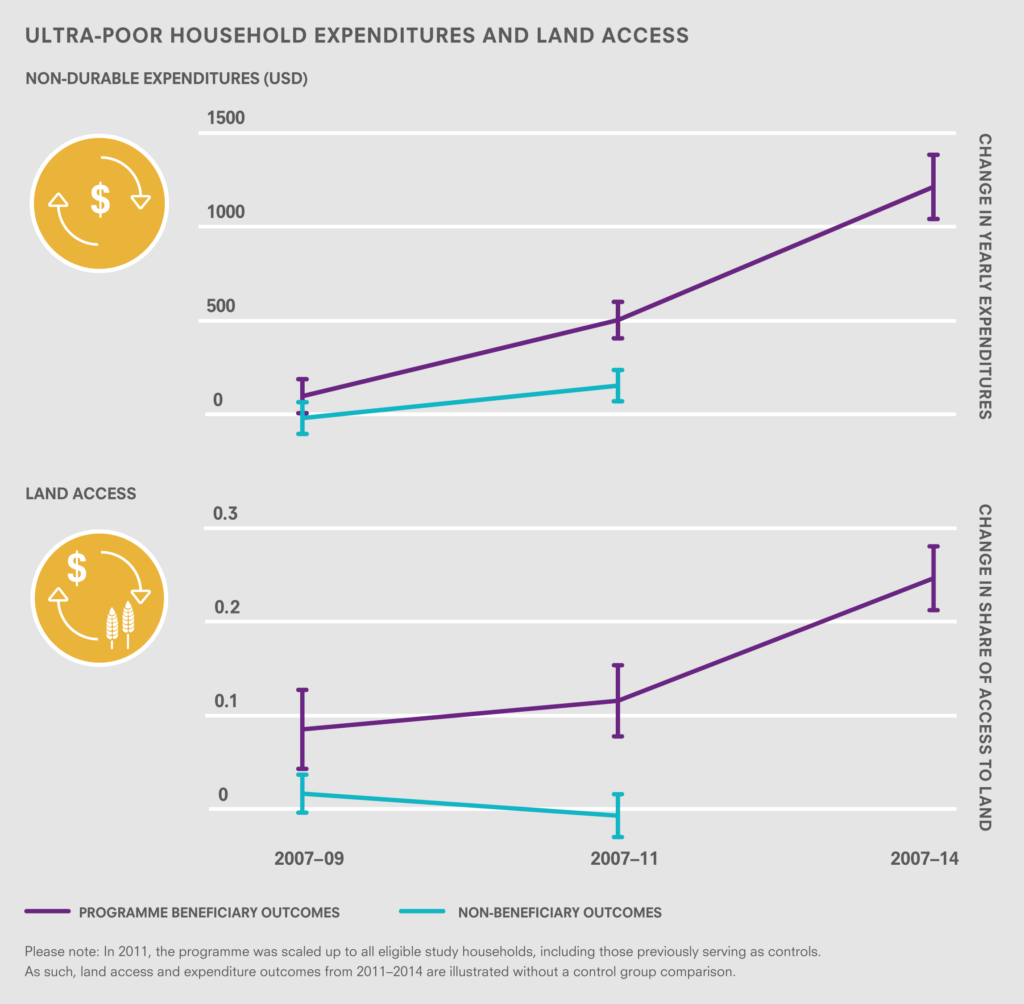

The transformative effects of the programme are sustainable. Seven years after the intervention, targeted households continue to escape poverty at a steady rate, as shown below. A survey conducted seven years after implementation found that changes were equal to or larger than those seen after two and four years. This was primarily driven by households accumulating and diversifying asset holdings. The change in spending on non-durables was 2.5 times higher after seven years than after four, and the increase in land access doubled.

Figure 2: Ultra-poor household expenditures and land access

Key message 3 – Benefits for the ultra-poor do not come at the expense of other households

A potential concern might be that the intervention has negative impacts on those who do not receive the programme in targeted villages. To test for potential negative effects, the research design tracks over 21,000 households, 6,700 of which are ultra-poor and 15,100 of which come from other wealth classes.

Gains to beneficiary households are not obtained at the expense of other (non-targeted) households in the same communities. The programme does not reduce consumption expenditure or savings of households ineligible for the programme, in fact, business assets of non-targeted households actually increase over time. This may be because beneficiary households are sharing some of their new resources with others or requiring less support from others. Findings are consistent with wider evidence that increasing savings amongst the poor has positive spillovers (Dupas et al. 2015). The value of land owned by the upper classes does fall, as the value of land owned by the ultra-poor increases, but the drop accounts for only 2% of the value of land owned by the upper classes.

Regular meetings with BRAC staff members © BRAC

Key message 4 – The poorest face barriers – rather than being unwilling or unfit – to engage in similar jobs as wealthier women

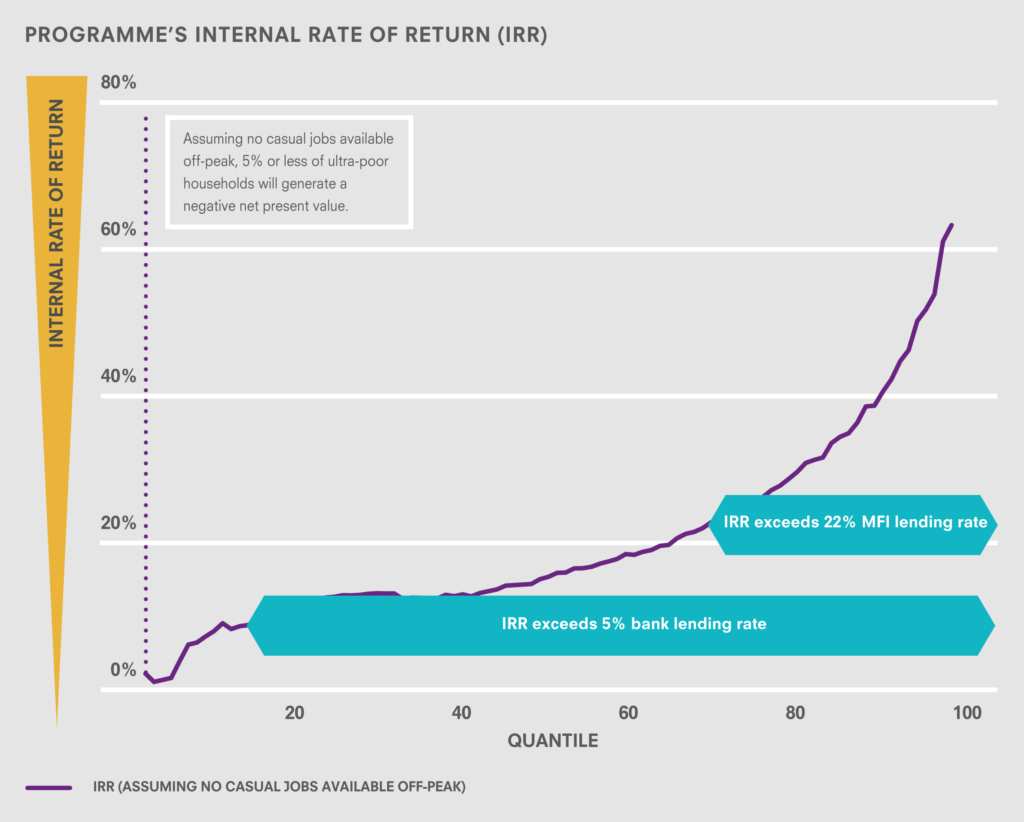

On average, the programme benefits are 5.4 times larger than its costs; the estimated internal rate of return ranges from 16% to 23%5. Working fewer hours in poorly-paid casual wage labour, beneficiaries now spend more time in livestock rearing. Returns to this occupational shift are sizeable, and suggest that ultra-poor women are willing and able to work similar jobs as wealthier women, but that wealth class differences may require a ‘big-push’ to overcome.

Estimated internal rate of return varies by the assumed opportunity cost of time. One important barrier may be in credit markets. The programme’s internal rate of return exceeds both formal and microfinance (MFI) lending rates for a sizeable share of households, as shown in below. This suggests that the ultra-poor are unable to borrow, even to finance highly profitable investments. Another constraint may be their inability to acquire the skills needed to move into more profitable jobs.

Figure 3: Programme’s internal rate of return (IRR)

Key message 5 – BRAC’s approach can be scaled up and successfully adapted to different contexts

The programme impacts have proven highly scalable. BRAC has reached 1.6 million households6 in Bangladesh via its Targeting the Ultra-Poor programme. Similar livelihood programmes based on BRAC’s approach have reached over 7000 households in Ethiopia, Ghana, Honduras, India, Pakistan, and Peru (J-PAL and IPA Policy Bulletin 2015). Randomised evaluations of these programmes have found broadly similar positive impacts, despite the differences in cultures, market access and structures, subsistence activities and scope of government safety net programmes (Banerjee et al. 2015). The long-run benefits of the programmes outweigh their upfront costs in all countries except Honduras7.

Across the studies, the interventions helped beneficiaries to move into more stable selfemployment activities and spend more time working each day. Savings increased significantly, particularly in programmes that incorporated mandatory savings. Most positive economic impacts were still observed a year after programme activities had ended. The similarity of findings suggests that the poorest face similar constraints across countries, and provides confidence that the BRAC model can work across different contexts and with different implementers. Taken together with the longer-run effects estimated for the Bangladesh intervention, the results suggest that comprehensive livelihood programmes may offer the potential to put the poorest on a sustainable, long-term trajectory out of poverty.

Household with their livestock in Naogoan district, Bangladesh © BRAC

Policy recommendations

The world’s poorest households have long been excluded from the benefits of modern economic growth. A combination of barriers prevent them from accessing the more stable self-employment opportunities available to wealthier members of their communities. Such barriers trap the poorest in jobs with low and irregular incomes.

1. ‘Big-push’ interventions combining large-scale asset transfers with skills training may provide a cost-effective means of improving outcomes for this traditionally hard to reach group. In Bangladesh, the poorest women in village economies significantly improved their economic outcomes and earnings. Findings from six similar livelihood programmes, based on BRAC’s model, suggest results are robust to context and implementing agency.

2. Continuing improvements seven years after implementation suggest that the programme may help the ultra-poor escape poverty at an increasing rate in the long-term. Improvements after seven years were equal to or larger than after two or four years. More evidence is needed on long-run sustainability of impacts. But long-term data from Bangladesh suggests that ‘big-push’ livelihood programmes may help the poorest move onto a sustainable trajectory out of poverty and contribute to achieving the Sustainable Development Goals.

3. Further evidence is needed on the elements of programme design and implementation that helped some programmes achieve particularly significant gains. Understanding which components were particularly effective, and how they impacted different groups, may inform future interventions and ensure programmes maximise results, while remaining cost-effective. Varying designs in different setting sheds light on these questions; for instance, income diversification may help to explain the success of interventions in Bangladesh, Ethiopia, and India.

References

Bandiera, Oriana, Robin Burgess, Narayan Das, Selim Gulesci, Imran Rasul and Munshi Sulaiman (2015). Labor markets and poverty in village economies.Mimeo London School of Economics.

Banerjee, Abhijit, Esther Duflo, Nathanael Goldberg, Dean Karlan, Robert Osei, William Parienté, Jeremy Shapiro, Bram Thuysbaert, and Christopher Udry (2015). A multifaceted program causes lasting progress for the very poor: Evidence from six countries. Science 348, no. 6236: 1260799.

Banerjee, Abhijit, and Andrew Newman (1993). Occupational choice and the process of development. Journal of political economy: 274–298.

Crépon, Bruno, Florencia Devoto, Esther Duflo, and William Pariente (2001). Estimating the impact of microcredit on those who take it up: Evidence from a randomized experiment in Morocco. American Economic Journal: Applied Economics 7, no. 1 (2001): 123–150.

Dupas, Pascaline, Anthony Keats, and Jonathan Robinson (2015). The Effect of Savings Accounts on Interpersonal Financial Relationships: Evidence from a Field Experiment in Rural Kenya. No. w21339. National Bureau of Economic Research.

J-PAL and IPA Policy Bulletin (2015). Building Stable Livelihoods for the Ultra-Poor. Cambridge, MA: Abdul Latif Jameel Poverty Action Lab and Innovations for Poverty Action.

Karlan, Dean, and Martin Valdivia (2011). Teaching entrepreneurship: Impact of business training on microfinance clients and institutions. Review of Economics and Statistics 93.2 (2011): 510–527.

Schultz, Theodore W (1980). Nobel lecture: The economics of being poor. The Journal of Political Economy: 639–651.

Citation

Balboni, C., Bandiera, O., Burgess, R., & Kaul, U. (2015). Transforming the economic lives of the ultrapoor. IGC Growth Brief Series 004. London.