Growth brief: Harnessing natural resources for inclusive growth

Natural resources can support sustainable and inclusive growth in sub-Saharan Africa if key policy areas in the natural resource management chain are tackled and strong institutions are put in place.

-

IGCGrowthBriefNRMCollier20151.pdf

PDF document • 541.7 KB

Introduction

In this brief, we present a framework for natural resource management. This brief can be useful for policy-makers looking to strengthen and better diagnose the weaknesses in their national natural resource management (NRM) framework. It can also be a useful starting point for those interested in understanding the challenges related to ensuring natural resources support inclusive growth.

Despite the recent fall in commodity prices, Sub-Saharan Africa’s resource boom is continuing. During the past decade of high prices, many new discoveries were made, and the extraction of these new resources will take place over the next few years. Natural resources, through the revenues they generate, have the potential to lead to large and sustained improvements in African standards of living. Yet, too often, those opportunities are missed.

Africa has had resource booms before, but they have seldom been harnessed for sustained development. For much of its post-colonial history, natural resources have fuelled conflict and filled the pockets of political leaders more than they have benefited the population. The default option is that this history of missed opportunities will repeat itself and, for much of the region, this is a likely prospect. Harnessing resources well for the benefit of society is complicated. The steps involved are the subject of this brief.

Resource discoveries bring risks as well as opportunities. Mismanaged, they lead to unsustainable consumption sprees, as politicians struggle to meet exaggerated popular expectations. However, this need not be the case. Some developing nations have successfully managed their natural resource wealth, and have had a path of sustained growth and development as a result. In order to do so, governments of resource endowed countries will need to get the natural resource management policy chain right. They must also spend time and resources building robust institutions ensuring resource revenues support sustainable growth.

Key messages

-

Natural resources do not need to be a curse

The resource curse is not inevitable and, if properly managed, resourcedriven

development is the best growth opportunity for many favourably endowed

African countries. Indeed, most of African’s natural resources have not yet been discovered, which represents a formidable opportunity for growth. -

Governments need to get the natural resource management policy chain right

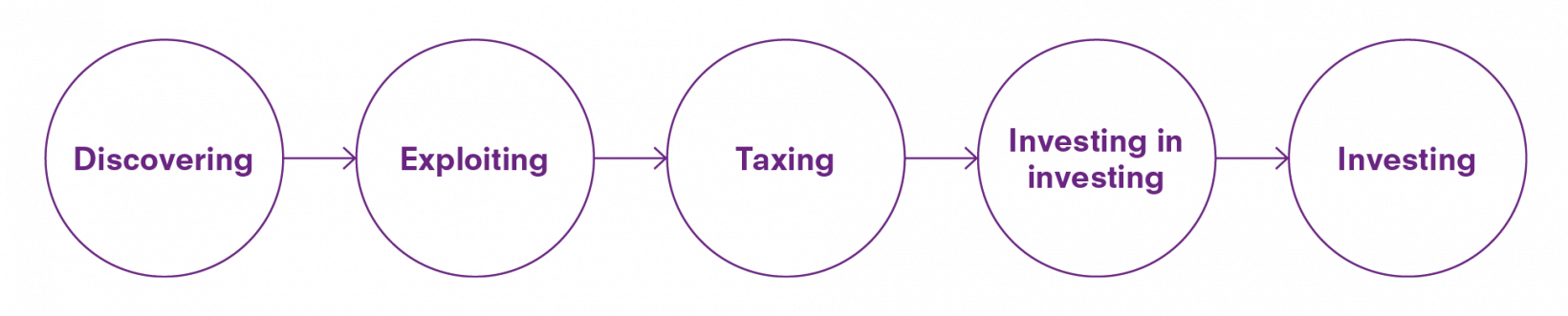

The natural resource management (NRM) policy chain has five key areas: discovering, exploiting, taxing, ‘investing in investing’, and investing. All of these need to be adequately developed. Government needs to set up strong policies in each of those areas.

-

Strong political actions are required to ensure natural resource wealth is used to support inclusive growth

Governments should build strong institutions and rules, and ensure the citizen body supports them. Strong political actions are necessary to build and maintain the integrity of the NRM policy chain and to ensure natural resource wealth is used to support inclusive growth.

Key message 1 – Natural resources do not need to be a curse

The idea that countries with natural resources are subject to a ‘resource curse’ – the paradox that countries and regions with an abundance of non-renewable natural resources tend to have less economic growth and worse development outcomes than countries with fewer natural resources – is now commonplace, and widely accepted. The ‘resource curse’ as best known is about political dysfunction. The most important of those dysfunctions is that discovering natural resources often acts as a source of conflict between factions fighting for a share of the revenue (Klare 2002; Besley and Persson 2010). Another important dysfunction is that the revenues generated by the depletion of non-renewable resources, though unsustainable, are excessively devoted to consumption. Indeed, resource-rich countries actually accumulate less public capital than resource scarce-scarce ones at the same level of income (Collier and Venables 2011, Bhattacharyya and Collier 2014).

Whether natural resources are a blessing or a curse for a country is still debated among economists. Economic research is inconclusive (Collier 2010, p.39). It shows that resource-dependent countries grow slower on average, but this is due to outlier countries that grow fast and eventually move out of resource-dependence. Research also shows that natural resources tend to reduce the overall national economic output – countries end up producing less than they otherwise would have, even if what they produce – resources – is worth more. Overall, natural resources can help countries grow out of resource dependency, but they more often trigger an economic decline in other sectors of the economy.

The resource curse is not inevitable. Malaysia used its earnings from resource exports to diversify its economy. Botswana used its diamonds to become the fastest growing economy in the world. What needs to be understood is that the resource curse is optional – the consequence of policy errors. Properly managed, resource-driven development is the best growth opportunity for many favourably endowed African countries.

Known subsoil assets in sub-Saharan Africa are of about USD 45,000 per square km. As a comparison, known subsoil assets in the OECD at of USD 265,000 per square km.1 Despite these figures, Africa generally has the reputation of being resource-rich and it might well be. Indeed, what the above figures reflect is not Africa’s poor resource endowment, but rather the low intensity of prospecting that has taken place on the continent so far. By definition, undiscovered resources cannot be ‘known’, but a reasonable assumption over such a huge geographic area such as that of sub-Saharan Africa is that it has about as much natural resource wealth per square km as OECD countries, which have been more thoroughly prospected. What the figures above imply is that most of Africa’s subsoil assets have yet to be discovered. The potential revenue generated by those natural resources is enormous and represents a much needed inflow into national budgets. For this reason, we claim natural resources have the potential to be transformational for African economies.

Key message 2 – Governments need to get their natural resource management policy chain right

Getting natural resource management policies right is more important than in any other domain of policy. Unfortunately, most countries get it wrong. In order for there to be a viable framework for the exploitation of natural resources, several interdependent decisions have to be implemented. Figure 1 below demonstrates our understanding of the key component, all of which need to be developed in order to turn resources into sustainable revenue.

The chain below represents the natural chain of events in the discovery process: Natural resources are discovered, then exploited, and then taxed. The government prepares the investing environment, and then uses much of the revenues it receives to scale up domestic investment. While we show this as a linear decision process, we realize that, in fact, efforts need to be put on various fronts simultaneously. When strong policies in all or most of these NRM policy areas are present and implemented, we can say there is good governance of natural resources. Each of these poses substantial challenges.

THE 5 NATURAL RESOURCE MANAGEMENT POLICY AREAS

Discovering

Countries typically under invest in prospecting. Because of the political risks surrounding prospecting, private companies have not invested enough in searching for resources. This is why so little of Africa’s likely sub-soil endowment has been discovered. When prospecting is left entirely to private companies the government is placed at an informational disadvantage – companies can take advantage of the fact that they have more and better information about the mine than the government. Companies can thus under report the amount and value of the resource exploited, and they can also get resource exploitation rights for a lower price.

In order to counter this problem, we recommend governments invest in public surveys of mineral resource wealth. This does not imply that the government should directly undertake the prospecting process itself, but rather contract a reputable company to produce surveys of mineral resource wealth. This survey can then be used to attract companies to bid for exploitation rights in a setting where both government and private parties have similar access to geological information.

Exploiting

At the exploitation stage, the problem is one of dealing with the very large positive and negative externalities generated by the resource exploitation process. Let us start with the positive.

One of the most beneficial aspects of natural resource exploitation is the infrastructure it generates, such as transport links and healthcare facilities. Unfortunately, it is not a given that the infrastructure privately built as part of the exploitation process will be shared with public users, or will be built with public uses in mind. It is possible, at the contract negotiation stage, for the government to insist on multi-use or multiuser infrastructure. The small extra cost to companies achieves a much larger social gain so that it is mutually beneficial for a government to accept a little less tax revenue in return for open usage of valuable infrastructure.

A good example of this is the contract signed between the Government of Guinea and the Rio Tinto corporation in 2014 for the development of the Simandou iron ore mine. The mine is planned to become the largest integrated iron ore mine and infrastructure project ever developed in Africa. Upon completion, the project is expected to double the gross domestic product of Guinea. The Government contract essentially traded off some tax revenues in return for the construction of a railway to be designed for multiple uses by third parties. Whenever possible, we recommend the government studies the possible positive side-effects from the exploitation infrastructure and ensures exploitation contracts allow social benefits to be fully realised.

On the downside, the most obvious negative consequence of natural resource exploitation is the environment damage that too often occurs as a result of exploitation. While the nature and extent of such damage can often not be predicted in advance, what the government can do is ensure contracts clearly stipulate who is liable in the case of environmental damage, and set up a working system of public compensation for environmental damage.

Taxing

Governments have a strong interest in maximizing the revenue raised from natural resource exploitation, most of which comes in the form of taxation. However, imposing a tax on extracted resources is particularly hard because of the difficulty of monitoring and verifying the company’s declared resource exploitation revenues. This is another problem due to a party having more information than the other.

This problem is further exacerbated by the presence of corruption. In setting the tax and royalty rates, the government faces an internal agency problem. That is, the government must delegate the negotiation to a small group of its members and resource extraction companies have a strong incentive to bribe these individuals. In doing so, corrupt officials allow those companies to keep a higher share of the natural resource rent, which would otherwise have been given to the government and could have been used to benefit broader society. To protect itself, the government needs to adopt a negotiation process that is transparent.

This internal agency problem is compounded by the information problem. That is, because the government has considerably less knowledge as to the Discovering Exploiting Taxing IGC Growth brief Harnessing natural assets for inclusive growth 5 true value of its natural assets than does the company extracting them, corruption is more difficult to detect. A solution to both the agency and the information problem is to first invest in public geological information, and then to hold a well-conducted auction of the extraction rights, inviting bids on the royalty rate companies would be willing to pay.

In order to ensure proper and efficient taxation mechanisms are in place, we recommend governments: (1) Adopt transparent negotiation processes; (2) Auction extraction rights; (3) Put strong transparency arrangements for revenue management in place (a first step for which would be to join the Extractive Industries Transparency Initiative (EITI); and (4) Set up proper procedures to allocate extraction rights and binding agreements about tax rates.

Investing in investing

In a development setting, characterized by a chronic lack of capital, it is sensible that a government should use much of its resource revenues to invest in domestic assets such as infrastructure, rather than save it. Saving all of one’s resource income does not maximise the long-run income of low-income, growing countries, because they have so much need for investment now. However, poor countries usually start with very limited capacity to invest productively. Before scaling up domestic investment, it is therefore sensible to improve the capacity to invest. We term this phase ‘Investing in Investing’.

‘Investing in Investing’ includes both developing the public sector’s ability to conduct large-scale investment projects, and removing impediments to private sector investment. Building public sector capacity involves the design, selection, implementation and evaluation of projects. Countries vary a lot in each of these skills, so there is much to learn from neighbours who perform those activities better. Enhancing private sector capacity involves removing unnecessary bureaucratic hurdles, deepening financial markets, and trying to reduce the cost of various types of capital goods where they are more expensive than the global average. Until investment capacity has been built, savings should be deposited abroad, where returns are higher, to be brought home as capacity improves. To squander a brief period of high revenues on misjudged investments would be a tragic waste of a rare opportunity.

Investing

Effectively investing the revenues from natural resource exploitation is the most essential step to ensuring that the exploitation of the resources is sustainable and benefits the country in the long term. Revenues arising from the depletion of nonrenewable resources are by nature unsustainable. After all, countries are effectively depleting assets in the ground. There is thus a powerful case to be made for those revenues to generate at least equally valuable assets on top of the ground. For this reason, governments should try to invest large shares of their natural resource revenues into infrastructure and other forms of capital that support long-term growth.

However, while countries must ensure appropriate investment is made, they must also safeguard it for the future. To that effect we recommend countries endeavour to save large amounts (between 30%–60%) of all tax revenue generated by natural resource taxation. Those savings will be available for the next generation, which might no longer be able to draw revenues from natural resources.

Another problem that sound investment helps avoid is price volatility. Commodity prices being highly volatile, natural resource revenues are volatile too, which leads to uncertainty in the public budgeting process. In order to ensure stable public expenditure, a public expenditure smoothing rule needs to be put in place, and funded by savings generated in surplus years.

However, saving revenues for the future can be politically challenging. The pressure on governments to spend revenues on consumption is intense for several reasons. On the one hand, the average citizen is extremely poor and wishes to benefit from this new-found wealth now, not in the distant future. Similarly, the political horizon is short, and upcoming elections always make it attractive for politicians in power to spend natural resource revenues in ways that support consumption – for example by funding fuel subsidies – instead of investing it in capital goods. Finally, the prevalence of corruption makes citizens suspicious of politicians’ actions. To make investing in assets feasible, citizens must be able to trust that resource revenues not visibly used for mass consumption are being spent on assets rather than being captured by the elite.

Chain of events in the discovery process

Key message 3 – Robust institutions are required to ensure natural resource wealth support inclusive growth

What makes the policy chain above difficult is that many of these decisions are interdependent, but are taken separately by different people or different groups. This makes harnessing natural resources a weakest link problem. If any link in the chain is broken, the outcome will be problematic.

Further, it is often difficult to lock future politicians into commitments. For example, money saved by a prudent finance minister might be squandered by a successor and this risk reduces the incentive for prudence in the first place. Fortunately, there are examples of societies which have successfully mitigated this risk, one being Botswana (see box on the right-hand side of the page). However, as in Botswana, strong political actions need be taken to build the institutions that maintain the integrity of the NRM policy chain. Indeed, to ensure good resource policies are in place, countries need to build robust rules and institutions, and ensure that citizens are supportive of them.

All rules, whether legislative or informal, are only effective if implemented – their mere existence is insufficient to constrain a government from succumbing to the temptations of excess public consumption. The force of rules depends on proper monitoring and enforcement capacity, which come out of strong institutions. The only way those rules and institutions will be strong is for them to be understood and supported by a body of citizens – which we call the ‘critical mass’ – who are collectively sufficiently influential to protect them. Only with such a critical mass is there enough pressure on politicians not to break rules. It is, however, not easy to build that critical mass, and to develop that informed understanding of natural resource management.

Getting it right: The example of diamonds in Botswana

The example of diamonds in Botswana illustrates the importance of the political process in ensuring positive outcomes. Although Botswana has always been a functioning democracy, when the government first received diamond revenues, it successfully managed to protect them. President Ian Khama achieved good stewardship of diamond revenues through adept domestic political leadership. The rules and institutions created to implement asset accumulation were unremarkable: Firstly, a balanced budget rule and secondly, a sovereign wealth fund. These could readily have been subverted had Parliament and the Ministry of Finance wished to do so. But President Khama and his successors countered inflated expectations by explaining the case for investment, as encapsulated in the slogan ‘We’re poor and so we have to carry a heavy load.’ Having built the case for deferring consumption, President Khama maintained trust by ensuring that elite corruption was unacceptable. The government also followed this up with a sustained education campaign to encourage prudence in the population. Successive governments have been able to preserve highly prudent behaviour for several decades, and thus accumulate massive foreign exchange reserves, without either dedicated foreign funds or complex rule structures (Collier & Venables 2011).

Policy recommendations

Sub-Saharan Africa is still at the beginning of its natural resource discovery process. Natural resources do not need to be a curse. If properly managed, resource-driven development is the best opportunity for many resource-endowed African countries to grow sustainably and support the development of its citizens. In order to reap the benefits of its resources, governments of resource-endowed countries will need to follow this set of recommendations in order to get the natural resource management policy chain right:

- Invest in public surveys of mineral resource wealth. Little of sub-Saharan Africa’s resource wealth has been discovered, and more effort needs to be put into the discovery process. The information generated from the survey can be used to attract companies to bid for resource exploitation rights in a setting where both government and private parties have similar access to geological information.

- Consider the possible positive side-effects from the resource exploitation infrastructure and ensure contracts allow social benefits to be fully realised.Indeed, one of the most beneficial aspects of natural resource exploitation is the infrastructure it generates, such as transport links and healthcare facilities. Unfortunately, it is not a given that the infrastructure privately built as part of the exploitation process will be shared with public users, or will be built with public uses in mind. It is possible, at the contract negotiation stage, for the government to insist on multi-use or multi-user infrastructure.

- Ensure contracts clearly stipulate who is liable in the case of environmental damage, and set up a working system of public compensation for environmental damage. Environmental damage too often occurs as a result of resource exploitation. While everything possible should be done to prevent it, governments must also be ready to deal with it in a way that ensures fair and adequate compensation.

- Adopt transparent negotiation processes, auction extraction rights, put strong transparency arrangements for revenue management in place, and set up proper procedures to allocate extraction rights and binding agreements about tax rates. It is very difficult to monitor true resource exploitation revenues, and even harder due to often pervasive corruption problems. The mechanisms proposed ensure that governments get the share of revenues they deserve.

- Enhance private sector capacity by removing unnecessary bureaucratic hurdles, deepening financial markets, and trying to reduce the cost of various types of capital good where they are more expensive than the world average.This will improve the investment climate in the country, and thereby support ‘Investing in Investing’, which includes both developing the public sector’s ability to conduct large-scale investment projects, and removing impediments to private sector investment.

- Save large shares (30%–60%) of the resource income abroad, where returns are higher, while the country is improving its investment climate. Those savings should be brought home as capacity to invest into worthwhile and profitable ventures improves. This large share of savings will support future generations, who might no longer benefit from a steady income flow from natural resources, thereby making current resource exploitation sustainable.

- Invest large shares of their natural resource revenues into infrastructure and other forms of capital that support long-term growth. Countries are effectively depleting assets in the ground. There is thus a powerful case to be made for those revenues to generate at least equally valuable assets on top of the ground. Build strong institutions and rules, and ensure the citizen body supports them. Strong political actions are necessary to build and maintain the integrity of the NRM policy chain and to ensure natural resource wealth is used to support inclusive growth.

Harnessing natural resources is a weakest link problem. If any link in the chain is broken, the outcome will be suboptimal. All of the above actions need to be implemented in order to create a sustainable NRM framework. Because many of those actions are interdependent and taken separately by different people or different groups, it’s very difficult to get it right.

Getting NRM policies right is more important than in any other domain of policy. Natural resources have the potential to lead to large and sustained improvements in African standards of living. This is a chance that needs to be taken seriously, and governments must spend time and resources building robust institutions ensuring resource revenues support sustainable growth.

References

Bhattacharyya, S. and Collier, P.(2014). Public capital in resource rich economies: Is there a curse? Oxford Economic Papers, 66 (1). pp. 1–24. ISSN 1464-381

Besley, T. and Persson, T. (2010). State Capacity, Conflict, and Development. Econometrica, 78: 1–34. doi: 10.3982/ECTA8073

Collier, P. (2010). The plundered planet: Why we must, and how we can, manage nature for global prosperity. Oxford: Oxford University Press.

Collier, P. and Venables, A. (2011). Plundered nations?: Successes and failures in natural resource extraction. Houndmills, Basingstoke, Hampshire: Palgrave Macmillan.

Klare, M. (2002). Resource wars: The new landscape of global conflict. New York: Metropolitan Books.

The World Bank, The Changing Wealth of Nations (2014). Subsoil Assets. Retrieved from http://data. worldbank.org/data-catalog/wealth-of-nations

Further reading on natural resource management policy

Collier, P. and Laroche, C. (2014) IGC Blog Post: If we want the full benefit from resources, this is what we need www.theigc.org/blog/if-we-want-the-fullbenefit-from-resources-this-is-what-we-need

Collier, P. (2014) IGC Blog Post: One budget number every African citizen will need to know www.theigc. org/blog/one-budget-number-every-african-citizenwill-need-to-know

Conrad, R. (2014) IGC Project: Optimal Taxation Regimes www.theigc.org/project/natural-resourcesoptimal-taxation-regimes

Natural Resource Charter, www.naturalresourcecharter.org

Natural Resource Governance Institute, www.resourcegovernance.org/publications

About the authors

Paul Collier

Sir Paul Collier is Director of the International Growth Centre (IGC). Paul is a Professor of Economics and Public Policy at the Blavatnik School of Government, University of Oxford; Director of the Centre for the Study of African Economies; a CEPR Research Fellow; and Professorial Fellow of St Antony’s College, Oxford. He was formerly the senior advisor to Tony Blair’s Commission on Africa, and was Director of the Development Research group at the World Bank for five years. He researches the causes and consequences of civil war; the effects of aid; and the problems of democracy in low-income and natural-resource-rich societies.

Caroline Laroche

Caroline Laroche is an Economist at the International Growth Centre (IGC). She holds an MPA in International Development from the London School of Economics and Political Science, during which she specialised in the management and governance of aid. Prior to taking up her position at the IGC, Caroline did consulting work for the FAO, started and managed a small NGO in Ecuador and contributed to research projects with the International Development Research Centre in Canada, Innovations for Poverty Action in Mali and the Centre for Microfinance Research in India.

Citation

Collier, P., and C. Laroche (2015) Harnessing natural assets for inclusive growth. IGC Growth Brief Series 001. London.